Ocean rates remain frozen at $1,400-$1,600 to the USWC as the Lunar New Year shutdown halts all Chinese logistics. Discover why the market is at a standstill and what to watch for in March.

The Supreme Court’s landmark IEEPA tariffs ruling strikes down major duties. Learn how this decision impacts Section 301 and 232 tariffs and how to claim refunds.

Ocean rates hold steady at $1,400-$1,600 for USWC as China’s pre-holiday shipping window closes. Explore the impact of high trucking costs and the upcoming total market shutdown.

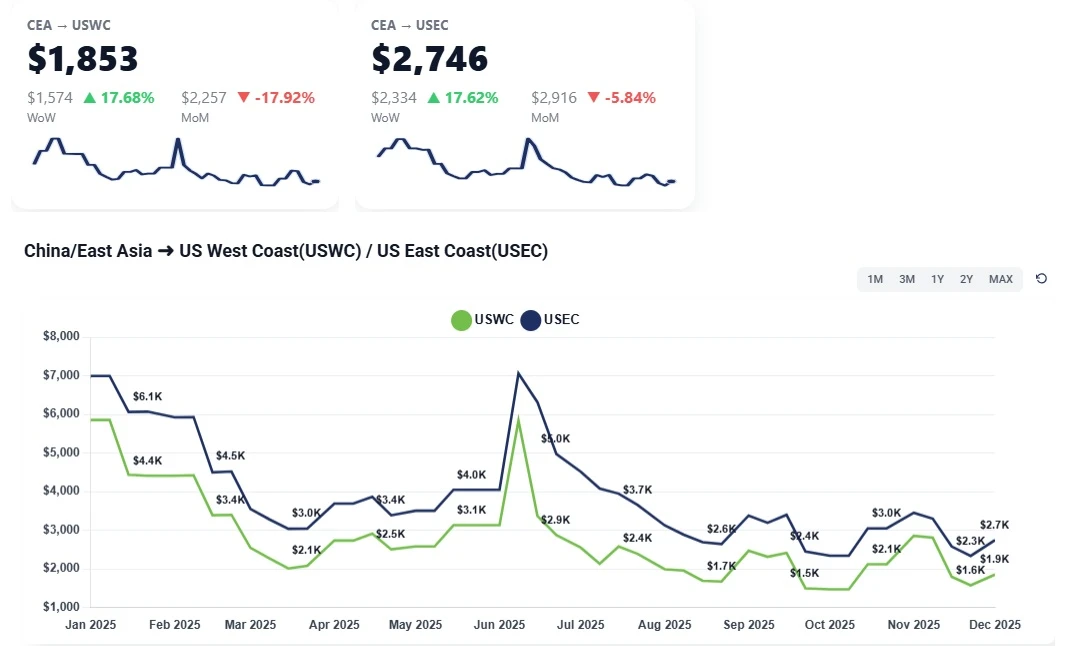

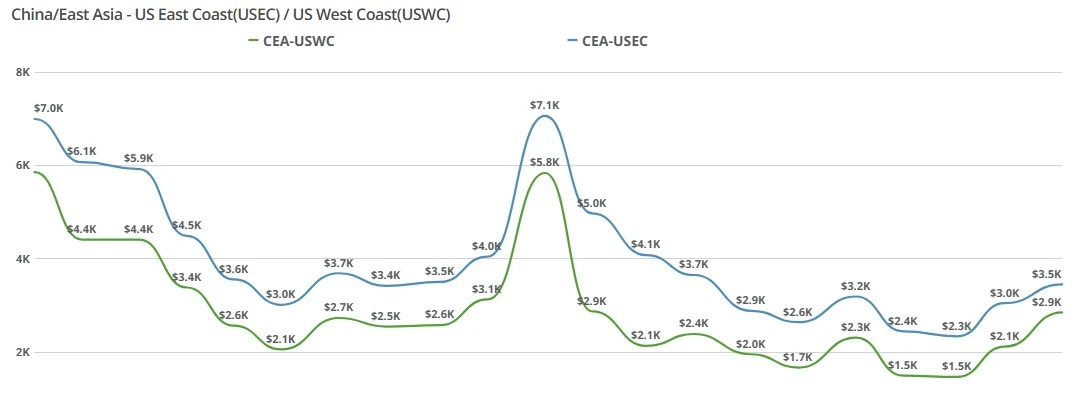

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Each day the Supreme Court moves closer and closer to a ruling for or against the Trump administration's IEEPA tariffs. See what Baker Tilly's Pete Mento advises importers do to get ready for any out come, what the possible outcomes could be and more.

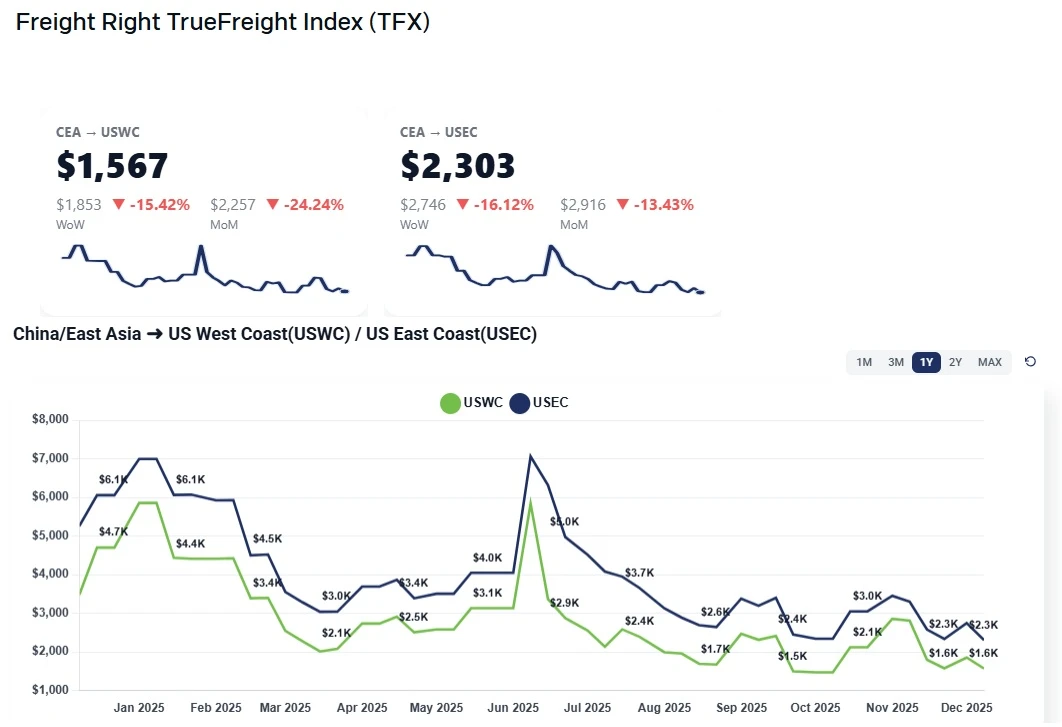

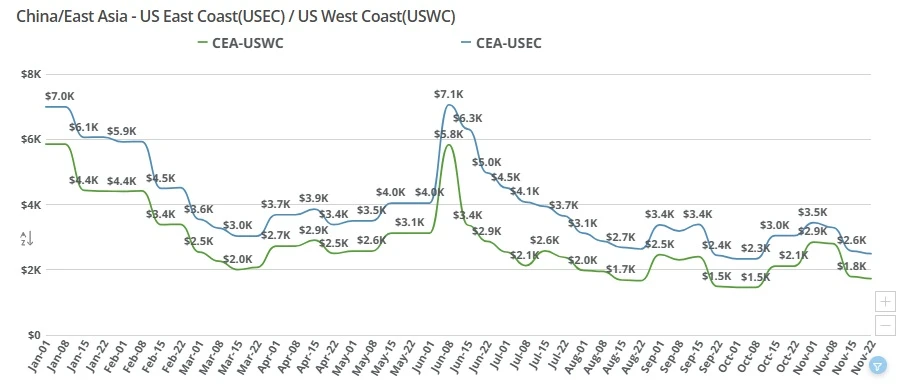

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

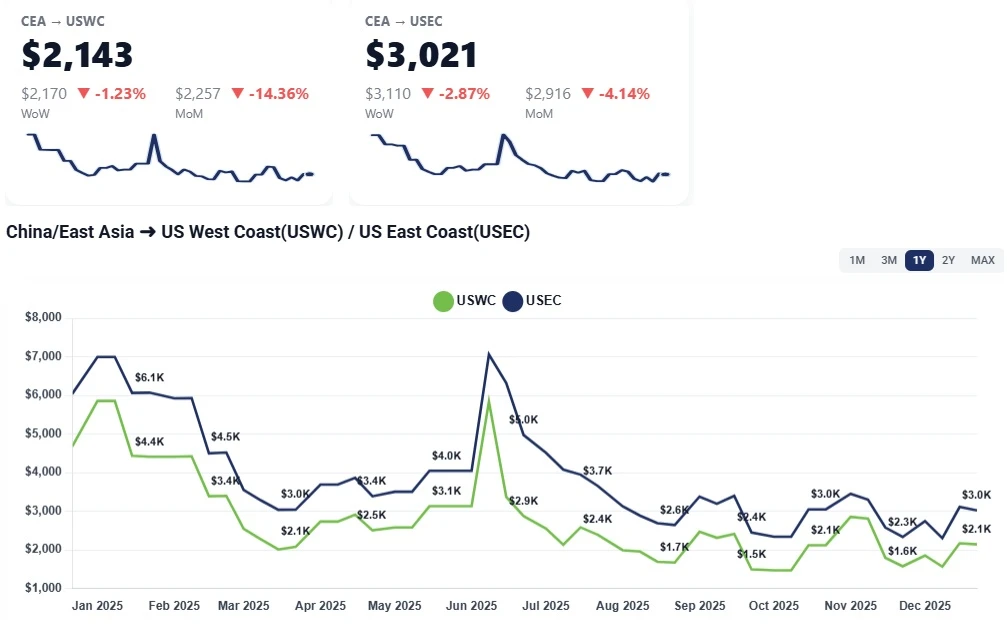

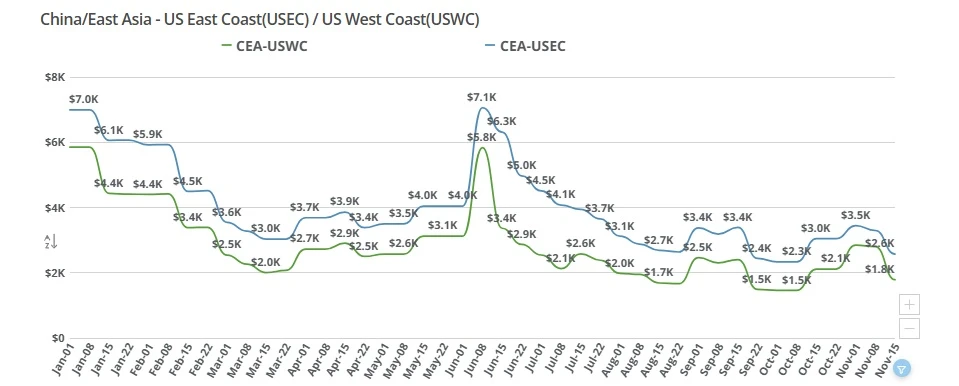

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Big and bulky fulfillment doesn’t have to block global growth. Learn how ecommerce brands can ship oversized products internationally with real-time freight rates, duty-paid delivery, and zero foreign inventory.

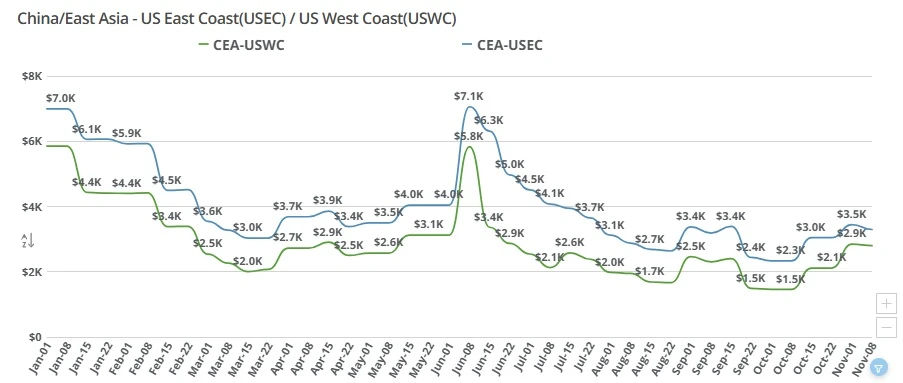

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

China-US ocean freight rates continue to decline, with the East Coast premium narrowing as carriers compete for limited volume. Get the key market drivers and outlook in this week’s update.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

Trump’s latest trade deal with China and South Korea cuts tariffs, boosts U.S. exports, and deepens security and economic cooperation.