On February 20, 2026, the Supreme Court of the United States delivered a landmark decision in Learning Resources, Inc., et al. v. Trump, fundamentally altering the landscape of American trade policy and executive power. In a sweeping ruling, the Court held that the International Emergency Economic Powers Act (IEEPA) does not grant the President the authority to unilaterally impose tariffs.

This decision marks the conclusion of a high-stakes legal battle over the boundaries of presidential authority and the "power of the purse". For importers, the ruling represents a significant victory, but it also signals the start of a complex administrative "mess" as the industry shifts from paying "emergency" duties to seeking billions in potential refunds.

The core of the dispute centered on two words within IEEPA: "regulate" and "importation". The Government argued that the power to "regulate... importation" during a declared national emergency naturally included the power to impose tariffs.

The Supreme Court rejected this view, asserting that the power to tax—which includes tariffs—is a "birth-right power" vested exclusively in Congress by Article I, Section 8 of the Constitution. Chief Justice Roberts, delivering the opinion of the Court, emphasized that while the President has broad tools under IEEPA to block or freeze property, the statute contains no mention of "tariffs," "duties," or "taxes". The Court concluded that the term "regulate" does not encompass the distinct power to tax.

The decision revealed deep philosophical divisions regarding how to interpret the law and the role of the judiciary in policing delegations of power.

Chief Justice Roberts (Delivering the Opinion of the Court)

Chief Justice Roberts authored the principal opinion, joined by Justices Sotomayor, Kagan, Gorsuch, Barrett, and Jackson for the core ruling. Roberts relied heavily on the Major Questions Doctrine, which requires Congress to speak with "clear congressional authorization" when delegating powers of vast economic and political significance. He noted that since no President in IEEPA’s half-century history had used it to impose tariffs, the sudden claim of such "unbounded" power was an "extravagant" assertion of statutory authority.

Justice Gorsuch (Concurring)

Justice Gorsuch wrote a robust defense of the Major Questions Doctrine. He argued that the doctrine is not a new "magical" invention but a return to long-standing principles that protect the principal (Congress) from the agent (the Executive). He warned that without such checks, the separation of powers would give way to the "permanent accretion of power in the hands of one man".

Justice Barrett agreed with the result but sought to ground the Major Questions Doctrine in "routine textualism". She argued that context—including constitutional structure—is simply part of finding the "most natural meaning" of a statute, rather than a special rule used to "load the dice" against the Executive.

Joined by Justices Sotomayor and Jackson, Justice Kagan agreed that IEEPA does not authorize tariffs but rejected the need for the Major Questions Doctrine. She argued that "straight-up statutory construction" was sufficient: the word "regulate" has never included the power to tax in hundreds of other U.S. statutes, so there was no reason to assume it did here.

Justice Jackson emphasized the use of legislative history to determine congressional intent. She pointed to House and Senate Reports from 1941 and 1977, which described IEEPA's purpose as the power to "freeze" or "control" property transactions, rather than to levy taxes.

Joined by Justices Thomas and Alito, Justice Kavanaugh argued that the majority ignored historical precedent. He pointed to the 1971 "Nixon Tariffs" and the 1976 Algonquin case, where the Court allowed "monetary exactions" under similarly broad language. He contended that it makes little sense to allow a President to block 100% of imports via an embargo but forbid the "lesser" power of a tariff.

Justice Thomas argued that the nondelegation doctrine does not apply to foreign trade because importing is a "privilege" rather than a "right". He asserted that since the Founding, Congress has regularly handed over trade discretion to the President, and this case did not implicate core legislative power over life, liberty, or property.

The Majority (Roberts/Gorsuch/Barrett): Focused on the Major Questions Doctrine, requiring explicit clarity from Congress for "highly consequential" powers.

The Concurrence (Kagan/Sotomayor/Jackson): Argued the case could be resolved with routine interpretation; "regulate" simply does not mean "tax" in American legal parlance.

The Legislative Intent Approach (Jackson): Relied on committee reports to prove Congress only intended for the President to freeze assets, not raise revenue.

The Dissent (Kavanaugh/Thomas/Alito): Emphasized functionalism and historical practice; if the Executive can ban an item entirely, it should be able to take the "lesser" step of taxing it.

A critical question for the trade community is whether this ruling endangers other tariffs, such as those imposed under Section 301 (Trade Act of 1974) or Section 232 (Trade Expansion Act of 1962).

The short answer is likely no. The Court was careful to distinguish IEEPA from these other statutes.

Section 232: The Court reaffirmed its previous Algonquin ruling, noting that Section 232 contains specific language—authorizing the President to "adjust... imports"—and procedural requirements (like Commerce Department investigations) that IEEPA lacks.

Section 301: Justice Kavanaugh noted in his dissent that the Court’s ruling essentially tells the President he "checked the wrong statutory box". While IEEPA cannot be used for tariffs, Sections 301, 201, and 232 remain valid "boxes" because they contain the explicit language and procedural constraints required to levy duties.

For importers who have been paying duties on Canadian, Mexican, and Chinese goods under these emergency orders, the ruling is a financial seismic shift.

Immediate Relief: The IEEPA-based tariffs are now legally void. Moving forward, the government can no longer collect these specific duties under the authority of IEEPA.

The Quest for Refunds: An estimated $160 billion to $175 billion has been collected unlawfully. However, getting that money back is not automatic. Importers must navigate the administrative process of Post-Entry Adjustments (PEAs) and protests.

The Liquidation Window: Typically, importers have only 180 days after "liquidation"—when the government "closes the file" on a transaction—to file a formal protest. Pete Mento and other trade authorities note that while the Court hinted at finding a way to make every entry available for refund, the 180-day window is a significant hurdle for gathered data.

The aftermath of the decision is expected to be an administrative "goat rodeo" for the trade industry.

Customs Overrun: U.S. Customs and Border Protection (CBP) will likely be overrun with refund requests.

Extended Refund Windows: There is speculation that the government may extend the refund period past liquidation—potentially to two years—to allow for the massive audit of entries required.

Forensic Accounting: Importers must prove they paid the duties. This requires gathering purchase orders, proofs of payment to suppliers, and proofs of payment to brokers. Many medium and small importers who used multiple brokers may find their records too disorganized to successfully claim refunds.

Contractual Disputes: If an importer passed the tariff cost on to their customer, does the customer have a right to the refund? Pete Mento warns that this could trigger a wave of contract law disputes over who is the truly "injured party".

Navigating this "nasty mess" requires more than just a standard customs broker. Freight Right Global Logistics and Baker Tilly have teamed up to provide a comprehensive roadmap for importers caught in the post-IEEPA fallout.

Record Reconstruction: Responsibility for record-keeping lies with the importer, not the broker. Freight Right helps importers pull data from the Automated Commercial Environment (ACE) to identify every entry subject to the voided tariffs.

Audit Readiness: Baker Tilly’s forensic accounting teams work with importers to produce the "crucial" evidence required for an audit: purchase orders showing original negotiated prices and bank records proving the transaction.

Strategic Protests: Navigating the 180-day protest window requires precision. The collaborative effort ensures that protests are filed correctly and in a timely manner, protecting the importer’s right to a refund even if the government’s response is delayed.

This is a rapidly developing story. We'll be updating it frequently with the latest.

Each day the Supreme Court moves closer and closer to a ruling for or against the Trump administration's IEEPA tariffs. See what Baker Tilly's Pete Mento advises importers do to get ready for any out come, what the possible outcomes could be and more.

In a 7–4 ruling on August 29, 2025, the US Court of Appeals found President Trump exceeded his authority under IEEPA by imposing broad reciprocal tariffs. The decision is stayed until Oct 14, giving the administration time to appeal to the Supreme Court.

The May 21 product exclusion covers 103 separate exclusion requests

On August 29, 2025, a federal appeals court ruled 7–4 that President Trump’s emergency-based tariffs were unlawful, finding tariff powers rest with Congress. The court left them in place temporarily, granting the administration time to appeal to the SC.

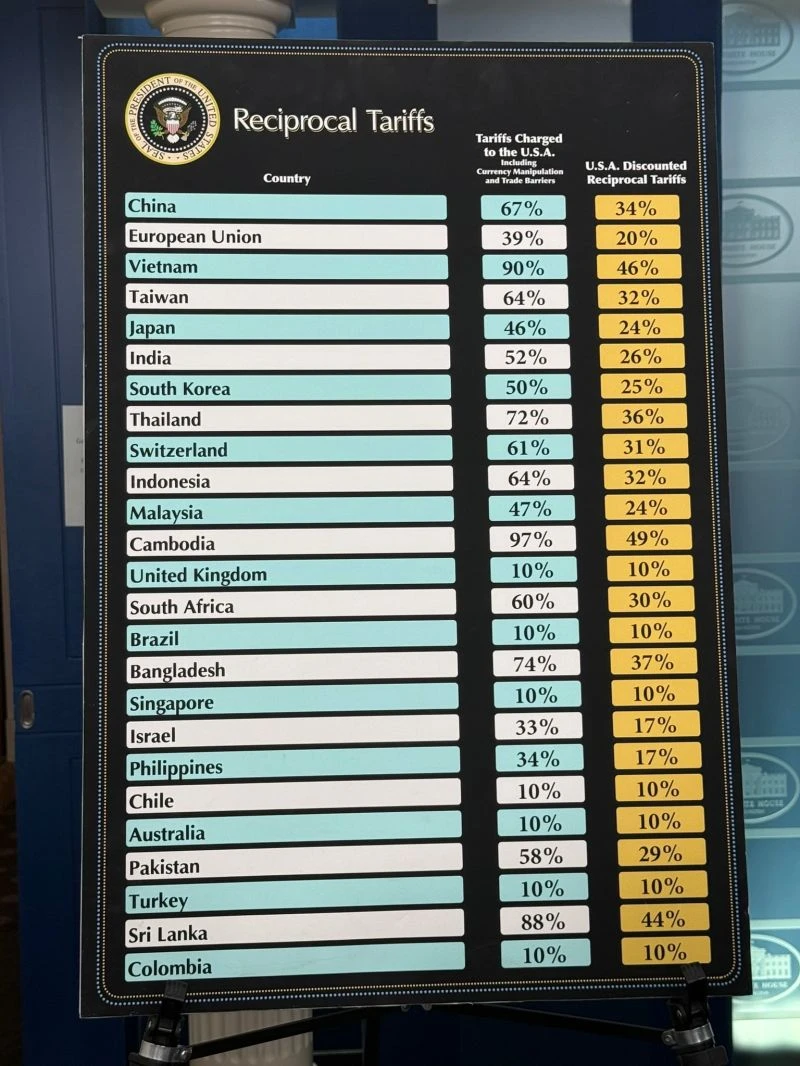

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

Founder & CEO of Freight Right Global Logistics, Robert Khachatryan, sat down with Tuck Ly, Vice President of Clearpoint International, to discuss the major issues affecting the global supply chain and port congestion

Do you really need multiple customs brokers? Find out how a single freight forwarding and customs brokerage provider saves you time and money.

On April 24th, The US Department of Homeland Security and US Customs & Border Protection have released new guidance around the end of the US' de minimis exception. See the changes ahead for importers and customs professionals.

President Trump issues Executive Order to stop overlapping tariffs on imports under national security and trade actions, ensuring duty rates remain targeted and non-cumulative. Effective retroactively from March 4, 2025.

This blog explores digital air freight and how e-bookings provide a more efficient and faster way for logistics professionals to make connections.