Updated 7/30/2025: President Trump signed an executive order to suspend the U.S. de minimis exemption globally, which previously allowed international commercial packages valued under $800 to enter duty-free

Updated 5/13/2025: new guidance around de minimis post US/China tariff negotiations.

Starting May 2, 2025, nearly all Chinese goods, even small e-commerce shipments valued under $800, will face heavy U.S. duties. Postal imports are hit with either 120% of item value or a flat per-item charge ($100–$200). Carriers must collect and remit duties, and CBP is modifying HTS rules accordingly, according to new guidance released from US Customs and Border Protection.

From the document, starting May 2, 2025, de minimis treatment for PRC/Hong Kong goods entered into the U.S. (except certain postal items) will be eliminated. On June 1, 2025, duties will increase on certain postal items.

No more duty-free treatment under 19 U.S.C. 1321(a)(2)(C) for PRC and Hong Kong products valued at or under $800.

Shipments must be properly entered and duties paid through CBP’s ACE (Automated Commercial Environment).

New Postal Duty Rates for China/Hong Kong Imports: Postal shipments valued ≤ $800 arriving from China/Hong Kong face two options:

120% Ad Valorem Duty (value-based), or Specific Duty:

$100 per item (May 2 – May 31, 2025)

$200 per item (starting June 1, 2025)

Carriers must collect and remit duties on postal imports. Additionally, carriers must have an international carrier bond to guarantee duty payments. Carriers must also consistently use one duty collection method and can only change it monthly with 24 hours notice.

Some shipments may still require formal customs entry even if duties have been prepaid via the postal system. Formal entries will follow normal HTSUS duties and taxes, not the flat postal rate.

On changes to the Harmonized Tariff Schedule (HTSUS):

PRC and Hong Kong goods are officially excluded from de minimis exemptions in HTSUS.

HTSUS Chapter 99 updated to add subdivision (w) clarifying duty treatment for Chinese postal imports.

Drawback (duty refund) is not allowed for these items.

Lastly, these duties apply in lieu of regular Section 301 China tariffs or normal MFN rates. CBP may suspend or amend its regulations temporarily to enforce these measures (such as relaxing entry paperwork requirements). Postal shipments that CBP flags for formal entry will NOT be eligible for the flat postal duty and will instead face full duties.

De Minimis Rate Adjustment (Section 4)

The tariff on low-value shipments (under $800) from China: Reduced from 120% to 54%.

The $100 per postal item duty remains unchanged, canceling the planned increase to $200 on June 1.

HTSUS notes are revised to reflect this temporary rate cut.

On July 30, 2025, President Donald J. Trump signed a new executive order to suspend the de minimis exemption globally, applying the restriction to all countries, not just China and Hong Kong. This marks a significant escalation in the administration's trade enforcement strategy.

Key Elements of the Global De Minimis Suspension:

Effective Date: The global suspension takes effect on August 29, 2025.

Transition Period: For the first six months, low-value postal shipments will be subject to a flat-rate duty between $80–$200, depending on origin.

Post-Transition: After the six-month period, all qualifying imports will face country-specific ad valorem tariffs.

Remaining Exemptions: Personal goods brought by travelers valued under $200 and gifts under $100 remain duty-free.

What This Means for Importers:

Businesses relying on bulk low-cost international shipments, especially from e-commerce platforms, should prepare for increased costs and customs processing times. Supply chains may need to be restructured to adapt to the new tariff regime.

This policy significantly alters the small-parcel import landscape and underscores the administration's broader agenda of rebalancing trade and enforcing customs oversight.

a detailed timeline of U.S. global trade policy changes from April to August 2025, including new tariffs, international negotiations, and their economic impact.

US government announces executive order aimed at stopping de minimis imports. See what will and won't change for US importers.

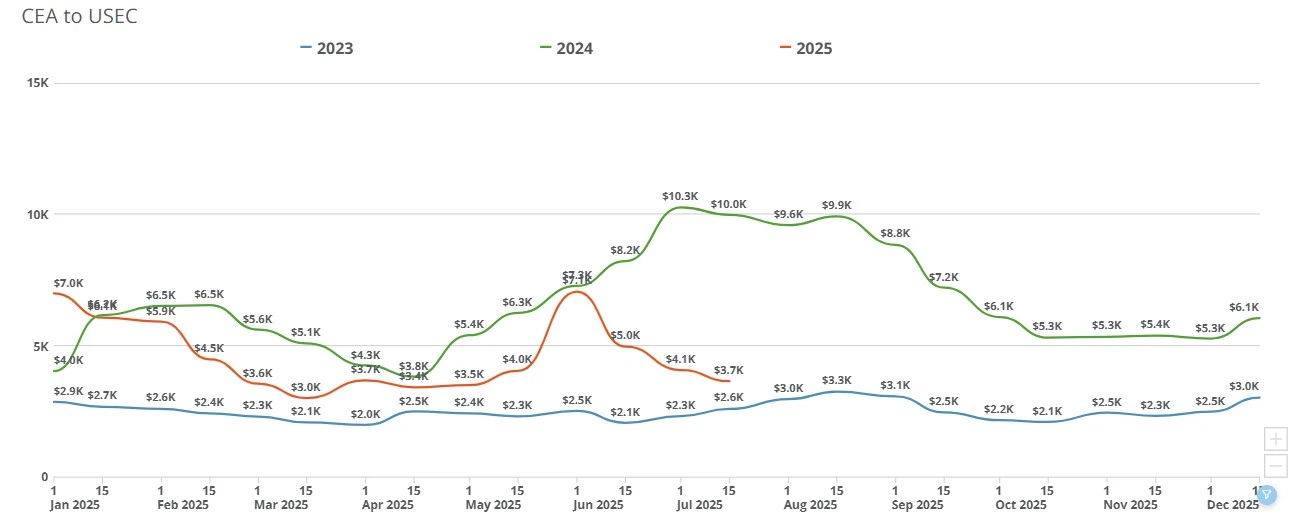

As the deadline before reciprocal tariffs take place, the Trump administration continues to make deals with nations around the world. Importers are back to taking a wait-and-see approach while rates USWC and USEC remain unchanged.

US consumer expectations have continued to evolve each year. We've pulled the latest research and surveys regarding US consumer buying preferences specifically around the desire around 2-day and same-day shipping preferences.

Founder & CEO of Freight Right Global Logistics, Robert Khachatryan, sat down with Tuck Ly, Vice President of Clearpoint International, to discuss the major issues affecting the global supply chain and port congestion

Rates continue to skyrocket, containers are nowhere to be found, and consumer spending keeps on rising, leading some to ask not when it will end, but if.

This blog explores digital air freight and how e-bookings provide a more efficient and faster way for logistics professionals to make connections.

Each day the Supreme Court moves closer and closer to a ruling for or against the Trump administration's IEEPA tariffs. See what Baker Tilly's Pete Mento advises importers do to get ready for any out come, what the possible outcomes could be and more.

The White House has announced new tariffs on branded pharmaceuticals and launched national security probes into medical equipment and robotics. Learn what’s changing, how hospitals and manufacturers could be affected, and where to track historical HS/HTS.

We examine how US-China trade tariffs have affected freight and logistics around the world.