This week, global trade policy saw several notable developments suggesting a turning point in how major economies manage supply chains, resource dependencies, and trade imbalances. The EU’s push to reduce dependency on Chinese raw materials and China’s simultaneous move to streamline rare-earth exports reflect a recalibration of trade flows, away from old dependencies and toward diversification and resilience. Meanwhile, China’s ability to hit a $1 trillion surplus despite shrinking exports to the US underscores the shifting geography of global trade: Chinese exporters are finding demand in other regions even amid Western tariff pressure. On the US side, domestic politics and social pressures over tariff impacts, especially on agriculture, are leading to compensatory relief packages, highlighting the real-world costs of trade policy decisions. Overall, the week illustrates how businesses, governments, and economic blocs are all trying to navigate a fragmented, volatile trade environment, balancing strategic interests, resource security, and economic stability.

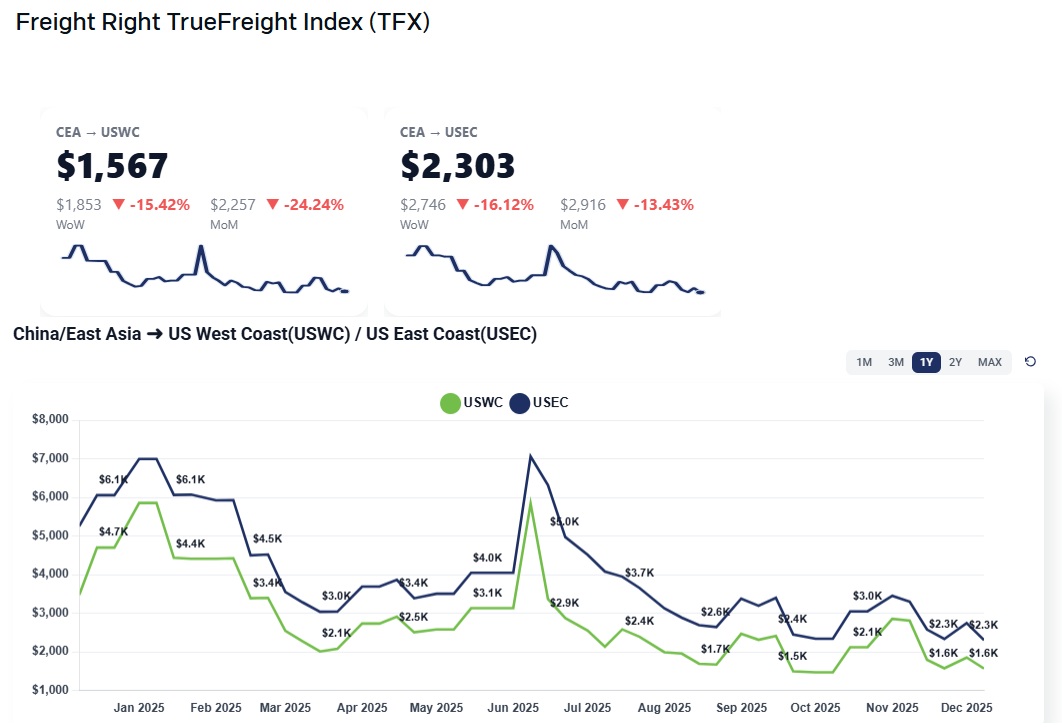

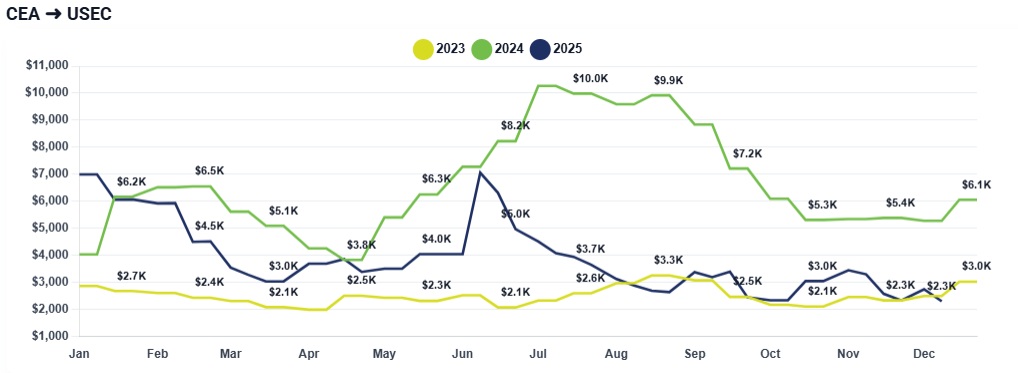

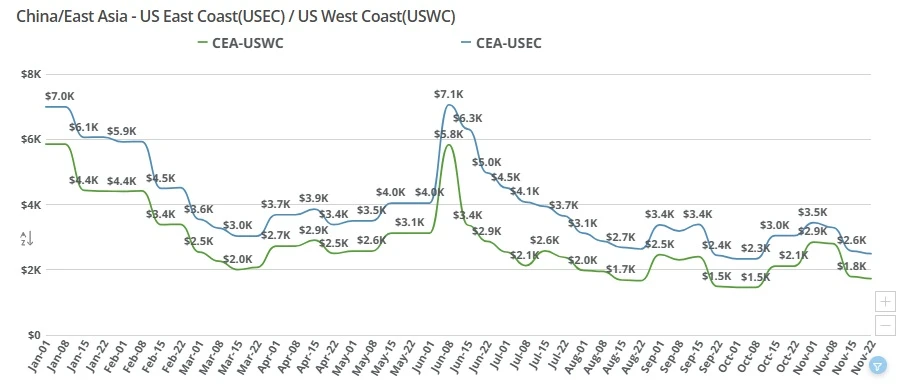

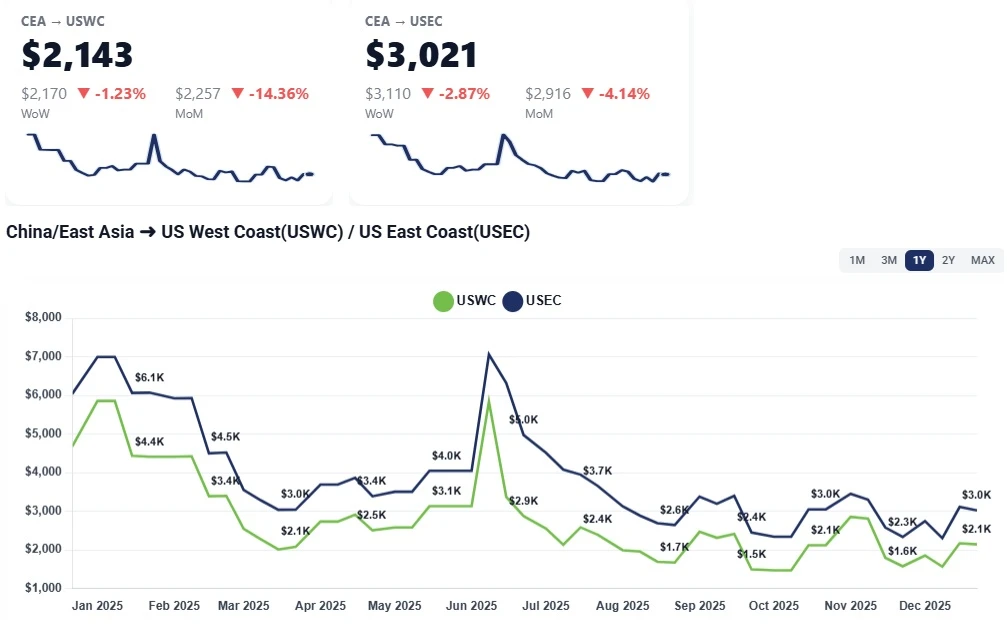

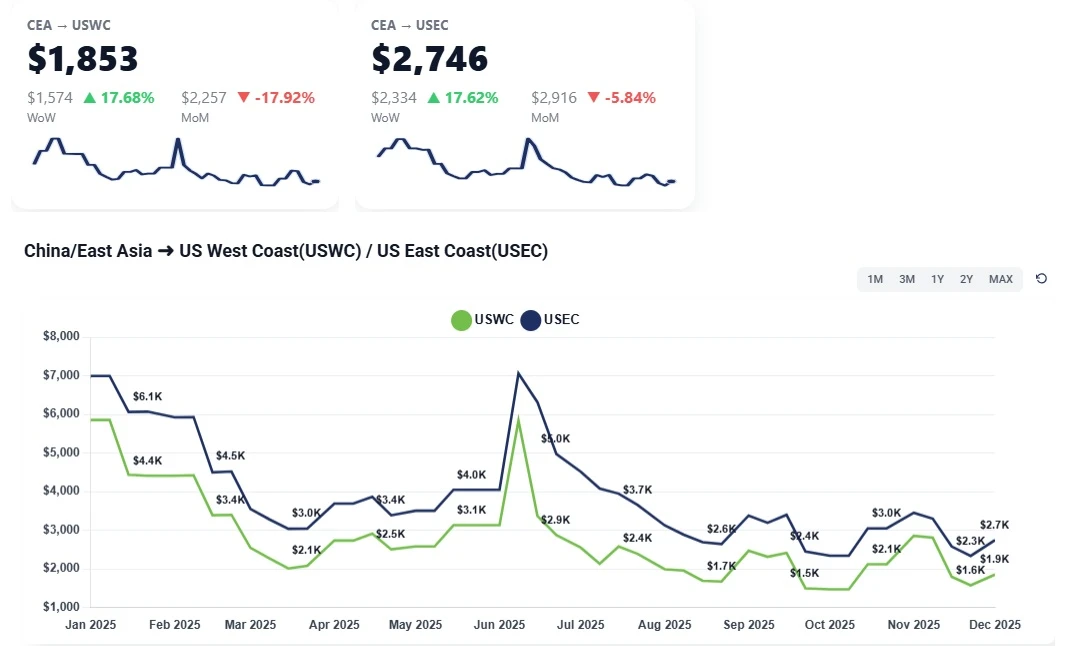

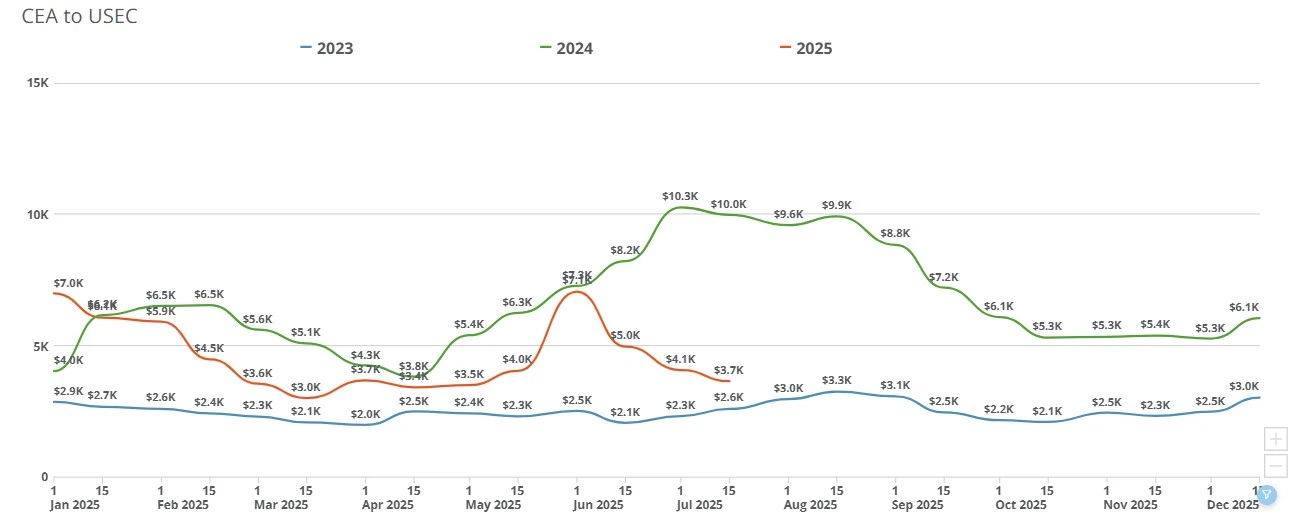

CEA to USWC: Spot levels attempted to firm this week on the back of carrier-driven micro-GRIs, but actual shipper-level deals in TFX remained close to late-November floors. Week-over-week, TFX is tracking the average spot freight rate down about ~15% week-over-week from China to USWC and down around 16% China to USEC. Month-over-month, USWC's rate has fallen by almost 24%.

CEA to USEC: A similar pattern played out on the USEC. Carriers pushed small December increases, but muted demand and ample capacity limited traction. Week-over-week TFX benchmarks decreased but remain within the tight, low-volatility band established after November’s sharp correction.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Demand is losing momentum heading into year-end: We’re seeing a clear pullback in December booking activity. Many importers already frontloaded earlier in the year due to tariff uncertainty and aren’t replenishing heavily right now. Combined with a broader cooling in consumer-driven shipments, the final weeks of the year are shaping up quieter than normal. When demand softens this sharply, GRIs tend to have limited staying power.

The late-November rate collapse is still influencing market behavior: Spot levels fell hard at the end of November, particularly on the transpacific. Even though carriers have launched fresh GRIs this month, the market is still digesting that correction. We can see it in the way rates respond: they may jump briefly at the start of a GRI, but quickly slide back as soon as carriers need to fill space. The market is acting like it’s trying to find a new stable floor rather than climbing into a sustained uptrend.

Carriers are attempting smaller, more frequent GRIs but shippers are resisting: Instead of pushing large, occasional increases, carriers this month are introducing smaller, more frequent bumps aimed at being easier for the market to accept. But when we look at actual transactional levels, they show resistance. Many shippers are negotiating rates back down toward pre-GRI levels, especially on the West Coast, where competition among carriers is strongest.

Overcapacity continues to undermine pricing: We are still in a structural oversupply environment. Even with some routing disruptions elsewhere in the world, there is more vessel capacity in the market than needed for current trade volumes. As long as this imbalance persists, carriers struggle to maintain rate increases no matter how often GRIs are announced. This week’s rate of softness is another reflection of that persistent overcapacity.

Europe is steadier than the U.S., but not enough to lift the broader market: Demand into Europe is holding up better than into North America, and rates there have been comparatively more stable. But stability in one region isn’t enough to offset the weakness we’re seeing on the transpacific, which remains the primary global pressure point. The transpacific continues to drag on overall market sentiment and pricing.

For the rest of December, expect continued “micro-GRIs” into the second half of December as carriers position for January contracting and bunker adjustments. Given soft fundamentals and still-elevated capacity, TFX CEA to USWC and CEA to USEC rates should trade sideways with mild upward bias, rather than showing any extended rally.

From early January onwards, Carriers are likely to attempt another early-January increase. A short-lived lift as post-holiday restocking and early Chinese New Year bookings coincide with blank sailings; Quick normalization once those orders clear and importers resume conservative ordering patterns.

By late February (Chinese New Year), expect firmer space and mildly rising spot levels. Post-Chinese New Year, with U.S. and EU inventories not significantly depleted, the market is likely to revert back toward current TFX levels or slightly lower unless carriers coordinate material capacity withdrawals.

Reuters: Global trade set to grow 7% to pass record $35 trillion this year, UN agency says

https://www.reuters.com/business/global-trade-set-grow-7-pass-record-35-trillion-this-year-un-agency-says-2025-12-09/

Bloomberg: How the EU and CPTPP Can Preserve Global Trade

https://www.bloomberg.com/opinion/articles/2025-12-08/eu-cptpp-can-save-global-trade-without-us-leadership

The Washington Post: Despite Trump tariffs, China’s global trade surplus tops $1 trillion

https://www.washingtonpost.com/world/2025/12/08/china-trade-surplus-record/

Global Trade Magazine: Container Shipping Rates Rise Again After Three-Week Drop

https://www.globaltrademag.com/container-shipping-rates-rise-again-after-three-week-drop/

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

As the deadline before reciprocal tariffs take place, the Trump administration continues to make deals with nations around the world. Importers are back to taking a wait-and-see approach while rates USWC and USEC remain unchanged.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.