Explore how the 2025 U.S.-U.K. Economic Prosperity Deal reshapes tariffs, boosts exports, and opens new opportunities for automotive, aerospace, and metals trade.

President Trump issues Executive Order to stop overlapping tariffs on imports under national security and trade actions, ensuring duty rates remain targeted and non-cumulative. Effective retroactively from March 4, 2025.

US consumer expectations have continued to evolve each year. We've pulled the latest research and surveys regarding US consumer buying preferences specifically around the desire around 2-day and same-day shipping preferences.

On April 24th, The US Department of Homeland Security and US Customs & Border Protection have released new guidance around the end of the US' de minimis exception. See the changes ahead for importers and customs professionals.

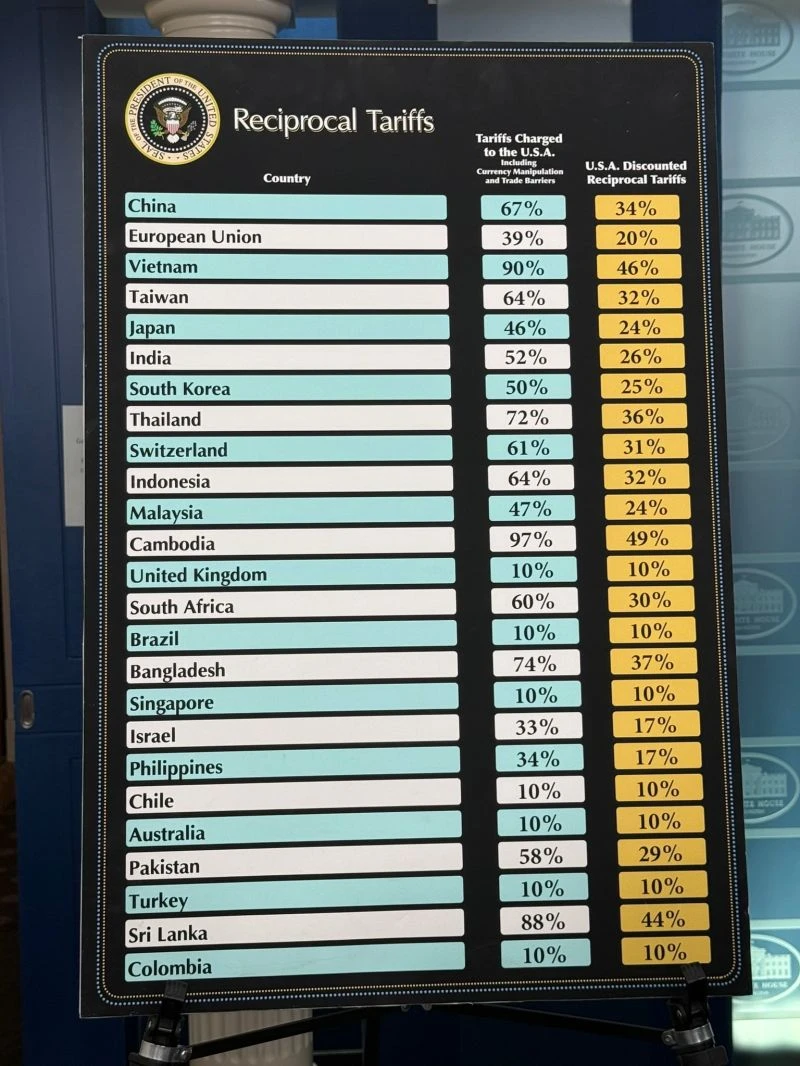

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

Based on the latest insights from the 2025 National Trade Estimate Report, here’s a practical breakdown of the most pressing trade challenges across the United States’ top 10 goods trading partners.

Some exciting news from our corner of the logistics world—our CEO, Robert Khachatryan, has been shortlisted for the The LA Times Studios - LA Executive Leadership Awards.

Today, we're proud to announce Freight Right's proprietary freight rate index, the TrueFreight Index (TFCX). Learn how we built the index. Subscribe to get weekly rate and market updates.

Learn the top 2 reasons for eCommerce cart abandonment—high shipping costs and slow delivery—and discover actionable strategies to reduce lost sales and boost conversions.

Outer space is the newest export frontier, where rockets and satellites count as high-tech cargo, triggering a bureaucratic maze of customs, export controls, and duty drawbacks. As the space economy grows, regulators face challenges from orbital warehouse

The International Longshoremen's Association began their strike October 1, 2024, affecting ports running along the east coast and Gulf regions of the United States. See what ports are affected and what this strike can mean for shippers.

US government announces executive order aimed at stopping de minimis imports. See what will and won't change for US importers.

A look into the volatile freight contract season, exploring broken promises, rate surges, and solutions for sustainable agreements through strategic contracting and innovative market practices.

Freight Right leads in LAX customs brokerage, managing over 100K tons of air cargo annually. Discover our role in LAX’s cargo efficiency and compliance.

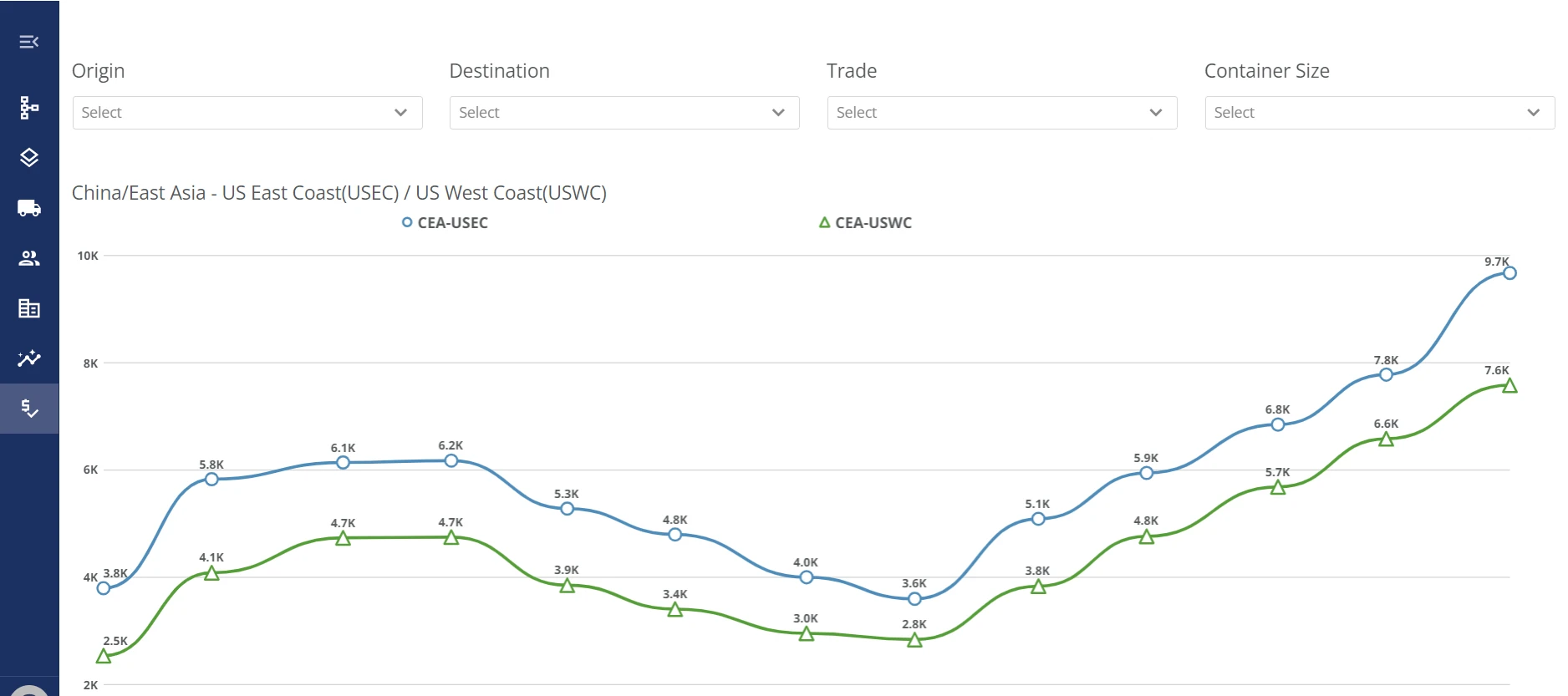

Explore the journey from ‘Buy Now’ to your home in our China-US Ocean Freight Shipping Guide. Discover the trade, environmental impact, and future of shipping.

The Panama canal is experiencing lower water levels as a result of a drought exacerbated by El Nino. The results of this drought have implications for all sizes of shippers around the world but particularly for small to medium sized shippers that are in a

In the hospitality and hotel sectors, the success of a project often hinges on countless elements working together seamlessly. Among these, shipping Furniture, Fixtures, and Equipment (FF&E) plays an integral role, often influencing a project's timeline,

Discover the complexities of shipping freight to Alaska, and learn why partnering with Freight Right is essential for efficient deliveries.

Demurrage and detention fees are mostly avoidable when you use the right solutions and partnerships to help you manage your shipments.

Do you really need multiple customs brokers? Find out how a single freight forwarding and customs brokerage provider saves you time and money.