Singapore’s shipping company, the Pacific International Lines (PIL) announced on Feb. 14 of the company’s decision to withdraw from the Transpacific market, leaving the trade lanes up for more competition.

For years, PIL has been one of the main economy ocean carriers to service China to the United States trade lanes, and its withdrawal plan will affect the commercial trade arrangements with its partners, especially those that serve the China-U.S. trade.

PIL’s last Transpacific sailing will take place in March of this year, after which the company plans on focusing its efforts on “further strengthening its position in the North-South Trade,” a region that covers Africa, the Middle East / Red Sea, India Sub-Continent, Latin America, and Oceania.

The company is among the world’s top 10 containership operators and is the largest shipowner in Southeast Asia. The company has served more than 500 locations in over 90 countries worldwide.

Do you really need multiple customs brokers? Find out how a single freight forwarding and customs brokerage provider saves you time and money.

Each day the Supreme Court moves closer and closer to a ruling for or against the Trump administration's IEEPA tariffs. See what Baker Tilly's Pete Mento advises importers do to get ready for any out come, what the possible outcomes could be and more.

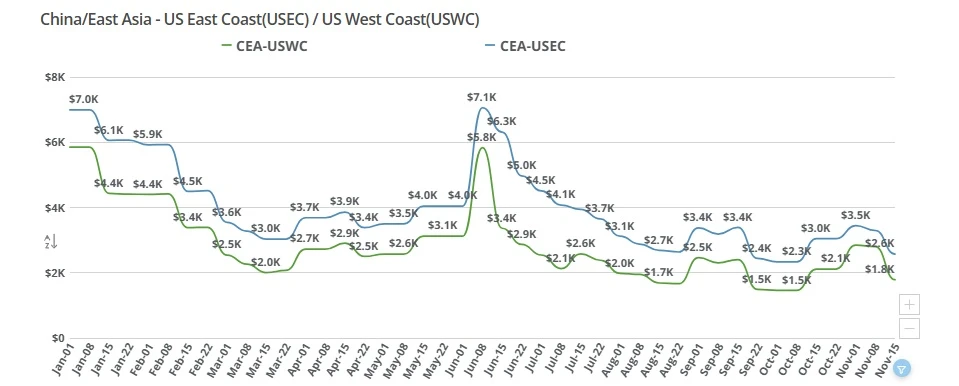

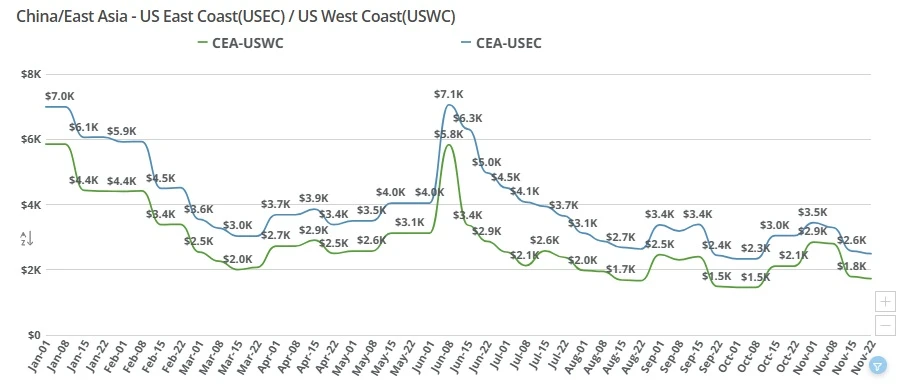

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

This article will explain what international air freight charges are and how to calculate the chargeable weight when shipping goods overseas.

A Freight Right survey reveals 78% of big and bulky ecommerce merchants struggle to fulfill international orders due to freight, pricing, and operational barriers.

China-US ocean freight rates continue to decline, with the East Coast premium narrowing as carriers compete for limited volume. Get the key market drivers and outlook in this week’s update.

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

Ocean rates remain frozen at $1,400-$1,600 to the USWC as the Lunar New Year shutdown halts all Chinese logistics. Discover why the market is at a standstill and what to watch for in March.