Last week, the global trade policy landscape saw a mix of slowing down and reactivation. The US administration, while maintaining its broader tariff agenda, indicated a pause or delay in the imposition of large semiconductor import tariffs, reflecting sensitivity to supply-chain disruption, consumer pricing and the US–China trade truce. Meanwhile, Canada and India moved to reset bilateral trade negotiations, signalling a thaw in previously strained relations and a renewed push to expand trade and investment. At the same time, high‐level engagement between the U.S. and China underscored that major trade policy shifts continue to be intertwined with geopolitics and technology-driven supply chain.

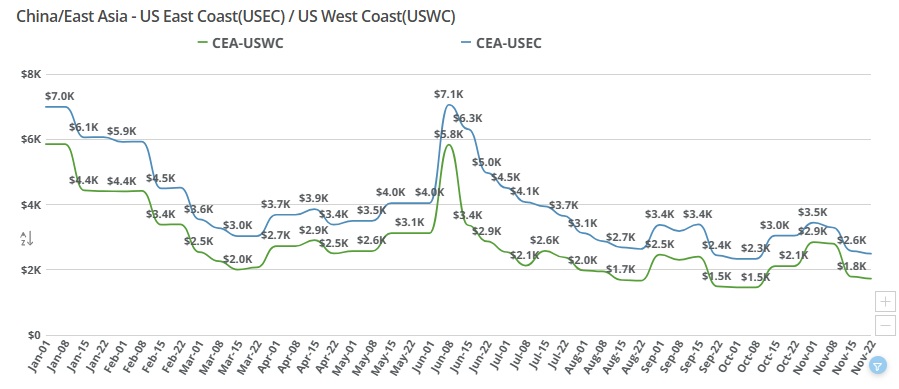

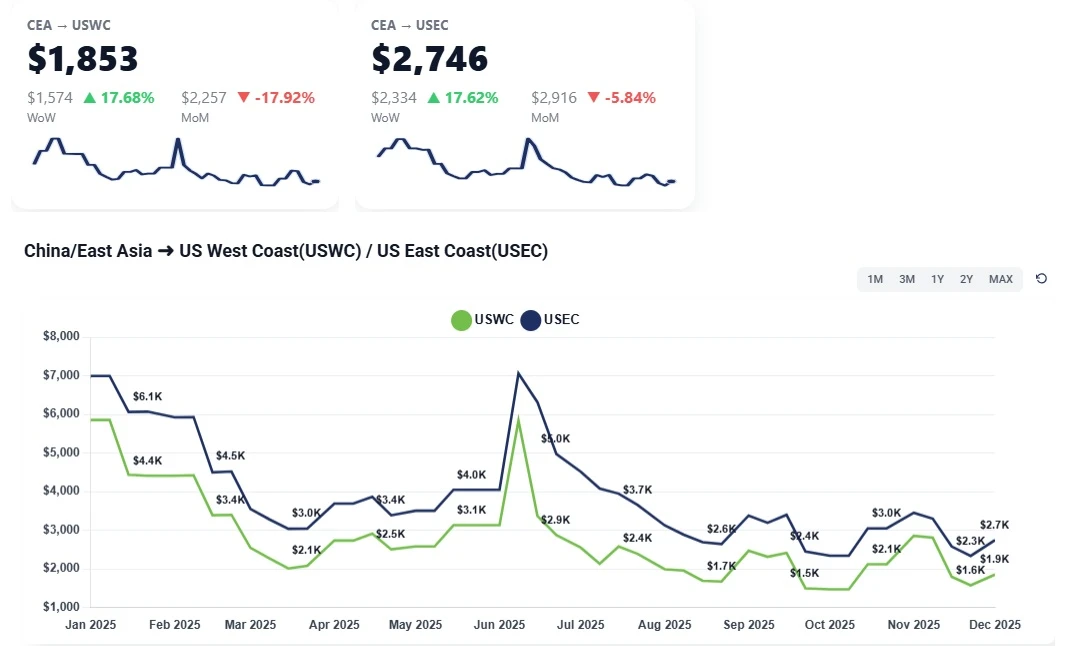

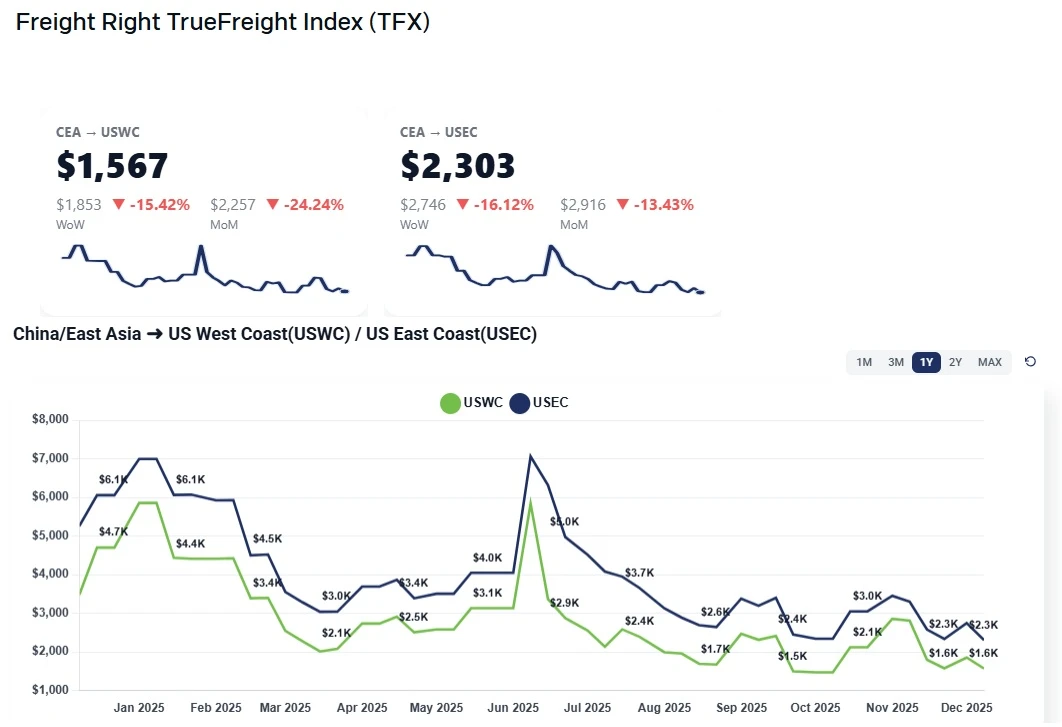

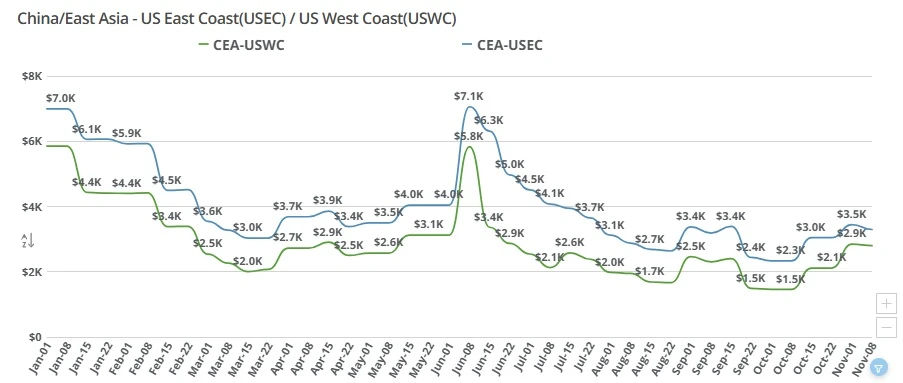

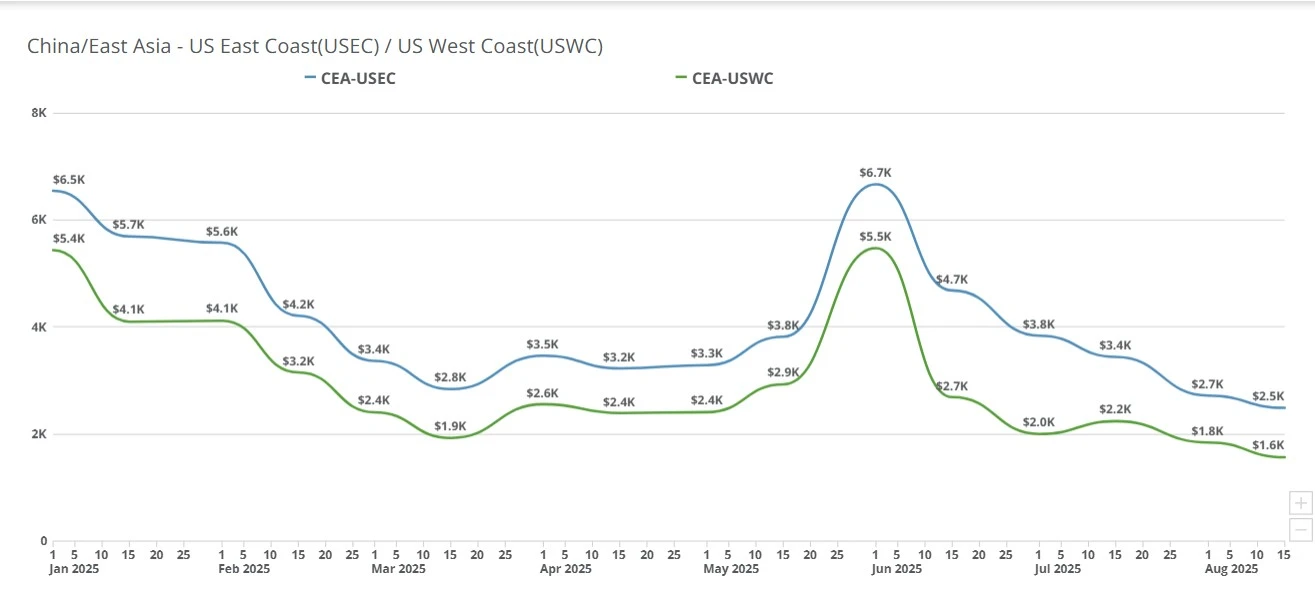

CEA to USWC: Spot rates continued their rapid decline this week, now falling to the $1,350–$1,500/FEU range, with some carrier-specific lows touching $1,350. This marks the fifth or sixth consecutive weekly drop in November, driven by slow demand and an extremely short holiday week in the US.

CEA to USEC: USEC rates also fell, now averaging ~$1,900/FEU, shrinking the typical spread between West and East Coast from ~$800–$900 to just $600–$700. Both lanes are effectively at or near their “rock-bottom” levels for the year.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Demand Collapse During Thanksgiving Week: With Thanksgiving and the following Friday holiday, most shippers paused activity, creating one of the slowest weeks of the year. Carriers have little leverage to hold pricing when demand is essentially absent.

Continuous Rate Reductions From Carriers: Carriers issued back-to-back reductions Monday and Tuesday, marking 5–6 cuts in November alone. Some carriers with traditionally lower pricing pushed offers down to $1,350/FEU, accelerating the downward trend.

Rates Fell Faster and Earlier Than Expected: The market anticipated declines in late November, but not to this extreme, and not at month-end heading into December. Current levels are now near floor pricing, leaving little room for further decline without carriers taking losses.

Muted Peak Season & Retail Inventory Overhang: BFCM-related imports largely occurred in September–October and at lower volumes than normal. Retailers still carry excess inventory and initiated aggressive discounting early, reducing inbound demand.

Blank Sailings Not Tight Enough to Boost Rates: Carriers have eased blank sailings rather than increasing them, expecting Chinese New Year demand to improve. Space remains widely available, even 1–2 days before sailing, eliminating rate pressure.

December likely to stay at rock-bottom levels. Rates are expected to remain flat or soften slightly heading into December. With multiple public holidays and business closures, carriers have no incentive to introduce GRI/PSS mid-month.

January rate increase expected ahead of Chinese New Year. Carriers are almost certain to push through GRIs or PSS by early or mid-January to capitalize on pre-CNY cargo. Current levels are unsustainably low, and carriers will not want to move CNY volumes at $1,300–$1,900.

Post-CNY slowdown will return. Once CNY passes (Feb 18 window), carriers expect a deep lull for several months. Any rate strength in January–February will likely be short-lived.

No market surprises expected: The near-term outlook is stable, predictable, and soft. Rates will close the year at or near current levels unless an unexpected shock emerges.

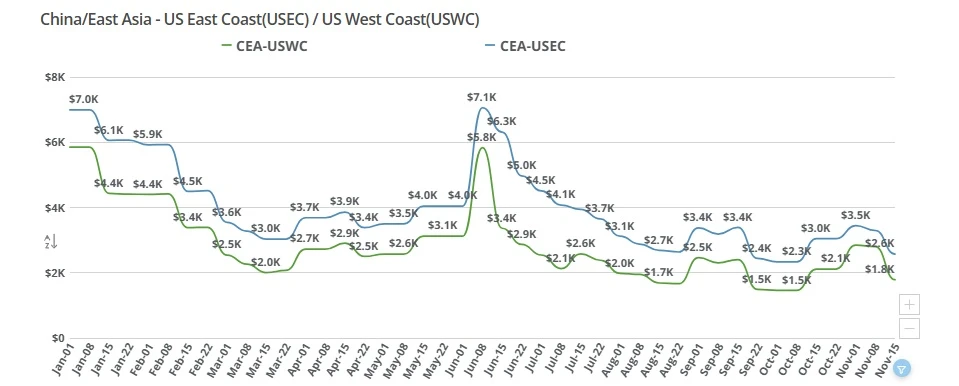

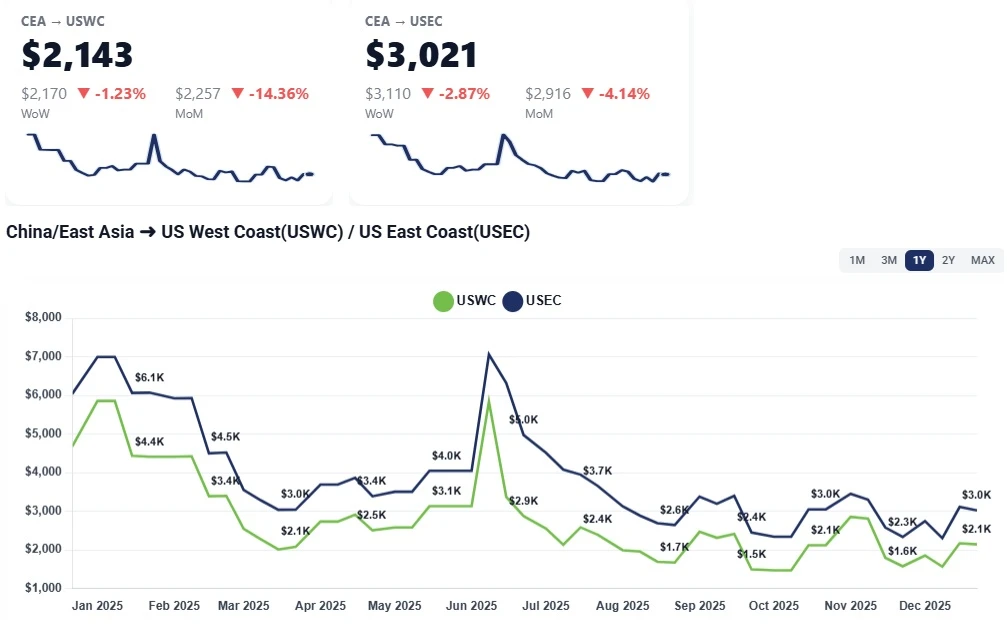

CEA to USWC (China to U.S. West Coast): Rates continued to climb week-over-week as carriers push peak-season pricing ahead of December demand. Although the increases are moderate, capacity tightening and steady booking momentum are sustaining upward pressure.

CEA to USEC (China to U.S. East Coast): East Coast rates also moved higher this week, with all-water services seeing firmer pricing due to stronger demand, longer transit times, and continued blank-sailing strategies. The week-over-week uptick is in line with broader peak-season behavior.

December peak season is fully underway, prompting carriers to raise FAK levels and tighten space allocation.

Consistent increase in booking activity from China shippers preparing for year-end retail replenishment.

Blank sailings and capacity management from carriers continue to restrict available space, pushing rates higher.

Ongoing equipment imbalances, especially in key China export hubs, are adding upward pressure on short-term rates.

Importers front-loading shipments due to uncertainty around January market conditions and potential schedule disruptions.

Rate strength is expected to persist through the end of December, with carriers signaling additional GRIs if demand remains firm.

Capacity constraints will likely remain tight, particularly on USEC services, as vessels sail fuller approaching the holiday cutoff period.

A short-term stabilization or slight softening may emerge in early January once holiday-driven demand tapers, though much will depend on carrier discipline with blank sailings.

Shippers should plan for elevated rates and limited premium space availability for the remainder of the month and secure bookings as early as possible.

The New York Times: Trump’s Global Tariffs Curtailed Trade, Data Shows

https://www.nytimes.com/2025/11/19/us/politics/trumps-tariffs-trade-data.html

Bloomberg: How Tariffs and Tech Are Reshaping Global Trade

https://www.bloomberg.com/news/newsletters/2025-11-20/how-tariffs-and-tech-are-reshaping-global-trade

Global Trade Magazine: 2025 Global Shipping Chaos: ‘Brexit on Steroids’ as Policy Shifts Disrupt Trade

https://www.globaltrademag.com/2025-global-shipping-chaos-brexit-on-steroids-as-policy-shifts-disrupt-trade/

Reuters: Trade between Latin America and the Caribbean due to grow in 2025 despite US tariff policy, ECLAC report shows

https://www.reuters.com/world/americas/trade-between-latin-america-caribbean-due-grow-2025-despite-us-tariff-policy-2025-11-19/

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

China-US ocean freight rates continue to decline, with the East Coast premium narrowing as carriers compete for limited volume. Get the key market drivers and outlook in this week’s update.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

The amount of truckers is dwindling and it is not good news for the freight industry. Why is this happening and what are the long and short term solutions?

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.