By late 2025, the United States was operating under a renewed trade-policy push from President Donald J. Trump, who earlier in the year declared a national emergency over persistent trade imbalances. This was formalized under Executive Order 14257, which introduced sweeping reciprocal tariffs to correct what the administration called “non-reciprocal trade practices.”

That move, grounded in the International Emergency Economic Powers Act (IEEPA) and related trade statutes, established a legal foundation for recalibrating U.S. tariffs on nearly all imports. It set the stage for a new era of trade deals, one in which allies and partners could earn tariff relief by aligning more closely with U.S. economic and security priorities.

In May 2025, Trump issued Executive Order 14298, temporarily reducing tariffs on Chinese imports to 10 percent to acknowledge “progress in discussions” with Beijing. This was followed by a September 2025 order that expanded the reciprocal tariff framework and introduced a “Potential Tariff Adjustments for Aligned Partners (PTAAP)” annex , allowing nations that committed to fair trade and security cooperation to qualify for reduced tariffs (White House Fact Sheet, Sept. 5 2025).

On November 1 2025, the Donald J. Trump administration published a Fact Sheet announcing a comprehensive U.S.–China economic and trade agreement.

The U.S. will reduce its average tariff on Chinese goods from ~57 % to ~47%. Specifically, the U.S. will cut the "fentanyl-related" tariff component from 20 % to 10%.

China will pause for one year its new export‐controls on rare earth minerals (the controls announced in early October) and review/refine their implementation.

The U.S. will suspend for one year its new rule regarding export restrictions on entities 50%-owned by black-listed firms (i.e., delaying that technology export tightening).

Both sides will suspend “tit-for-tat” port/ship fees (via U.S. Section 301 action against China’s ship-/maritime industry and China’s countermeasures) for 12 months.

China made commitments relating to large‐scale U.S. agricultural purchases (namely soybeans) in the near term.

In return, the U.S. agreed to suspend or reduce certain reciprocal tariffs and to engage in ongoing bilateral trade talks.

This deal marks a shift: rather than simply imposing high tariffs, the U.S. is offering relief contingent on specific commitments by China, notably in areas of national security (fentanyl precursor control), strategic supplies (rare earths), market access (agriculture), and technology.

Although the November fact sheet focused on China, the administration’s broader strategy also encompassed South Korea. During a late-October 2025 state visit, the President announced a series of multi-billion-dollar investment and trade deals with Seoul, including cooperation in energy, manufacturing, and defense.

According to a Congressional Research Service brief, South Korea was among seven partners offered provisional tariff relief under the reciprocal framework. These arrangements collectively signaled Washington’s intent to reward partners that supported U.S. objectives in trade, technology, and security.

Analysts view the combined China and South Korea deals as the first major test of the Trump administration’s reciprocal-tariff system.

By pairing tariff pressure with economic incentives, the U.S. is reshaping its trade relationships, demanding measurable market access and strategic cooperation in return for economic relief.

The White House says the approach will “strengthen American industry, restore fairness, and safeguard national interests.” Critics warn it could still unsettle global markets, depending on how compliance and enforcement unfold.

Either way, the 2025 executive orders and subsequent deals represent a decisive pivot: trade as strategy, not simply commerce, aligning economic policy tightly with foreign-policy goals.

Explore how the 2025 U.S.-U.K. Economic Prosperity Deal reshapes tariffs, boosts exports, and opens new opportunities for automotive, aerospace, and metals trade.

The White House has announced new tariffs on branded pharmaceuticals and launched national security probes into medical equipment and robotics. Learn what’s changing, how hospitals and manufacturers could be affected, and where to track historical HS/HTS.

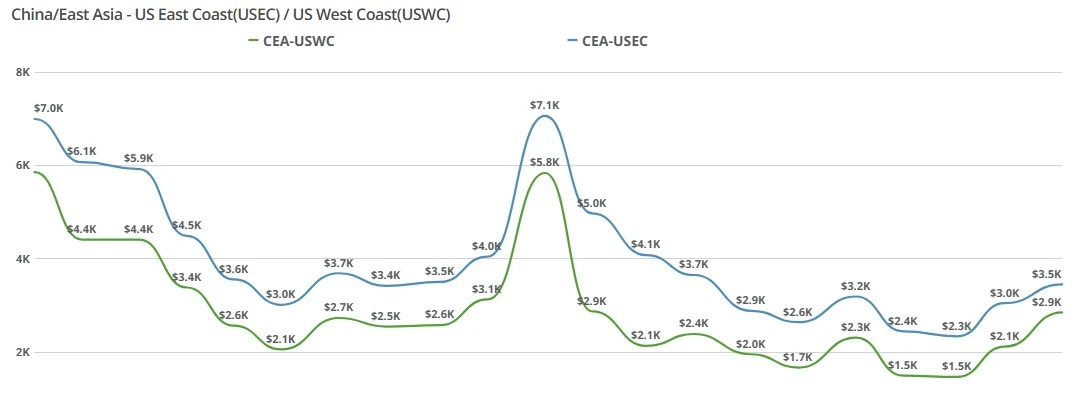

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

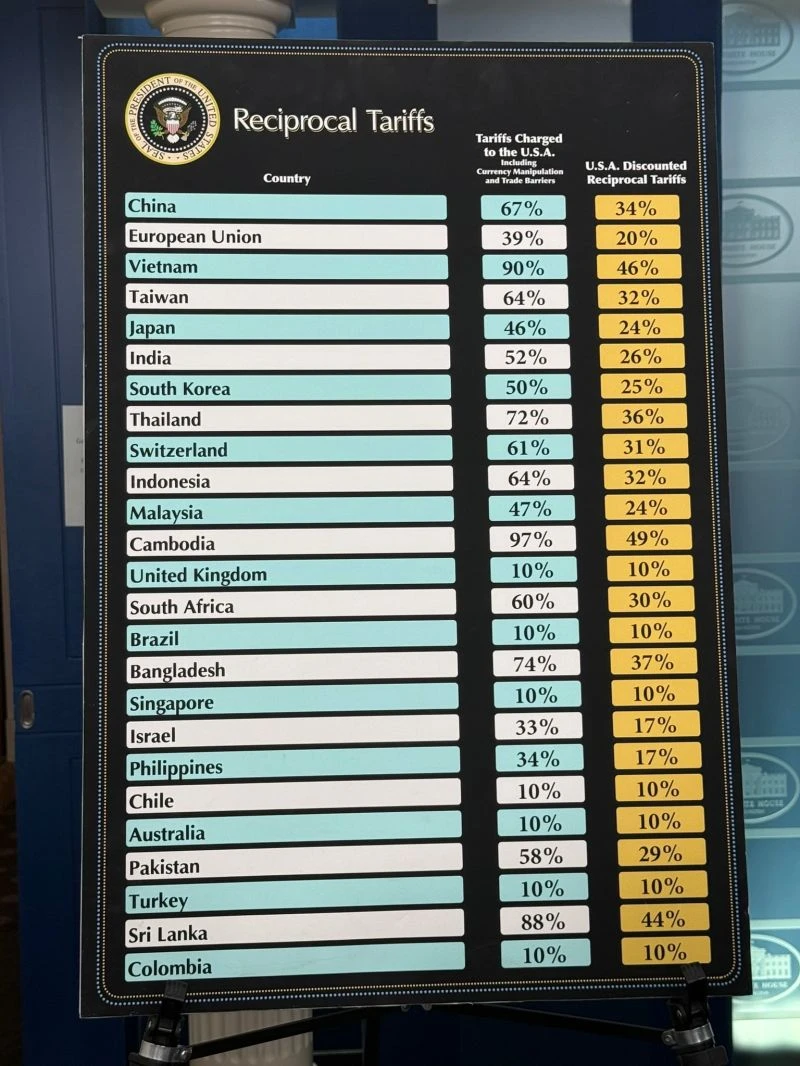

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

On August 29, 2025, a federal appeals court ruled 7–4 that President Trump’s emergency-based tariffs were unlawful, finding tariff powers rest with Congress. The court left them in place temporarily, granting the administration time to appeal to the SC.

President Trump issues Executive Order to stop overlapping tariffs on imports under national security and trade actions, ensuring duty rates remain targeted and non-cumulative. Effective retroactively from March 4, 2025.

a detailed timeline of U.S. global trade policy changes from April to August 2025, including new tariffs, international negotiations, and their economic impact.

The U.S. will impose 10% tariffs on lumber and 25% on furniture starting October 14, 2025, a move set to impact housing costs, supply chains, and trade relations.

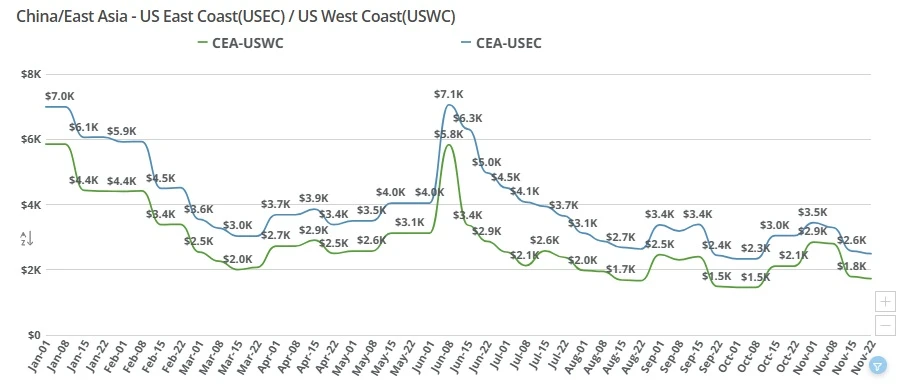

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

The Trade Deal signed between the two governments has become subject to much discussion as critics say that it's vague and doesn't address the actual problems.