During the past week, US trade policy took a decidedly more aggressive turn, marked by a sweeping expansion of steel and aluminum tariffs and an escalation in the WTO dispute mechanism, most notably with Brazil. Simultaneously, negotiations with the European Union continued in a more diplomatic but loosely formalized manner, while major stakeholders sounded alarms over the broader economic fallout. Analysts and trade experts alike painted a sobering picture: the era of strong, multilateral trade governance is under threat, with fragmentation, revenue-driven protectionism, and tethered regional blocs emerging as defining characteristics of the global trading landscape.

On Markets & Rates:

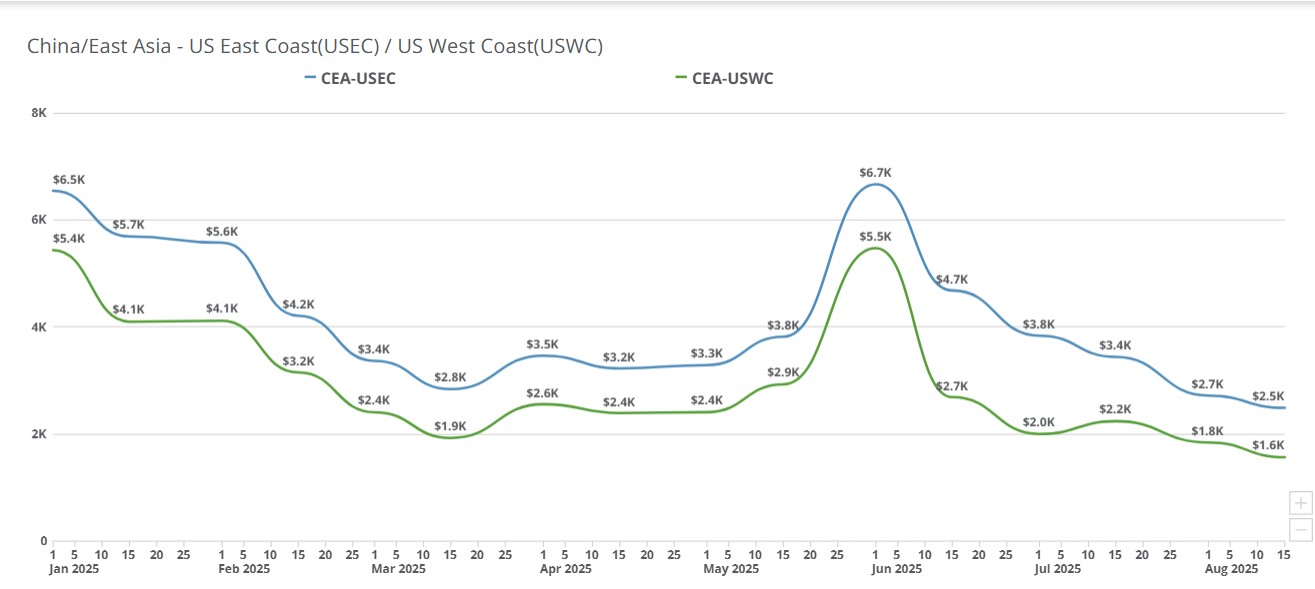

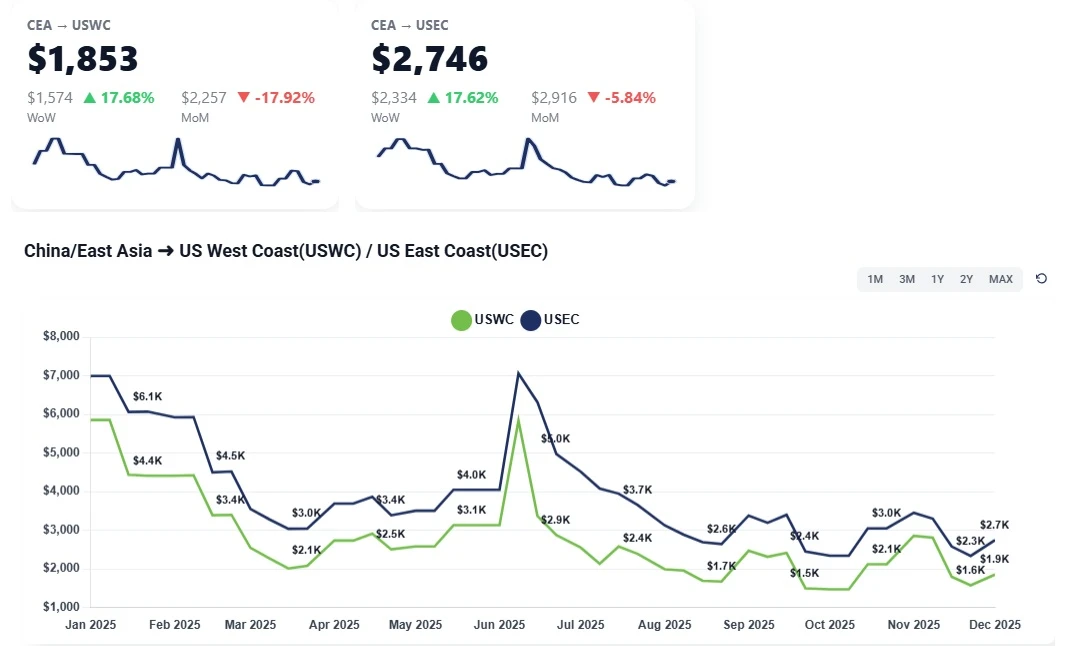

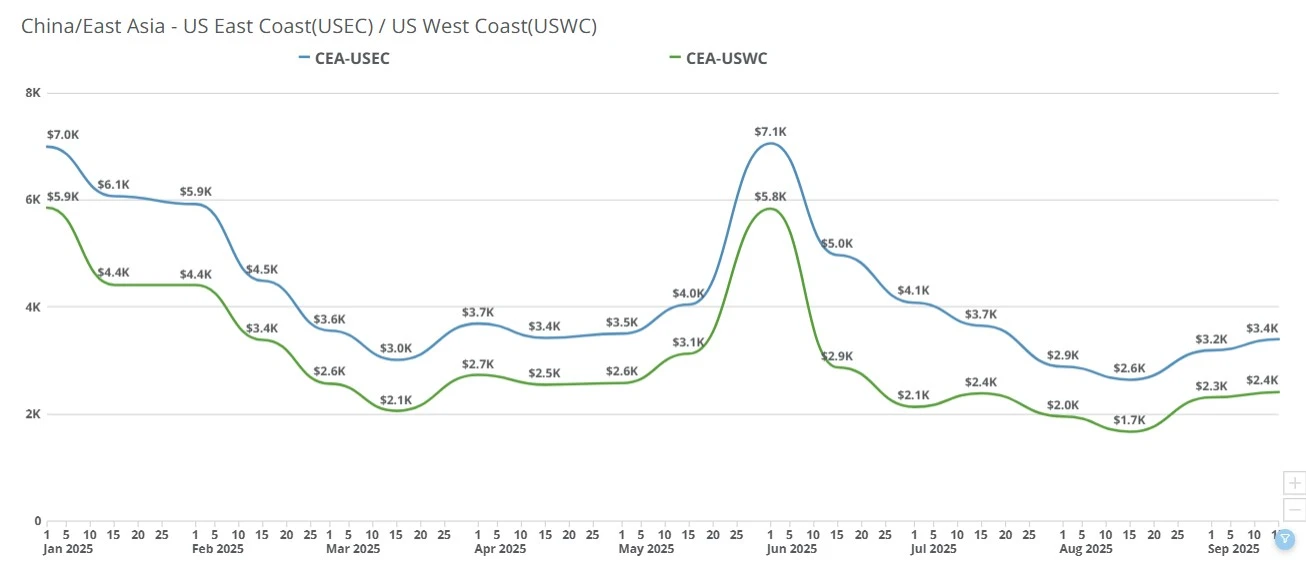

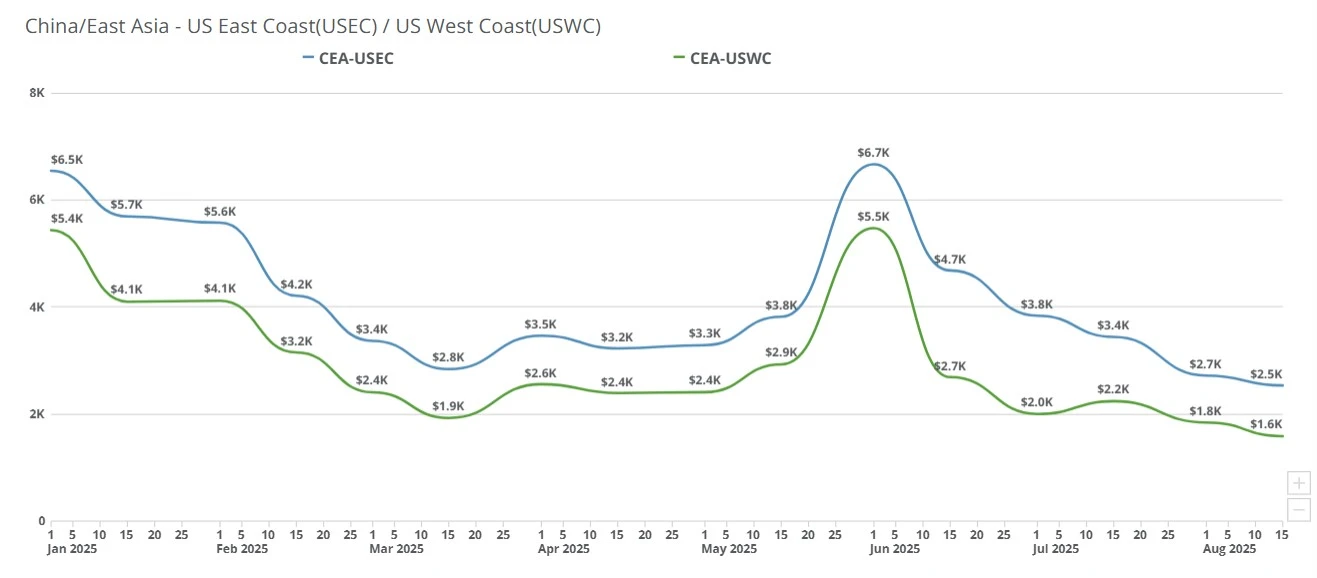

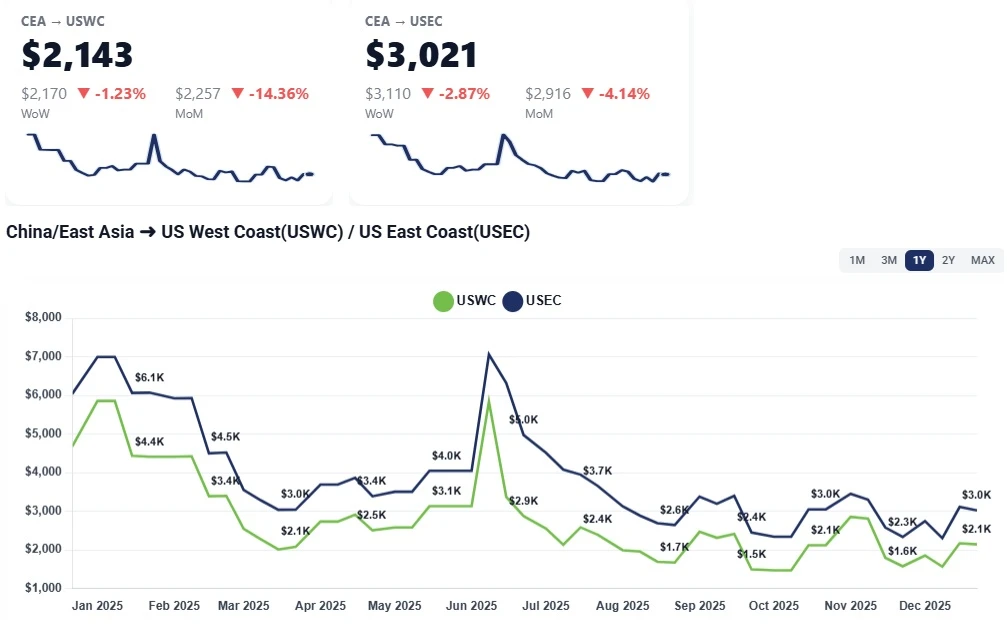

CEA/USWC (China-US West Coast): Spot rates eased to a little over $1,400/FEU, roughly $100 lower week-over-week as carriers cut late-August prices to attract last-minute loads. CEA/USEC (China - US East Coast): Spot rates slipped to ~$2,300/FEU, also down about $100 WoW on similar late-month discounting.

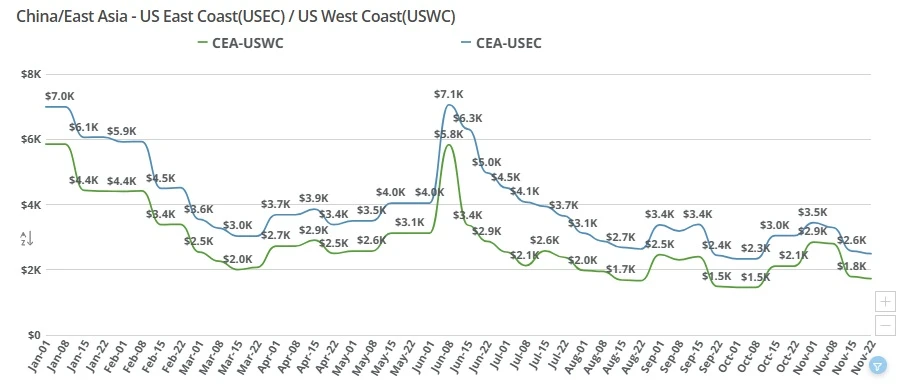

TrueFreight Index (TFX) is tracking the following rates this week. Graphics below illustrate current FEU trends only.

Week of August 25, 2025:

CEA/USEC 20FT $2248.01

CEA/USEC 40FT $2733.66

CEA/USEC 40HC $2733.66

CEA/USWC 20FT $1444.89

CEA/USWC 40FT $1785.08

CEA/USWC 40HC $1797.8

Week of August 18, 2025:

CEA/USEC 20FT $2281.37

CEA/USEC 40FT $2778.65

CEA/USEC 40HC $2778.65

CEA/USWC 20FT $1472.58

CEA/USWC 40FT $1818.61

CEA/USWC 40HC $1832.23

End-of-month push by carriers: Lines trimmed prices further in the last week of August to pull forward bookings, with reductions communicated on short notice. Some shippers captured deals; others may have missed the window.

Capacity discipline continues: Despite price cuts, carriers are blanking sailings this week, next week, and likely the following week, tightening effective supply even as they stimulate demand.

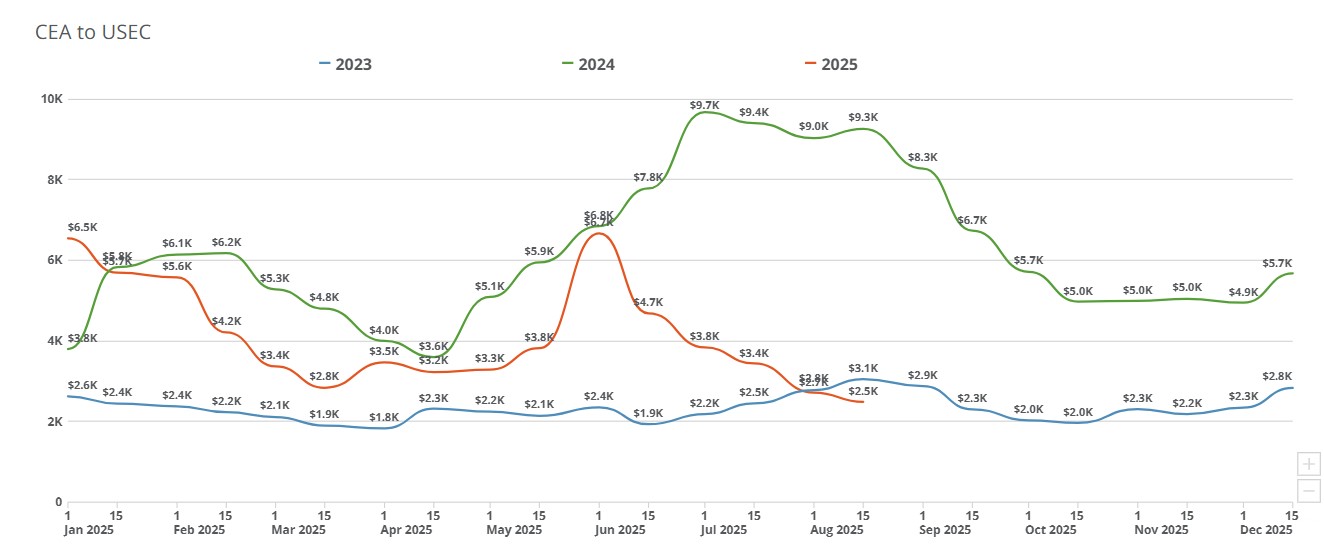

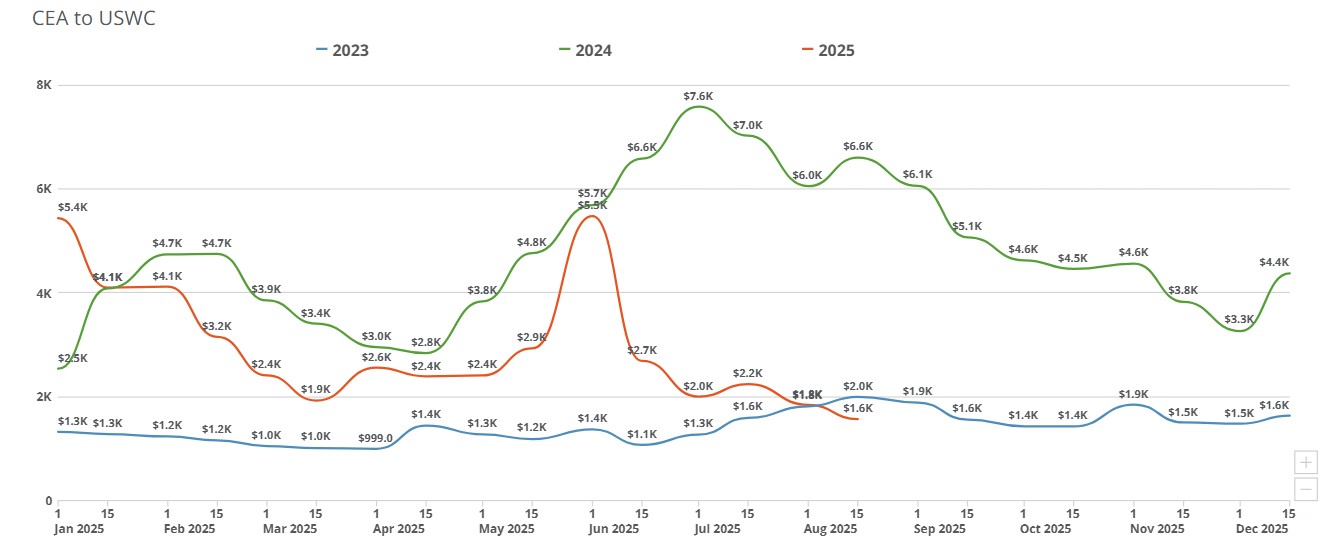

Laddered GRI playbook in view: Carriers are signaling a September GRI (~$2,300–$2,400 USWC; ~$3,400 USEC), typically launched high for a few days before stepping down as mid-month demand softens.

Muted peak-season sentiment: Market levels are at or below late-summer 2024 and even below late-Aug/Sept 2023, underscoring soft demand and conservative holiday expectations across importers and retailers.

Early September reset, then drift: Expect a GRI in early September to lift USWC toward $2,300–$2,400 and USEC higher, but history suggests rapid give-backs within days, with levels likely settling around $1,500–$1,600/FEU to USWC by late September (still ~$200 above today).

October lull, then a Chinese New Year mini-peak: With most holiday freight already decided, October volumes look thin; seasonality then points to a brief pre-Chinese New Year bump as factories ship before extended closures, typically in early January.

Watch tariffs and sentiment: If US-China tariff policy eases into mid-November, it could add a modest late-year and January tailwind to bookings alongside the Chinese New Year rush.

WSJ: Trump Vows to Retaliate Over Taxes on Tech Giants: https://www.wsj.com/livecoverage/stock-market-today-dow-sp-500-nasdaq-08-26-2025/card/trump-vows-to-retaliate-over-taxes-on-tech-giants-4Qz56aAgUWs6WC1kFEhX?mod=djemlogistics_h

Bloomberg: US Takes Steps to Hit India With 50% Tariff From Wednesday: https://www.bloomberg.com/news/articles/2025-08-25/trump-administration-notice-signals-50-tariff-to-hit-india-soon?mod=djemlogistics_h

CNBC: Canada drops many of its retaliatory tariffs on the U.S.: https://www.cnbc.com/2025/08/22/canada-retaliatory-tariffs-trump-autos-steel.html

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

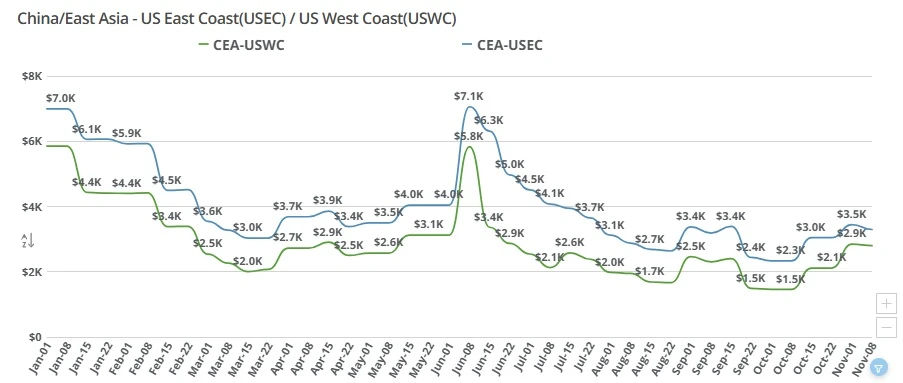

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.