This week was dominated by Washington’s tariff legal saga and a calibrated softening at the margins. The White House moved to fast-track a Supreme Court appeal to keep emergency tariffs in place, even as it carved out zero-duty lanes for “aligned partners” and priority inputs beginning Sept. 8. Abroad, policymakers reacted on two fronts: defensive impact assessments (India’s finance team flagging a 0.5-0.6% GDP hit) and diversification plays (Beijing pushing an upgraded ASEAN pact). Europe’s trade data offered an early read-through of U.S. measures with weaker German exports. Net-net, the global trade stance remains restrictive, but with selective exemptions and regional deals emerging as pressure valves.

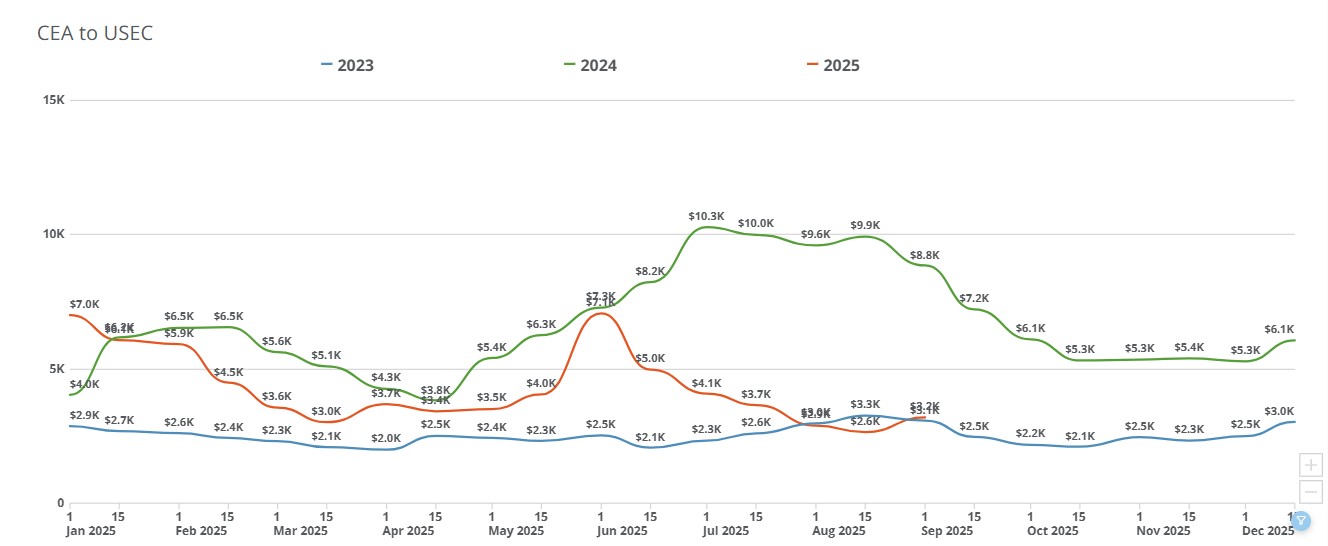

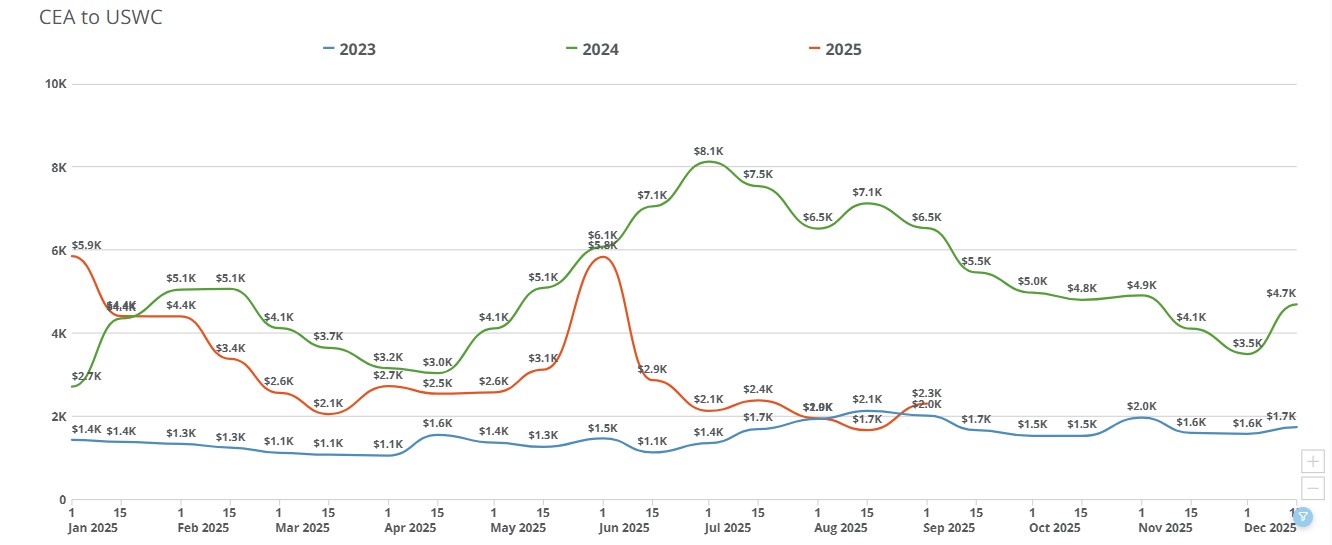

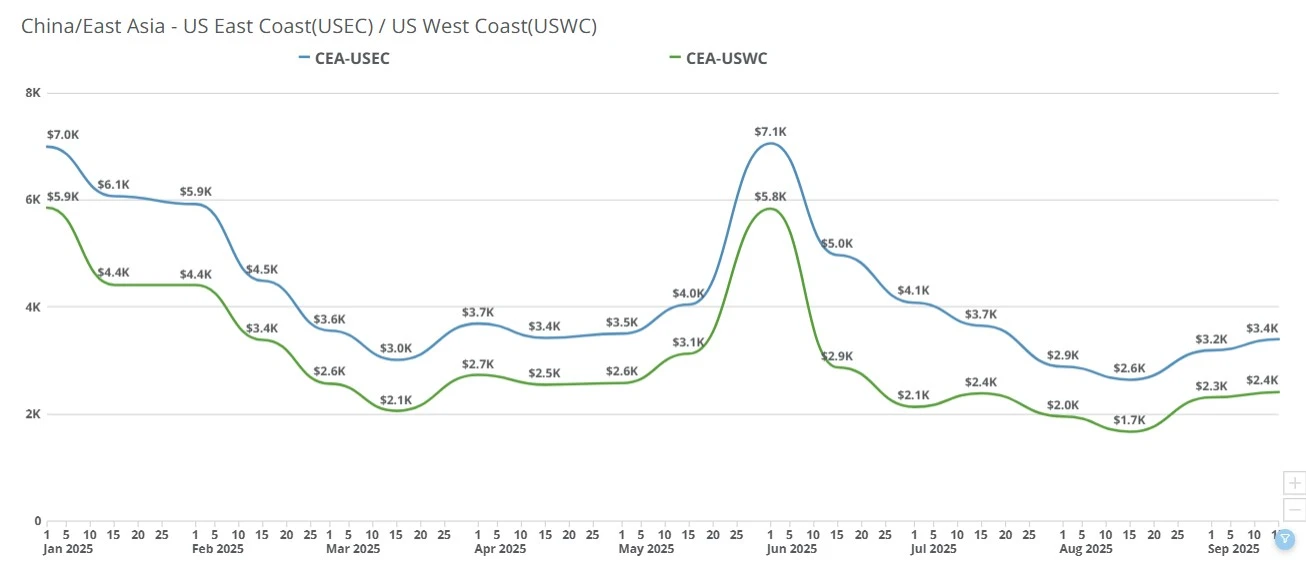

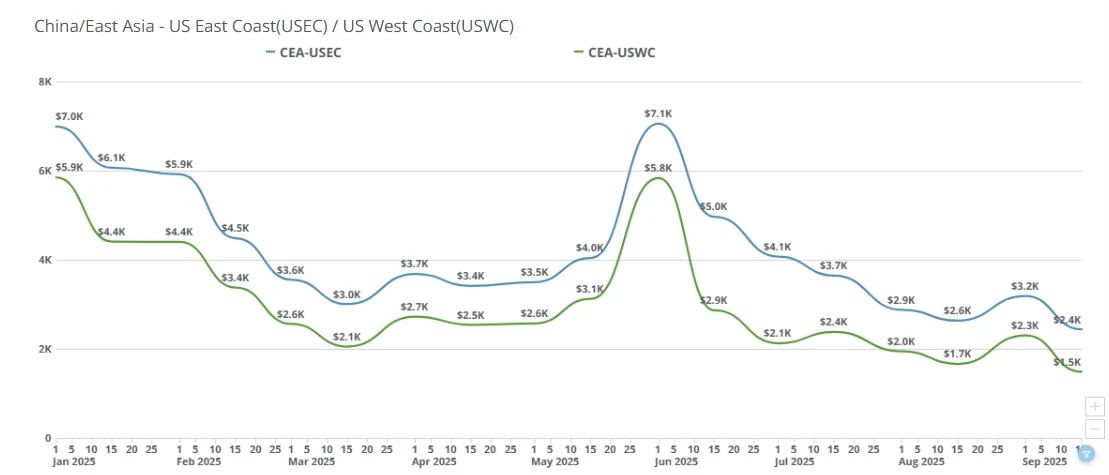

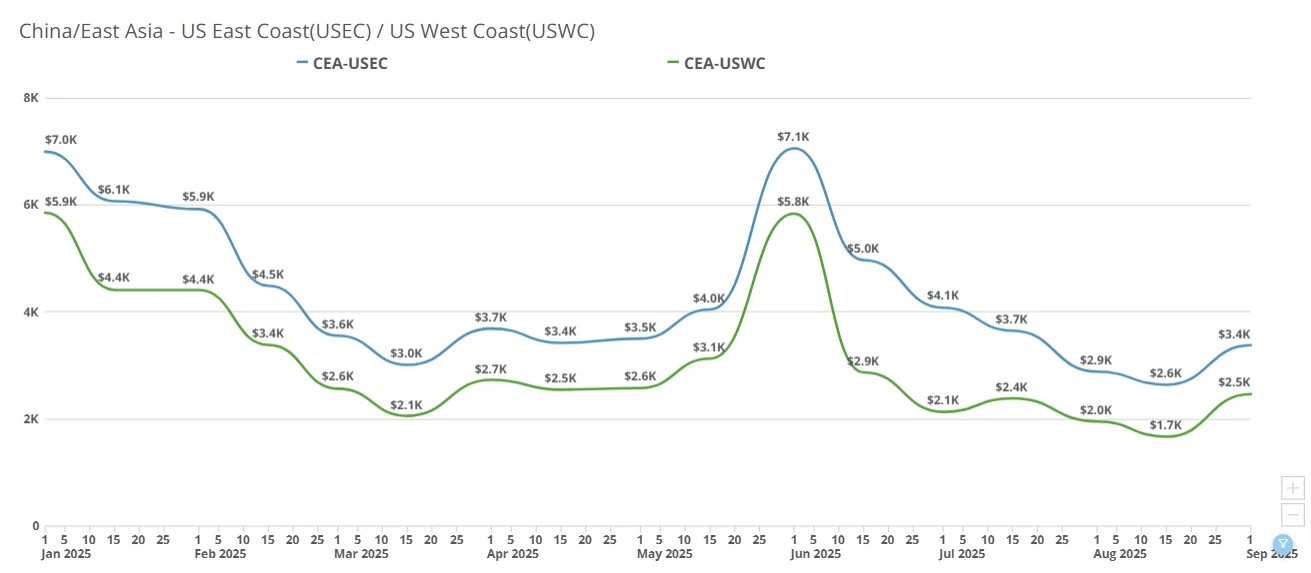

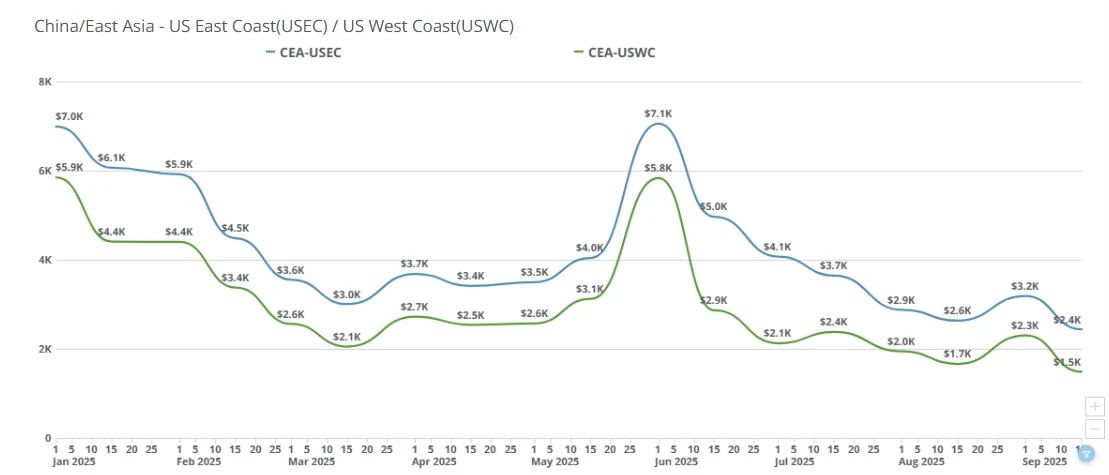

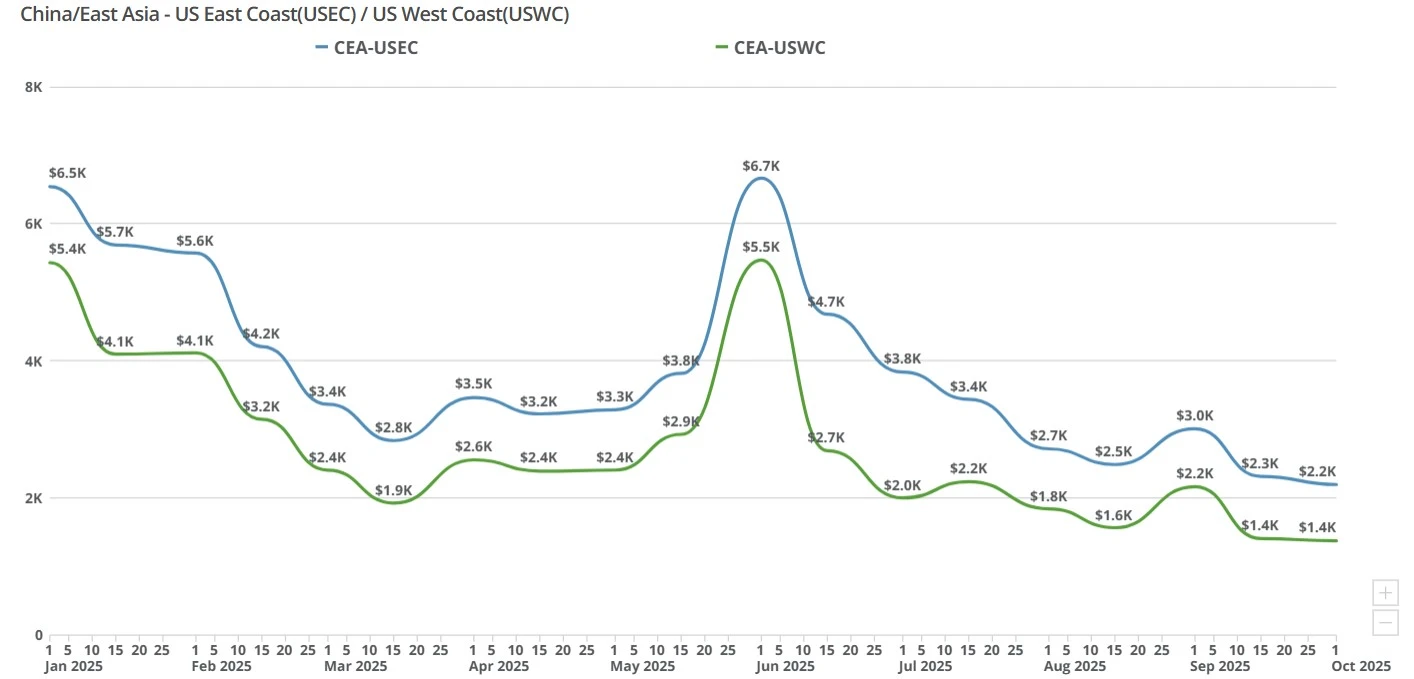

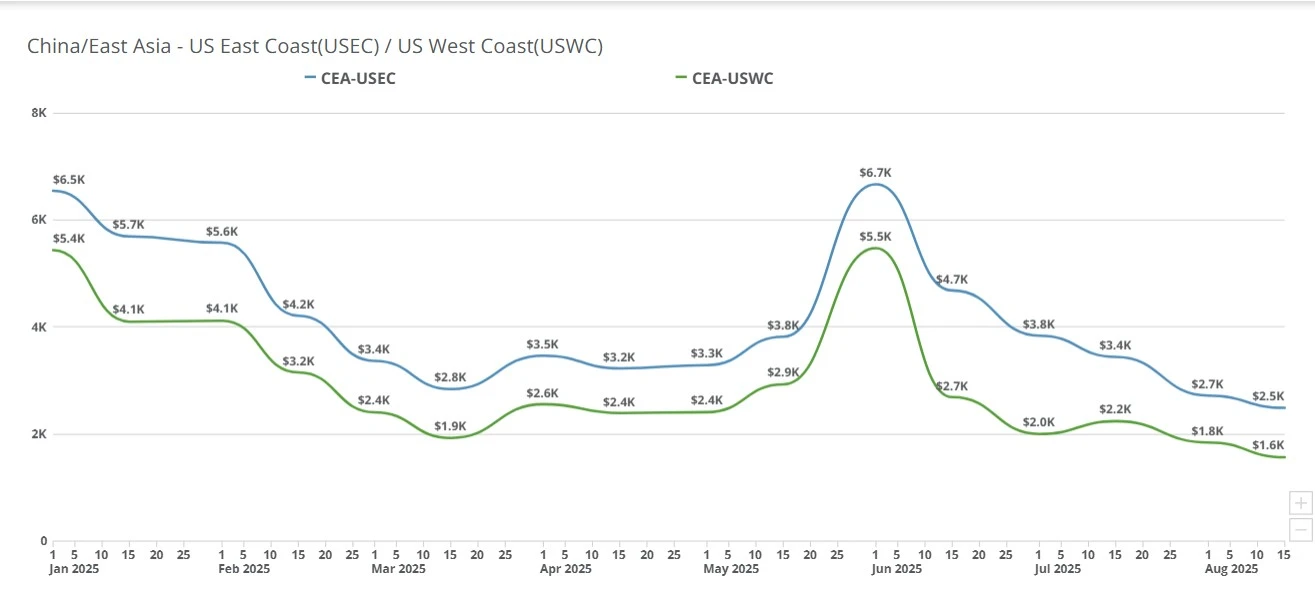

Rates decreased very slightly week-to-week. Last week’s GRI followed through and gave the spot market an expected shock in the form of container prices going up between $800-900 dollars. Rates saw about a 1% decrease. The decrease was expected as are decreases throughout the month of September. The time to look at most closely will be next week as that will help provide insight into the direction of the rest of September before going into Golden Week and the off-season.

Competition is getting increasingly fierce between freight forwarding companies. Forwarders, especially those dealing with SMBs, are fighting for business wherever they can get it as the pool of importers willing to continue to import with spot costs almost $1,000 more expensive than August and tariffs remains small but continues to shrink. Partners are reporting it’s increasingly common to take jobs at-cost or with extremely small margins, often between $25-75. We have not yet reached the point where negative margins are common place but it does not seem far away.

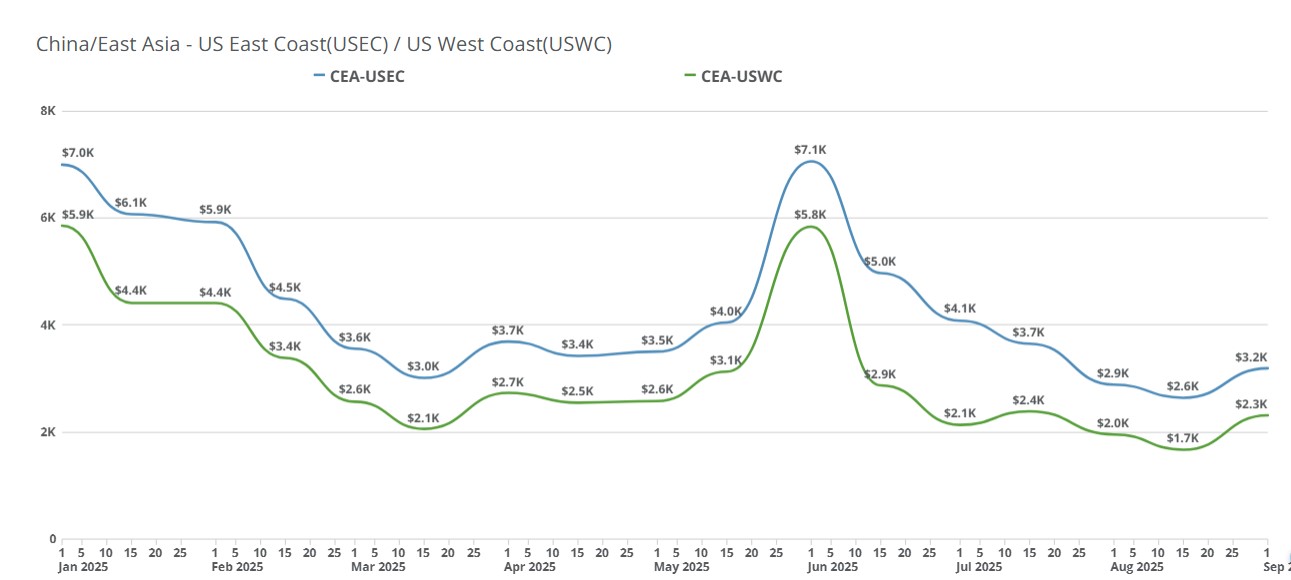

CEA/USEC currently range between $2200-2700. CEA/USWC currently range between $1800-$2400

Week of September 8, 2025:

CEA/USEC 20FT $2633.8

CEA/USEC 40FT $3192.4

CEA/USEC 40HC $3192.4

CEA/USWC 20FT $1859.95

CEA/USWC 40HC $2321.07

CEA/USWC 40FT $2312.23

Week of September 1, 2025:

CEA/USEC 20FT $2787.96

CEA/USEC 40HC $3379.28

CEA/USEC 40FT $3379.28

CEA/USWC 20FT $1983.46

CEA/USWC 40FT $2467.17

CEA/USWC 40HC $2478.19

WSJ: Supreme Court Agrees to Fast-Track Trump’s Tariff Appeal: https://www.wsj.com/us-news/law/supreme-court-agrees-to-hear-trumps-tariff-appeal-330b62ca?mod=djemlogistics_h

ShippingWatch: Trump wants 100 percent EU tariffs on China and India to pressure Russia: https://shippingwatch.dk/miljo_og_politik/article18522192.ece

NikkeiAsia: Tariffs to spur US partners to diversify, ex-negotiator says: https://asia.nikkei.com/economy/trade-war/tariffs-to-spur-us-partners-to-diversify-ex-negotiator-says

Marketplace: Quarterly demand for industrial warehouses sees first drop in 15 years: https://www.marketplace.org/story/2025/09/05/why-warehouse-demand-dropped-for-the-first-time-in-15-years?_hsenc=p2ANqtz-90iTOU4ngZHsjz5Jo0fCapYNpFpPM49eOSHb8oZvp7orBibI7vd6LiKkUFKfucgF9MapPiYfeO3Yd5enNal61Fyqg0rQ&_hsmi=379833655

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

The Panama canal is experiencing lower water levels as a result of a drought exacerbated by El Nino. The results of this drought have implications for all sizes of shippers around the world but particularly for small to medium sized shippers that are in a

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

FEU & TEU rates change slightly week-over-week, importers that can afford to keep importing are continuning to do so while those that are hamstrung by tariffs are sidelined and the August 1st tariff deadline is one week away.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.