The transition into February was defined by the aggressive use of "energy-linked" trade penalties and a simultaneous race to secure alternative bilateral alliances. The United States’ introduction of secondary tariffs on countries supplying oil to Cuba, most notably targeting Mexico, signaled a high-risk expansion of trade as a tool of regime-change diplomacy. Conversely, the formalization of the EU-India FTA and the activation of the EU-Singapore Digital Trade Agreement demonstrate a concerted effort by the "Global Middle" to build resilient, rules-based corridors that bypass the volatility of US policy. However, the WTO’s drastic downward revision of trade growth to just 0.5% underscores a grim reality: the proliferation of these "tit-for-tat" measures is successfully decoupling major economies but at the cost of overall global prosperity.

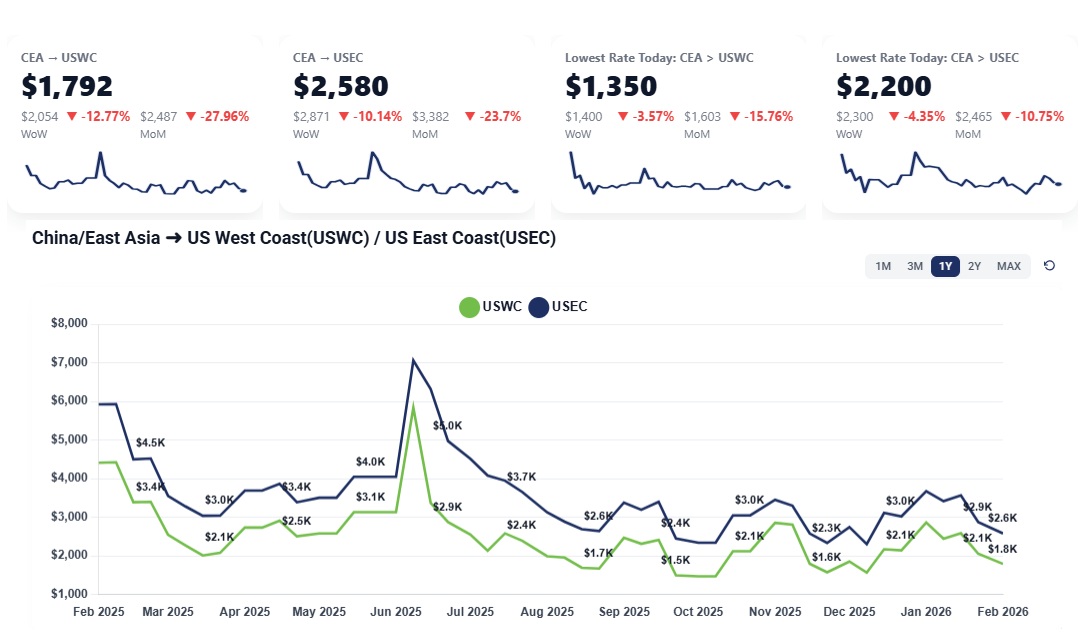

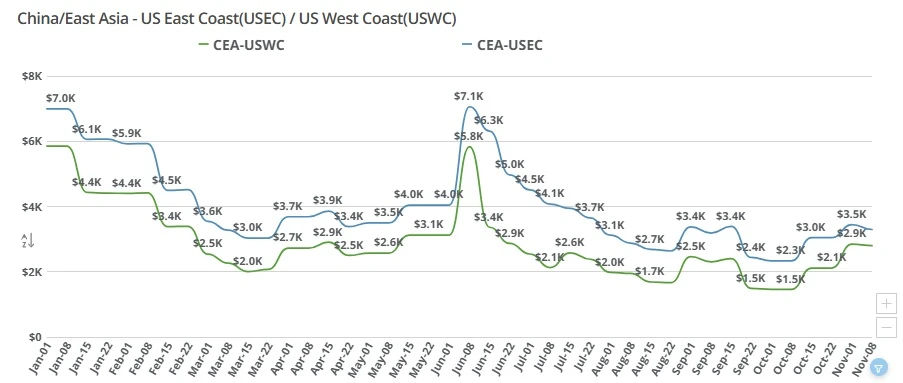

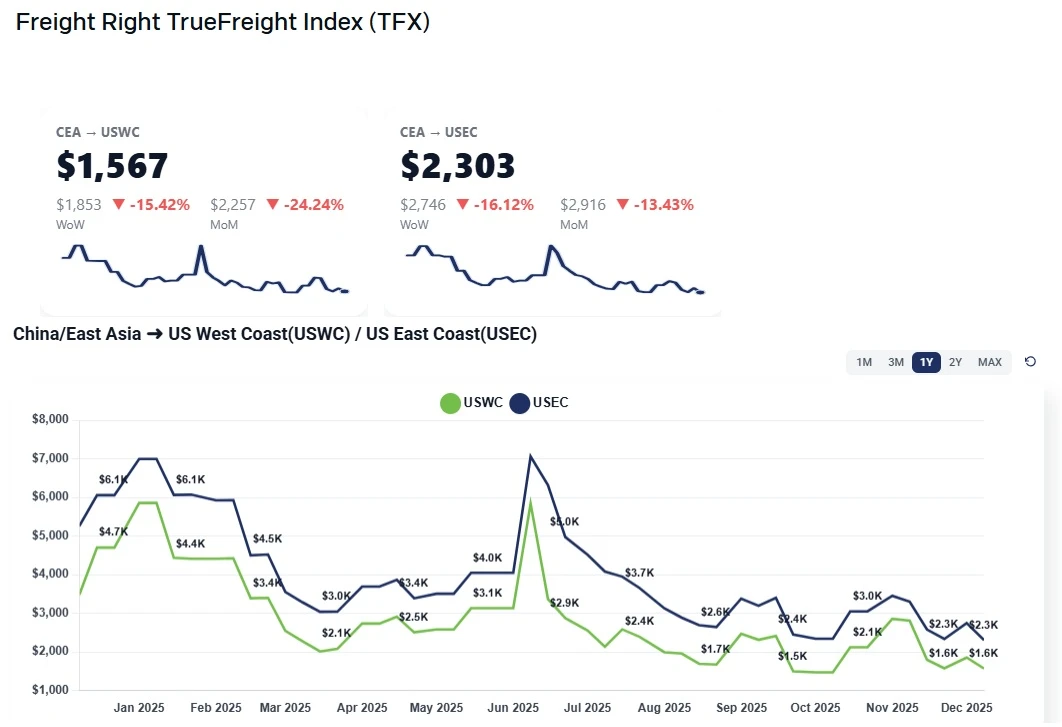

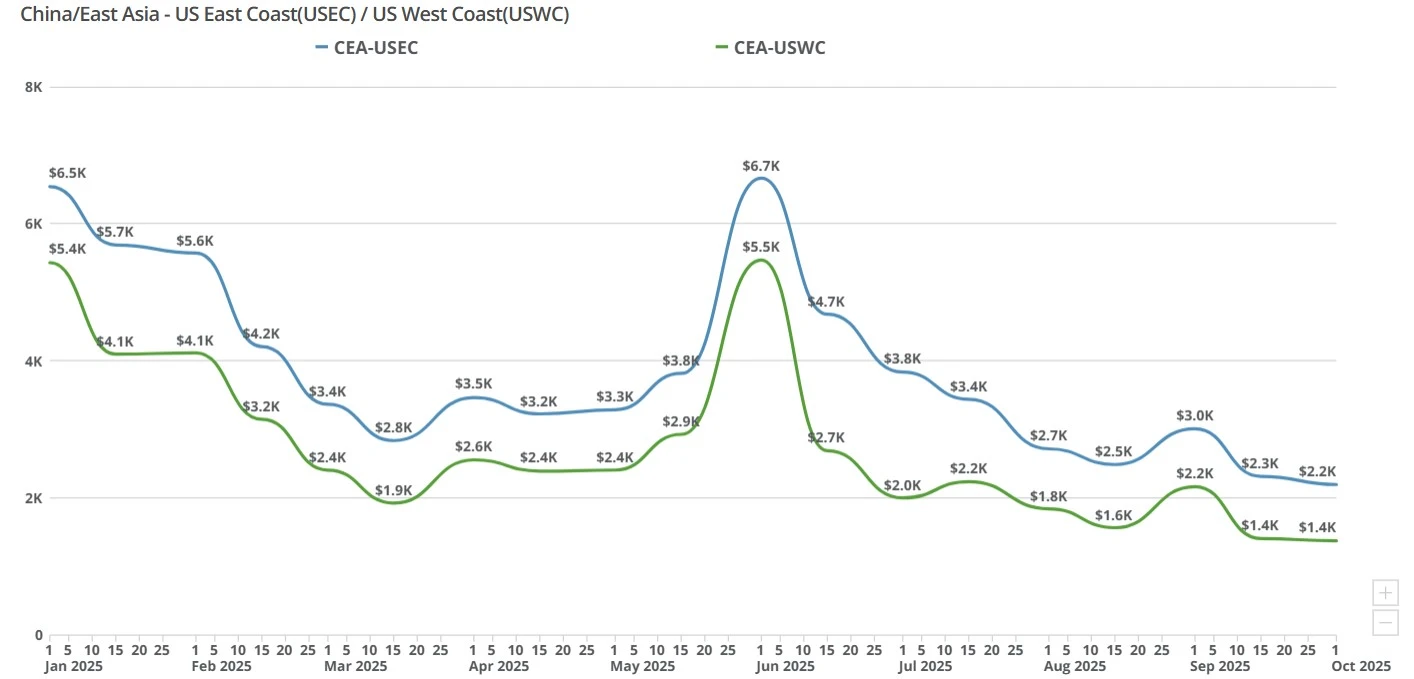

The ocean freight market has entered a phase of significant decline as the industry moves through the Chinese New Year period. Rates have retreated further than market analysts initially projected, reaching levels that challenge carrier profitability.

CEA to USWC: Rates have continued their downward slide, dropping to approximately $1,450 – $1,500 per container. This represents a new low for the year, pushing pricing well below previous support levels.

CEA to USEC: East Coast rates also dropped this week, further highlighting that the overarching trend shows rates dropping across all lanes, with carriers now operating at or near breakeven levels to maintain volume.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Late Lunar New Year Volume: Surprisingly, there was a minor uptick in bookings just before the holiday, as shippers waited until the very last possible week to move goods.

Carrier Desperation: Rates have fallen into the $1,450–$1,500 range, which is considered the "breakeven" point for many carriers; any further drops would result in carriers operating at a loss.

Booking Completion: The industry has essentially finished all bookings for the month of February, as the holiday shutdown in Asia effectively halts new manufacturing and shipping activity.

Air Freight Softening: Parallel to ocean freight, air freight rates have also begun to drop by 20–30 cents, with further declines expected as the post-holiday lull sets in.

The market is expected to remain "dead" for the remainder of February as Asia observes the New Year holiday. Shippers and carriers are now looking toward the end of March for the next major market signal.

A critical factor to watch will be the upcoming contract negotiations. We noted that carriers will likely look for ways to stabilize the market if the current low levels persist into the end of March. If demand does not rebound significantly post-holiday, the industry could face a prolonged period of "at-cost" shipping, which may eventually force carriers to implement more aggressive capacity management, such as additional blank sailings, to push rates back up.

Bloomberg: US Container Growth Vanishes with World Trade Flows Moving On

https://www.bloomberg.com/news/articles/2026-01-31/us-container-growth-vanishes-with-world-trade-flows-moving-on

Bloomberg: India’s Rupee, Stocks to Get Tariff-Truce Boost, Investors Say

https://www.bloomberg.com/news/articles/2026-02-03/india-s-rupee-stocks-to-get-tariff-truce-boost-investors-say

Global Trade Magazine: Mexico Heads Into 2026 With Momentum: A Nearshorer’s Outlook

https://www.globaltrademag.com/mexico-heads-into-2026-with-momentum-a-nearshorers-outlook/

Financial Times: The WTO needs an overhaul

https://www.ft.com/content/2ff1d4ce-4d63-4776-8e8c-ace6b3509f24

CNBC: Trump refuses to be outdone by Europe, signing his own U.S.-India trade deal

https://www.cnbc.com/2026/02/03/trump-us-india-trade-deal-europe-india-deal-compared.html

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

A look into the volatile freight contract season, exploring broken promises, rate surges, and solutions for sustainable agreements through strategic contracting and innovative market practices.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Explore the journey from ‘Buy Now’ to your home in our China-US Ocean Freight Shipping Guide. Discover the trade, environmental impact, and future of shipping.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.