During this week, the US intensified tariff actions, broadening its reach to Brazil, copper, Russia, the EU, and Canada, while key trading partners escalated retaliatory measures and accelerated negotiations. The EU prepared major counter-tariff plans, including use of its anti-coercion tool, as hopes for a US-EU deal faded. Canada responded by doubling down on “Buy Canadian,” pivoting to other markets, and boosting economic self-reliance. Markets remained buoyant, underpinned by investor optimism that Trump might relent (“TACO trade”) and by continuing AI-driven gains. Meanwhile, warning signs emerged: global tariffs threaten growth, and EU officials readied backup retaliation.

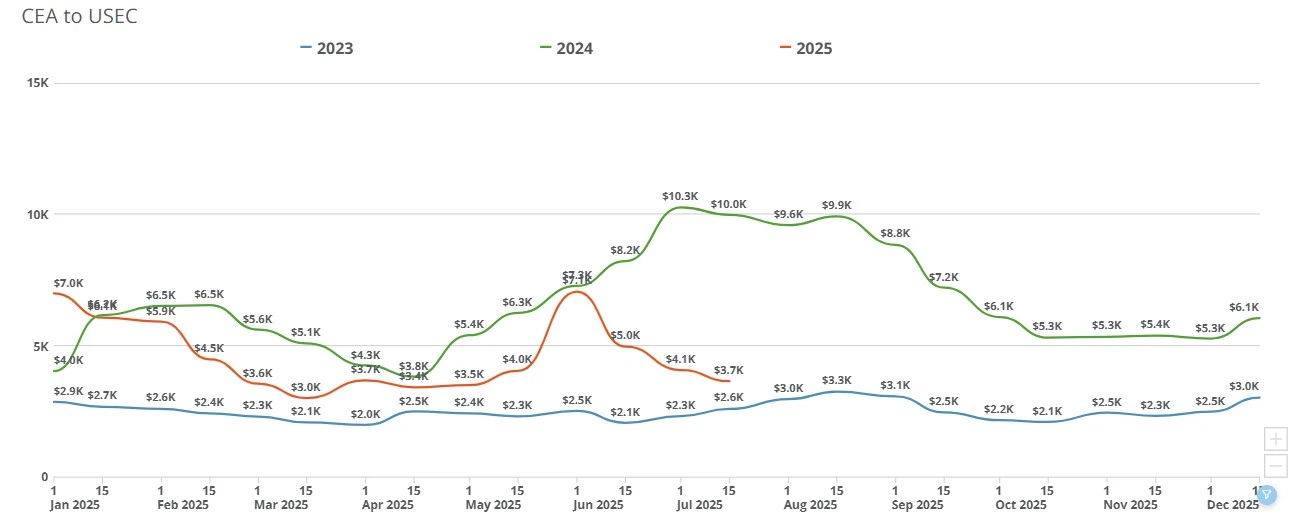

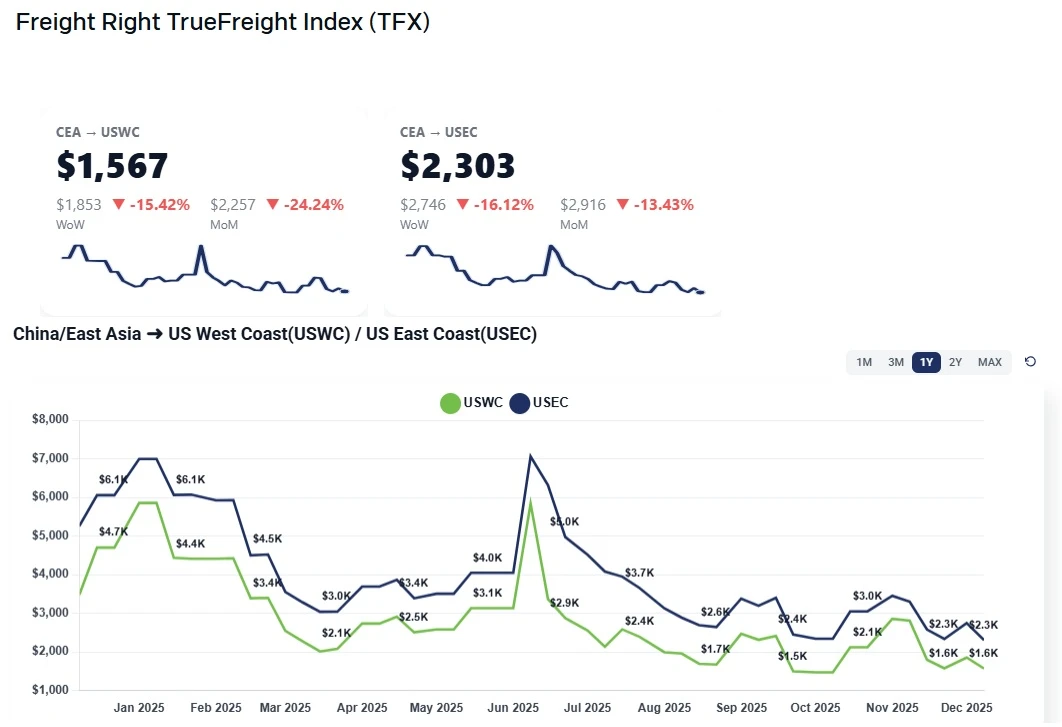

As of this week, the TrueFreight Index is tracking the following:

CEA/USEC 20FT $3166.03

CEA/USEC 40FT $3852.49

CEA/USEC 40HC $3852.49

CEA/USWC 20FT $1832.24

CEA/USWC 40HC $2274.49

CEA/USWC 40FT $2267.42

CEA/USEC 20FT $3332.43

CEA/USEC 40FT $4044.73

CEA/USEC 40HC $4044.73

CEA/USWC 20FT $1804.61

CEA/USWC 40FT $2239.25

CEA/USWC 40HC $2250.55

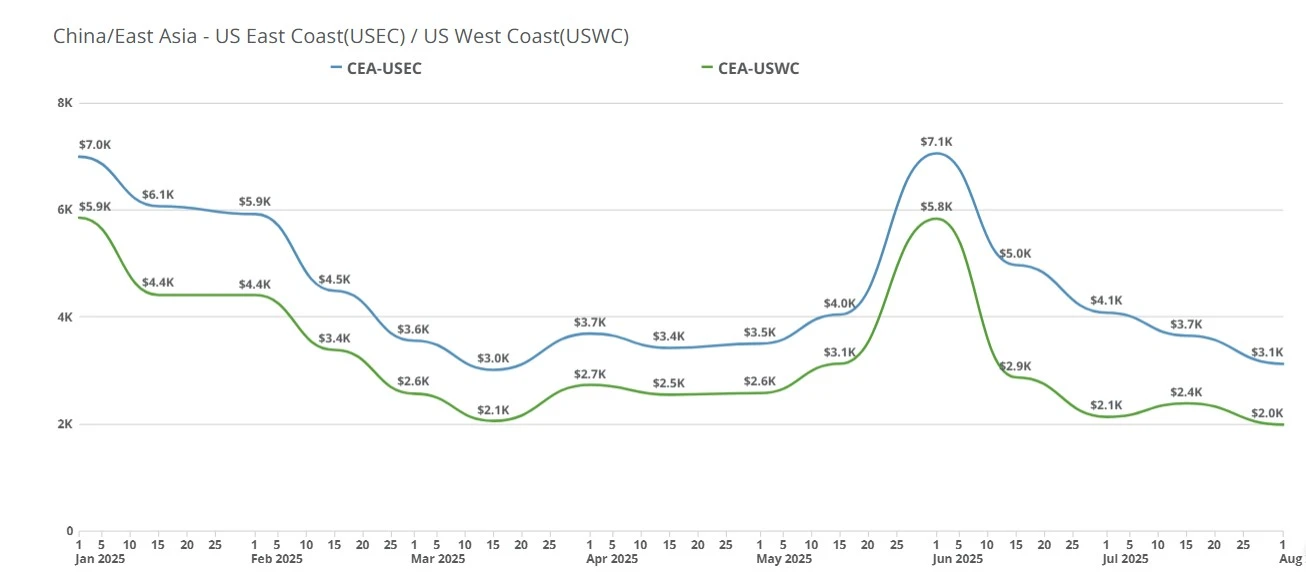

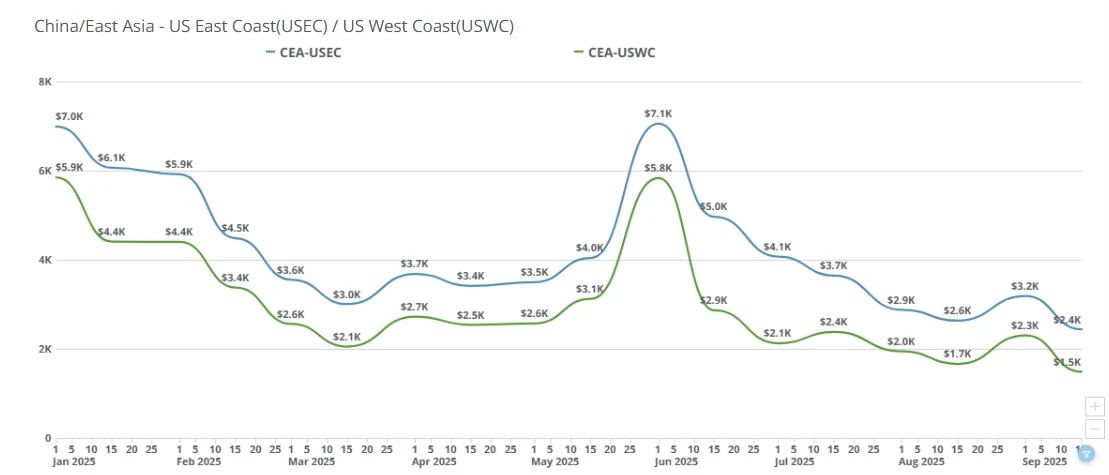

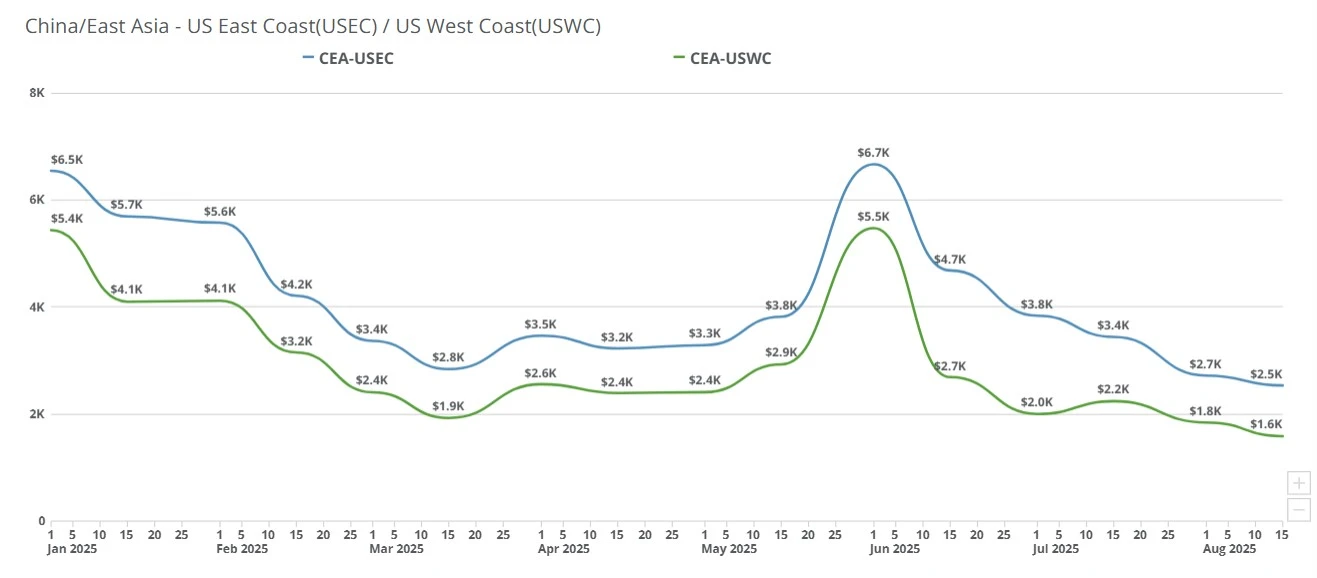

Rates from China/East Asia to the US West Coast continued to drift downward, with the TrueFreight Index showing spot rates averaging around $2,325/FEU last week. On the ground, some carriers are now quoting spot rates as low as $1,620/FEU, approaching 2023’s post-COVID lows. The latest drop represents a total decline of nearly 60% from mid-June levels, when last-minute pre-tariff frontloading sent rates soaring above $5,800/FEU.

Despite the falling rates, volumes remain stubbornly soft. Carrier efforts to spur demand through steep rate cuts have largely failed to trigger a rebound, and space is widely available on nearly all sailings, West Coast, East Coast, and inland.

Rates to the US East Coast dropped again but remain relatively firmer, averaging around $2,900/FEU, down from $3,200 the prior week. That’s still a premium of nearly $600 over West Coast rates. While Panama Canal and Suez constraints are contributing factors, the East Coast’s slower descent is primarily due to limited carrier coverage. Smaller carriers that flooded the West Coast market with excess supply do not operate East Coast services, keeping USEC capacity more balanced.

Muted Peak Season, Absent Demand: Normally, July and August mark the start of ocean freight’s traditional peak season. But this year, few shippers are acting on it. With volumes limited to “bare essentials,” most importers are still sidelined—either because they already frontloaded in Q1 or because they’re financially paralyzed by uncertainty. “Nobody is shipping,” one stakeholder noted. “Even at $1,600, there’s no rush.”

Tariff Anxiety and Economic Fog: The August 1 deadline for tariff extensions, and the August 12 Section 301 expiry for Chinese-origin goods, continues to cast a long shadow. Many small and mid-size importers remain in limbo, unable to justify new orders under potential 25% to 40% cost hikes. At the same time, sluggish consumer demand and lackluster sales events (e.g. a notably quiet Amazon Prime Day) are reinforcing the perception that inventory restocking can wait.

West Coast Oversupply vs. East Coast Constraints: The disparity in rate trajectories between coasts is less about canal congestion and more about supply dynamics. A glut of small carriers has crowded into the West Coast market, pushing rates to unsustainable lows. In contrast, East Coast routings remain controlled by larger carriers with more measured capacity, allowing them to maintain higher pricing, though even there, rate cuts are now accelerating.

Carrier Profit Pressure Rising: Some forwarders are still booking shipments profitably on pre-negotiated customer contracts that haven’t been adjusted downward, benefiting from the margin spread. But this is likely to disappear in August as customers demand updated pricing and margins revert to baseline.

Rates Near Cost, Recovery in Doubt: With spot rates approaching or even dipping below cost on some lanes, carriers are nearing a breaking point. Sustained operation at these levels is unlikely. Yet given the demand backdrop, another round of blank sailings or capacity withdrawal may be the only path to stabilize pricing. Whether that strategy can succeed again so soon after June remains unclear.

Unless another rush materializes ahead of the August tariff expiry, spot rates are likely to remain rangebound or continue softening into August. Carriers may respond with more aggressive capacity management, but absent a material demand spike, whether from renewed frontloading, inventory restocking, or geopolitical flashpoints, pricing will struggle to regain momentum.

With East Coast rates still nearly double West Coast levels, expect some routing rebalancing in Q3. But overall, the market appears to have already priced in the tariff threat, and without further clarity from Washington, shippers and carriers alike will likely remain cautious.

Trucking Drive: US Installs 17% Tariff on Tomatoes from Mexico: https://www.truckingdive.com/news/us-imposes-mexico-tomatoes-tariff/753641/

CBS News: How Automakers are Being Affected by Trump’s Tariffs: https://www.cbsnews.com/video/automakers-affected-by-trump-tariffs/

Financial Times: Lockheed Martin profits plunge almost 80% as it takes $1.6bn charge: https://www.ft.com/content/b43d3ad8-8794-4a39-b63b-13b5f86112b9

gCaptain: Putin Tightens Control Over Ports, Requiring FSB Approval for Foreign Ships: https://gcaptain.com/putin-tightens-control-over-ports-requiring-fsb-approval-for-foreign-ships/

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

As the deadline before reciprocal tariffs take place, the Trump administration continues to make deals with nations around the world. Importers are back to taking a wait-and-see approach while rates USWC and USEC remain unchanged.

The Trump administration re-issued reciprocal tariffs to global trading partners August 1st, transpacific rates nearing 2024 lows, carriers at or approaching the lowest rates we're likely to see for the forseeable future & more.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

This serves as a promising stepping stone in the resolution of the ongoing Trade War between the two countries. On Dec. 13, the U.S. and China reached what leaders of both countries call the “Phase One” of a long-awaited trade agreement, which serves as

US government announces executive order aimed at stopping de minimis imports. See what will and won't change for US importers.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

Founder & CEO of Freight Right Global Logistics, Robert Khachatryan, sat down with Tuck Ly, Vice President of Clearpoint International, to discuss the major issues affecting the global supply chain and port congestion

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Direct-to-consumer merchants selling oversized goods domestically and internationally have a unique set of logistical and pricing challenges. Freight Right's CEO Robert Khachatryan discusses those challenges on Ticker News Australia.