Another week of rock bottom spot market prices, trade policy changes and timid importers. It's officially Groundhog Day in the frieght markets.

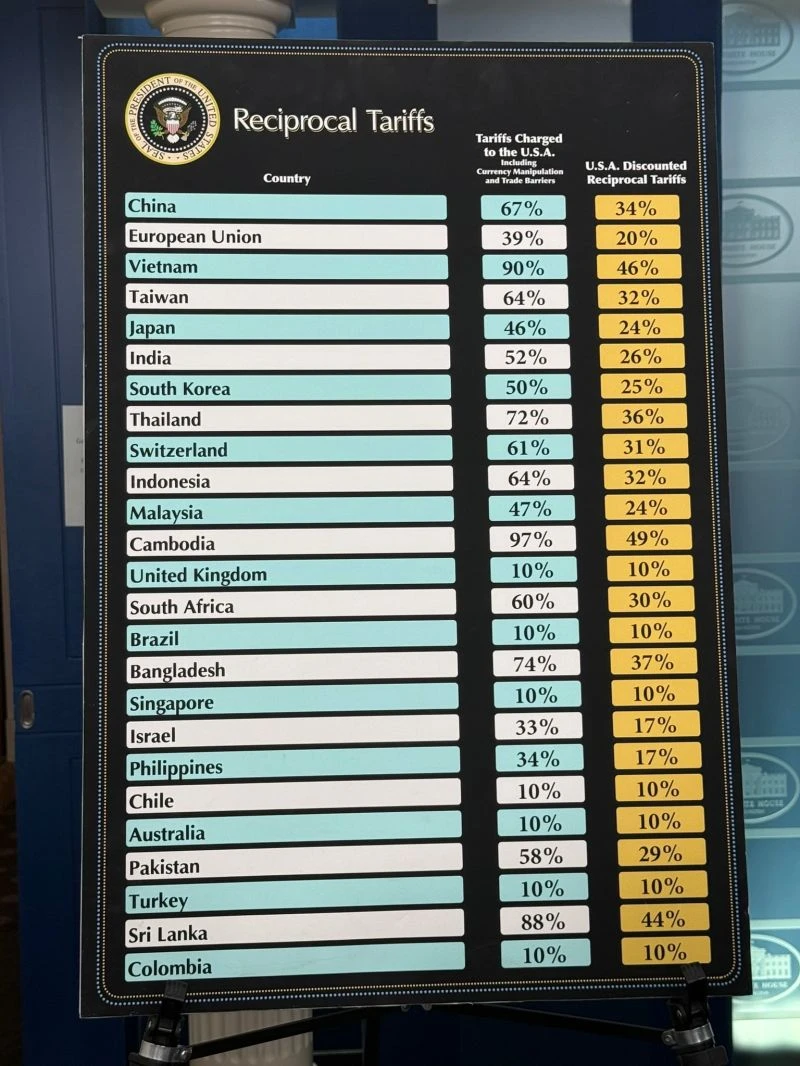

The week opened with Brussels pausing its US-focused countermeasures while Washington finalized the rulebook for its revamped reciprocal tariffs, including a 40% anti-transshipment penalty. Commerce advanced several trade-remedy actions, and on Aug. 6 the White House added a further 25% tariff on Indian goods (effective Aug. 27), escalating tensions even as the broader U.S. reciprocal tariff schedule took effect on Aug. 7. The WTO raised its near-term trade forecast but cautioned that the very tariff increases implemented this week would dampen flows later in the year. The period ended with a 90-day extension of the US-China tariff pause, maintaining the 10% reciprocal rate on China and averting an immediate escalation.

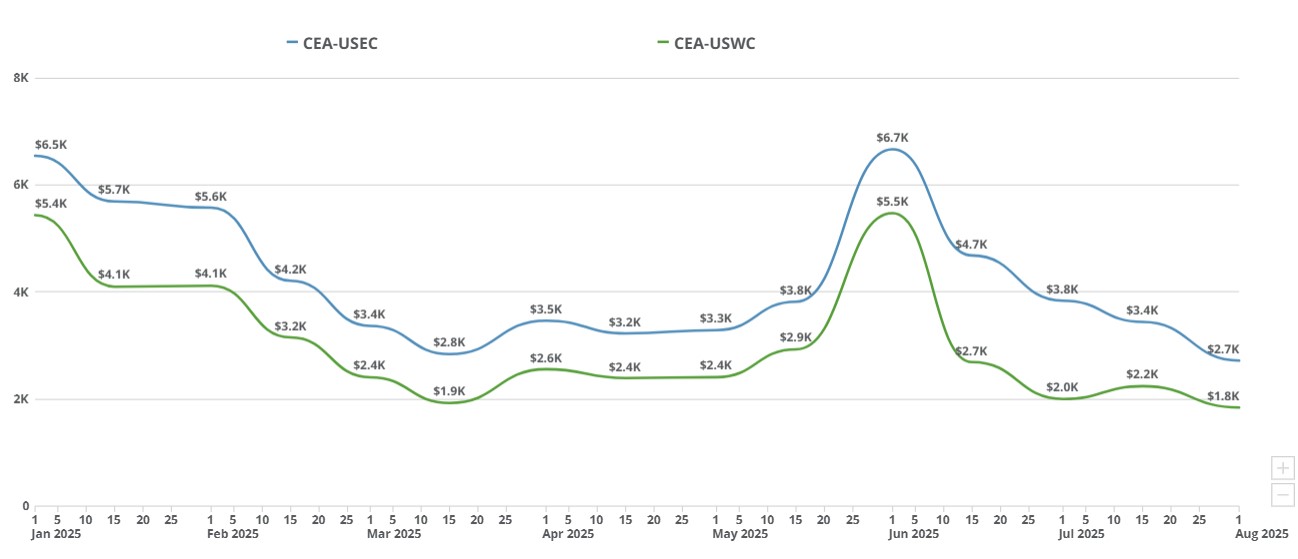

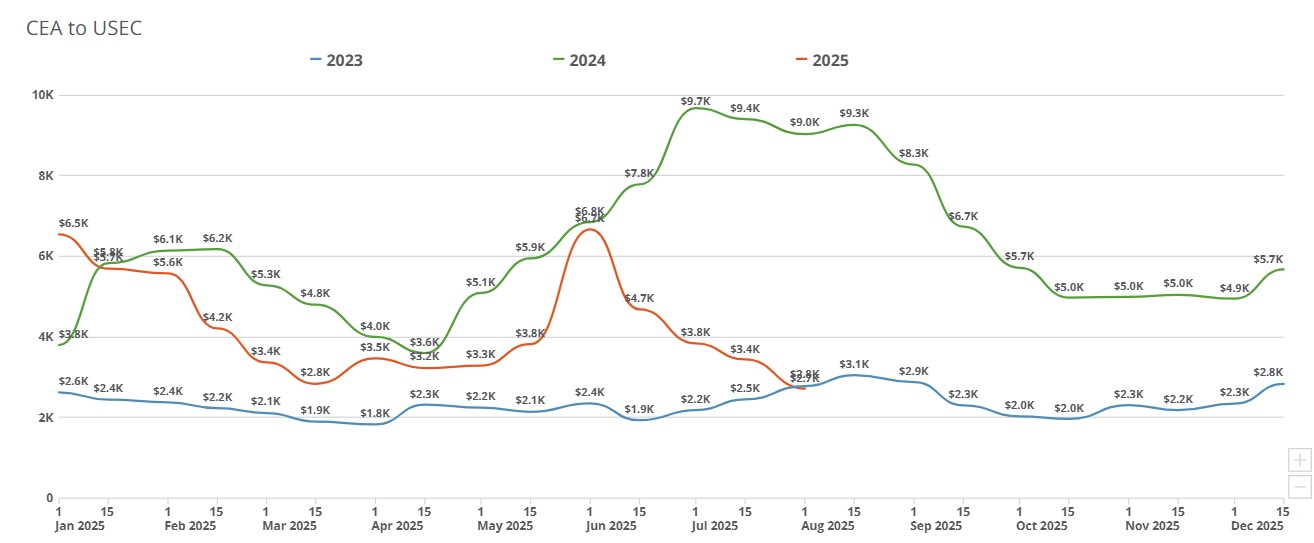

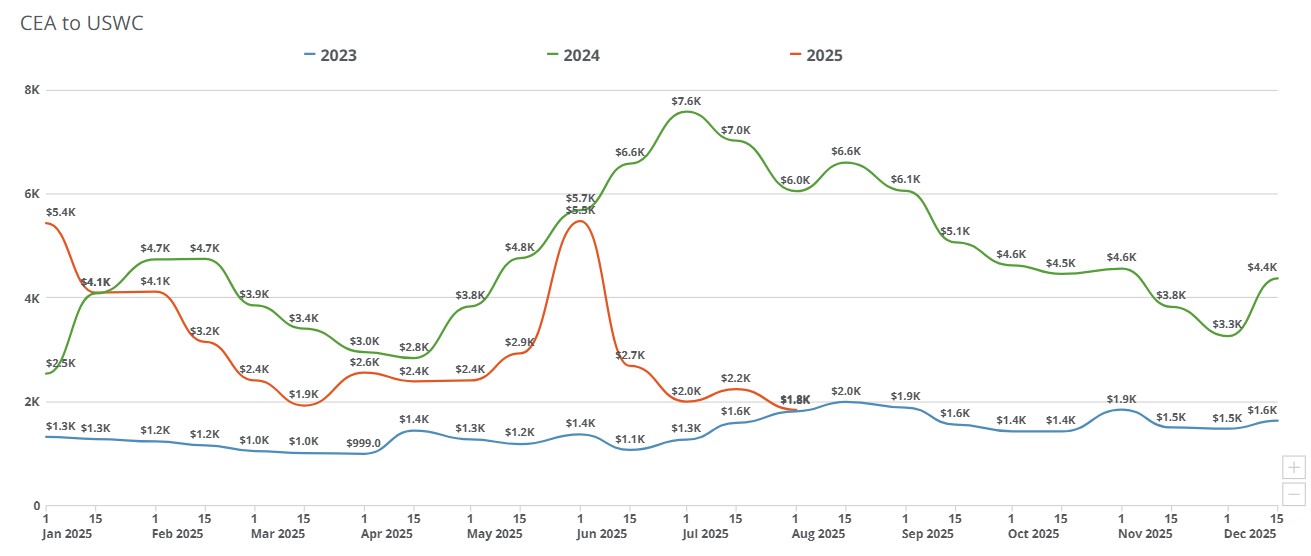

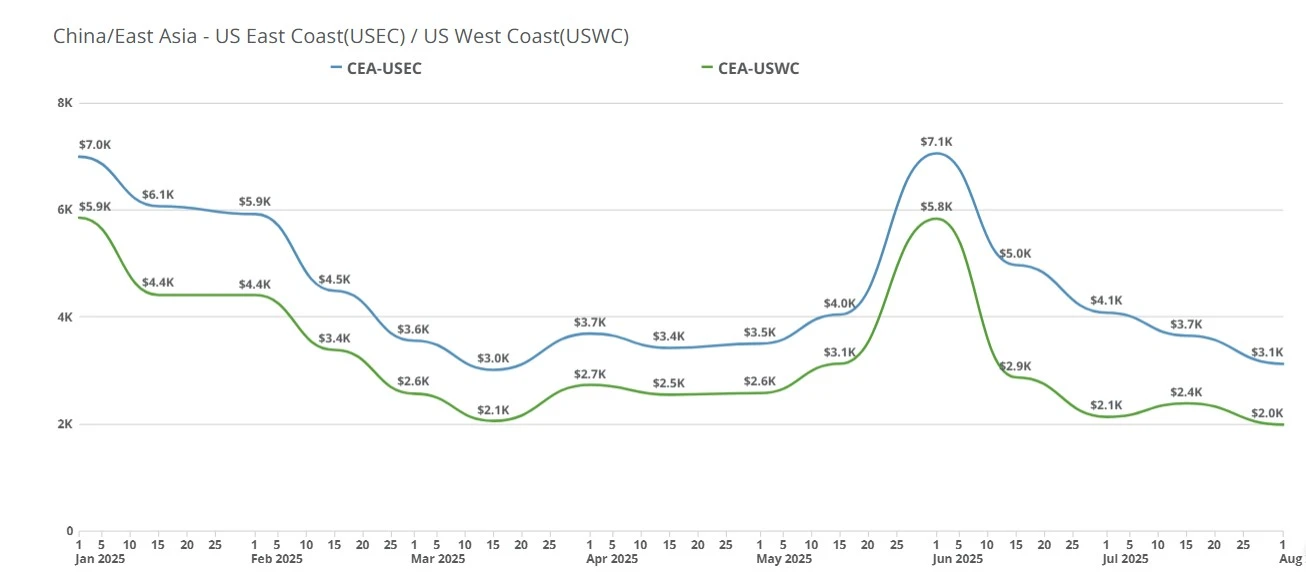

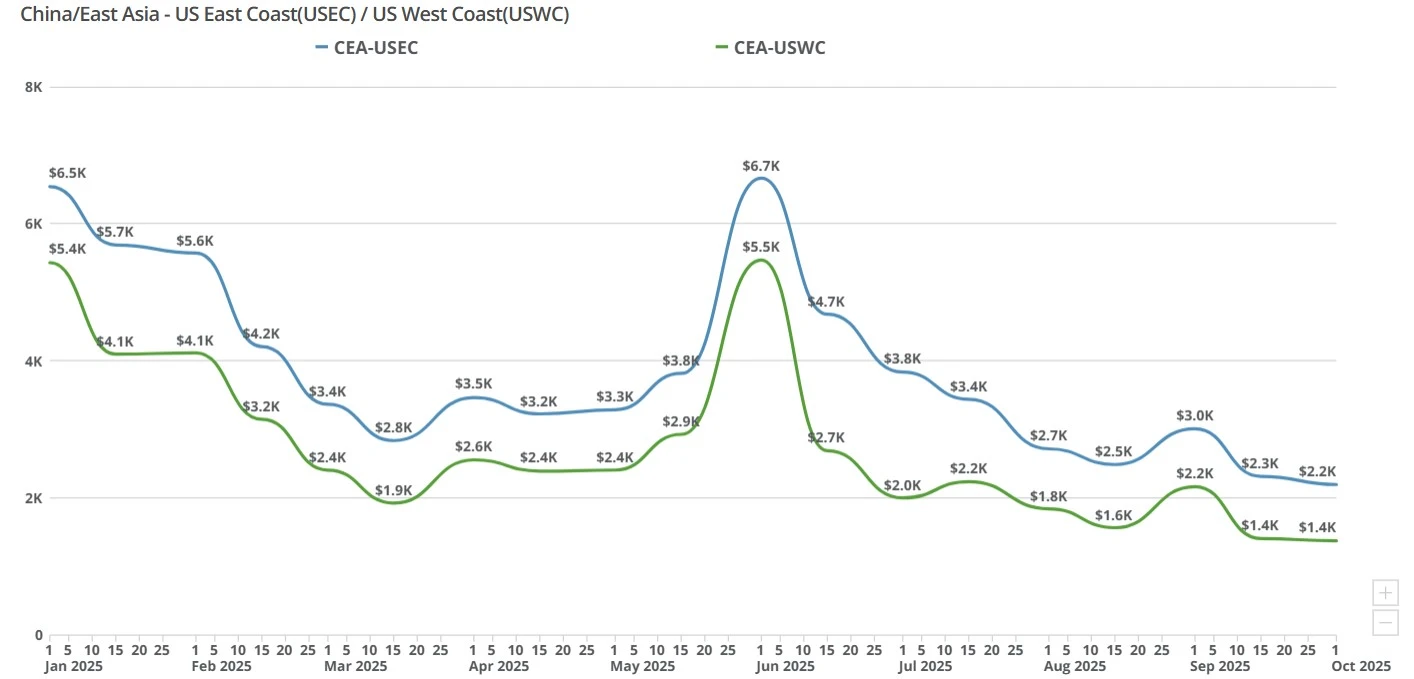

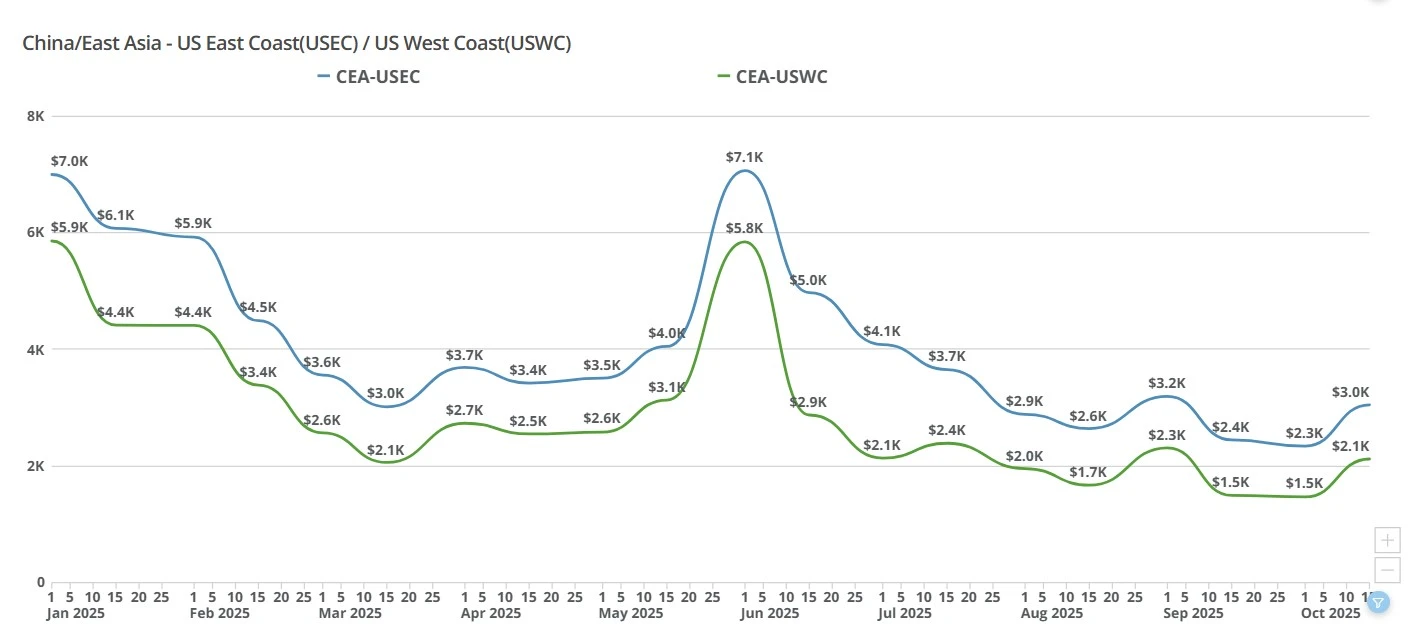

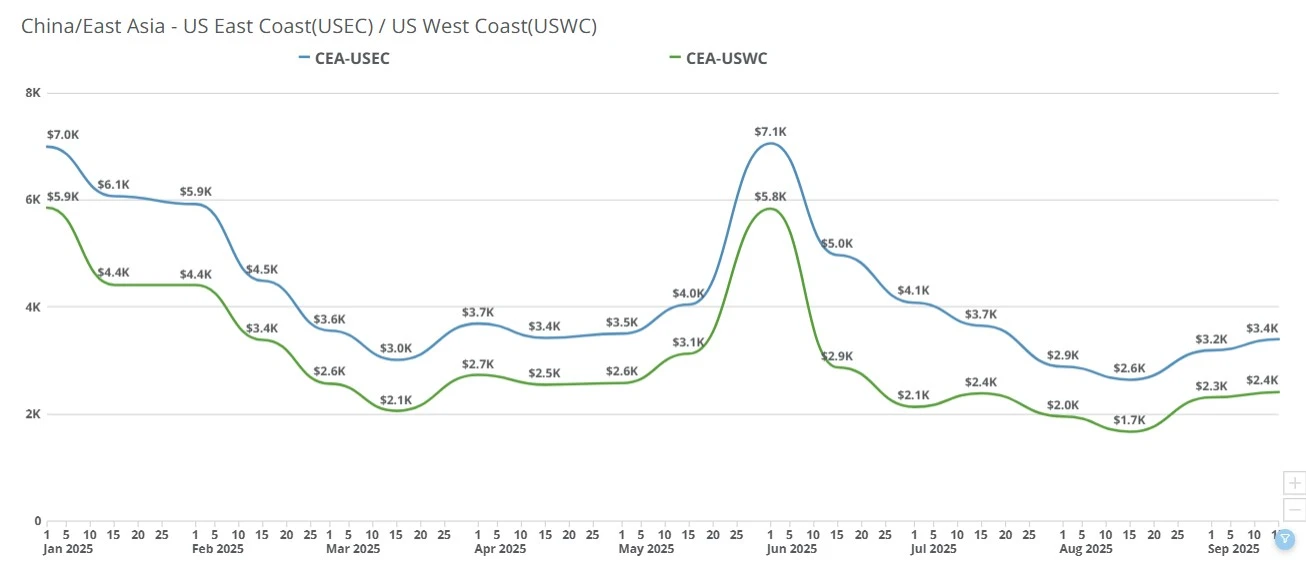

Transpacific ocean rates held largely steady this past week. CEA/USWC saw a repeat of last week: low spot quotes edged down about $50 w/w to roughly $1,550-$1,600/FEU on the lowest side (with some lows still near $1,500). August GRIs didn’t stick, and carriers are trimming sailings to stem further erosion. CEA/USEC also saw a repeat of last week. Flat to slightly softer w/w at about $2,600–$2,700/FEU on the lowest end from some carriers. Capacity adjustments are visible here too, but demand remains too soft for any meaningful rate lift.

Week of August 11, 2025:

CEA/USEC 20FT $2374.02

CEA/USEC 40HC $2885.57

CEA/USEC 40FT $2885.57

CEA/USWC 20FT $1583.48

CEA/USWC 40FT $1955.97

CEA/USWC 40HC $1984.44

Week of August 4, 2025:

CEA/USEC 20FT $2542.41

CEA/USEC 40FT $3125.14

CEA/USEC 40HC $3125.14

CEA/USWC 20FT $1628.72

CEA/USWC 40FT $1990.42

CEA/USWC 40HC $1990.42

Tariff clock reset, urgency gone: The 90-day extension of the 30% China baseline tariff removed the near-term “load now” deadline. A few shippers had paused bookings awaiting the decision; once confirmed, they resumed at prior cadence, not a surge.

Peak-season déjà vu - still muted: Importers have rebased their volumes to reflect tariff-era economics (e.g., from ~10 FCLs/week pre-tariffs to 2-4/week now). That keeps aggregate demand subdued despite the calendar.

GRIs fizzled; capacity getting pulled: Attempts to lift rates in early August failed in a soft market. Lines are blanking sailings and pruning loops to match supply to demand, which is stabilizing West Coast levels but not lifting them.

Pre-decision wobble only, not a wave: Some carriers reported a brief booking bump last week from shippers worried the extension might not come. Once the extension landed, the market reverted to “steady/slack.”

Profit pressure at the floor: With USWC lows ~$1.5-1.6k/FEU, carriers are hovering near contribution margins; they’re unlikely to slash deeper without more capacity action hence the current blanking.

Sideways-to-soft through the rest of August as confidence (not demand) stabilizes under the new 90-day window. Expect pockets of tightness around blank sailings and roll pools, but broad rate momentum remains limited.

On rates CEA/USWC’s low spot likely holds in the $1.5k–$1.8k/FEU range unless carriers accelerate cuts or a fresh policy shock hits. Any uptick will be modest and uneven, tied to capacity management more than demand. CEA/USEC’s low spot, $2.6k–$3.0k/FEU, will likely continue into August with mild firmness possible if lines shift more capacity off the longer transit lane. Still, muted import programs cap upside.

A small late-Aug/September pickup is plausible (holiday top-ups), but far from a classic peak. The tariff environment has structurally lowered run-rates; think incremental bumps, not breakouts.

Bigger picture, faster capacity withdrawals that over-tighten certain weeks, policy volatility that reintroduces deadline front-loading and operational hiccups (port congestion, weather) that create short, local price flares without changing the overall soft trend are likely to continue through August.

Linkdin News: Here's how On sneakers beat tariffs: https://www.linkedin.com/news/story/heres-how-on-sneakers-beat-tariffs-6497868/

CNBC: Trump extends China tariff deadline by 90 days: https://www.cnbc.com/2025/08/11/trump-china-tariffs-deadline-extended.html

The White House: Fact Sheet: President Donald J. Trump Continues the Suspension of the Heightened Tariffs on China: https://www.whitehouse.gov/fact-sheets/2025/08/fact-sheet-president-donald-j-trump-continues-the-suspension-of-the-heightened-tariffs-on-china/

Subscribe to the TrueFreight Index for weekly updates: https://www.freightright.com/freight-right-rate-index

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

The Trump administration re-issued reciprocal tariffs to global trading partners August 1st, transpacific rates nearing 2024 lows, carriers at or approaching the lowest rates we're likely to see for the forseeable future & more.

a detailed timeline of U.S. global trade policy changes from April to August 2025, including new tariffs, international negotiations, and their economic impact.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

Transpacific ocean and air rates jump as carriers pull capacity, Apple charters tighten space, and shippers rush to beat U.S. tariff deadlines

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.