As tariff deadlines approach, dealmaking begins to pick up.

Several landmark bilateral trade agreements were finalized by the US. Notably with Japan, Indonesia, the Philippines, and the European Union. The agreements set reciprocal tariffs at manageable levels (typically 15–19%) in exchange for substantial investment and market access commitments. As the August 1 “Liberation Day” tariff deadline approached, Trump escalated pressure on countries without deals by threatening tariffs as high as 50%. Meanwhile, global bodies like the IMF issued warnings about inflation and growth risks tied to these high and uncertain tariff levels, even as US revenue from tariffs smashed records. This period saw rapid stabilization of trade terms through deals, but carried rising concern over long‑term economic volatility and policy coherence.

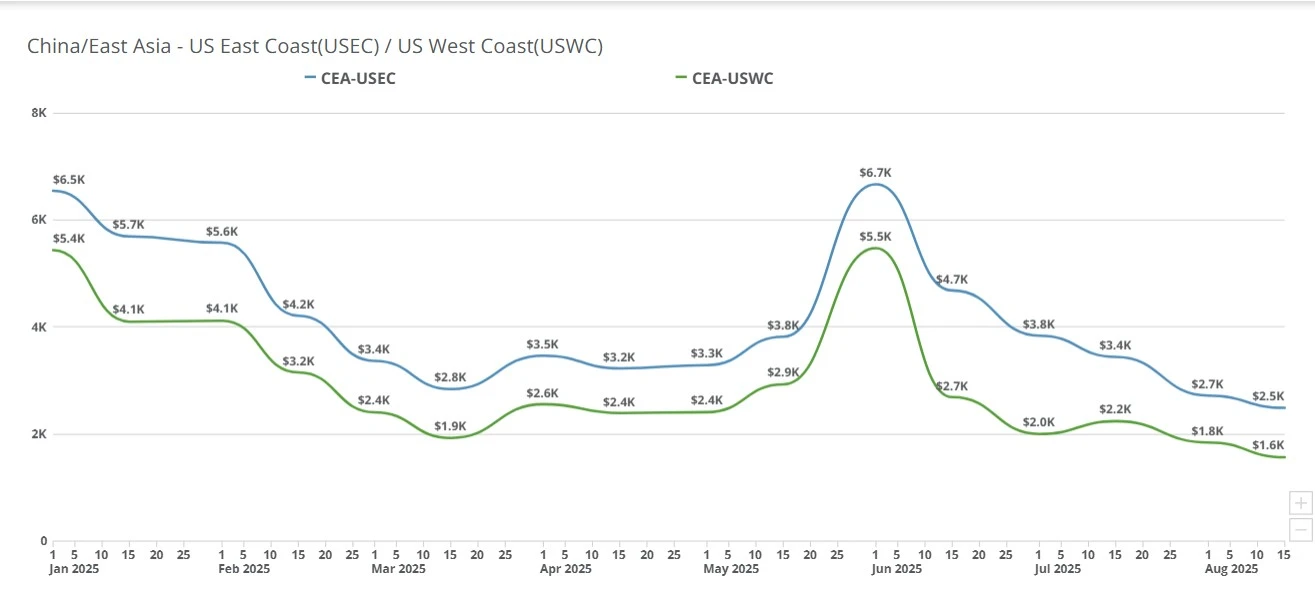

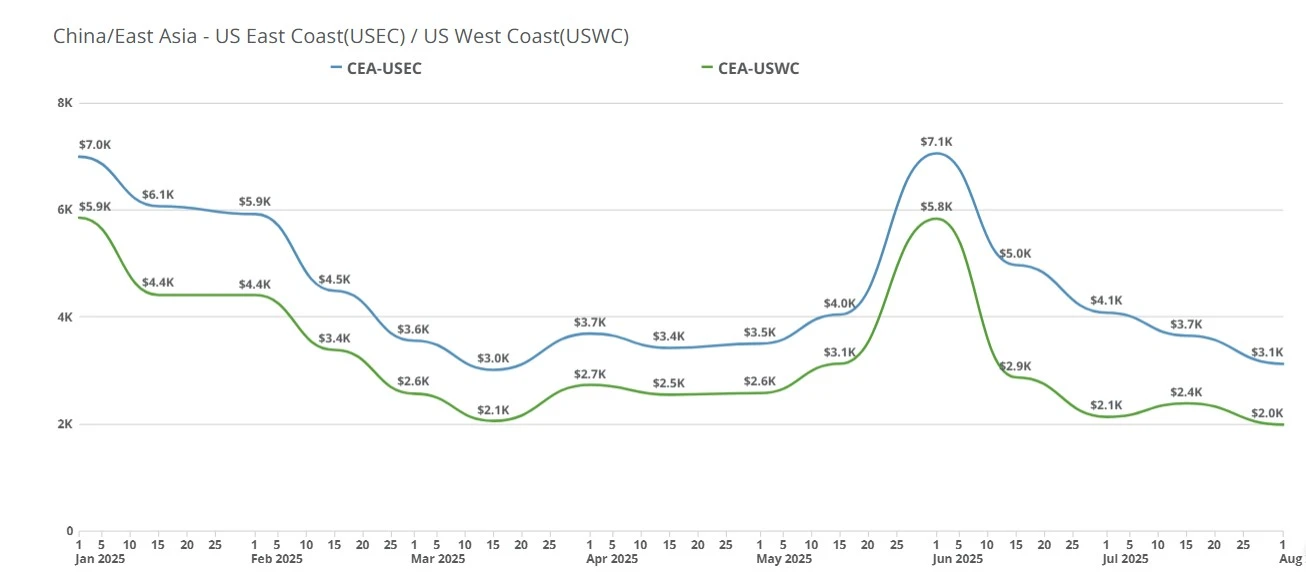

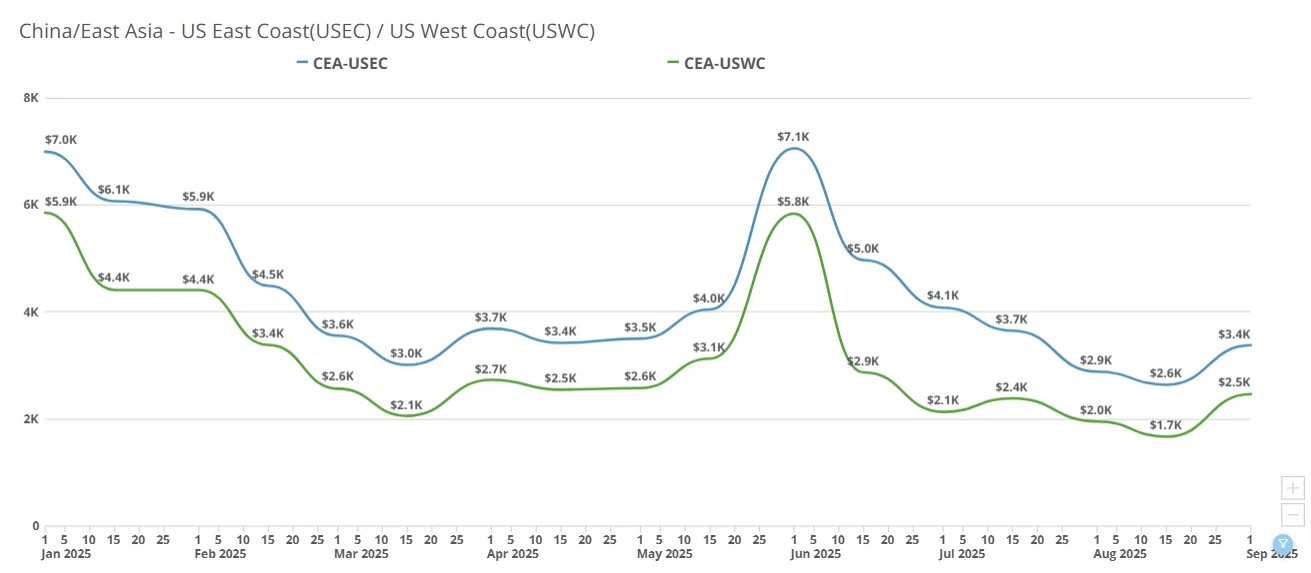

As of this week, the TrueFreight Index is tracking the following.

Transpacific ocean freight rates remained largely unchanged this past week, with carriers unable to push through planned General Rate Increases (GRIs) as demand continued to falter. Average spot rates from China to the U.S. West Coast are holding in the $1,700–$2,000/FEU range, with some carriers even offering $1,700–$1,800/FEU effective August 1st. East Coast rates are hovering around $2,900–$3,200/FEU, maintaining a $1,200–$1,300 spread between coasts.

This stabilization reflects what many consider the market floor for current conditions, as dropping rates much further would risk breaching annual BCO contract levels and triggering widespread contract renegotiations.

Trump’s “TACO” tariff policy disruption: Erratic tariff announcements and repeated deadline shifts have thrown U.S. liner shipping schedules into chaos, creating multiple periods of frontloading followed by steep demand drops.

Peak season likely over: Instead of a traditional summer surge, this year’s shipping cycle saw a rush for goods in January through March, asharp brake after the April 1.0 tariff announcement, a modest rebound in May after tariff delays, well below expectations, another sharp decline in June, compounded by the July 7 notification of Tariff 2.0, leading to widespread uncertainty and booking hesitancy.

Bookings far below normal: Vizion data shows China–US bookings were 39% lower the week of June 30–July 6 compared to mid-May and 18% lower YoY. Across all origins, U.S. bookings fell 12% YoY in what should have been peak season.

Declining Chinese market share: Imports from China to the U.S. dropped from 40% in January to 29% in June, erasing most of Q1’s early surge.

Failed GRI attempts: Carriers initially aimed for $3,000/FEU (USWC) and $4,000/FEU (USEC) for August 1st but were forced to slash offers within a week due to weak demand.

Barring a dramatic policy shift, the traditional transpacific peak season may have already ended. Outlook factors include:

Higher tariff environment from August onward: Even if tariff deadlines are extended, most countries—including China—will face higher effective rates than before the tariff war, capping demand growth.

Potential rate pressure in early August: Carriers may reduce FAK levels further in an attempt to stimulate bookings, though sustaining rates below $1,900 (USWC) and $2,900 (USEC) would trigger contract disputes with BCOs.

NRF forecast is pessimistic: Volumes for August–November are projected to decline more than 18% YoY, falling 7% below 2023 levels, signaling a weak peak season and possibly the lowest late-year volumes in years.

Market uncertainty persists: Until tariff policies stabilize, U.S.-bound cargo will continue to face unpredictable swings, with few expecting a meaningful rebound before Q4.

This year’s transpacific peak season may have “quietly ended” weeks earlier than normal, a direct result of volatile U.S. trade policy and repeatedly shifting tariff deadlines.

The White House: Fact Sheet: The United States and European Union Reach Massive Trade Deal: https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-the-united-states-and-european-union-reach-massive-trade-deal/

FreightWaves: Less than 2 years after Flexport bought Convoy’s tech stack, it’s being sold to DAT: https://www.freightwaves.com/news/less-than-2-years-after-flexport-bought-convoys-tech-stack-its-being-sold-to-dat

The Guardian: US and China poised to extend tariff truce after failing to find resolution at talks: https://www.theguardian.com/us-news/2025/jul/29/us-and-china-poised-to-extend-tariff-truce-after-failing-to-find-resolution-at-talks

WSJ: Welcome to the Grocery Store Where Prices Change 100 Times a Day: https://www.wsj.com/business/retail/surge-grocery-prices-electronic-shelf-labels-a3d47701?mod=djemlogistics_h

--

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

FEU & TEU rates change slightly week-over-week, importers that can afford to keep importing are continuning to do so while those that are hamstrung by tariffs are sidelined and the August 1st tariff deadline is one week away.

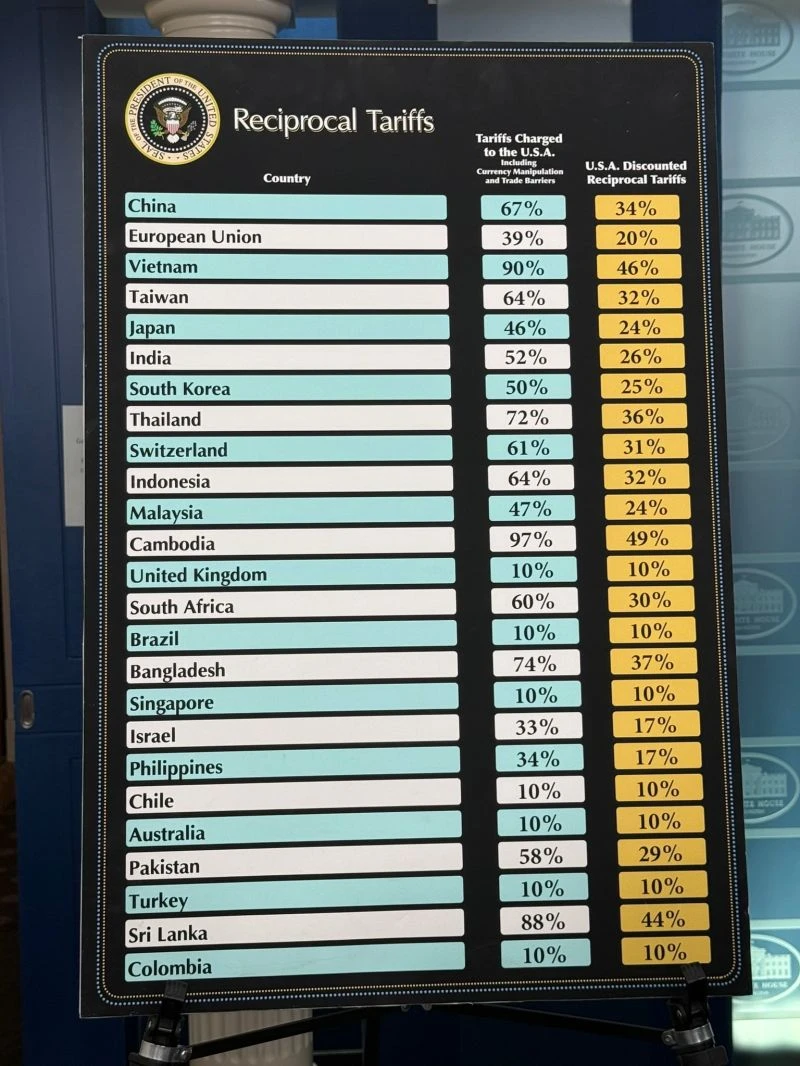

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

On August 29, 2025, a federal appeals court ruled 7–4 that President Trump’s emergency-based tariffs were unlawful, finding tariff powers rest with Congress. The court left them in place temporarily, granting the administration time to appeal to the SC.

The Los Angeles Business Journal has ranked Freight Right as the #19 Best Place to Work.

A list of strict ATA Carnet accepting-countries and the specifications they hold. Most non-commercial, exhibiting importers and exporters recognize the value and role of ATA Carnets in the complicated field of trade. While the World Customs Organization

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

The Trump administration re-issued reciprocal tariffs to global trading partners August 1st, transpacific rates nearing 2024 lows, carriers at or approaching the lowest rates we're likely to see for the forseeable future & more.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

Each day the Supreme Court moves closer and closer to a ruling for or against the Trump administration's IEEPA tariffs. See what Baker Tilly's Pete Mento advises importers do to get ready for any out come, what the possible outcomes could be and more.

In a 7–4 ruling on August 29, 2025, the US Court of Appeals found President Trump exceeded his authority under IEEPA by imposing broad reciprocal tariffs. The decision is stayed until Oct 14, giving the administration time to appeal to the Supreme Court.