Last week, from October 28 to November 3, 2025, global trade policy remained highly dynamic. A major development was the signing of an upgraded free-trade agreement between China and ASEAN, seen as a strategic response to the U.S.’s aggressive tariff posture. At the same time, trade-policy watchers recorded a steady stream of new regulatory and industrial-policy measures across multiple regions, underscoring that tariff pressure is driving realignment in supply-chains and trade flows. Businesses globally are now operating in an environment of heightened uncertainty, adapting to tariff risk and recalibrating sourcing and distribution strategies accordingly.

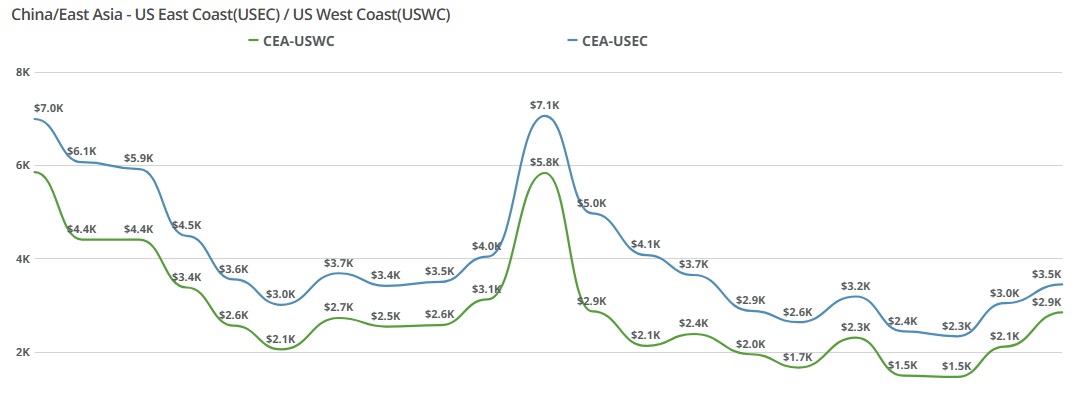

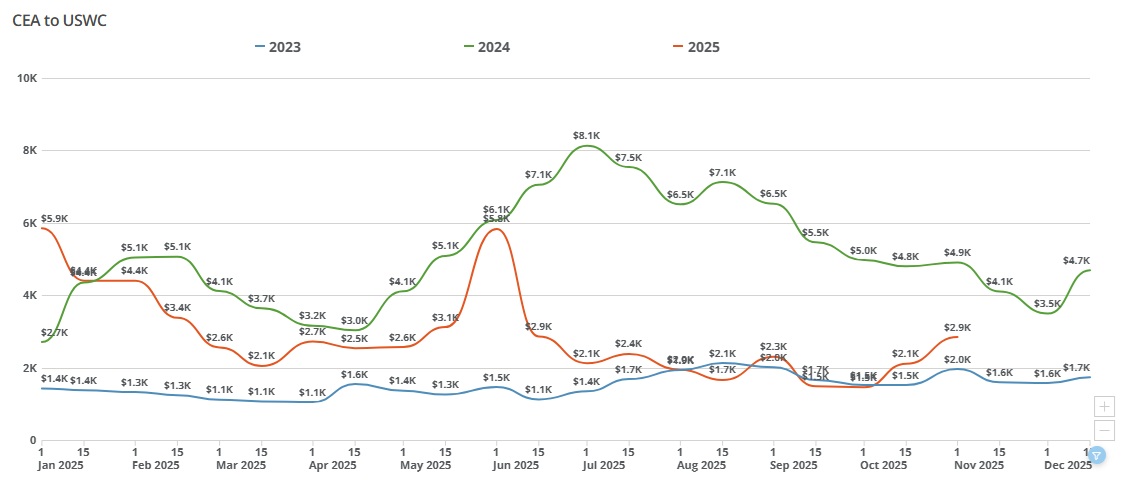

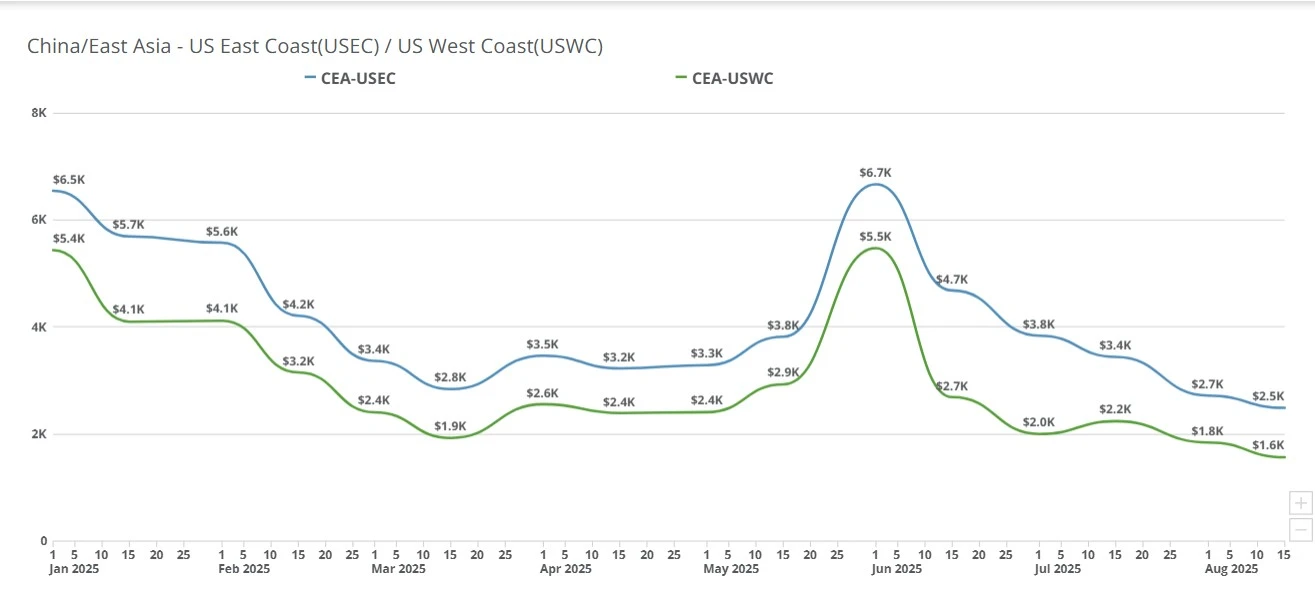

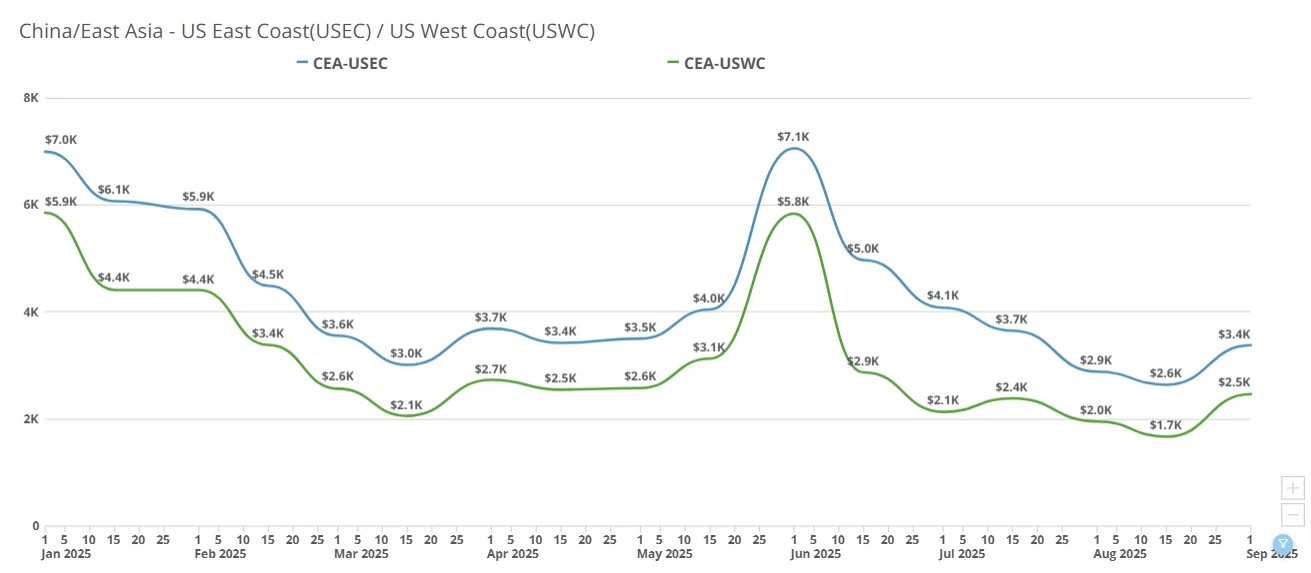

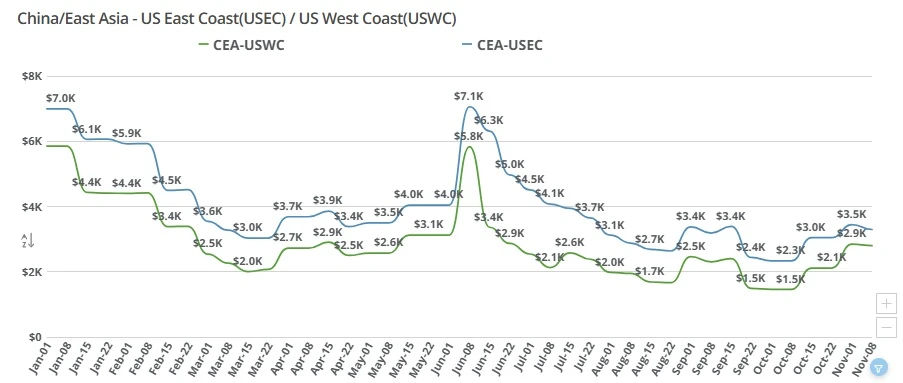

CEA → USWC (China → U.S. West Coast): After the Nov 1 GRI lifted posted FAK levels toward the ~$2,900–$3,100/FEU range, actual market-clearing “specials” are widely available around $1,900–$2,100/FEU, with agents indicating a week-over-week slide of roughly $400–$500. These discounts are tied to specific near-term sailings (e.g., vessels around Nov 7 and Nov 12) and reflect carriers’ need to backfill half-empty ships.

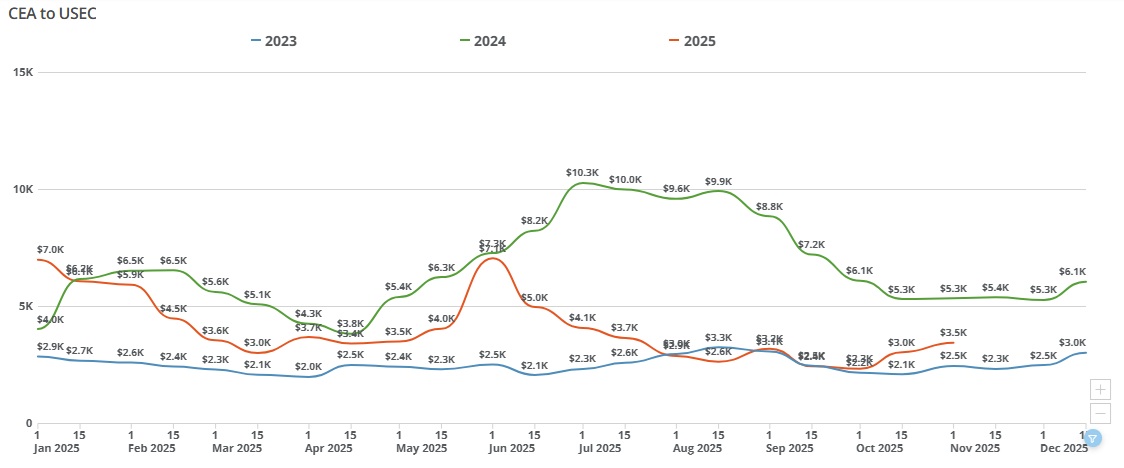

CEA → USEC (China → U.S. East Coast): Similar two-tier dynamics. Posted tariffs remain elevated, but “specials” are circulating near ~$2,800/FEU, implying a modest week-over-week softening from early-month peaks. Discounts are again limited to named sailings.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Demand air pocket post-peak: With peak season done, bookings are thin; carriers are sailing with excess space and need loads now.

Policy uncertainty = importer pause: Headlines about possible tariff changes lack concrete CBP/White House implementation guidance, prompting shippers to wait, further weakening near-term demand.

Two-tier pricing to save face: Carriers keep the higher filed FAKs on paper while quietly pushing broad “specials” to fill a couple of imminent vessels, avoiding the optics of formally rolling back the GRI.

Widespread access to discounts: Forwarders across the market are receiving and selling the discounted rates; this isn’t a niche or restricted offer.

Short booking window: In a two-week pricing cycle, there are effectively only two relevant sailings; carriers concentrate discounts there to quickly firm load factors.

For the next 1–2 weeks, expect USWC to hover $1,800–$2,000/FEU and USEC around $2,700–$2,900/FEU on specials, with posted FAKs remaining higher but not representative of transactable levels.

The current gap between filed and discounted rates is likely to narrow or close, as carriers align headline rates with market reality once immediate sailings are covered. Timing could be late November or the first half of December.

If concrete US–China policy changes materialize or typical pre-CNY pull-forward emerges, carriers may test fresh GRIs; absent that, soft fundamentals should keep rates range-bound near today’s specials. Shippers should target named-sailing space to capture discounts and avoid paying posted FAKs.

Reuters: South Korea's Lee says global trade order at critical inflection point: https://www.reuters.com/world/china/south-koreas-lee-says-global-trade-order-critical-inflection-point-2025-10-31/

The Wall Street Journal: Meet Rapidly Evolving Global Trade With Resilience Strategies https://deloitte.wsj.com/riskandcompliance/meet-rapidly-evolving-global-trade-with-resilience-strategies-047bbbee

Global Trade Magazine: President Trump to Skip Supreme Court Tariffs Hearing https://www.globaltrademag.com/president-trump-to-skip-supreme-court-tariffs-hearing/

Global Trade Magazine: US and China Announce Trade Pact Suspending Tariffs and Export Controls https://www.globaltrademag.com/u-s-and-china-announce-trade-pact-suspending-tariffs-and-export-controls/

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.