Global trade dynamics were marked by heightened protectionism, legal pushback, and strategic realignments.

The U.S.-India trade confrontation intensified sharply as the U.S. imposed a 50% tariff on key Indian exports, prompting economic turbulence in India and escalating diplomatic tensions. Concurrently, U.S. courts challenged the legality of President Trump’s sweeping tariffs, ruling they exceeded executive authority, but allowed them to stand pending appellate review.

These developments reverberated across markets: South Korea’s export performance faltered, reflective of the ripple effects of U.S. tariffs, while American firms in China largely opted to stay put, underscoring persistent complexity in reshoring efforts. In Europe, the divergence between a struggling UK manufacturing sector and a resilient Eurozone highlighted uneven exposure to trade pressures.

Meanwhile, policy signals grew more aggressive: proposed 200% pharmaceutical tariffs risked disrupting healthcare supply chains, and the EU accelerated trade deal negotiations to fortify its global trade stance. Monetary authorities, including the ECB, flagged tariffs as inflationary risks, reinforcing calls for integrated regulatory frameworks amid geopolitical volatility.

Global markets, gripped by mounting uncertainty, displayed muted responses, underscoring that legal, political, and economic crosswinds have turned tariff policy into a complex balancing act for businesses and policymakers alike.

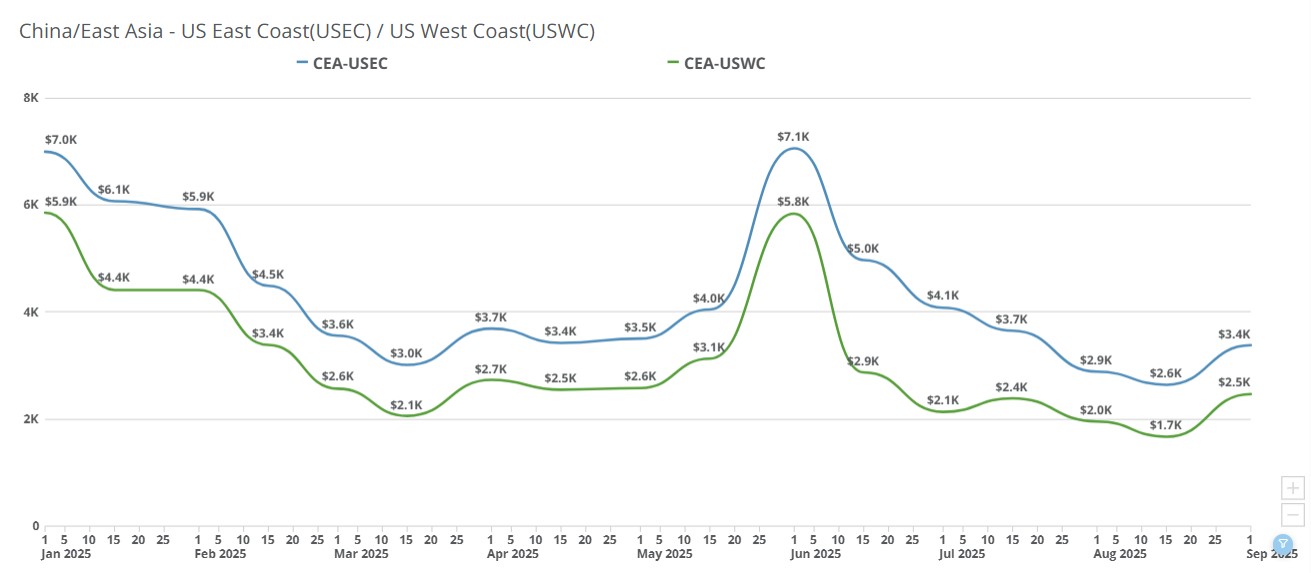

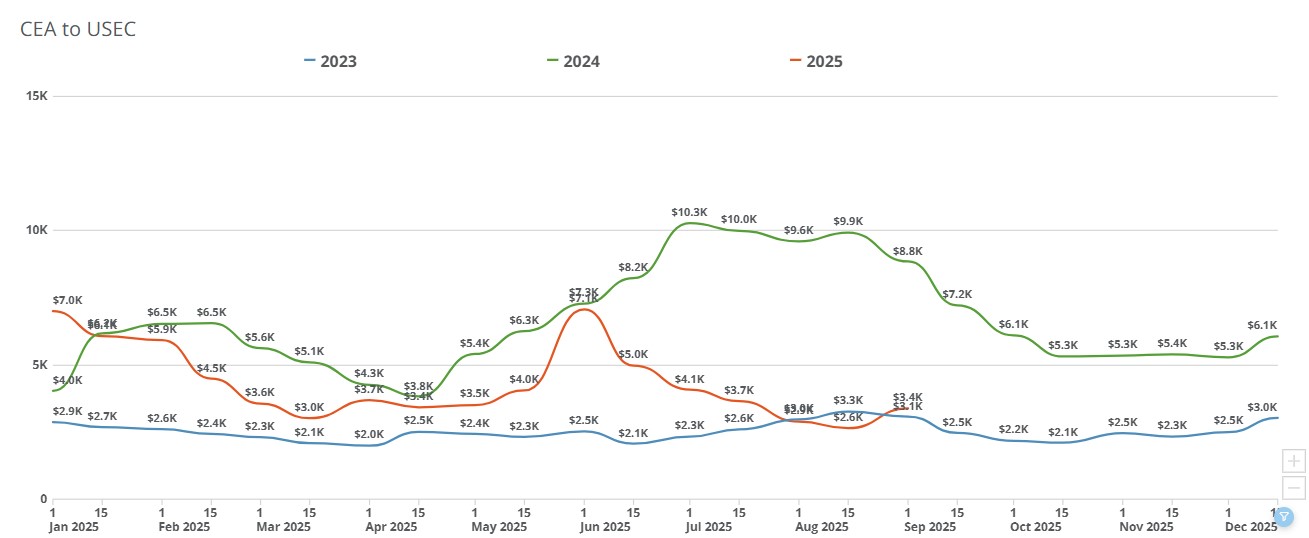

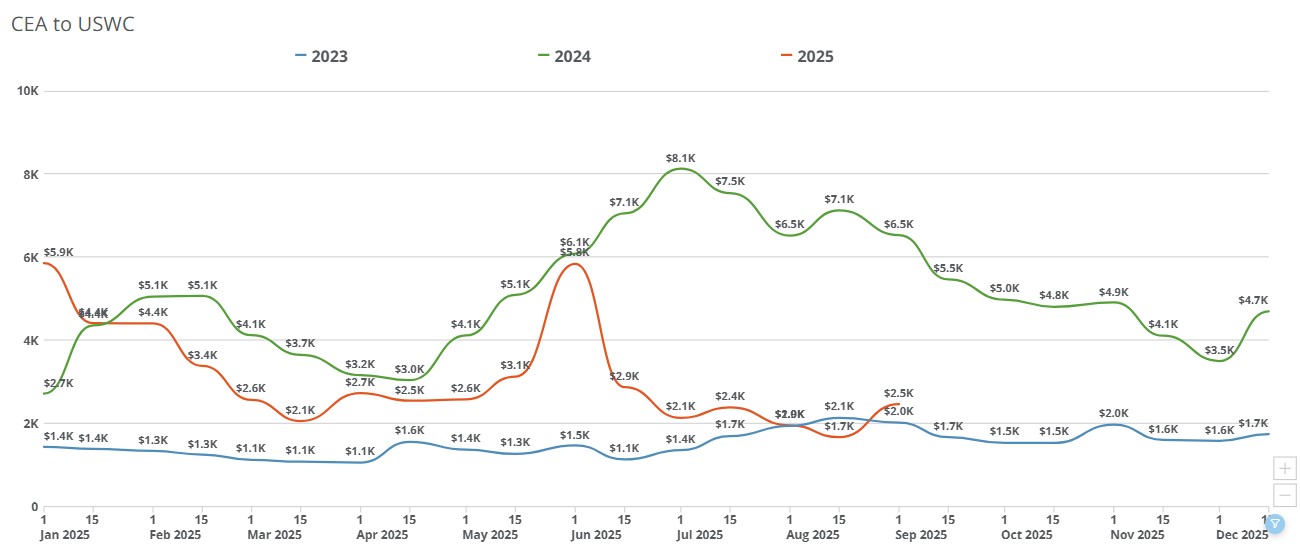

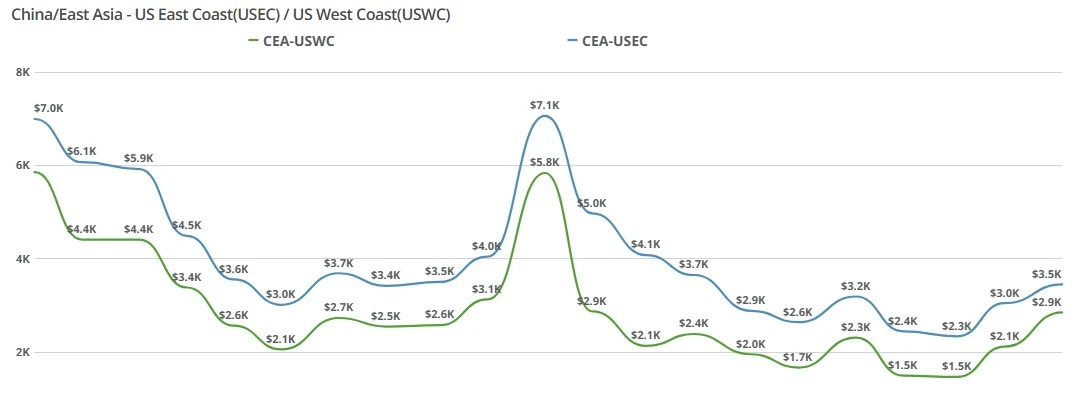

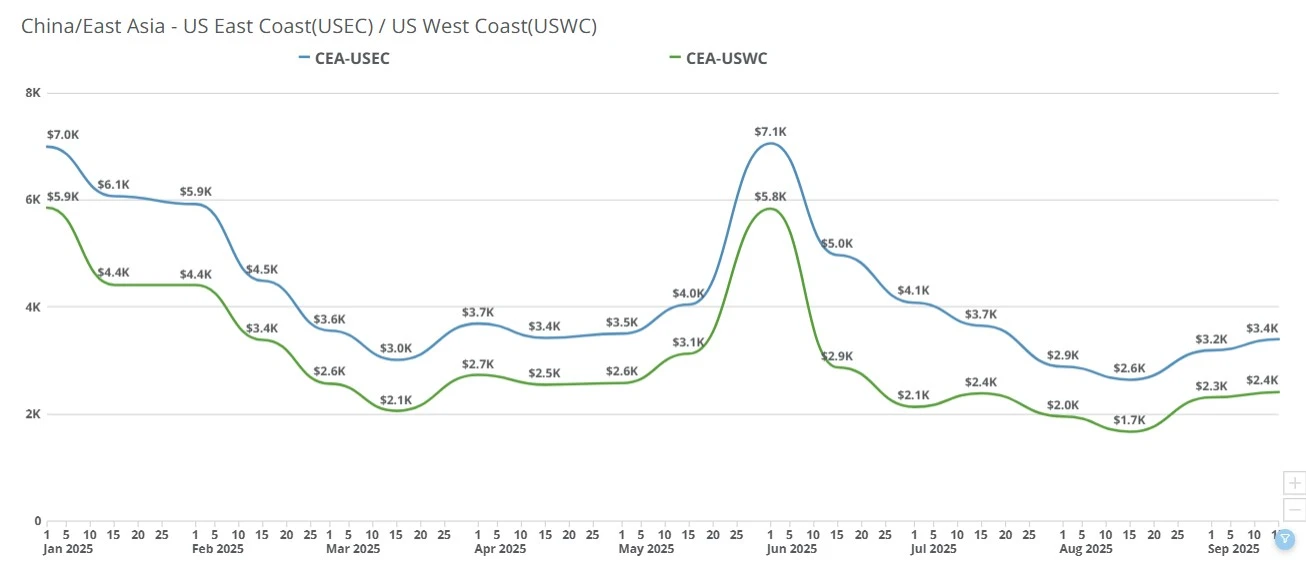

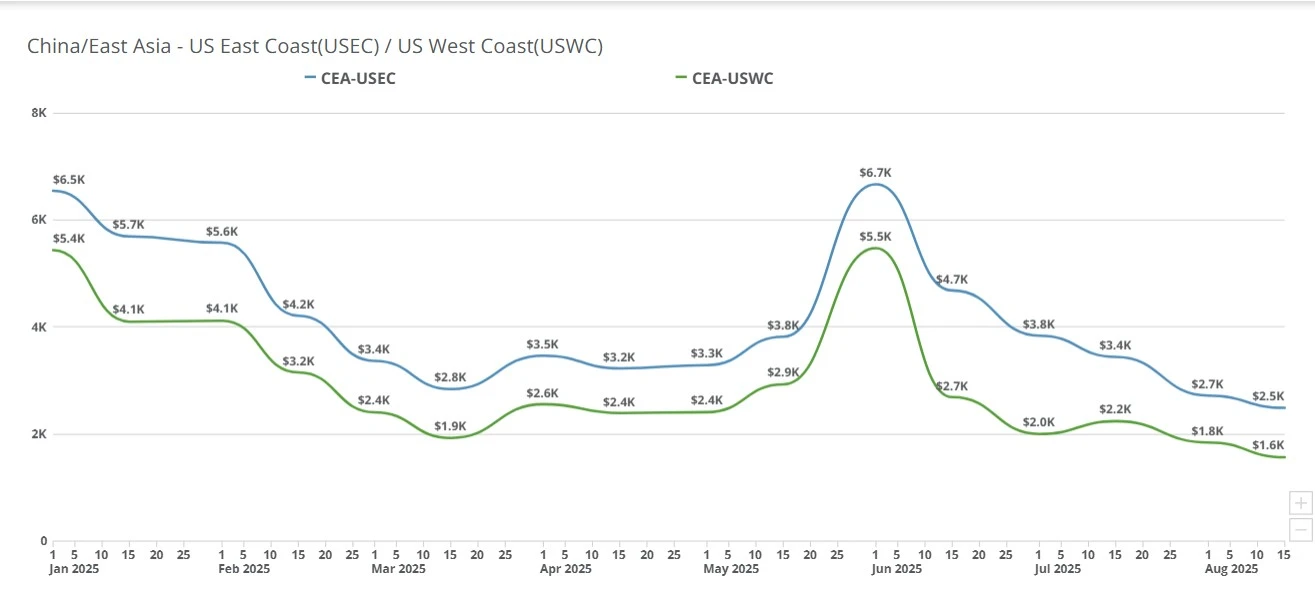

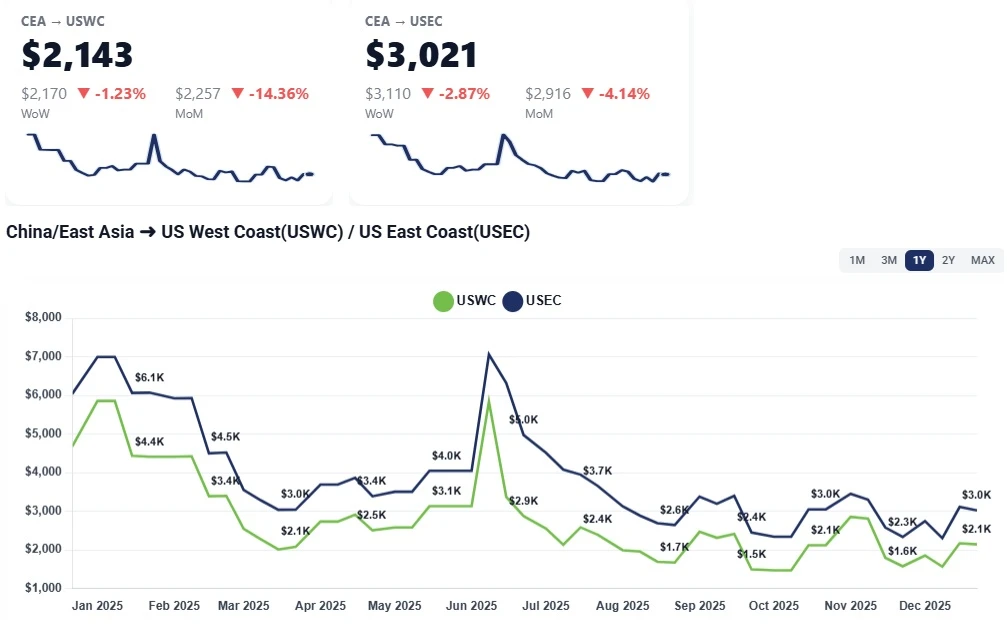

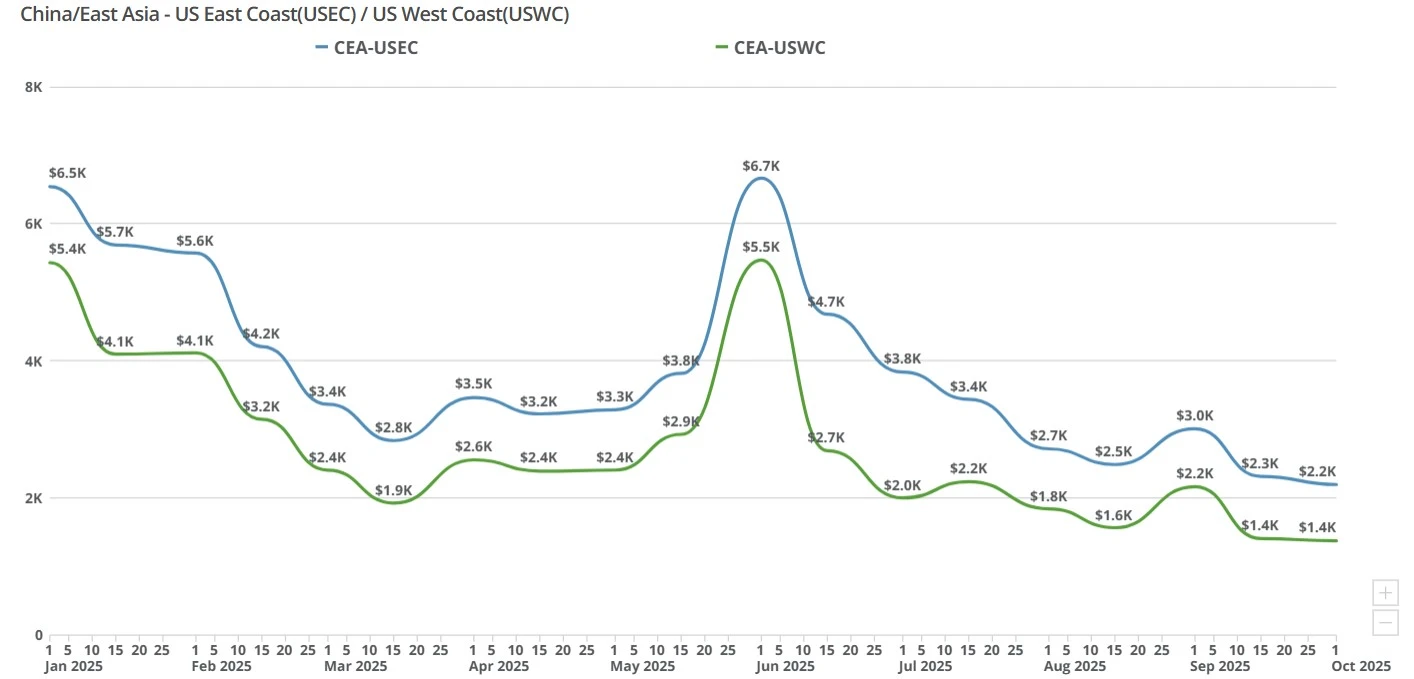

Spot rates from CEA/USWC and CEA/USEC jumped sharply week-over-week following carriers’ early-September GRI/PSS moves. Market talk pegs the increase at roughly $800–$900 per container from the mid-$1,400s–$1,500s last week to about $2,300–$2,400 now, with an isolated offer near $1,900 for a limited-window sailing from a smaller carrier. Select agents/specials are circulating at ~$300–$400 below prevailing levels, but broadly the market has reset higher for the moment.

Week of September 1, 2025:

CEA/USEC 20FT $2787.96

CEA/USEC 40HC $3379.28

CEA/USEC 40FT $3379.28

CEA/USWC 20FT $1983.46

CEA/USWC 40FT $2467.17

CEA/USWC 40HC $2478.19

Week of August 25, 2025:

CEA/USEC 20FT $2248.01

CEA/USEC 40FT $2733.66

CEA/USEC 40HC $2733.66

CEA/USWC 20FT $1444.89

CEA/USWC 40FT $1785.08

CEA/USWC 40HC $1797.8

This Week Explained:

Timed GRI into pre-Golden Week window: Carriers pulled rates up now to capture the short pre-holiday push before China’s early-October Golden Week, recognizing there’s little pricing power left once October begins.

“Stair-step” reduction playbook: If demand softens at these levels, carriers are likely to shave rates in phases (e.g., ~$300 this week, ~$200 next), rather than roll back the full hike in one shot.

Demand is cautious, not collapsing: Most importers are in “wait-and-see” mode unless weekly cadence or holiday inventory commitments force lifts at today’s prices. Urgency remains limited.

Tariff uncertainty not a release valve: Legal chatter hasn’t materially changed buying behavior; shippers aren’t assuming near-term tariff relief.

Pockets of sub-market capacity: A few lanes/sailings are posting ~$200–$400 under market (e.g., ~$1,900 on a specific departure), but these are narrow and timing-specific.

Expect carriers to test the ceiling for another few days; if liftings don’t materialize, look for methodical trims over the next 1-3 weeks. A plausible near-term landing zone is the high-$1,700s to low-$1,800s per container, still well above August levels but below today’s post-GRI peak, barring a late surge in orders. Importers with flexibility may benefit from waiting a week to reassess; those with fixed weekly flow or holiday-critical inventory should budget for today’s premiums while pressing for sub-market allotments where available. If carriers remain stubborn on price into mid-September without volume response, expect a very flat, quiet market thereafter as the pre-holiday window closes.

Journal of Commerce: Niche carriers plan to ride out declining spot rates on the trans-Pacific: https://www.joc.com/article/niche-carriers-plan-to-ride-out-declining-spot-rates-on-the-trans-pacific-6071722?utm_source=newsletter&utm_medium=email&utm_campaign=daily%newswire

The Guardian: Here’s what to know about the court ruling striking down Trump’s tariffs: https://www.theguardian.com/us-news/2025/aug/30/trump-tariffs-explainer

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

Ocean rates hold steady at $1,400-$1,600 for USWC as China’s pre-holiday shipping window closes. Explore the impact of high trucking costs and the upcoming total market shutdown.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.