On Dec. 13, the U.S. and China reached what leaders of both countries call the “Phase One” of a long-awaited trade agreement, which serves as a promising first step in the restoration of American and Chinese trade relations. This Phase One deal asks both parties of structural reform, changes to China’s economic and trade regime in the areas of “intellectual property, technology transfer, agriculture, finance, and currency and foreign exchange.”

As a result of the agreement, China announced of its commitment to making generous amounts of purchases of U.S. goods, in return for the reduction of Section 301 List 4A tariffs from 15% to 7.5% — a noticeable 50% cutback — which is seen as crucial groundwork for better trade conditions between the two powers.

Section 301 4A currently houses goods varying from telecommunications equipment, motor vehicle products, kitchenware, apparel, live animals, and other widely-used commercial goods — containing a large number — approximately $120 billion of Chinese imported goods. Nonetheless, tariffs on lists 1, 2, and 3 will remain in place with a whopping 25% tariff.

It is believed that this Phase One ordeal will get China to buy close to $200 billion more of U.S. goods, specifically farm and agricultural products, for the next two years, which in turn will reduce the trade deficit.

Additionally, China agreed to open U.S. credit card companies and banks within its origins, giving the U.S. full access so that American businesses can operate in China without having to go through local banks there.

While the “Phase One” agreement seems like an auspicious step in the advancement process of America’s trade relations with China. Until they have shown full commitment to resolving this seemingly-long Trade War, we cannot assume that either government will live up to their promises. What’s next?

Ongoing trade tensions between the United States and China continue to be the defining story of the 2019 global economy. What started off as an ongoing dialogue about the economic relationship between the two largest economies in the world has transformed

The United States-Mexico-Canada Trade Agreement (USMCA) Replaces the North American Free Trade Agreement (NAFTA)

The Trade Deal signed between the two governments has become subject to much discussion as critics say that it's vague and doesn't address the actual problems.

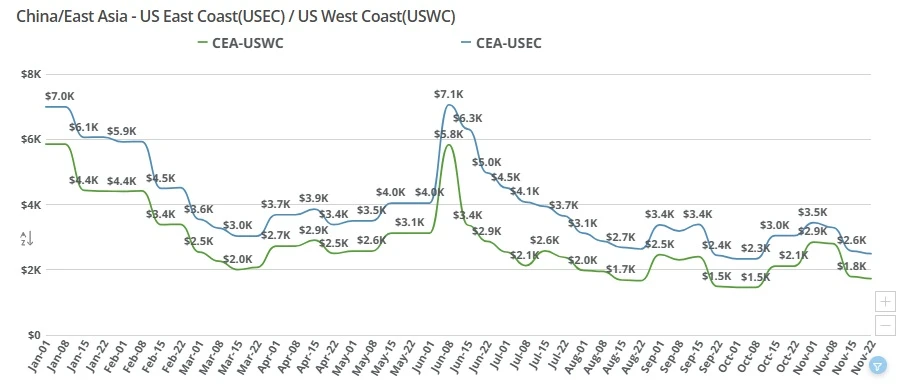

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

The amount of truckers is dwindling and it is not good news for the freight industry. Why is this happening and what are the long and short term solutions?

Freight Right is now offering direct consolidated ocean shipments to the Port of Long Beach and Los Angeles.

Why it’s so expensive to ship goods and to travel between multiple U.S. ports.

A list of strict ATA Carnet accepting-countries and the specifications they hold. Most non-commercial, exhibiting importers and exporters recognize the value and role of ATA Carnets in the complicated field of trade. While the World Customs Organization

US consumer expectations have continued to evolve each year. We've pulled the latest research and surveys regarding US consumer buying preferences specifically around the desire around 2-day and same-day shipping preferences.

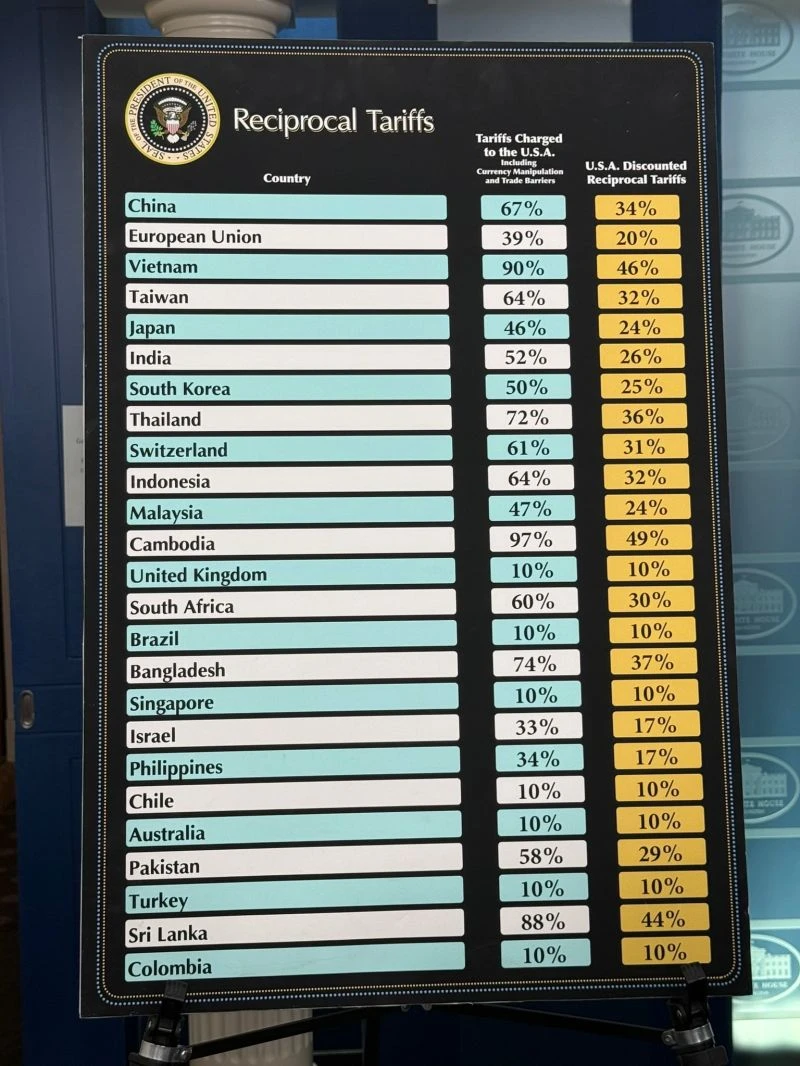

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.