The week saw policy implementation and process-building (U.S.-Japan tariff changes going live and Commerce formalizing how Section 232 auto-parts tariffs are handled), while Washington signaled further expansion of national-security tariffs on automotive components. Litigation risk sharpened as the U.S. Supreme Court set a November hearing on the legality of the broader tariff program, but measures remain in force. In Europe, the Commission continued to harden its trade defense stance with two new definitive anti-dumping regulations against Chinese products.

Meanwhile, downstream effects kept spreading: carriers flagged earnings pressure from the end of de minimis, Brazilian beef shipments to the U.S. slid, South Africa opened talks to dial back new U.S. tariffs, and macro indicators showed demand shifts (ECB consumer spending changes; UNDP’s sharp downgrade to Vietnam’s U.S. export outlook). Net-net, enforcement tightened, legal and diplomatic channels stayed active, and demand continued to adjust to a higher-tariff baseline.

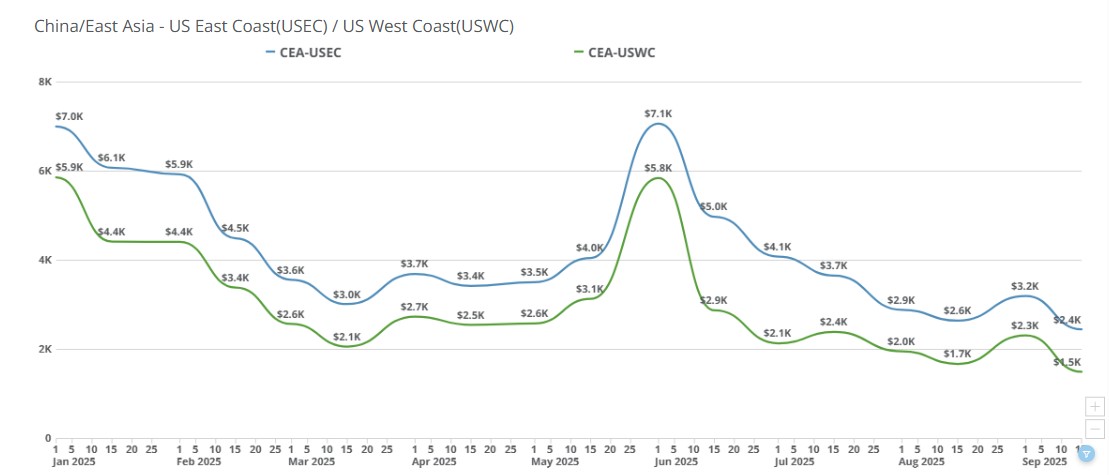

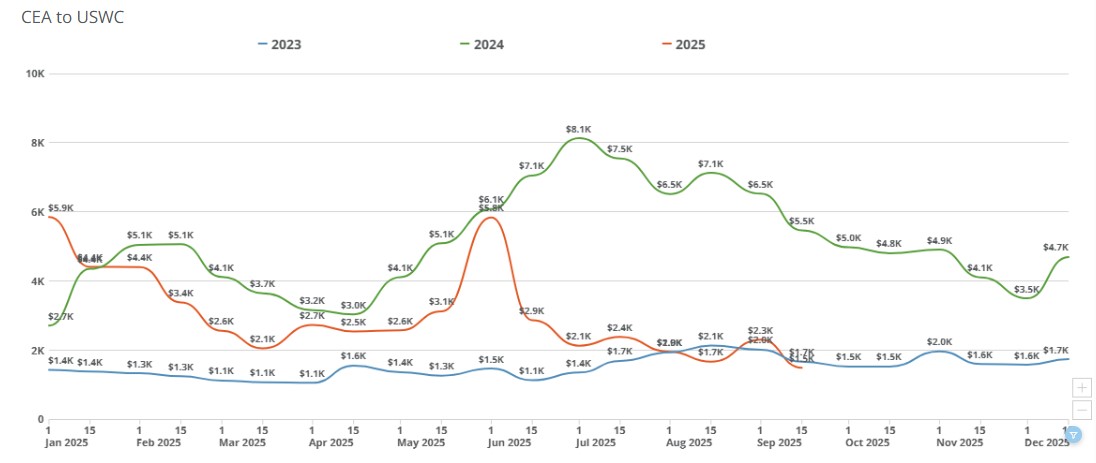

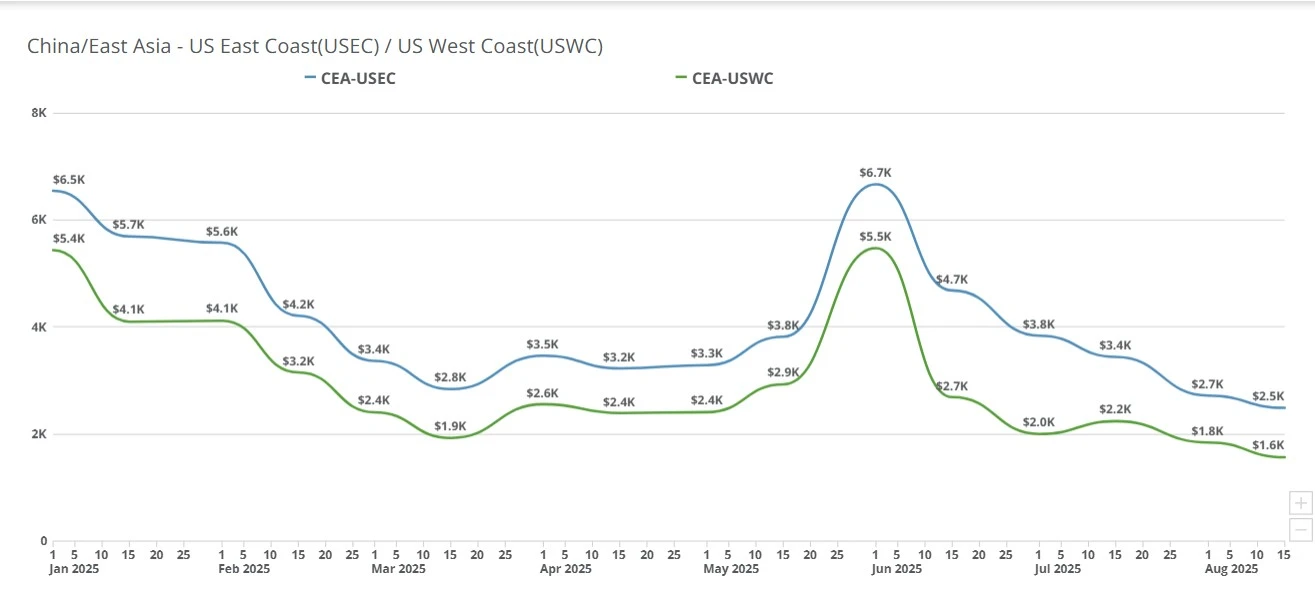

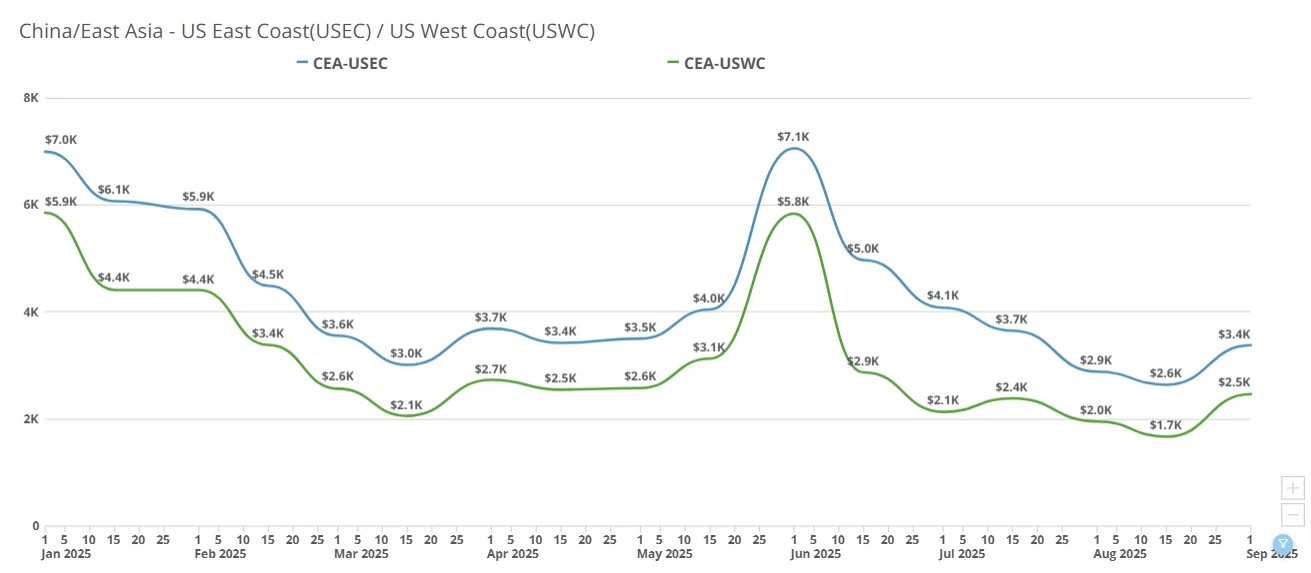

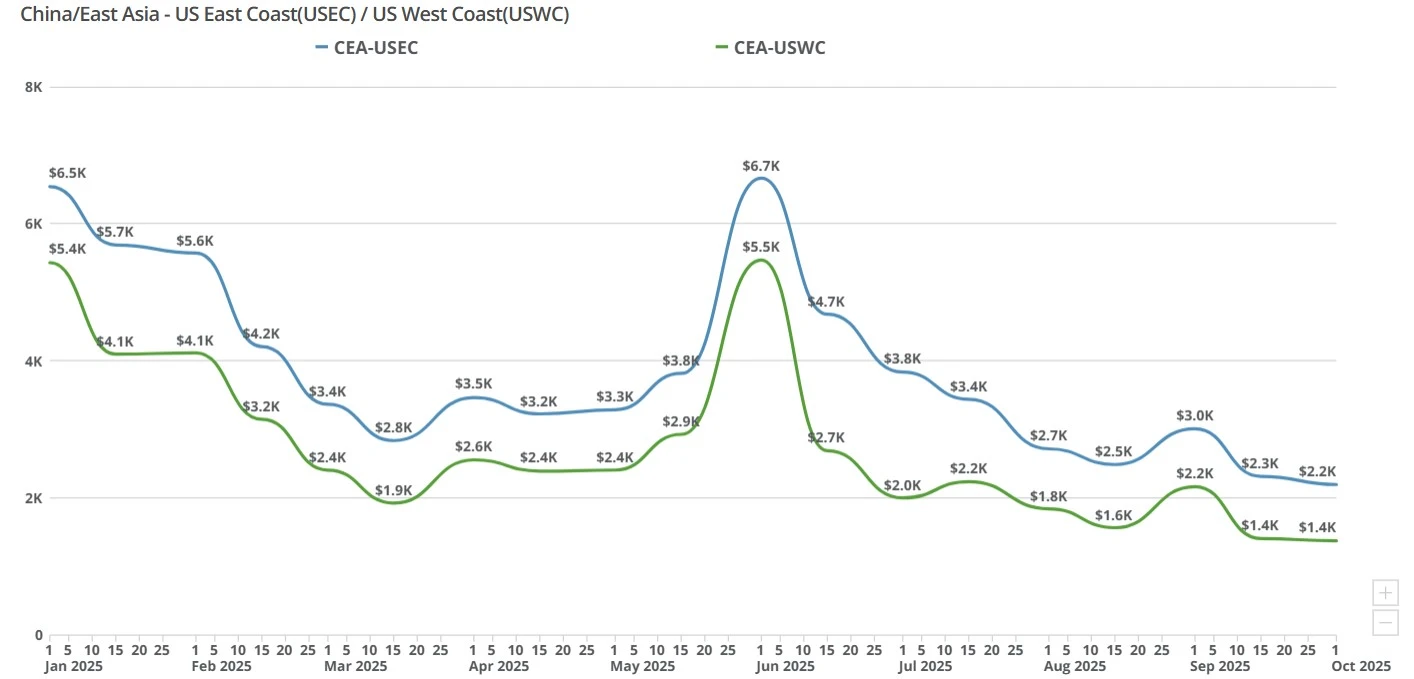

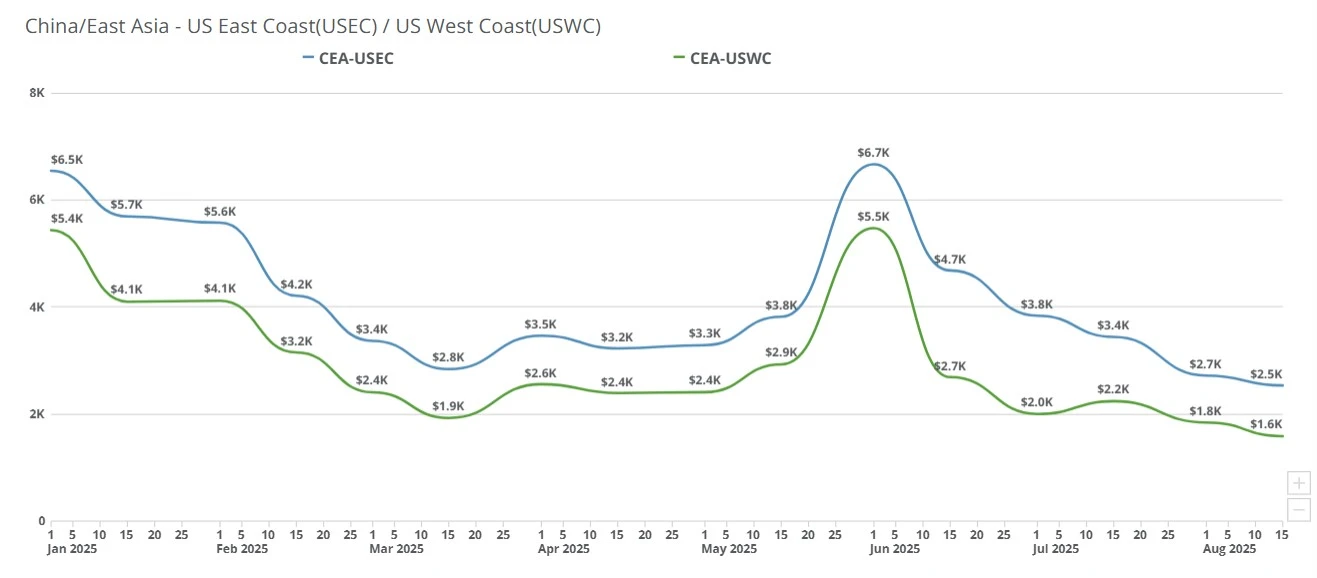

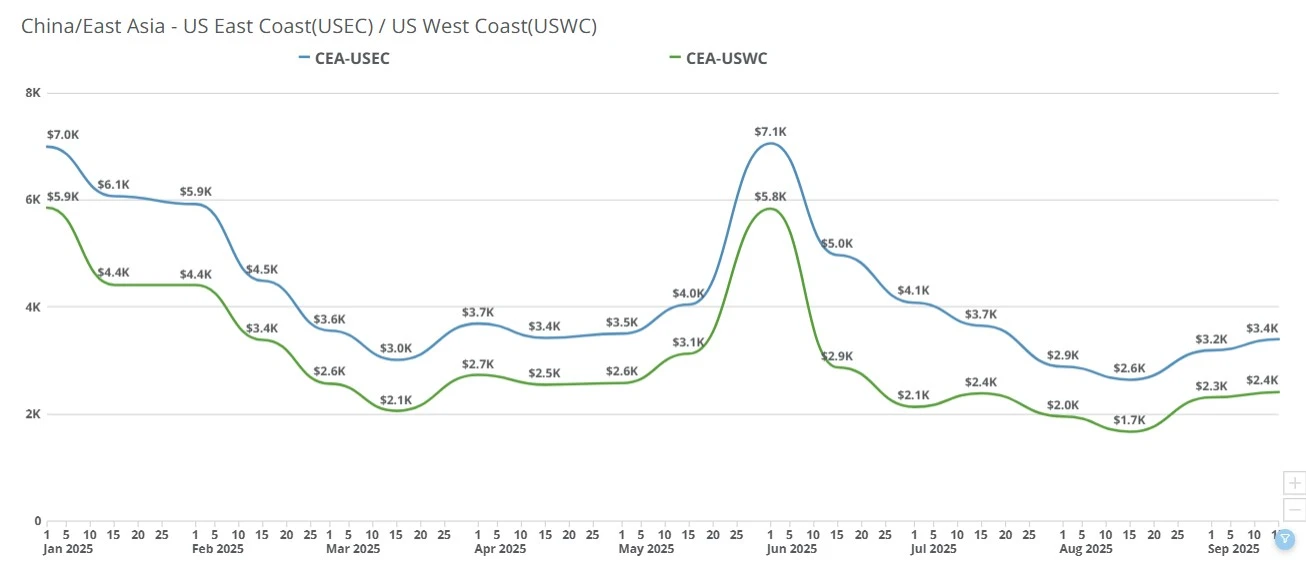

On CEA/USWC (China/U.S. West Coast): Spot slid week-over-week; early-month GRI gains have fully unwound with some quotes back near the ~$1,400/FEU trough.

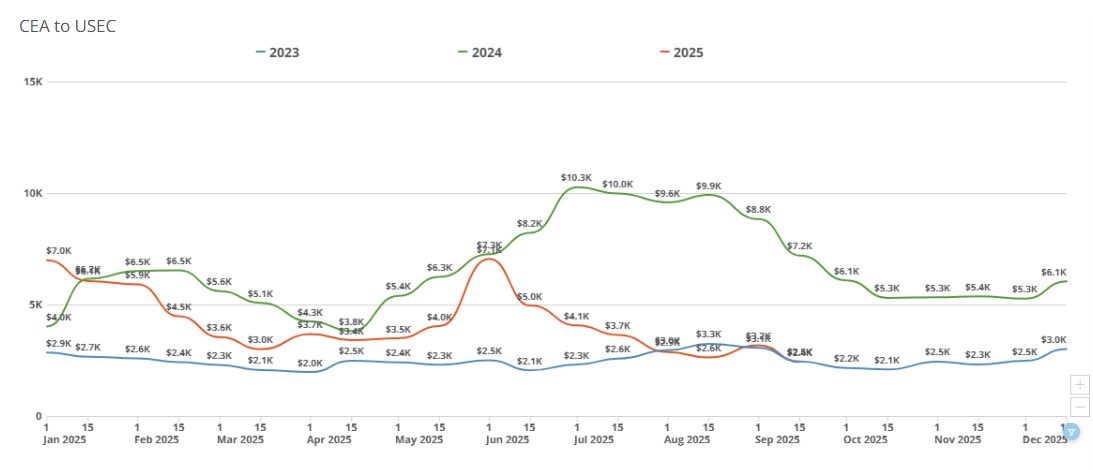

On CEA/USEC (China/U.S. East Coast): Softer week-over-week as carriers rolled back early-September increases; differentials versus the West Coast narrowed as attempted hikes failed to hold.

Week of September 22, 2025:

CEA/USEC 20FT $2381.09

CEA/USEC 40FT $2865.84

CEA/USEC 40HC $2865.84

CEA/USWC 20FT $1592.88

CEA/USWC 40HC $1959.48

CEA/USWC 40FT $1954.52

Week of September 15, 2025:

CEA/USEC 20FT $2732.92

CEA/USEC 40FT $3279.78

CEA/USEC 40HC $3279.78

CEA/USWC 20FT $1924.28

CEA/USWC 40HC $2360.15

CEA/USWC 40FT $2355.13

According to the Federal Reserve Bank of St. Louis, trucking rates continue to increase week-to-week, hitting a new all-time high of ~$454 dollars USD. Learn more about Federal Reserve Bank of St. Louis' LTL price tracker here.

Muted demand & stale volumes: Booking activity remains thin; even steady shippers are moving with razor-thin margins.

Cut-throat pricing pressure: China-based NVOs/forwarders are taking at - or below-cost business; U.S. forwarders report margins as low as $65–$70 per box to keep cargo moving.

Early-month GRIs didn’t stick: Carriers’ increases at the start of the month were reversed as the market “adjusted back.”

Capacity exceeding demand backdrop: Through mid-summer, failed GRIs, added capacity, and then blank sailings signaled carriers battling sliding rates. Momentum still leaning bearish for the rest of September and past Golden Week.

Pre-Golden Week timing effects: Suppliers are pushing last-minute shipments before China’s holiday; this is lifting air freight rates briefly but isn’t a structural demand recovery for ocean freight.

Over the next 10-14 days, expect a lull in ocean departures as China heads into Golden Week; first week of October sailings/loads should be light. Rates likely flat-to-down absent a sudden capacity pullback. Post-Golden Week, the temporary air bump should unwind; ocean spot rates will remain under pressure unless carriers meaningfully remove capacity or a policy shock revives demand. Recent months’ pattern including weak GRIs, and selective blankings suggests only gradual stabilization at best.

We're expecting 1–2 more months of aggressive pricing from China-based forwarders; normalization depends on volume recovery that isn’t visible yet.

Supply Chain Dive: De minimis elimination strains Lululemon’s fulfillment model: https://www.supplychaindive.com/news/lululemon-de-minimis-elimination-impact-2025/760670/

Journal of Commerce: Ocean carriers cut capacity to arrest Golden Week rate slide: https://www.joc.com/article/ocean-carriers-cut-capacity-to-arrest-golden-week-rate-slide-6085086

Freightos: (recorded webinar featuring Freight Right’s Robert Khachatryan): Stable Chaos: A Digital Supply Chain Summit: https://www.freightos.com/logistics-technology-insights/logistics-technology/digital-supply-chain-summit/

Subscribe to TFX for weekly updates: https://www.freightright.com/freight-right-rate-index

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

Freight Right leads in LAX customs brokerage, managing over 100K tons of air cargo annually. Discover our role in LAX’s cargo efficiency and compliance.

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.