On September 30, 2025, the Trump administration announced sweeping import tariffs on wood products, specifically setting a 10% duty on softwood lumber and timber and a 25% tariff on kitchen cabinets, bathroom vanities, and upholstered wood furniture. These new rates are slated to take effect on October 14.

The measure was formally issued through a Presidential Executive Order, invoking Section 232 of the Trade Act of 1974, which allows imports to be regulated when they are determined to threaten national security. The administration argues that dependence on foreign wood products is undermining U.S. industry and infrastructure resilience.

Moreover, the proclamation signals that the duties could increase as of January 1, 2026, potentially reaching 50% for certain furniture and cabinetry items from non-cooperative countries.

This is not an entirely new front. Earlier in 2025, the administration launched an investigation into lumber and timber imports under Section 232, signaling its intent to treat wood imports as strategic goods. Trump also used executive actions to boost domestic wood supply, for example by expediting salvage logging and simplifying permitting procedures, to reduce reliance on imported timber.

In August, Trump announced a furniture tariff investigation, declaring that duties would be imposed within “50 days.” The furniture sector thus became the next logical target in the administration’s broader trade posture.

The logic is partly political and partly economic: To protect U.S. wood and furniture makers, claim that unfairly cheap imports are “flooding” the market, and reposition global supply chains to favor domestic production.

The announcement provoked a flurry of reactions:

Home builders and construction firms are worried. Tariffs on lumber and furniture will raise building costs. One estimate suggests the new levies could add roughly $1,000 to the cost of a home.

Furniture exporters, especially from Vietnam, are bracing for margin squeezes. Some firms are holding ground; betting U.S. consumers will absorb the cost.

Canadian lumber sectors are especially vulnerable. As a major supplier of softwood lumber to the U.S., Canada is expected to feel heavy economic strain. It has already earmarked subsidies (billions of dollars) to buffer the hit.

Domestic critics, including the U.S. Chamber of Commerce, caution that tariffs may backfire, by hurting industries that depend on wood imports and by pushing up inflation.

The stock market and homebuilder-related equities reacted: home building stocks slipped after the announcement.

Meanwhile, lumber futures jumped, reflecting expectations of tighter supply.

This tariff moves sits at the intersection of trade policy, economic risk, and legal vulnerability:

Pass-through risk: Even if the tariff is imposed on imports, many expect the added cost will be passed on to U.S. buyers (builders, furniture makers, consumers).

Supply constraints: The U.S. may struggle to scale up domestic wood production quickly, especially given forestry, labor, and environmental constraints.

Retaliation & trade wars: Affected countries may respond with countermeasures, raising tensions.

Legal pushback: Trump’s broader tariff program (e.g. via emergency powers) is already being challenged in court. A key case, Learning Resources v. Trump, examines the constitutionality of tariffs imposed under emergency authority.

Political risk and continuity: Tariffs tied to discretionary executive action may shift with changes in administration or policy priorities.

January 1, 2026 could bring tariff escalation if trade partners don’t acquiesce.

Exporters, especially in Asia and Canada, will likely lobby for carve-outs, exemptions, or new trade deals.

Domestic wood & furniture firms may see opportunity expansion, but scaling capacity takes time.

Builders and consumers will watch housing costs, which already face pressure from interest rates and material cuts.

Legal rulings over the legitimacy of Trump’s tariff framework may constrain how far these policies can go.

The US imposed a 100% tariff on Chinese-made port cranes to cut reliance on China’s infrastructure, prompting backlash from U.S. ports and retaliation from Beijing.

Learn the top 2 reasons for eCommerce cart abandonment—high shipping costs and slow delivery—and discover actionable strategies to reduce lost sales and boost conversions.

In the hospitality and hotel sectors, the success of a project often hinges on countless elements working together seamlessly. Among these, shipping Furniture, Fixtures, and Equipment (FF&E) plays an integral role, often influencing a project's timeline,

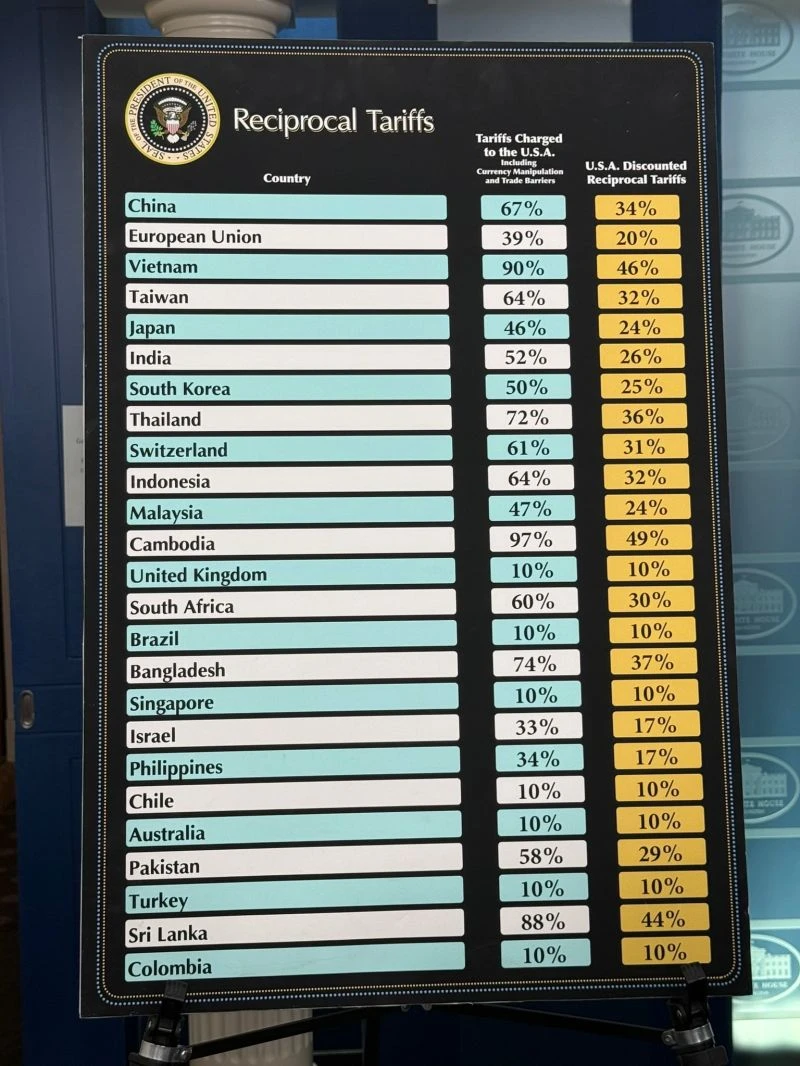

On April 2nd, the Trump administration announced reciprocal tariffs aimed at 50 countries and a baseline 10% tariff on all imports to the US. Here are the latest tariffs the US plans to levy against other countries.

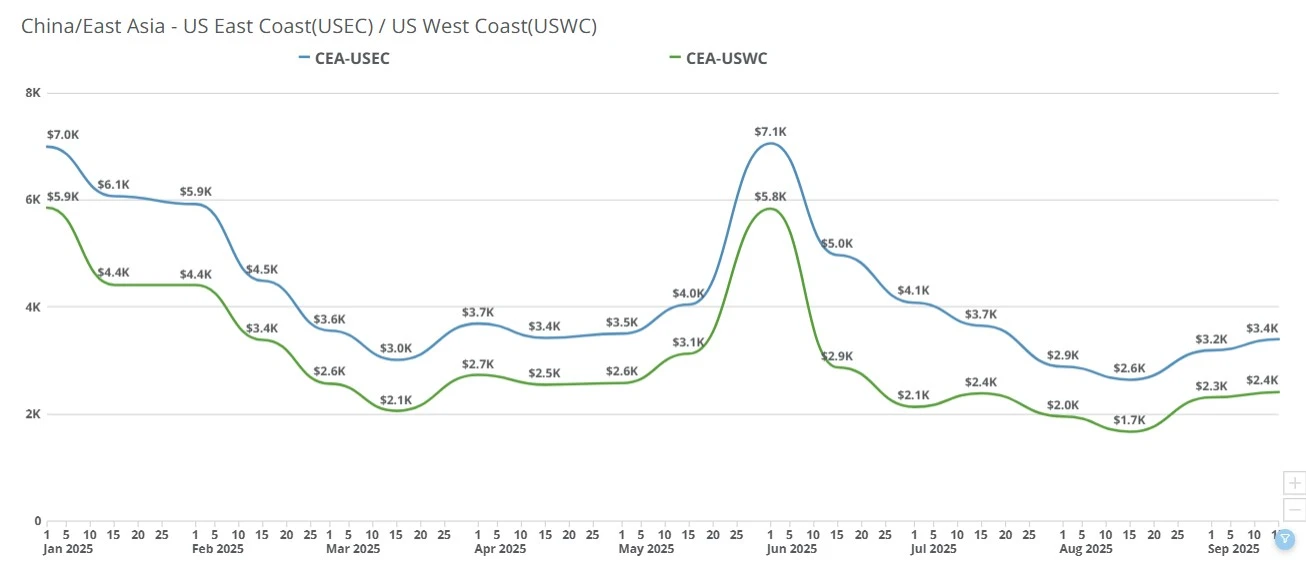

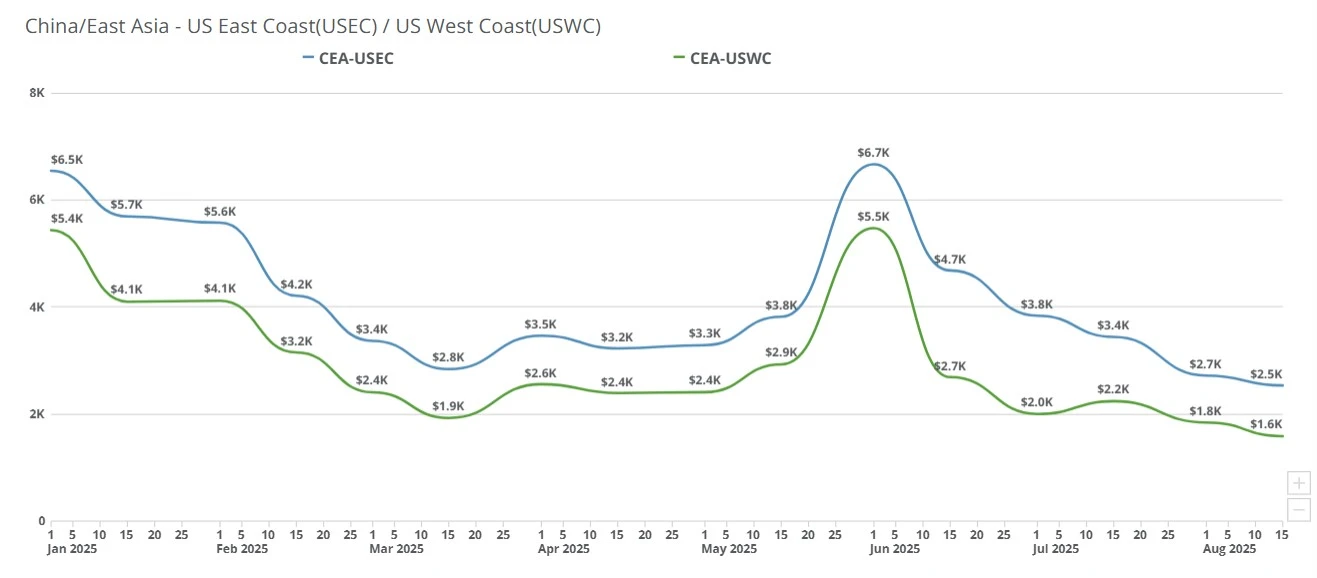

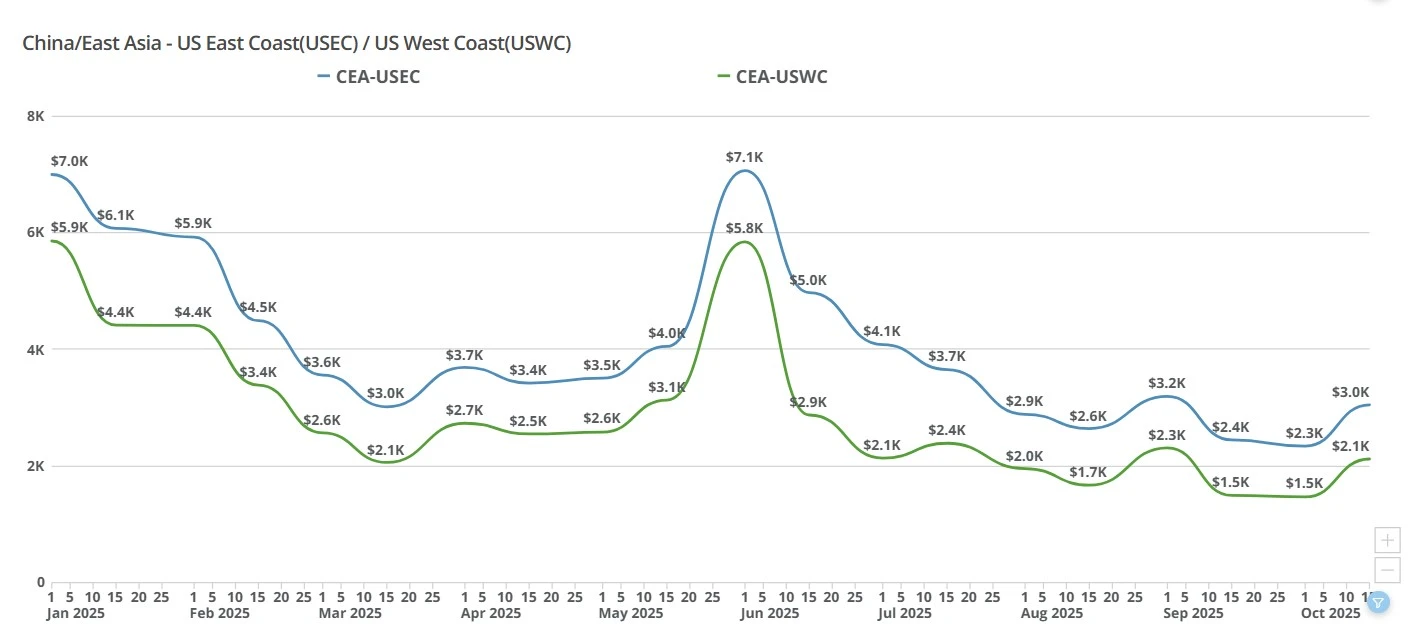

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

Direct-to-consumer merchants selling oversized goods domestically and internationally have a unique set of logistical and pricing challenges. Freight Right's CEO Robert Khachatryan discusses those challenges on Ticker News Australia.

Founder & CEO of Freight Right Global Logistics, Robert Khachatryan, sat down with Tuck Ly, Vice President of Clearpoint International, to discuss the major issues affecting the global supply chain and port congestion

Transpacific ocean and air rates jump as carriers pull capacity, Apple charters tighten space, and shippers rush to beat U.S. tariff deadlines

Freight Right CEO Robert Khachatryan joins the E-commerce Coffee Break podcast to share insights on shipping large, heavy, and high-value goods internationally, avoiding hidden costs, and expanding into 45+ markets without a local presence.