Global trade dynamics were marked by escalating protections and shifting alliances. The U.S. extended its tariff truce with China, sustaining a fragile peace in one of the world’s largest trade relationships. Meanwhile, India initiated its own defensive measure by proposing multi-year tariffs on steel to guard against import surges from China.

Concurrently, tensions between the U.S. and India deepened, as Washington raised tariffs to 50%, prompting Indian criticism and elevating concerns over broader economic fallout. Fitch signaled that India's pharmaceutical sector could be next in the tariff crosshairs, reminding markets of the fragile and uneven reach of protectionist measures.

Across the board, firms and policymakers were advised to brace for inflationary pressures and trade disruptions resulting from continued tariff expansion and geopolitical complexity. The period underscored the shifting contours of global trade in the era of fortified national interests and strategic recalibrations.

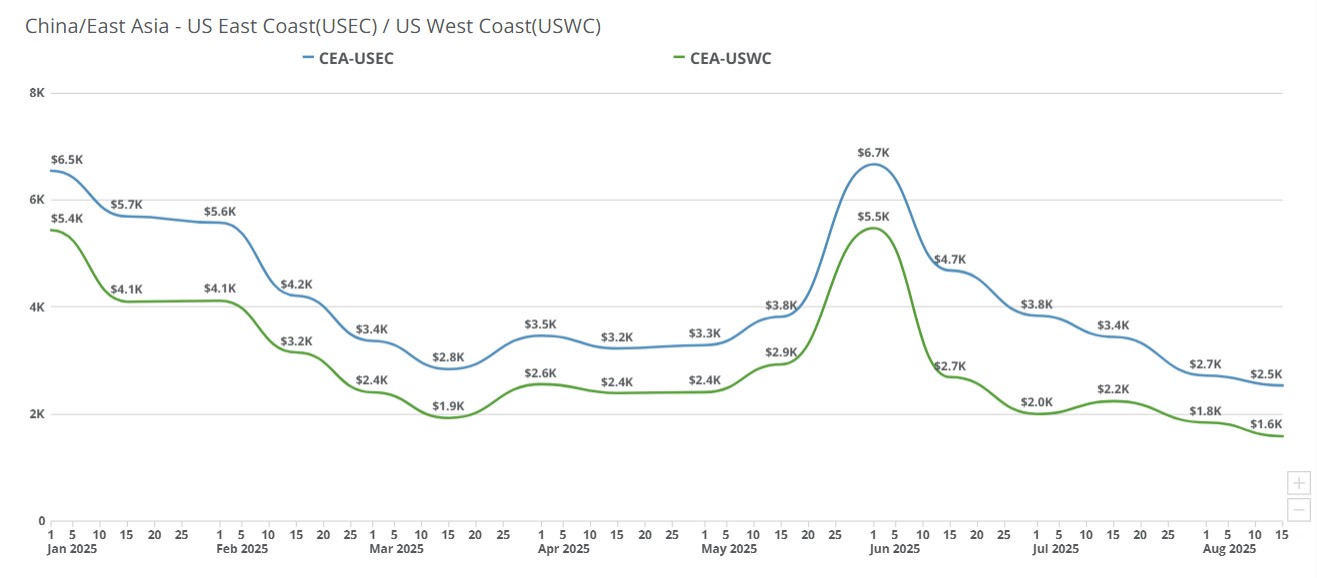

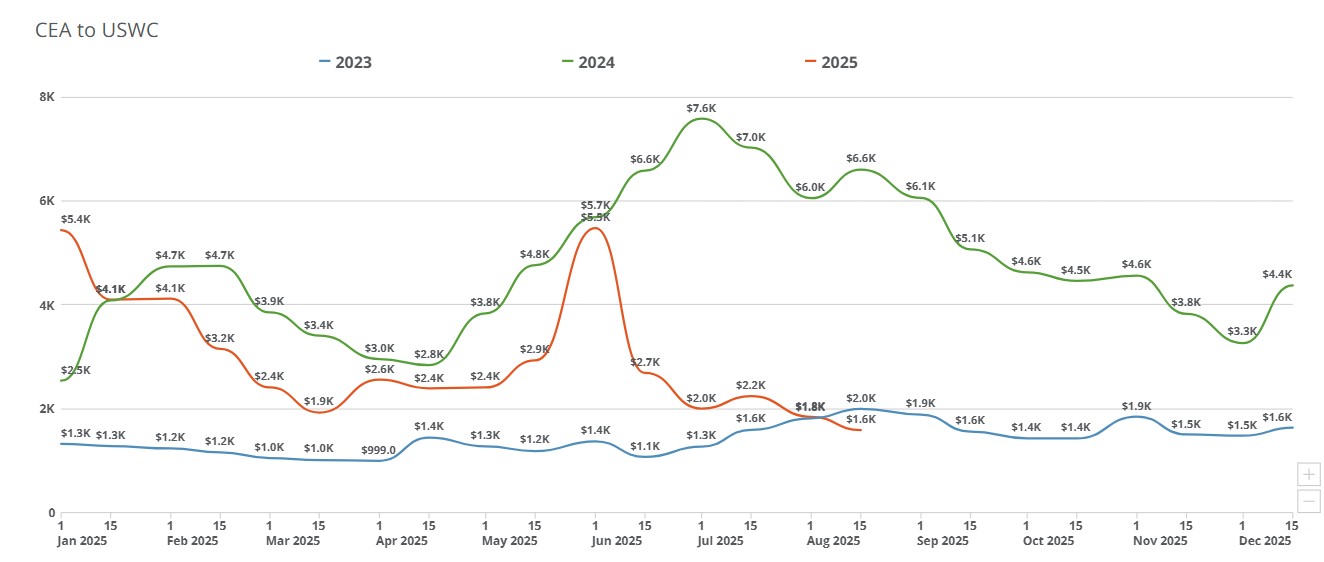

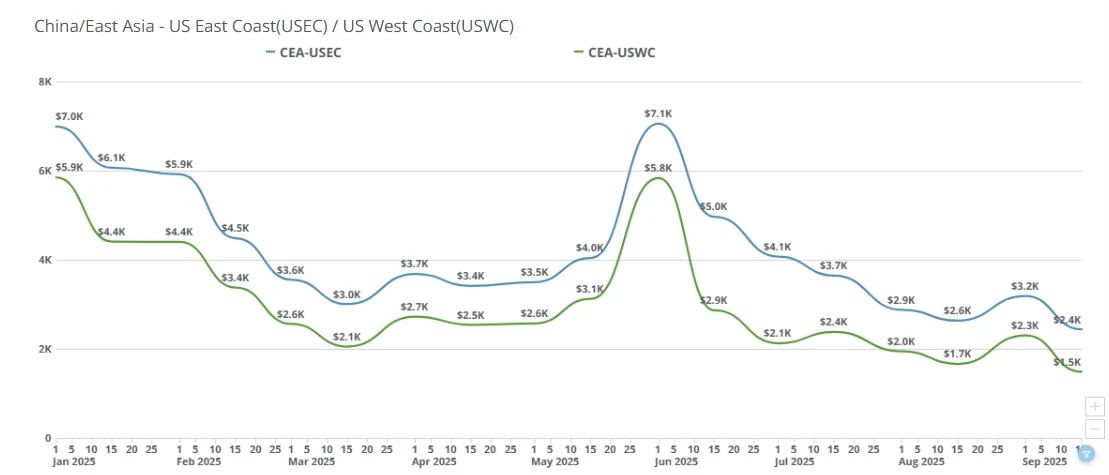

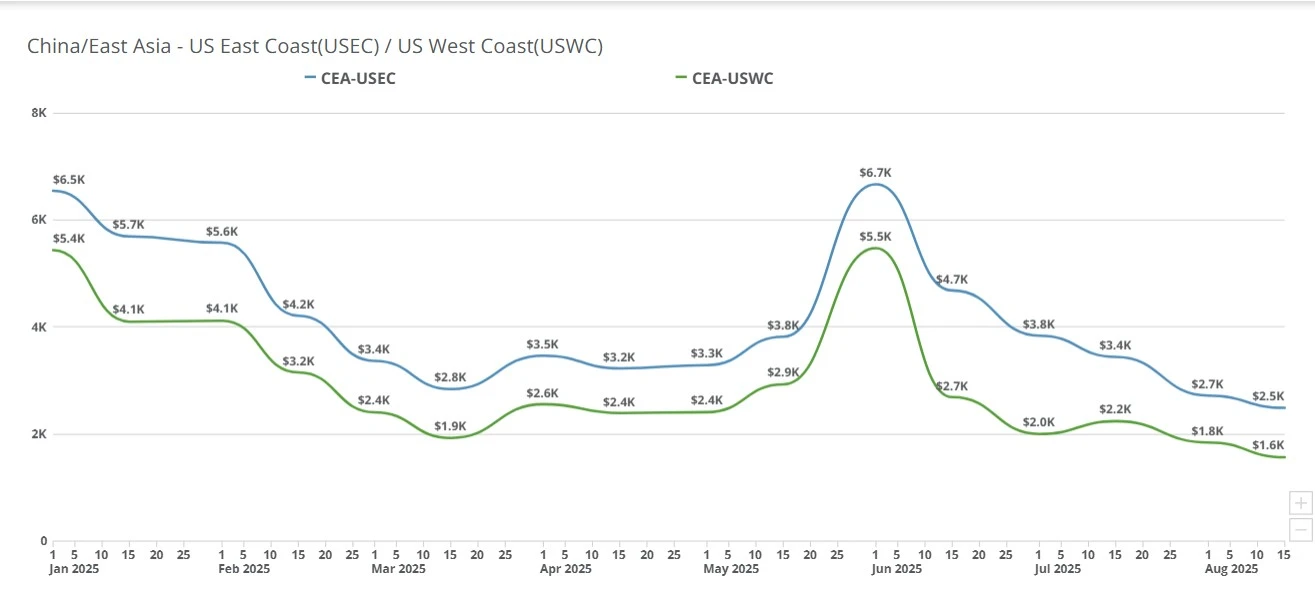

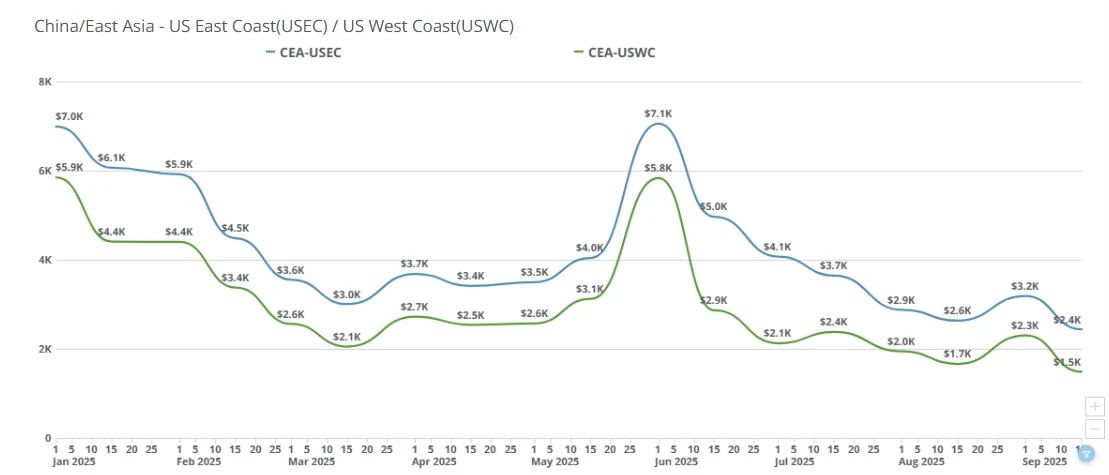

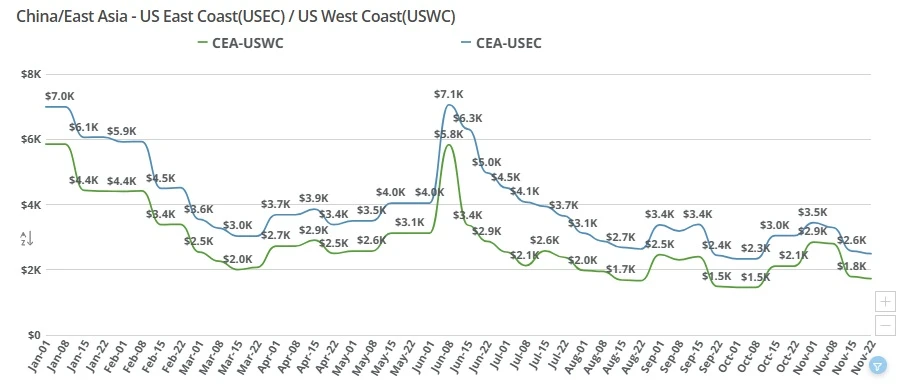

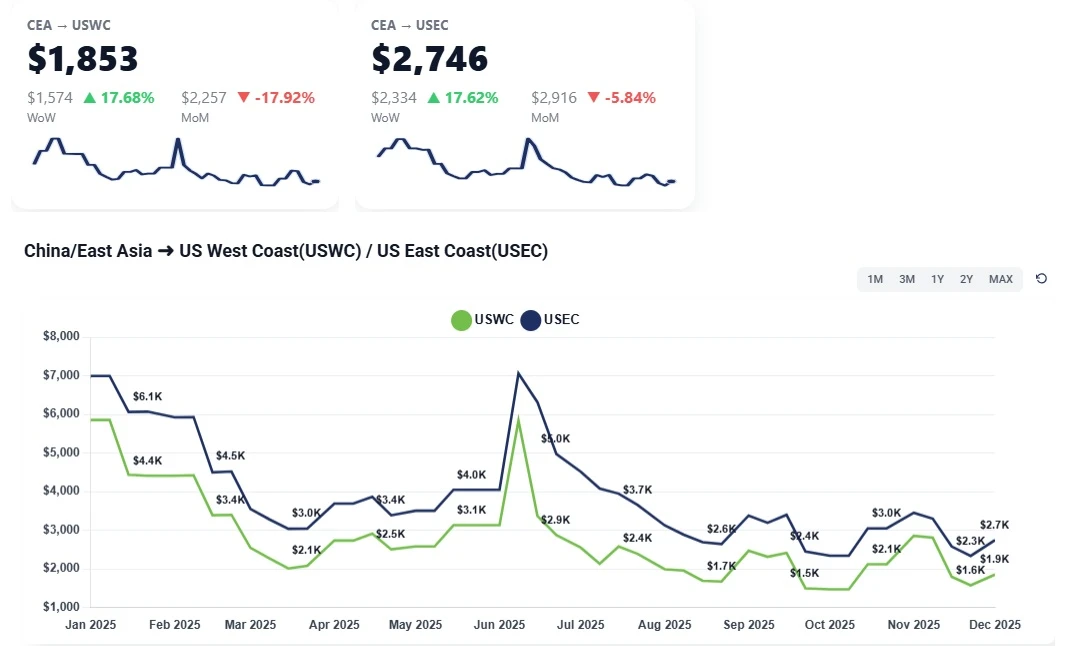

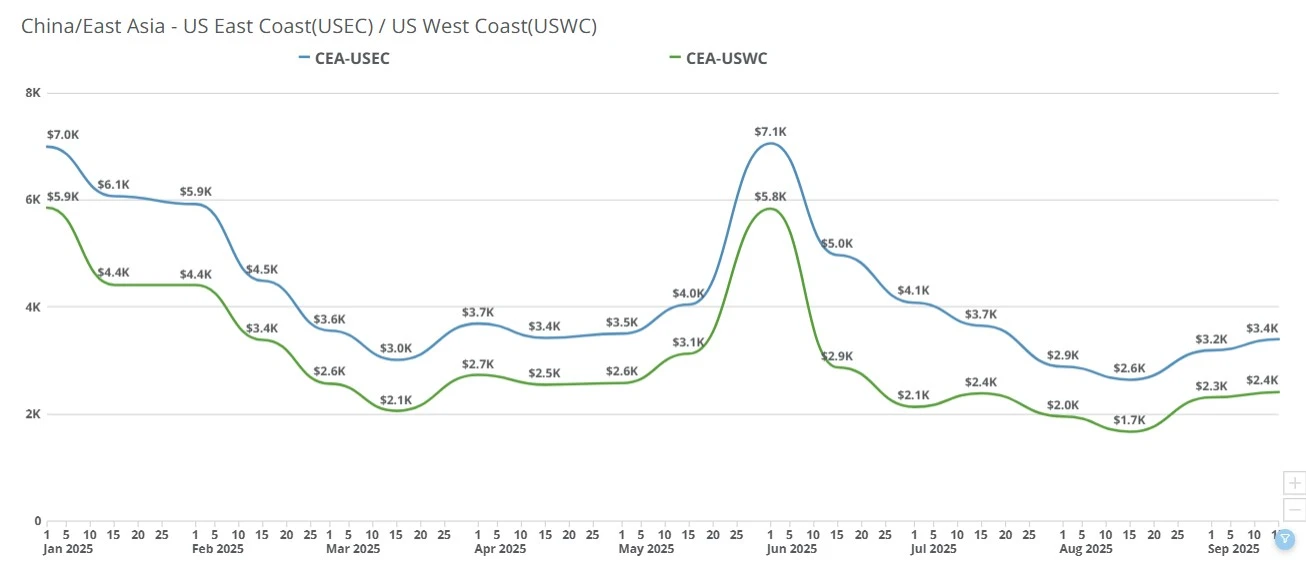

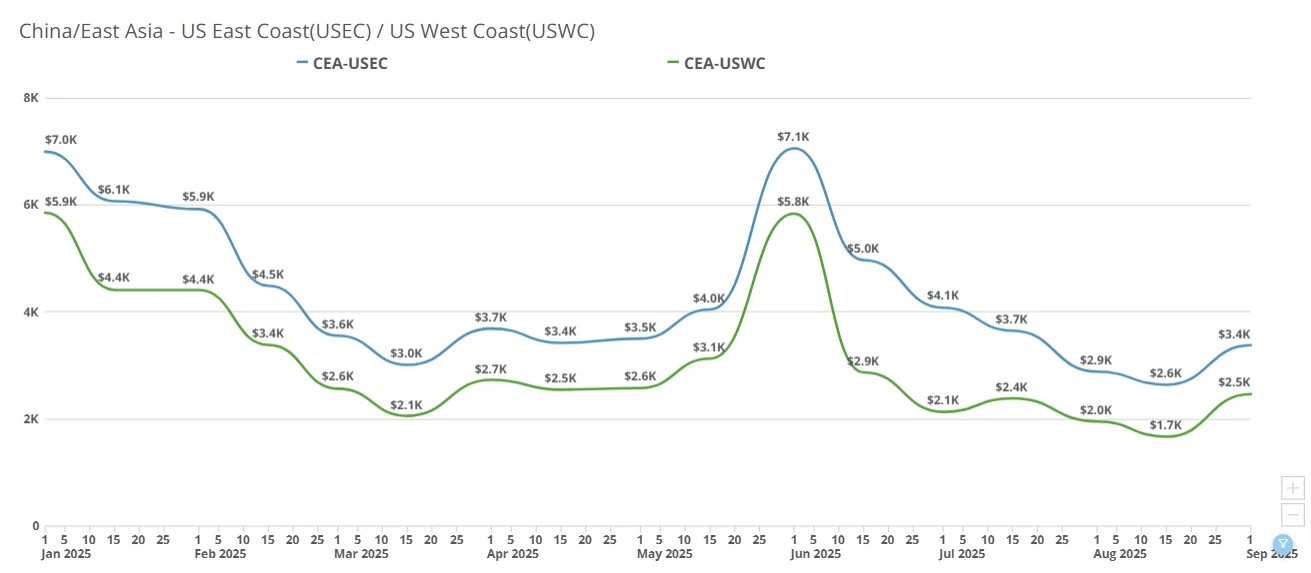

Regarding CEA/USWC, spot levels edged down again week‑over‑week by roughly $50-$100 per FEU, with all‑in quotes now clustering around $1,520-$1,550/FEU, as carriers trimmed offers to stimulate bookings.

Regarding CEA/USEC, sentiment is similarly soft with incremental declines; forwarders report matching down to competitors’ numbers to keep freight moving, implying modest week‑over‑week easing on this lane as well.

Week of August 18, 2025:

CEA/USEC 20FT $2281.37

CEA/USEC 40FT $2778.65

CEA/USEC 40HC $2778.65

CEA/USWC 20FT $1472.58

CEA/USWC 40FT $1818.61

CEA/USWC 40HC $1832.23

Week of August 11, 2025:

CEA/USEC 20FT $2374.02

CEA/USEC 40HC $2885.57

CEA/USEC 40FT $2885.57

CEA/USWC 20FT $1583.48

CEA/USWC 40FT $1955.97

CEA/USWC 40HC $1984.44

Fresh carrier discounts: Multiple lines cut offers by $50–$100 per box this week as they chase volume in a thin market.

Blank sailings ramping (Weeks 34–36): Carriers have already started canceling sailings over the next three weeks to tighten supply and set up a September hike.

GRI “setup” into September: Lines are explicitly targeting a ~$1,000/FEU GRI effective Sept 1, aiming to pull WC levels back toward $2,400-$2,500/FEU but acknowledge it will be a tough sell without demand.

Demand remains weak: Import volumes from many SMB shippers are sporadic or paused; only a slice of importers are actively moving boxes at today’s prices.

Front‑loading hangover: Some buyers pulled bookings forward into August while rates were cheap, which may leave September thin if GRIs stick.

Margin compression across the market: Competitive pressure is intense; forwarders report $50-$100/container margins just to keep cargo, underscoring how soft demand is relative to capacity.

Throughout the remainder of August, expect continued sideways‑to‑slightly‑down prints on both CEA/USWC and CEA/USEC as carriers lean on ad‑hoc discounts while blank sailings work through the system.

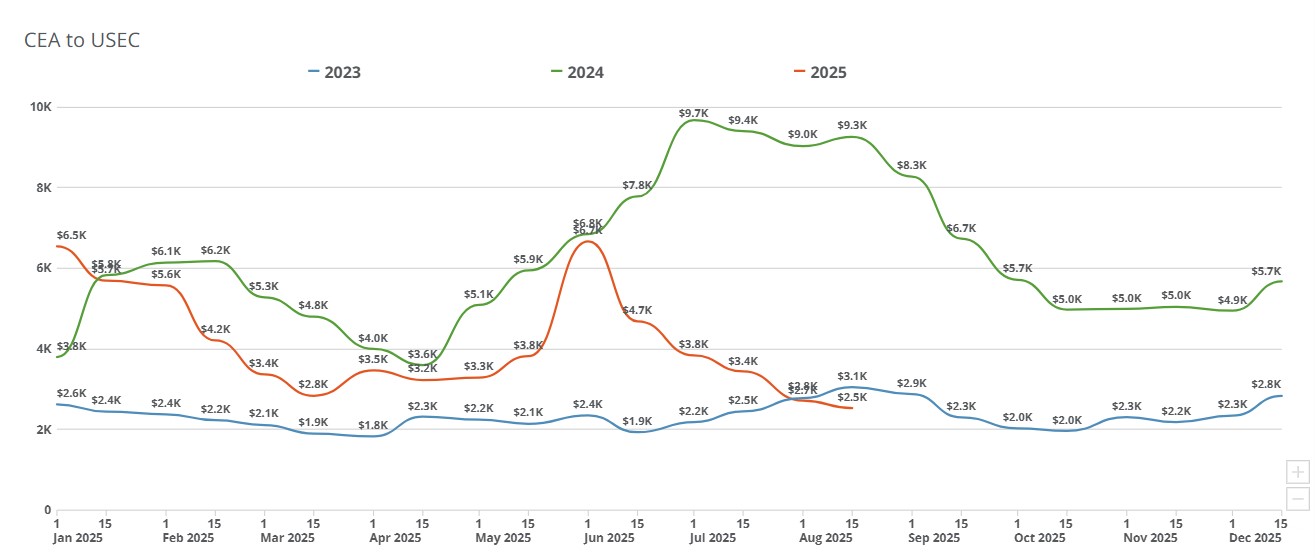

As we enter into September, we’re expecting carrier lines will likely publish ~$1,000/FEU increases. During that time, we’re expecting partial uptake, a short‑lived bounce if space tightens from blankings, followed by renewed discounting where lifts disappoint. Risk skew: If the market doesn’t support higher levels, carriers may sail light or roll back rates within a week or two, similar to June’s “shock‑and‑fade” pattern.

Bigger picture, faster capacity withdrawals that over-tighten certain weeks, policy volatility that reintroduces deadline front-loading and operational hiccups (port congestion, weather) that create short, local price flares without changing the overall soft trend are likely to continue through August.

WSJ: Global Economy Took Tariff Hike in Its Stride, But Stronger Headwinds Are Ahead: https://www.wsj.com/economy/trade/global-economy-took-tariff-hike-in-its-stride-but-stronger-headwinds-are-ahead-5af46e60

CNBC: These two charts show Walmart and Target's front-loading strategy: https://www.cnbc.com/2025/08/18/these-two-charts-show-walmart-and-targets-front-loading-strategy.html?trk=feed_main-feed-card_feed-article-content

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

The International Longshoremen's Association began their strike October 1, 2024, affecting ports running along the east coast and Gulf regions of the United States. See what ports are affected and what this strike can mean for shippers.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.