Last week, global trade policy saw several notable shifts. India pushed to expand imports and negotiate with the US, while the United States adjusted its tariff regime, reducing duties on certain Chinese chemical imports and rolling back tariffs on key agricultural goods (such as coffee, beef and cocoa) to ease input-cost pressures. Meanwhile, trade negotiations with Switzerland moved toward a tariff-reduction agreement. The changes in US policy had immediate ripple effects: Brazil’s coffee exports are disadvantaged by the US exclusion, and both Japan and Switzerland flagged economic contraction tied to US tariff impacts on exports. Overall, the developments reflect a dynamic environment where trade-policy levers are being actively used both for domestic cost relief and for negotiating trade architecture abroad.

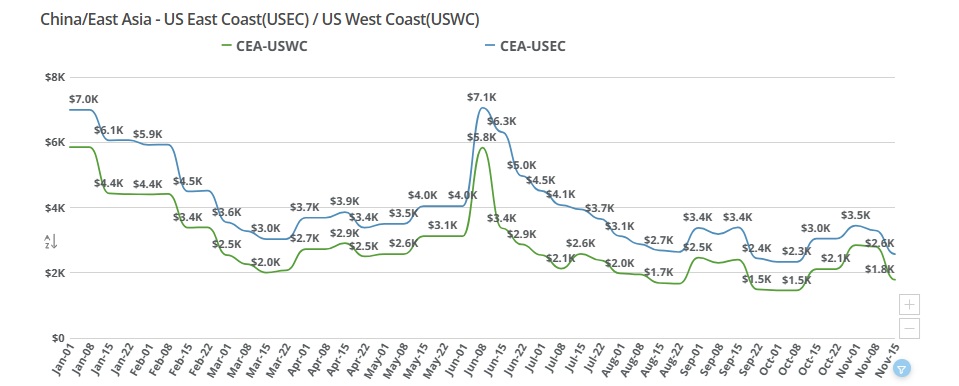

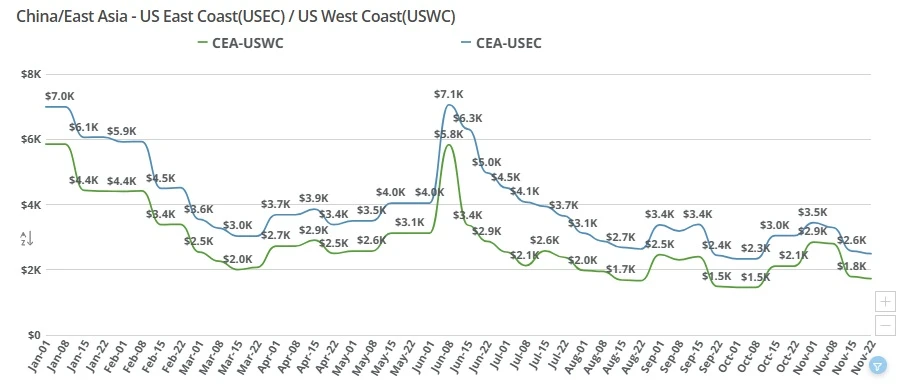

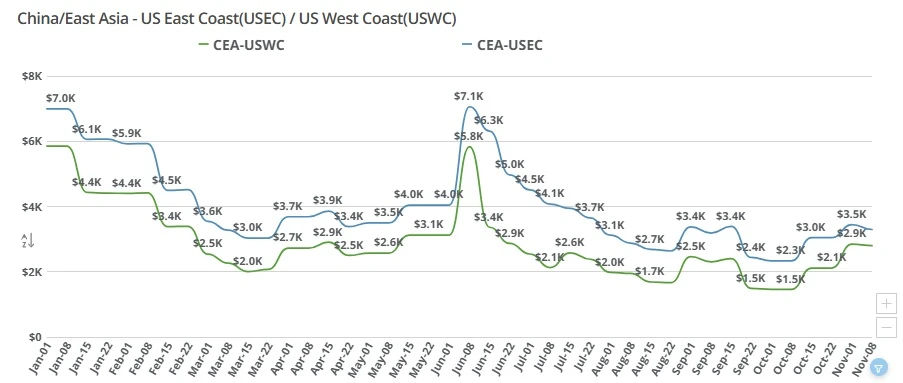

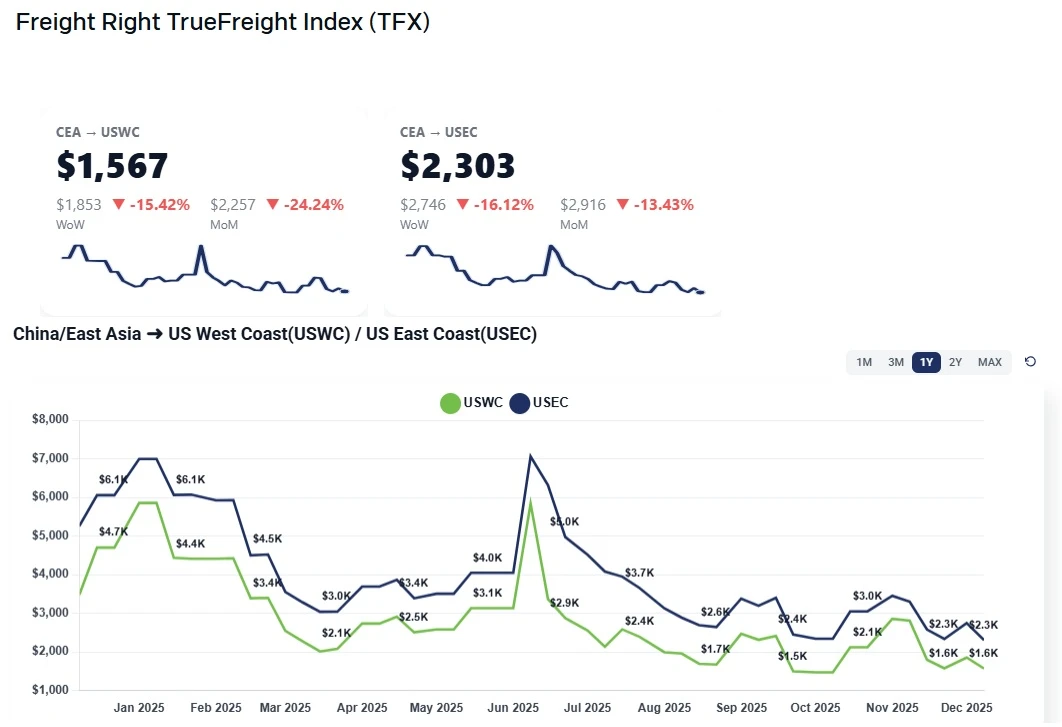

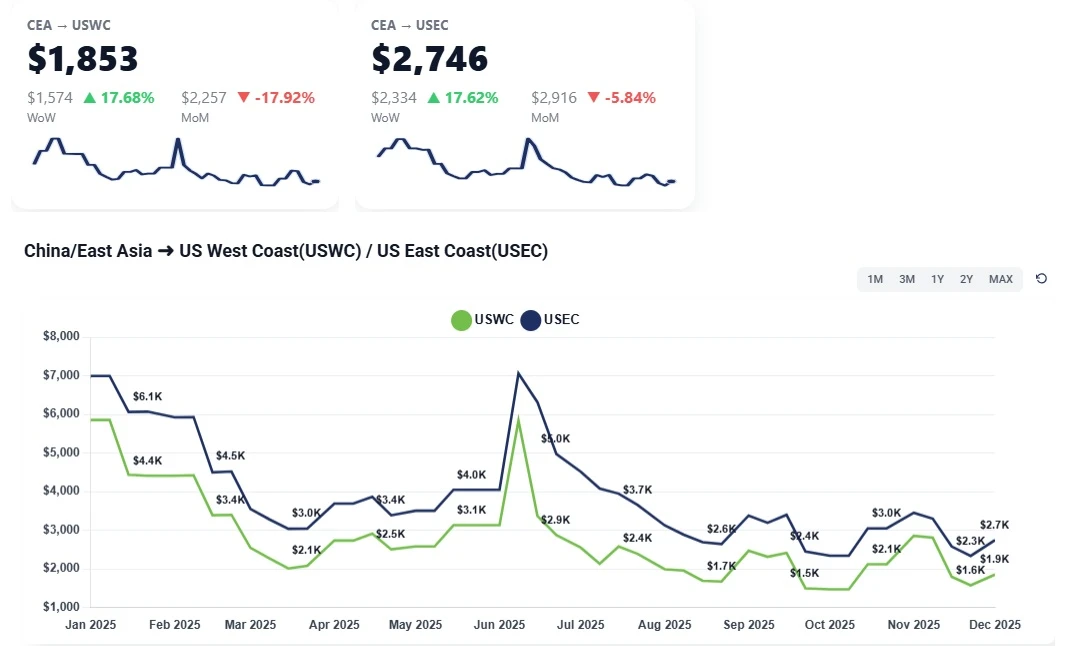

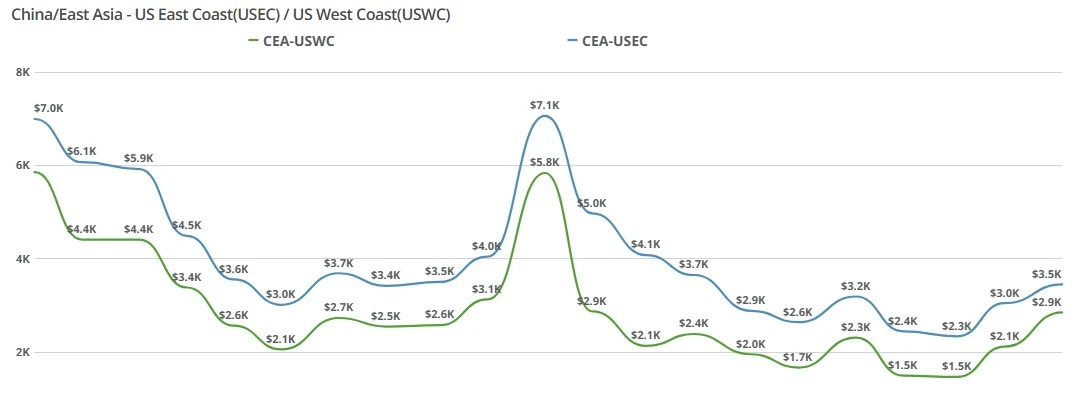

China Export Area (CEA) to US West Coast (USWC) and US East Coast (USEC) spot rates have fallen sharply this week after several successive reductions from carriers.

CEA to USWC: Rates have dropped multiple times in recent weeks and are now roughly in the $1,400–$1,600/FEU range, essentially unwinding much of the early Q4 increases.

CEA to USEC: Rates sit around $2,300/FEU, with the traditional premium over the West Coast narrowing to about $700 versus the usual $800–$900 spread, reflecting especially weak demand to the East Coast.

Overall, both lanes are seeing “very fast” rate erosion, with East Coast pricing under even more pressure than the West Coast.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Faster-than-expected post-peak correction: Rates have been cut “four or five times already,” dropping back to levels seen before the last two GRIs, indicating carriers have quickly walked back early-November increases.

No effective rate-holding mechanism: With little in the way of firm GRIs or capacity controls sticking, the market is in “free flow”, allowing rates to slide as carriers chase limited cargo.

Seasonal demand slowdown & holiday focus: We are firmly in the off-peak window; shippers are focused on holidays rather than new orders, and factories in Asia are approaching seasonal slow periods, reducing bookings out of CEA.

Tariff reduction impact has been muted: The recently announced 10% reduction in some U.S. tariffs on Chinese goods has not translated into a noticeable uptick in exports yet, likely because it coincides with a traditionally slow season.

Aggressive carrier and forwarder competition: Large forwarders are receiving lower fixed rates from carriers as carriers push for volume. Those large players then sell near-cost to smaller forwarders, who in turn quote customers at or below their own cost just to hold onto accounts. Chinese forwarders in particular are pressuring U.S. forwarders with very low offers.

East Coast demand is especially weak: We see “pretty dead” volume to the East Coast, which is why the USEC premium over USWC has compressed to roughly $700. Carriers are actively hunting for USEC volume, keeping those rates under heavier pressure.

Capacity and space are no longer an issue: Recent West Coast hiccups, including some rolling two weeks ago, have abated as carriers have put vessels back into rotation. There is now plenty of space on both coasts, removing any short-term support for rate levels.

Industry strain, but not collapse: While rate competition is intense and some forwarders are in “more inconsistent” or vulnerable positions, widespread closures are not seen; more so downsizing rather than shutting doors.

With about a week and a half left in November, we're not expecting rates to rise again before month-end, despite carriers’ tendency to try increases wherever possible. For December, base case is the same or slightly lower rates, not higher, given very weak shipment activity and upcoming international holidays and factory closures in Asia.

Carriers are expected to push for a rate rebound in January, either by implementing increases at the start of the month or by pre-loading GRIs in the second half of December to build momentum heading into Q1.

As long as East Coast demand remains weaker and cargo continues to favor the West Coast, we're expecting the USEC premium to remain compressed. The USWC may find a floor sooner if volumes there stabilize, while USEC rates could continue to lag.

With big forwarders, smaller forwarders, and China-based players all fighting for share, below-cost quoting is likely to persist in the near term. Unless carriers meaningfully pull capacity or successfully enforce GRIs, the market will remain highly price-competitive through December.

Space and schedule reliability remain strong, but ongoing rate pressure is squeezing forwarder margins, which could lead to selective downsizing and consolidation if the low-rate environment continues into early 2026.

Air freight rates from China to the U.S. continue to climb as we move deeper into the traditional peak season. Among all major U.S. gateways, China to JFK remains the highest-priced lane, reflecting strong demand, tight capacity, and carriers’ continued attempts to push rates upward ahead of year-end.

PVG to JFK spot rates remain elevated across all weight breaks.

Premium carriers (e.g., CK, UA) show little to no discounting even at higher chargeable weights.

Space availability continues tightening, particularly for e-commerce-heavy eastbound flows.

Peak Season Demand: Q4 promotions and holiday shipments are driving increased export volume.

E-commerce Surge: Strong order flows (especially post-Singles Day) are boosting demand for fast airport-to-door solutions.

Capacity Constraints: Passenger flight belly space has not fully recovered, leaving freighter capacity in high demand.

Carrier Pricing Strategy: Airlines continue raising rates to secure favorable 2026 BSA negotiations.

Lane Imbalances: JFK’s congestion, longer transit times, and higher demand keep pricing above other U.S. destinations.

Expect rates to remain firm or increase further through late November into early December. Unless demand sharply weakens, carriers are positioned to maintain elevated levels.

For the next two weeks, rates likely hold or rise, especially on JFK and LAX lanes as online retailers push last-mile order deadlines.

After 3 weeks until end of December, airlines may continue tightening space allocations to maintain rate strength into early 2026 contract talks.

Axios: U.S. companies more confident on trade than global peers, HSBC says

https://www.axios.com/2025/11/18/trade-tariffs-us-companies

Global Trade Magazine: U.S. and South Korea Detail New Trade and Investment Terms

https://www.globaltrademag.com/u-s-and-south-korea-detail-new-trade-and-investment-terms/

CNN: China used its trade juggernaut to withstand US tariffs. Can it keep its edge?

https://edition.cnn.com/2025/11/14/china/china-us-trade-war-global-exports-intl-hnk-dst

Wall Street Journal: Tesla Wants Its American Cars to Be Built Without Any Chinese Parts

https://www.wsj.com/business/autos/tesla-china-parts-supply-chain-639efc84?mod=djemlogistics_h

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

FEU & TEU rates change slightly week-over-week, importers that can afford to keep importing are continuning to do so while those that are hamstrung by tariffs are sidelined and the August 1st tariff deadline is one week away.

Each day the Supreme Court moves closer and closer to a ruling for or against the Trump administration's IEEPA tariffs. See what Baker Tilly's Pete Mento advises importers do to get ready for any out come, what the possible outcomes could be and more.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.