The week was dominated by legal, retaliatory, and coordination signals rather than broad new tariff slates. In Washington, the U.S. Supreme Court’s decision to hear tariff cases put the legal foundations of 2025 measures under the microscope, while the Office of the United States Trade Representative (USTR) advanced process steps, notably a fresh Section 301 comment window on China, that could recalibrate future tariff scopes. Beijing escalated a major retaliation against the EU with steep anti-dumping duties on pork, as Brussels quietly tuned its trade-defense rulebook via Official Journal corrections.

In London, the TRA’s imports dashboard underscored the UK’s trade-defense posture. Geopolitically, the Treasury's warning that Europe must act first on tariff pressure tied to Russian oil highlighted the trans-Atlantic bargaining around using tariffs as a sanctions tool. Meanwhile, U.S./China talks yielded a TikTok framework amid wider tariff discussions, and the WTO’s fisheries-subsidy pact finally took effect, one of the few multilateral bright spots in an otherwise fragmenting trade landscape.

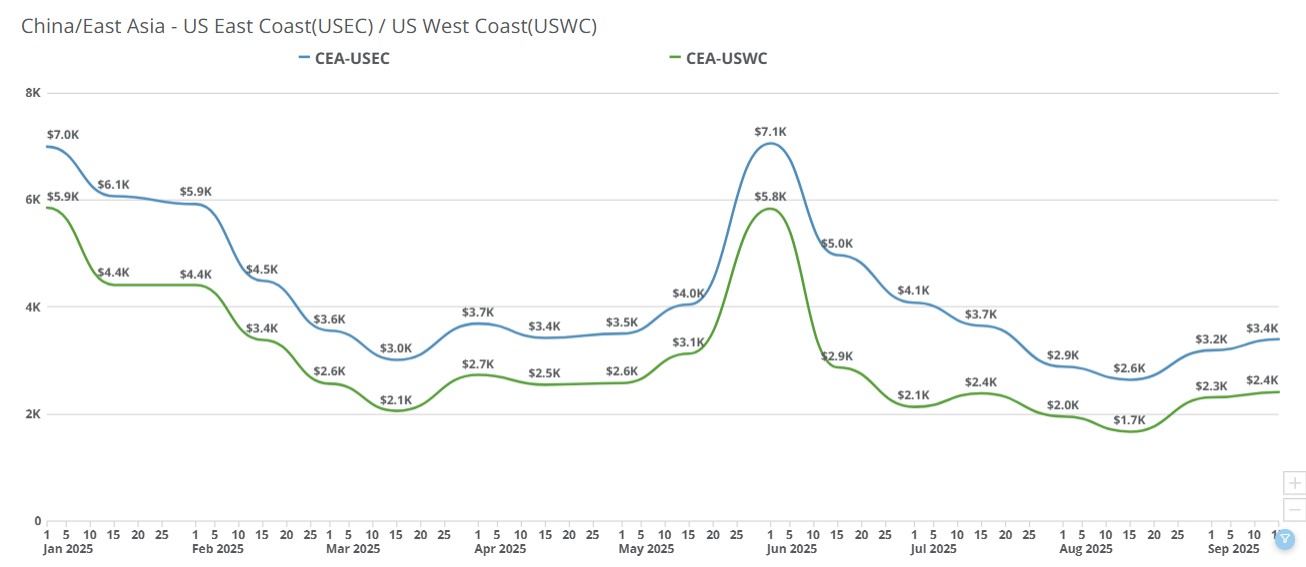

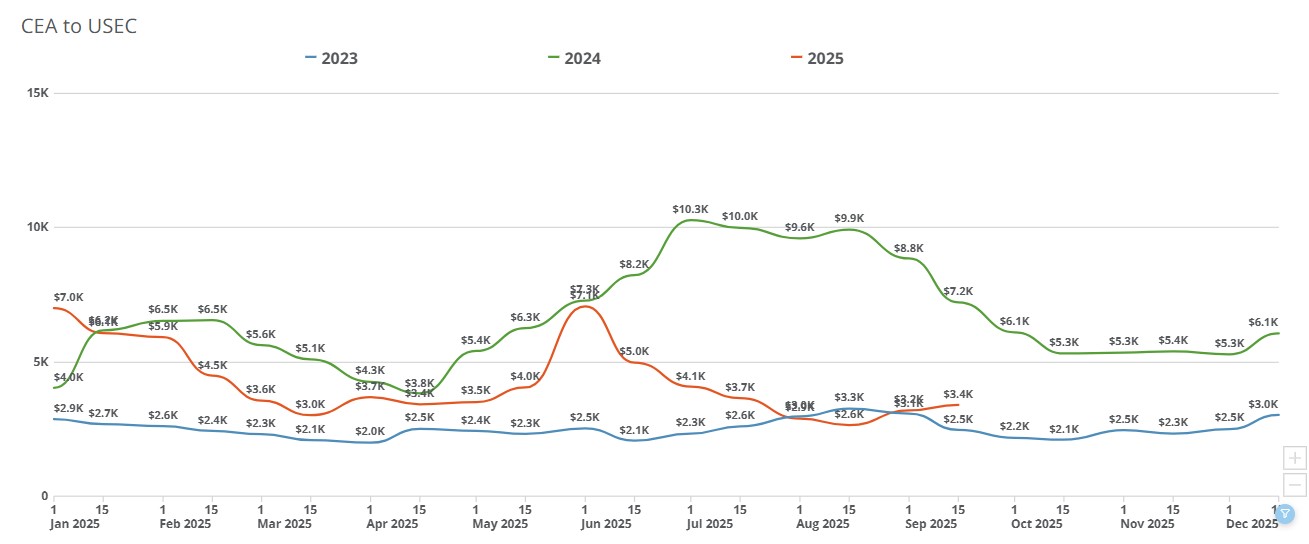

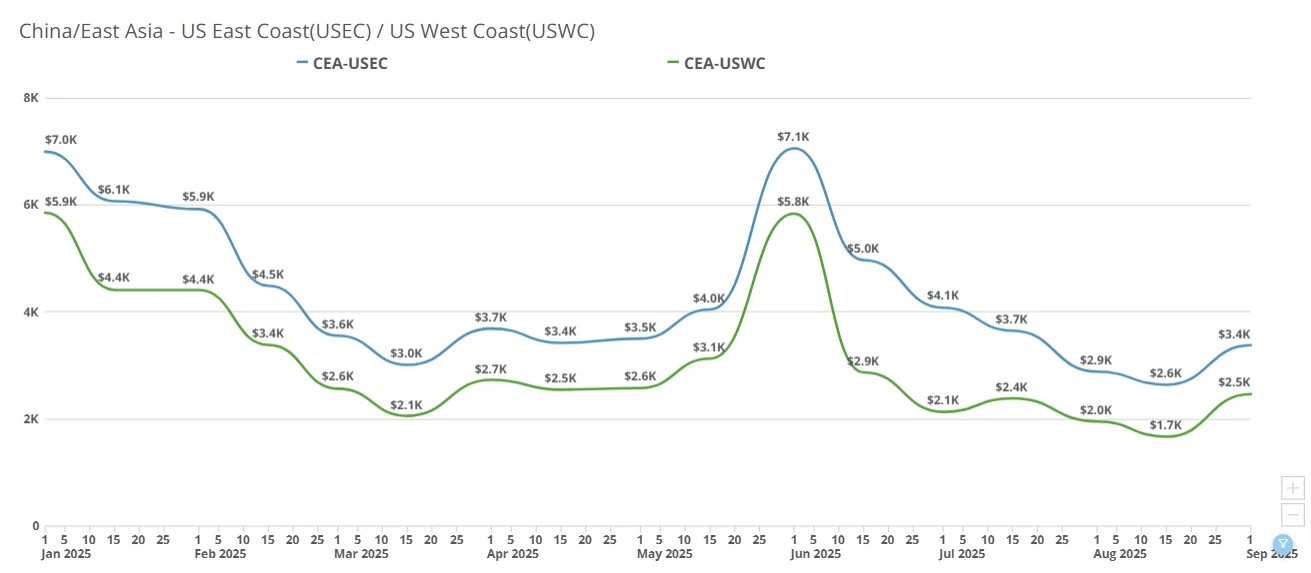

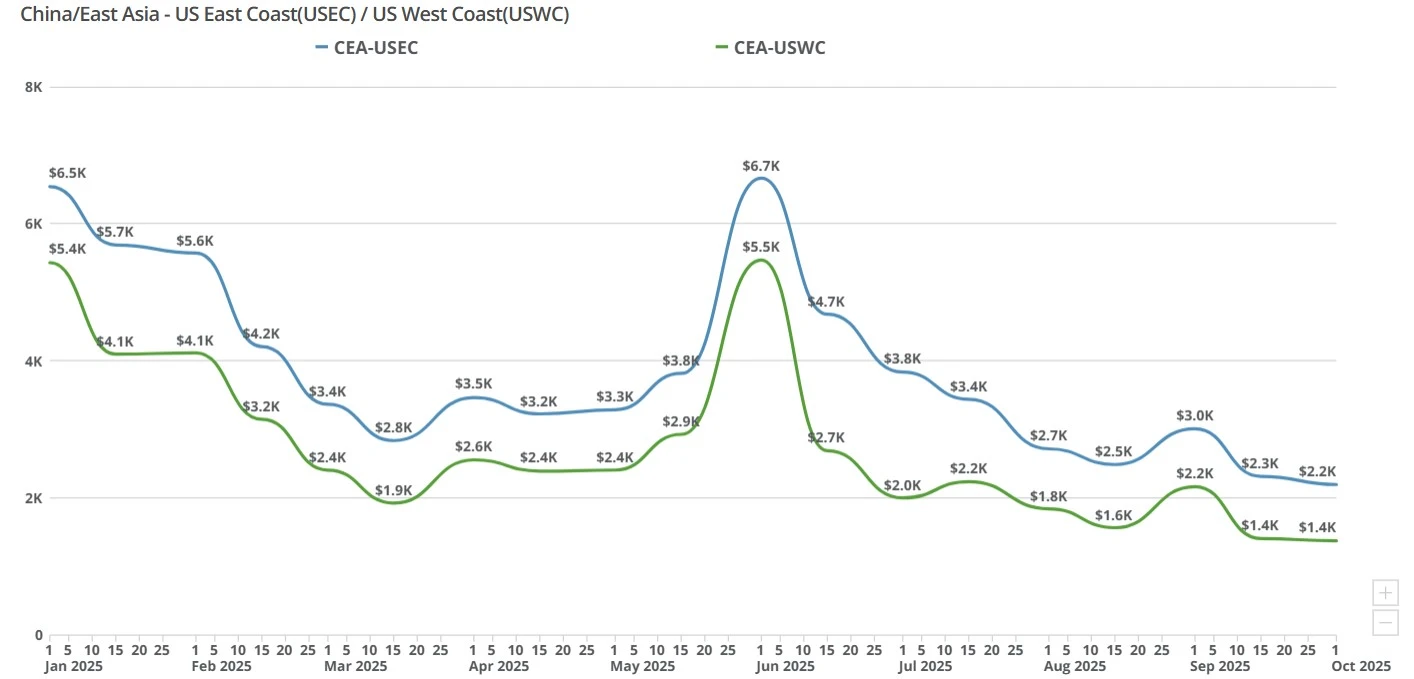

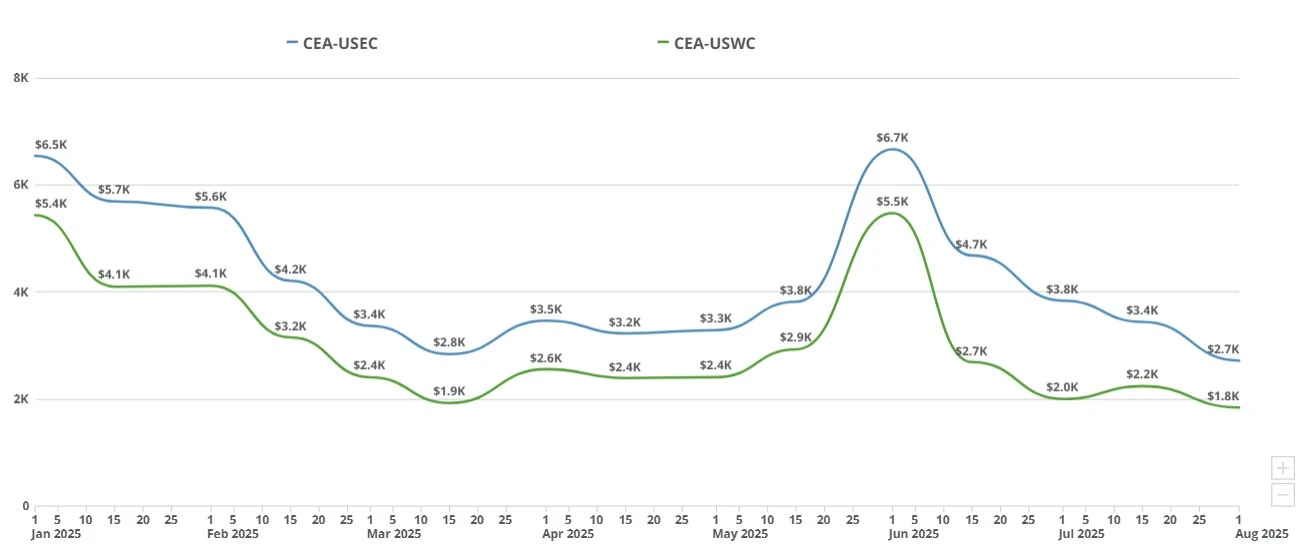

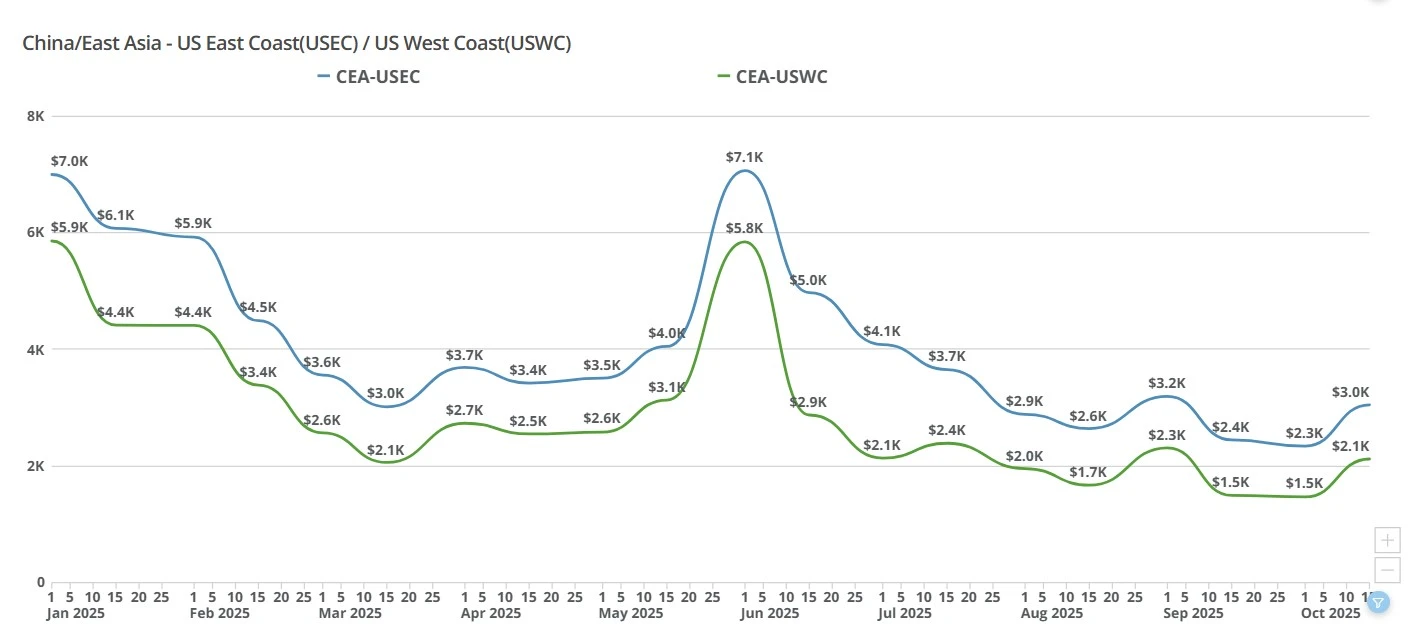

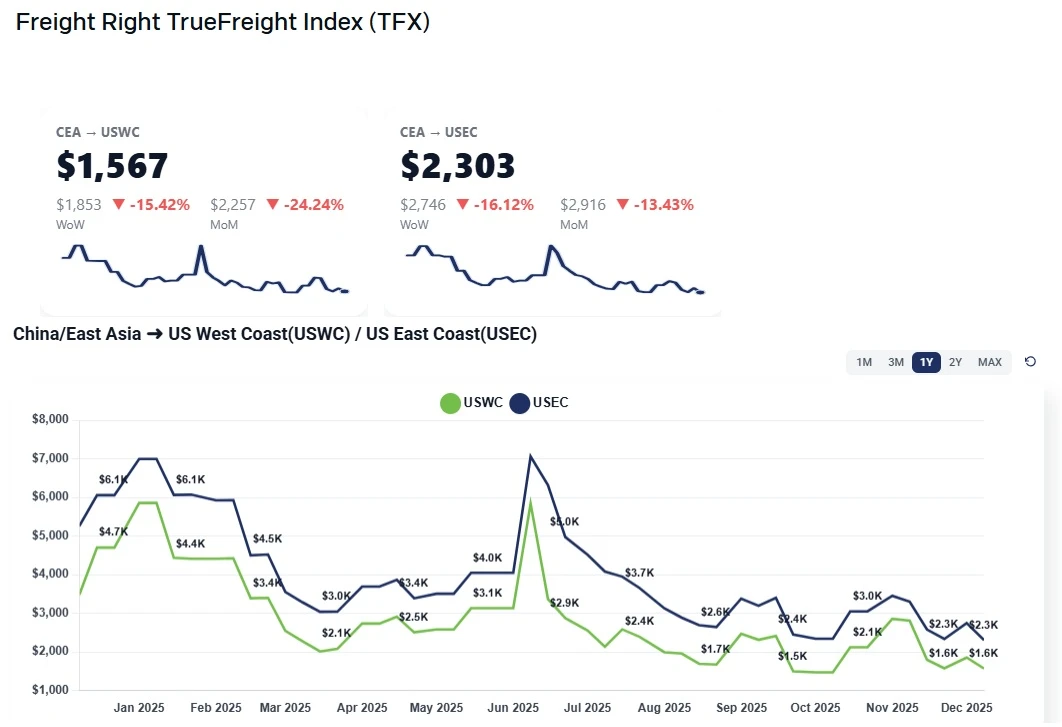

For CEA/USWC (China to U.S. West Coast): Spot levels rolled back to roughly $1,500–$1,600/FEU on basic services after carriers unwound early-September GRIs. That’s a sharper week-over-week drop from last week’s broadly quoted $1,800–$2,400/FEU, with some market sell rates now centering closer to $1,600–$1,900 depending on service and cut-off windows.

For CEA/USEC (China to U.S. East Coast): Pricing has compressed into a $2,400–$2,500/FEU band. Compared with last week’s $2,200–$2,700/FEU quotes, the midpoint is slightly lower and the spread is tighter as carriers chase volume and trim surcharges.

Week of September 15, 2025:

CEA/USEC 20FT $2732.92

CEA/USEC 40FT $3279.78

CEA/USEC 40HC $3279.78

CEA/USWC 20FT $1924.28

CEA/USWC 40HC $2360.15

CEA/USWC 40FT $2355.13

Week of September 8, 2025:

CEA/USEC 20FT $2633.8

CEA/USEC 40FT $3192.4

CEA/USEC 40HC $3192.4

CEA/USWC 20FT $1859.95

CEA/USWC 40HC $2321.07

CEA/USWC 40FT $2312.23

September GRI rolled back to grab volume. In a very rare move emblematic of the times, carriers skipped planned mid-September “tiers” and reversed most of the $600–$800/FEU hikes pushed earlier this month, prioritizing load factors over price ahead of China’s early-October holiday shutdown.

Demand continues to rapidly fade. Peak-season bookings continue to fade week over week. Frontloading earlier in the summer plus tariff-driven whiplash left fewer urgent shipments for late September.

Price war among forwarders leads to true fights for survival. China-based NVOs holding carrier contracts are selling FAK at or near cost to hit MQCs and protect next-quarter tiers, dragging spot levels down and squeezing U.S. forwarders’ margins.

Contract flexibility points to a bear market. In another very rare move, select carriers are allowing shippers to pause contract obligations without penalties, an unusual, clear tell that they don’t expect a late-Q3 rebound. A shared sense of survivalism is taking hold between carriers, contract holders and freight forwarders as the size of pie of available importers continues to shrink.

Golden Week timing. With only a short runway before factory and port slowdowns, carriers are prioritizing certainty of lift today over rate discipline they’re unlikely to sustain in mid-October.

Expect carriers to test the ceiling for another few days; if liftings don’t materialize, look for methodical trims over the next 1-3 weeks. A plausible near-term landing zone is the high-$1,700s to low-$1,800s per container, still well above August levels but below today’s post-GRI peak, barring a late surge in orders. Importers with flexibility may benefit from waiting a week to reassess; those with fixed weekly flow or holiday-critical inventory should budget for today’s premiums while pressing for sub-market allotments where available. If carriers remain stubborn on price into mid-September without volume response, expect a very flat, quiet market thereafter as the pre-holiday window closes.

WSJ: The New Pitfall of Online Shopping: A Surprise Tariff Bill: https://www.wsj.com/business/logistics/the-new-pitfall-of-online-shopping-a-surprise-tariff-bill-bc4f333f mod=mw_quote_news&gaa_at=eafs&gaa_n=ASWzDAj9fLAAqtF3bTSV9nbaila4mk3pCtA7JAyR3OfnQCLTdx7hK7wwnK4sG48th8U%3D&gaa_ts=68c9b560&gaa_sig=gocoUCRcgU4OLHtTk-4PvaiSUZfJ_qYvYIJLUgJmdnTRnW7vZbYjOIsgQGbCCnG1BfrOFsDEtirmnnXGBz21Tg%3D%3D

MarineInsight: Empty Containers Now Make Up 41% of Global Shipping- New Report: https://www.marineinsight.com/shipping-news/empty-containers-now-make-up-41-of-global-shipping-new-report/

TransportTopics: US Tariff of 15% on Japan Auto Exports Kicks In Today: https://www.ttnews.com/articles/us-tariff-15-japan-autos

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

This blog explores digital air freight and how e-bookings provide a more efficient and faster way for logistics professionals to make connections.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Aug 4–11, 2025: EU pauses counter-tariffs; U.S. reciprocal tariffs start; +25% on India due Aug 27; China tariff truce extended 90 days; WTO signals risk.

Transpacific ocean and air rates jump as carriers pull capacity, Apple charters tighten space, and shippers rush to beat U.S. tariff deadlines

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.