In April 2025, former President Donald Trump reignited his hardline trade agenda by imposing sweeping tariffs on nearly all U.S. imports. Citing persistent trade imbalances, unfair foreign competition, and the need to revive domestic manufacturing, Trump invoked emergency powers to introduce a baseline 10% tariff, excluding Canada and Mexico. Framing the move as a bold effort to protect American jobs and industries, the administration aimed to pressure trading partners into renegotiating terms more favorable to the U.S. The decision quickly reshaped global trade dynamics and triggered intense diplomatic negotiations.

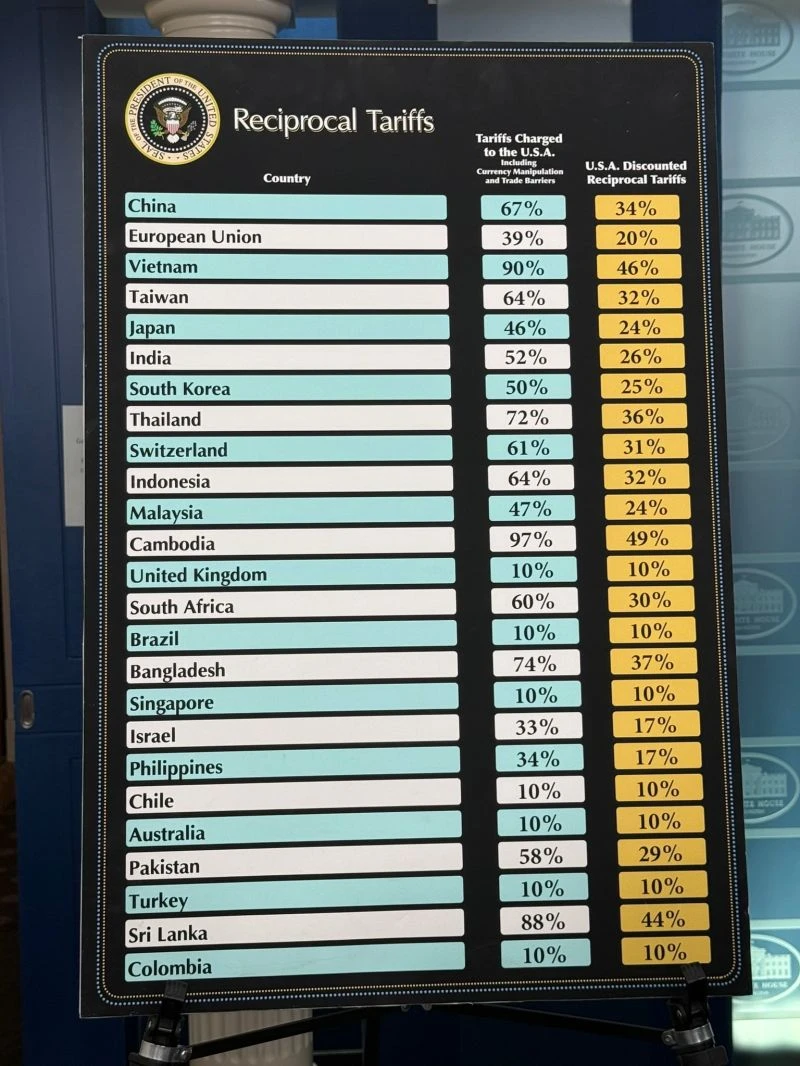

April 2: President Trump announced a 10% universal tariff on nearly all imports, excluding Canada and Mexico, under the International Emergency Economic Powers Act (IEEPA). This move aimed to address trade deficits and perceived unfair trade practices. (hbkcpa.com)

April 5: The 10% baseline tariff took effect. (hbkcpa.com)

April 9: Country-specific "reciprocal" tariffs were scheduled to commence, targeting nations with significant trade surpluses with the U.S. (hbkcpa.com)

April 10: Executive Order 14257 temporarily suspended country-specific tariffs (excluding China), maintaining the 10% universal tariff until July 9. (glc-inc.com)

May: The U.S. trade deficit narrowed sharply to $61.6 billion, the lowest since September 2023, primarily due to a significant drop in imports as businesses adjusted to the new tariff regime. (money.usnews.com)

June 30: The U.S. and the United Kingdom finalized a partial trade agreement, maintaining a 10% base tariff with certain preferential terms. (theguardian.com)

Throughout June: Negotiations continued with several countries. Vietnam agreed to a 20% tariff and 40% on transshipped goods, while talks with Canada resumed after it withdrew a digital services tax. (businessinsider.com)

July 6: President Trump extended the tariff negotiation deadline from July 9 to August 1, providing countries additional time to reach agreements. (theguardian.com)

July 7: The administration sent tariff notification letters to 12 countries, indicating new tariffs up to 70% effective August 1. (time.com)

July 8: President Trump announced a 50% tariff on copper imports to boost domestic production. This led to a significant increase in U.S. copper futures prices. (reuters.com)

July 8: Additional tariff letters were prepared for 15 to 20 more countries, with a general notice for those not receiving individual letters. (marketwatch.com)

July 9, 2025: President Trump announces a 50% tariff on Brazilian imports, citing political concerns.

July 10, 2025: Brazil announces reciprocal measures; global markets react to the escalating trade dispute.

July 11, 2025: Trump targets Canadian goods with 35% tariffs (impacting the loonie and markets); U.S. launches its first rare-earth mine—a tariff strategy pivot

July 12, 2025: Trump confirms 30% tariffs on EU and Mexico beginning August 1; EU warns of retaliation & pushes for negotiated fix

July 13, 2025: EU delays its countermeasures to allow deal talks; German officials express cautious optimism

July 14, 2025: Warning of up to 100 % secondary tariffs on Russia

July 15, 2025: EU warns 30 % tariff could undermine Eurozone growth

July 22, 2025: US–Japan deal, tariffs cut to 15%, backed by $550 B investment

July 22, 2025: 19% tariff announced on Philippine imports during PH President Marcos visit

July 27 to 29, 2025: Finalization of the U.S.–EU 15% baseline tariff agreement to take effect August 1

July 28, 2025: Advance tariff negotiations with China to extend tariff truce before the August 12 deadline

July 29, 2025: India–U.S. trade talks continue, with India expecting tariffs up to 25% and a broader deal by autumn.

August 1: Executive Order Signed (Late July 31)

President Trump signed an executive order imposing steep new tariffs on 66–69 countries, including the EU, India, Taiwan, Brazil, Canada, South Africa, and others. These tariffs range broadly—some as high as 41%—and were scheduled to begin August 7, though Canadian tariffs (35%) activated on August 1 due to special fentanyl-related measures.

August 1: Tariff Scope & Country Rates

Canada: 35% duties on most goods, tied to fentanyl tensions.

India: 25% tariffs initiated.

South Africa: 30% rate applied.

Taiwan: 20% duty enacted.

Several countries were exempted or negotiated reduced rates (e.g. Cambodia, Lesotho, Madagascar).

August 7: Reciprocal Tariffs Fully Activated

President Trump’s expanded set of reciprocal tariffs officially took effect on August 7, following a temporary pause. Affected goods from roughly 60–70 countries are now subject to newly defined ad valorem rates, marking the most sweeping update since April.

o Switzerland's tariff rose from 31% to 39%

o India faces a total 50% tariff > 25% reciprocal plus another 25% penalty linked to its imports of Russian oil.

August 18: Section 232 tariffs expanded to 50% on new steel/aluminum categories

U.S. broadened its Section 232 tariffs by adding over 400 new HTS codes covering steel and aluminum derivatives. These products now carry a 50% metal-content tariff, and importantly, the new rates apply even to goods already in transit.

August 19: India confirms $48B exports subject to 50% tariff from Aug 27

August 27: India begins redirecting exports post-50% tariffs announcement; warnings of nearly halved garment industry growth.

August 29: A federal court ruled that Trump’s tariffs on de minimis shipments violated the TFTEA. The 25–35% duties on e-commerce imports under $800 (e.g., from Temu, Shein, AliExpress) were ruled unlawful, though enforcement is paused until October 14.

The U.S. trade landscape remains in flux as negotiations, tariff adjustments, and policy shifts continue to unfold under the Trump administration. With key deadlines extended and new measures announced weekly, global markets and trading partners are closely watching for the next move. As these developments evolve, this article will be regularly updated to reflect the most current information on U.S. and global trade policies. Stay tuned for the latest updates, insights, and implications impacting businesses, supply chains, and international relations.

Updated Tariff rates as of August 21, 2025

Country/Sector | Previous Rate (%) | Current Rate (%) | Notes |

Brazil | 10 | 50 | Raised due to Bolsonaro trial tensions; confirmed Aug 1 |

Cambodia | 49 | 36 | Reduced from 49% post bilateral negotiations |

Indonesia | 32 | 19 | Lowered via July 23 trade deal with U.S. |

Vietnam | 46 | 20 (deal) / 46 | Default 46%; 20% under verified exporter agreement |

Philippines | 20 | 19 | Deal-based reduction from 20% to 19% |

Canada | 10 | 35 | New 35% tariff imposed under Aug 1 Executive Order |

Switzerland | 31 | 39 | Raised from 31% to 39% due to financial imbalance |

India | 26 | 50 (25% reciprocal + 25% oil penalty) | 25% reciprocal + 25% Russia oil-related penalty; effective Aug 27 |

European Union | 20 | 15 (pending) | Pending EU-wide deal to finalize 15% auto tariff retroactive to Aug 1 |

United Kingdom | 10 | 10 | Maintained under existing U.S.-UK agreement |

Australia | 10 | 10 | Unchanged under alliance status |

Japan | 25 | 15 | Reduced via Japan-U.S. deal (July 22) |

South Korea | 25 | 25 | No new deal; remains at 25% |

Mexico | 10 | 10 | Maintained baseline reciprocal tariff |

China | 10 | 10 (suspended) | Reciprocal tariffs suspended until Aug 12; Section 301 still applies |

Malaysia | 25 | 24 | Confirmed in July letters |

Thailand | 36 | 36 | No change; trade surplus cited |

Bangladesh | 37 | 37 | Targeted due to labor and textile policy concerns |

South Africa | 30 | 30 | Remains unchanged; broad-based reciprocal tariff |

Other Countries | 10 | 10 | Default baseline for non-listed countries |

Pharmaceuticals (sector) | 200 | 200 | Tariff remains at 200%; pharmaceutical protection |

Copper (sector) | 50 | 50 | Remains at 50% to protect strategic minerals |

Steel & Aluminum Derivatives | 25 (Section 232) | 50 | Expanded Aug 18 to over 400 HTS codes; 50% rate even in transit |

On April 24th, The US Department of Homeland Security and US Customs & Border Protection have released new guidance around the end of the US' de minimis exception. See the changes ahead for importers and customs professionals.

Explore how the 2025 U.S.-U.K. Economic Prosperity Deal reshapes tariffs, boosts exports, and opens new opportunities for automotive, aerospace, and metals trade.

The International Longshoremen's Association began their strike October 1, 2024, affecting ports running along the east coast and Gulf regions of the United States. See what ports are affected and what this strike can mean for shippers.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

Trump’s latest trade deal with China and South Korea cuts tariffs, boosts U.S. exports, and deepens security and economic cooperation.

The U.S. will impose 10% tariffs on lumber and 25% on furniture starting October 14, 2025, a move set to impact housing costs, supply chains, and trade relations.

Ongoing trade tensions between the United States and China continue to be the defining story of the 2019 global economy. What started off as an ongoing dialogue about the economic relationship between the two largest economies in the world has transformed

In the hospitality and hotel sectors, the success of a project often hinges on countless elements working together seamlessly. Among these, shipping Furniture, Fixtures, and Equipment (FF&E) plays an integral role, often influencing a project's timeline,

This article will explain what international air freight charges are and how to calculate the chargeable weight when shipping goods overseas.