This past week, international trade policy saw several significant shifts. The U.S. moved to reduce its tariff rate on Chinese imports from 20% to 10%, signalling a partial easing of its trade stance toward China. Simultaneously, the U.S. Supreme Court was actively examining the legality of the President’s expansive tariff-powers, raising questions about the institutional basis for such trade policy tools. Meanwhile, China responded by restricting exports of key chemical precursors to North America as part of a deal that links trade-policy and security issues (such as opioids) with tariffs. Also this past week, Switzerland is reported to be close to negotiating a substantial tariff-reduction deal with the U.S., demonstrating the broad reach of the U.S. trade-policy agenda beyond China. Taken together, these developments reflect both a hardening of trade policy frameworks (legal challenge to tariff authority) and selective de-escalation in key bilateral relationships, illustrating the dynamic, high-stakes nature of global trade policy in late 2025.

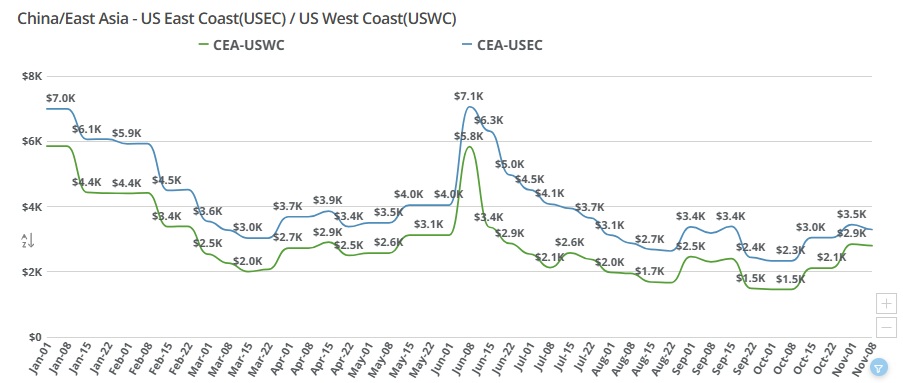

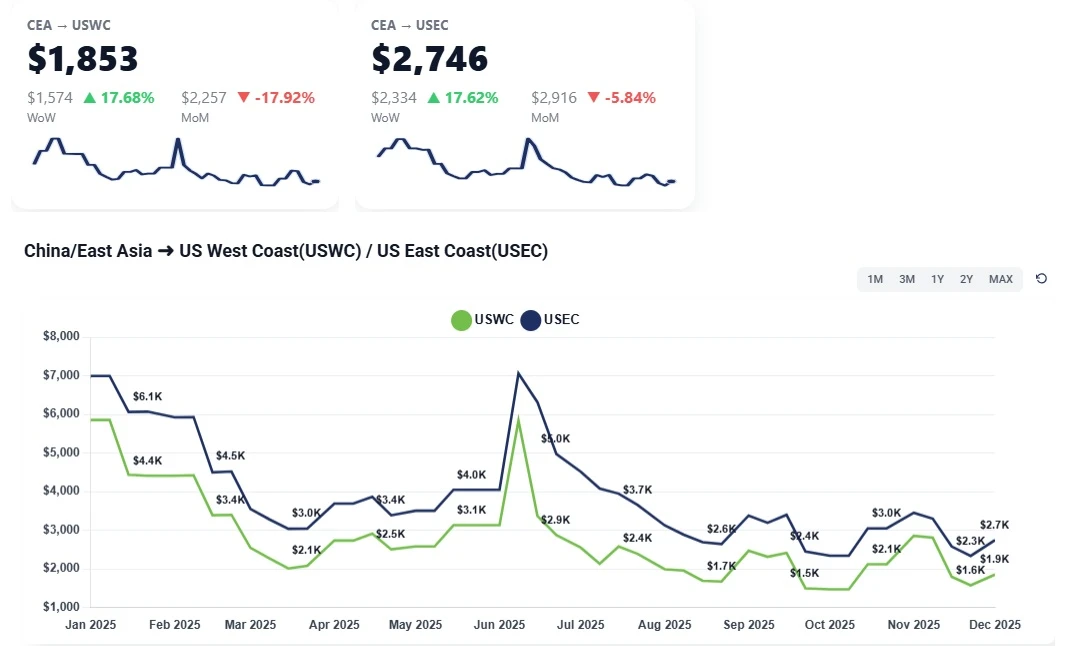

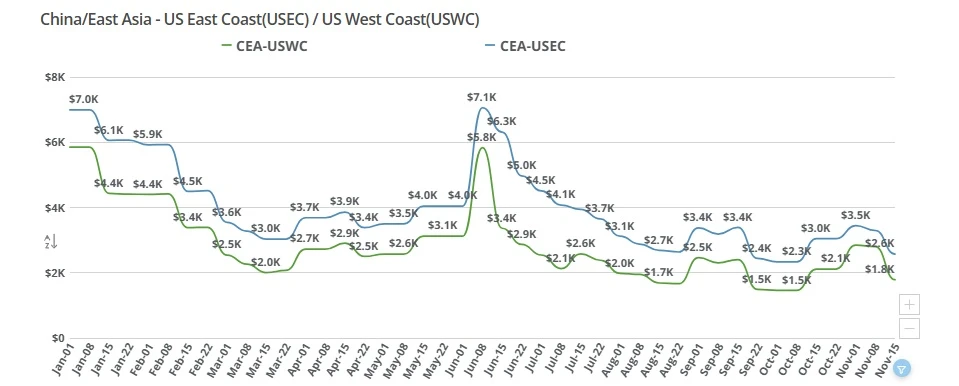

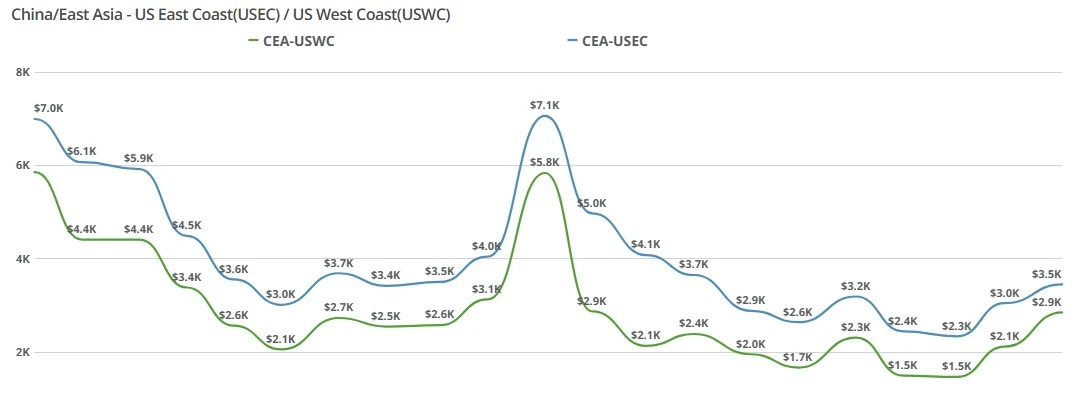

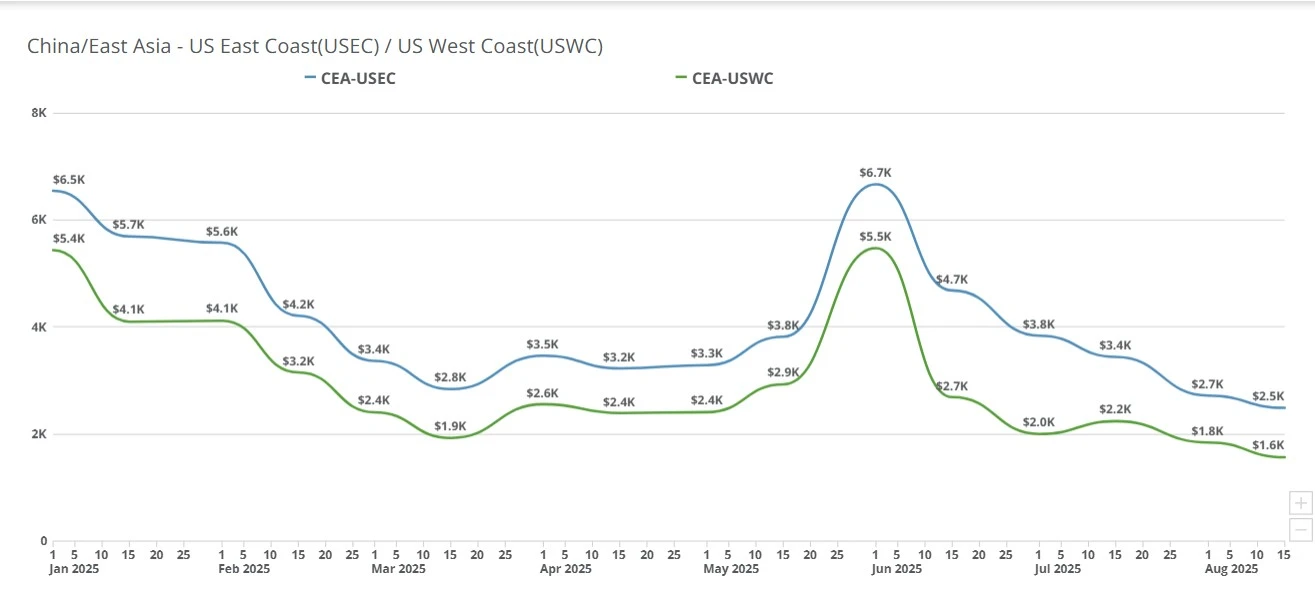

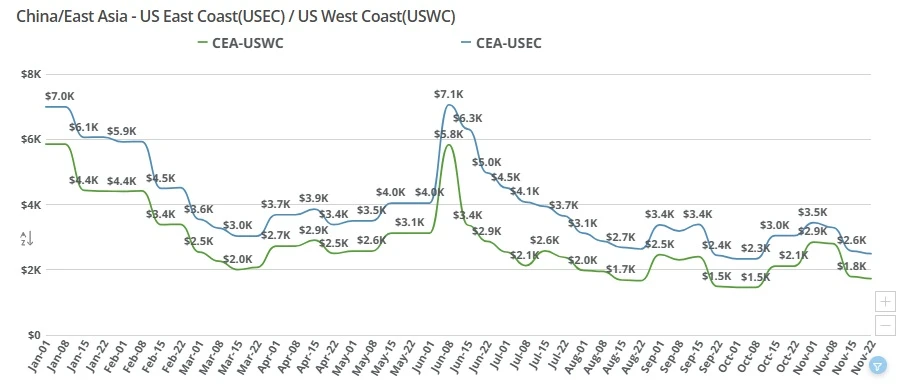

Spot rates keep easing week over week. China–US West Coast (CEA to USWC) is now hovering around $1,700–$1,750/FEU, while China–US East Coast (CEA to USEC) has slipped to roughly $2,500–$2,700/FEU.

The gap reported last week between 'special' rates being issued to freight forwarders from carriers and the carriers' 'fixed' advertised rate continued to shrink. Week to week there is now only about a $100 difference between special and advertised USWC and USEC rates.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Two-stage GRI, then unwind: Carriers pushed a rapid, two-step increase to establish higher benchmarks, then began stepping rates back as volumes failed to sustain the peaks.

Post-peak demand fades: With late November firmly off-peak, bookings have cooled, pressuring spot rates down on both coasts.

Tariff cut timing blunts impact: The U.S. reduction on certain China tariffs (effective Nov 10) lowers combined duties from ~30% to ~20%, but arriving at the end of peak season, it hasn’t meaningfully lifted volumes yet.

Contract vs. spot convergence: Any advantage from fixed/“special” rates has narrowed to about $100 and is fading as carriers align pricing.

Talk of a December GRI but skepticism remains: Some agents report verbal chatter of a Dec 1 hike (e.g., USWC to ~$2,850), yet market participants doubt it will stick without a demand catalyst.

Right now in November, we're expecting container rates to continue to fall, with USWC and USEC edging toward September-like levels if bookings remain tepid. A temporary December GRI attempt is possible, but without stronger liftings it would likely be short-lived. Looking to early January, rates have a good chance to rebound on pre-Lunar New Year pulls and as some shippers test the waters under the new, lower tariff regime, even if the tariff cut’s demand impact was muted in November. Net: down near term, volatile in December, firmer bias into January.

Air freight rates from China to the U.S. trended moderately upward in Week 46, driven by a sudden surge in e-commerce bookings following positive trade developments between the two countries. While overall volumes remain below last year’s levels, the combination of increased seasonal demand and tightening capacity has given airlines stronger pricing leverage.

China to U.S. West Coast (LAX, SFO): Rates rose by 5–8% week-over-week, supported by growing e-commerce shipments and constrained capacity due to weather-related flight disruptions.

China to U.S. East Coast (JFK, ORD, ATL): Rates climbed 6–10%, reflecting increased demand for electronics, e-cigarettes, and automotive parts, along with longer transit times via Anchorage.

Trade Policy Boost: The U.S. announced a 10% tariff reduction on select Chinese goods and a one-year suspension of port service fees, spurring a 300% spike in e-commerce container bookings.

E-commerce Peak Season: Major platforms began early Black Friday stockpiling, fueling air freight demand for small electronics, apparel, and accessories.

Capacity Constraints: Severe weather in Anchorage (ANC) has delayed flights, reducing available capacity.

Operational Disruptions: The U.S. government shutdown has slowed customs clearance and import processes, indirectly tightening supply chain flow.

Airline Strategy: Carriers are pushing rate hikes to secure favorable Block Space Agreement (BSA) contracts for 2026, using the seasonal volume bump as leverage.

Rates are expected to remain elevated through late November, as e-commerce demand peaks around Black Friday and Cyber Monday.

Should the policy relief measures hold, sustained e-commerce growth could extend rate strength into December. However, if weather disruptions persist or consumer spending softens, momentum may flatten in early December.

For long-term view, the temporary nature of tariff reductions suggests potential volatility in early 2026. Unless extended, exporters may front-load shipments to capitalize on lower tariffs before the policy expires.

UN Trade & Development: Global Trade Update (November 2025): Trade – a catalyst for achieving the Paris Agreement:

https://www.wsj.com/livecoverage/stock-market-today-dow-sp-500-nasdaq-11-10-2025/c[…]-for-india-switzerland-KwwLpk1HomZmoaQ2u8wE?mod=djemlogistics_h

Bloomberg: Re-wiring global trade: From tariffs to regional opportunity: https://www.bloomberg.com/professional/insights/regional-analysis/re-wiring-global-trade-from-tariffs-to-regional-opportunity/

South China Morning Post: Where are the ‘choke points’ in global trade and can they be overcome?: http://scmp.com/economy/global-economy/article/3332204/where-are-choke-points-global-trade-and-can-they-be-overcome

Global Trade Magazine: Supreme Court Reviews Legality of Trump’s Tariffs:

https://www.globaltrademag.com/supreme-court-reviews-legality-of-trumps-tariffs/

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

China-US ocean freight rates continue to decline, with the East Coast premium narrowing as carriers compete for limited volume. Get the key market drivers and outlook in this week’s update.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.