Updated 5/30/2025: The Trump administration's appeal to uphold tariffs through IEEA was granted. Liberation Day tariffs are still currently in effect. Read the court's judgemet here: https://www.cafc.uscourts.gov/opinions-orders/25-1812.ORDER.5-29-2025_2522636.pdf

Updated 5/29/2025: US District judge Rudolph Conteras ruled yesterday Trump's use of the IEEA act to establish tariffs was illegal and an overreach of presidential power. Read the full judgement here: https://storage.courtlistener.com/recap/gov.uscourts.dcd.279804/gov.uscourts.dcd.279804.35.0.pdf

On April 29th, 2025, the Trump administration released a new executive order regarding US trade and tariff policy. This Executive Order, issued under various legal authorities including IEEPA, the Trade Act of 1974, and the Trade Expansion Act of 1962, establishes that overlapping U.S. tariffs on the same imported article—when imposed under specific trade and national security authorities—should not be cumulative (“stacked”), unless explicitly permitted. The goal is to avoid excessive duty rates that exceed what is necessary to meet policy objectives.

If an imported article is subject to multiple tariffs under specified authorities, only one set will apply, based on a hierarchy:

Automobile Tariffs (Sec. 2a) override all others (2b–2e).

Northern and Southern Border Drug-Related Tariffs (Secs. 2b & 2c) override aluminum and steel tariffs (2d & 2e).

Aluminum (2d) and Steel (2e) tariffs may both apply to the same article if conditions for each are met.

This order only prevents stacking among the specific actions listed in Section 2. It does not affect duties imposed under other laws (e.g., HTSUS general duties, Section 301 tariffs, anti-dumping or countervailing duties).

Tariffs affected by this order include:

Proclamations and executive orders on automobiles, northern/southern border drug interdiction, and aluminum and steel imports (dating from 2018 to 2025).

CBP (Customs and Border Protection), in coordination with the Treasury, Commerce, and USTR, must update enforcement systems and guidance to reflect this order.

Necessary Harmonized Tariff Schedule (HTSUS) changes must be made by May 16, 2025, with the order applied retroactively to imports from March 4, 2025.

Refunds for overpaid duties will follow standard CBP procedures.

This order does not affect:

Other existing duties, taxes, or charges (e.g., Section 301 tariffs, synthetic opioid-related tariffs, HTSUS Column 1 rates).

Enforcement of any tariff outside the specified list.

The order does not grant any enforceable legal rights.

It is subject to legal limitations and funding availability.

In a 7–4 ruling on August 29, 2025, the US Court of Appeals found President Trump exceeded his authority under IEEPA by imposing broad reciprocal tariffs. The decision is stayed until Oct 14, giving the administration time to appeal to the Supreme Court.

Based on the latest insights from the 2025 National Trade Estimate Report, here’s a practical breakdown of the most pressing trade challenges across the United States’ top 10 goods trading partners.

The White House has announced new tariffs on branded pharmaceuticals and launched national security probes into medical equipment and robotics. Learn what’s changing, how hospitals and manufacturers could be affected, and where to track historical HS/HTS.

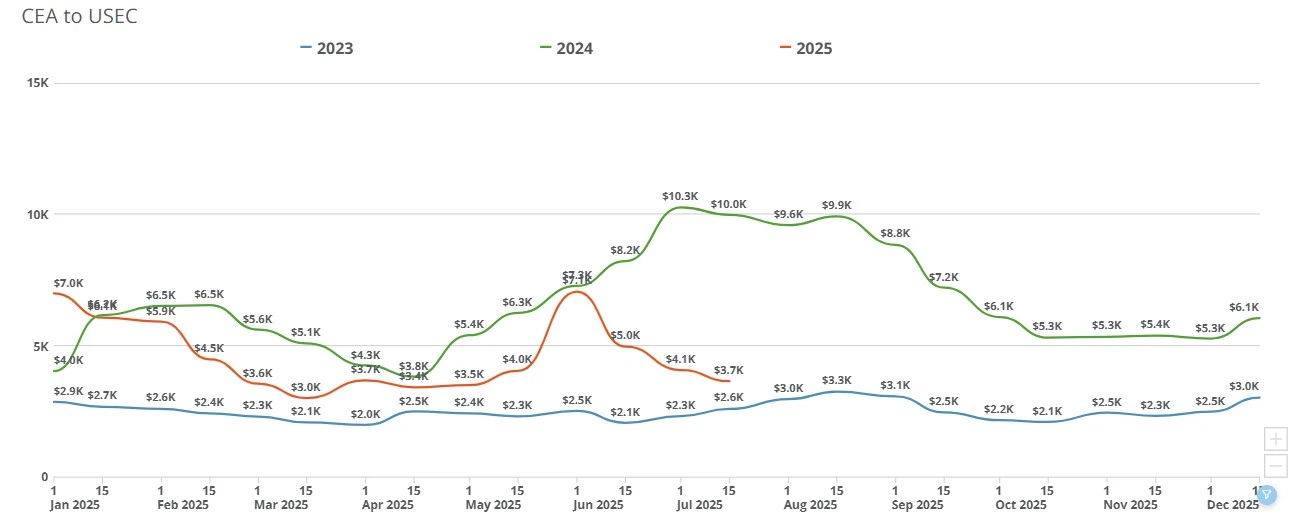

As the deadline before reciprocal tariffs take place, the Trump administration continues to make deals with nations around the world. Importers are back to taking a wait-and-see approach while rates USWC and USEC remain unchanged.

Founder & CEO of Freight Right Global Logistics, Robert Khachatryan, sat down with Tuck Ly, Vice President of Clearpoint International, to discuss the major issues affecting the global supply chain and port congestion

Trump’s latest trade deal with China and South Korea cuts tariffs, boosts U.S. exports, and deepens security and economic cooperation.

US government announces executive order aimed at stopping de minimis imports. See what will and won't change for US importers.

On August 29, 2025, a federal appeals court ruled 7–4 that President Trump’s emergency-based tariffs were unlawful, finding tariff powers rest with Congress. The court left them in place temporarily, granting the administration time to appeal to the SC.

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.

Demurrage and detention fees are mostly avoidable when you use the right solutions and partnerships to help you manage your shipments.