The United States has announced sweeping new tariffs on Chinese-made ship-to-shore (STS) container cranes, escalating an ongoing trade and security confrontation between Washington and Beijing.

Under the new directive issued October 10, the US Trade Representative (USTR) will impose a 100% tariff on port cranes manufactured in China, potentially pushing total duties on some models to as high as 270% once existing anti-dumping and countervailing measures are factored in. The measure is expected to take effect November 1, 2025, though implementation details may still shift depending on bilateral talks.

The White House said the tariff aims to curb US reliance on Chinese-built port infrastructure. Chinese manufacturer Shanghai Zhenhua Heavy Industries Co. (ZPMC) currently supplies around 80% of cranes used in US ports, a dominance that has raised national security concerns, according to FreightWaves.

Officials have long warned that such dependence could expose critical logistics infrastructure to cyber vulnerabilities or surveillance risks. The administration has characterized the new tariff as a defensive measure under Section 301 of US trade law.

The move has alarmed US port operators and logistics companies already struggling with rising costs and global supply chain disruptions. The American Association of Port Authorities (AAPA) estimates that the tariffs could add over $6 billion in costs over the next decade, Reuters reported.

Port executives argue that there are currently no domestic manufacturers capable of producing large STS cranes at scale, leaving facilities with little choice but to import from Asia. Several ports are requesting exemptions for crane orders placed before April 2025 or a delay in enforcement to allow pending shipments to arrive before the tariff hits.

“The immediate effect will be higher costs and slower modernization for US ports,” one logistics analyst said. “The long-term goal of reshoring crane production will take years to materialize.”

In response, Beijing condemned the move and introduced new port fees on US-built or -flagged vessels docking in Chinese ports, with rates expected to increase through 2028, according to AP News. Chinese state media framed the US tariffs as “economic coercion” and signaled further countermeasures.

The escalation comes amid a broader US-China trade standoff, with new duties also targeting vehicles, microchips, and clean energy products. Markets reacted sharply to the latest announcement — the Dow fell nearly 900 points on the day of the tariff news before partially rebounding.

Trade analysts expect the dispute to deepen as both nations adjust maritime fees and industrial policies. For now, port authorities are racing to complete existing crane installations before the November deadline, while the administration is reportedly reviewing incentives to expand domestic crane manufacturing.

The USTR has not ruled out additional tariff adjustments depending on China’s response.

The International Longshoremen's Association began their strike October 1, 2024, affecting ports running along the east coast and Gulf regions of the United States. See what ports are affected and what this strike can mean for shippers.

The U.S. will impose 10% tariffs on lumber and 25% on furniture starting October 14, 2025, a move set to impact housing costs, supply chains, and trade relations.

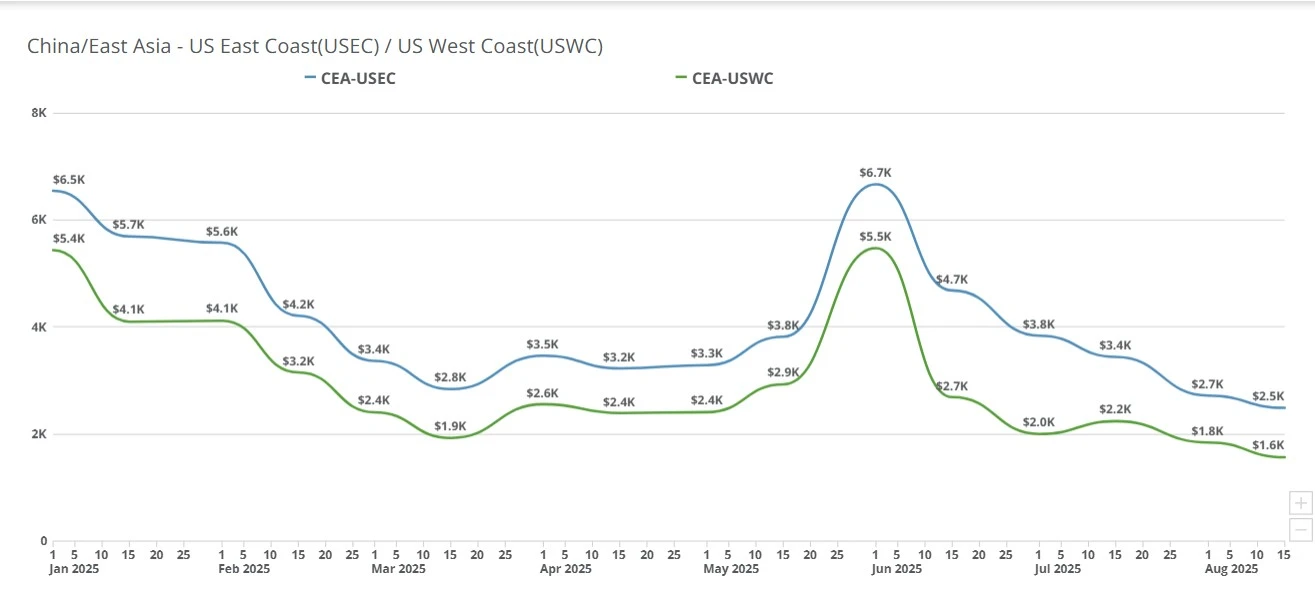

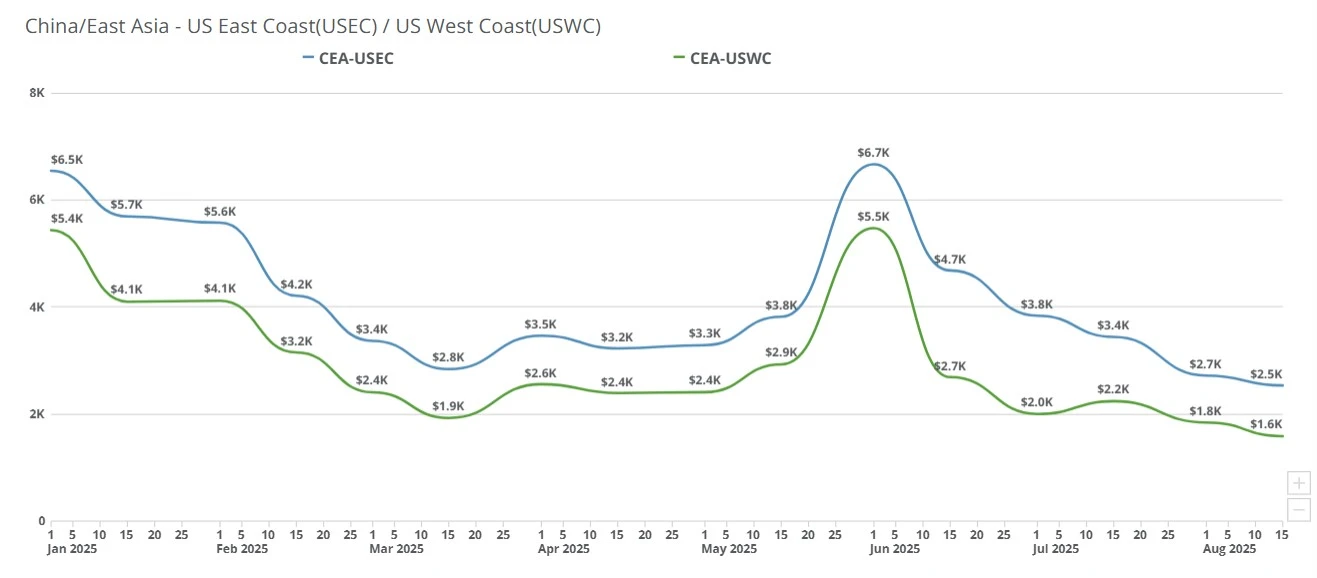

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

It has been established: ATA Carnets make the import/export experience of non-commercial goods so much easier, however, the usage of this document, has its own complications and concerns. Many Carnet holders often show concern about when to use each part

Rising COVID cases partially closes down one of the world's busiest ports, what does that mean for freight?

Trump’s latest trade deal with China and South Korea cuts tariffs, boosts U.S. exports, and deepens security and economic cooperation.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Why it’s so expensive to ship goods and to travel between multiple U.S. ports.

The White House has announced new tariffs on branded pharmaceuticals and launched national security probes into medical equipment and robotics. Learn what’s changing, how hospitals and manufacturers could be affected, and where to track historical HS/HTS.