Global trade policy was dominated by a significant escalation in US tariff actions and ongoing efforts elsewhere to manage trade disputes and expand market access. The most consequential development was the Trump administration’s announcement of a sweeping 25% tariff on any country trading with Iran, immediately raising tensions with major economies and attracting threats of retaliation, especially from China. This marked a continued hardline US approach to trade policy amid geopolitical concerns, and it occurred alongside domestic legal challenges over the authority for past tariff measures.

In parallel, Europe and South America advanced the long-gestating EU-Mercosur free trade agreement, signaling a major tariff-reducing integration after decades of negotiations and reflecting alternative trade cooperation amid rising protectionism. European efforts to strengthen commercial ties with India and resolve Beijing-EU industrial disputes over electric vehicles further underscored a multipolar trade landscape navigating both tariff pressures and strategic partnerships. Overall, the week’s events highlighted the persistence of tariff-driven disruption in global trade alongside efforts to pursue broader trade liberalization and dispute management.

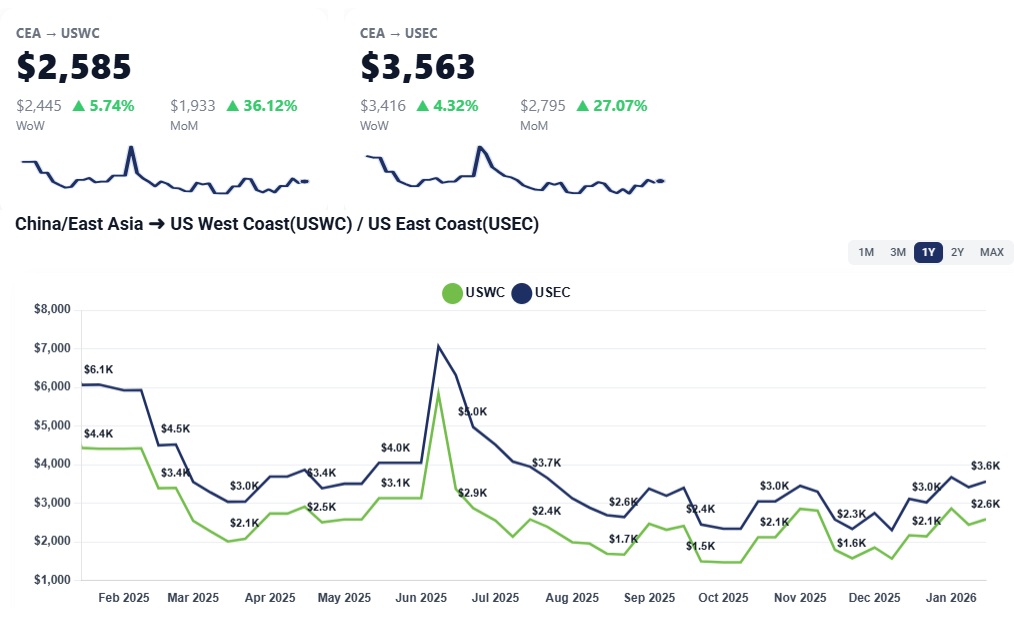

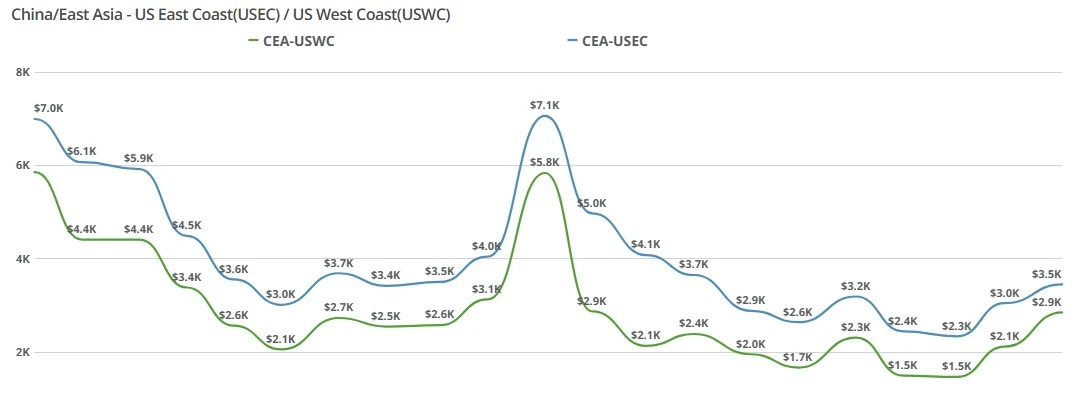

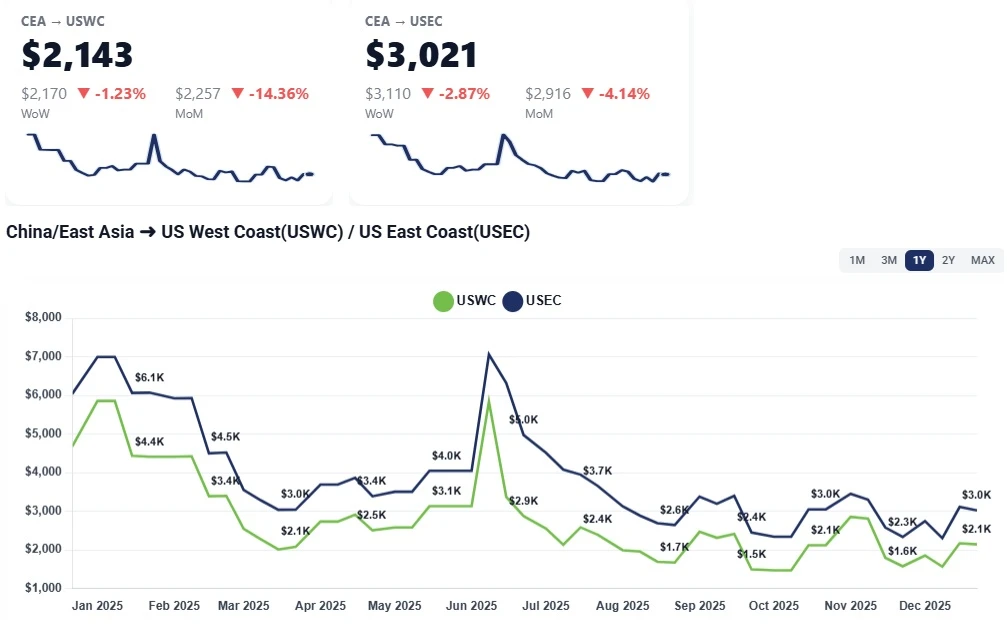

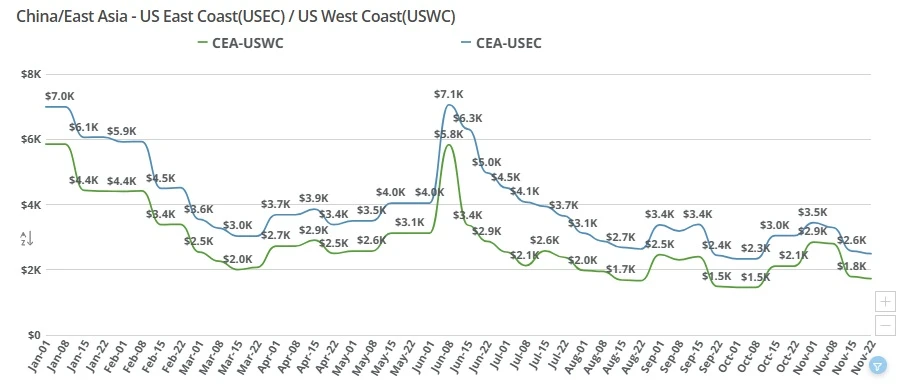

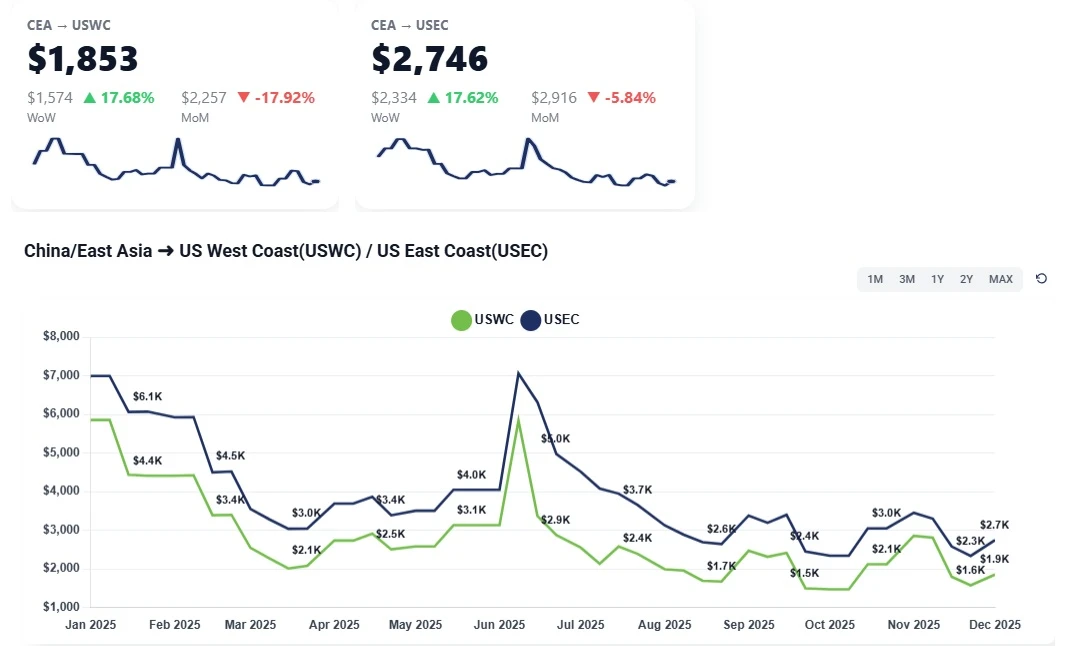

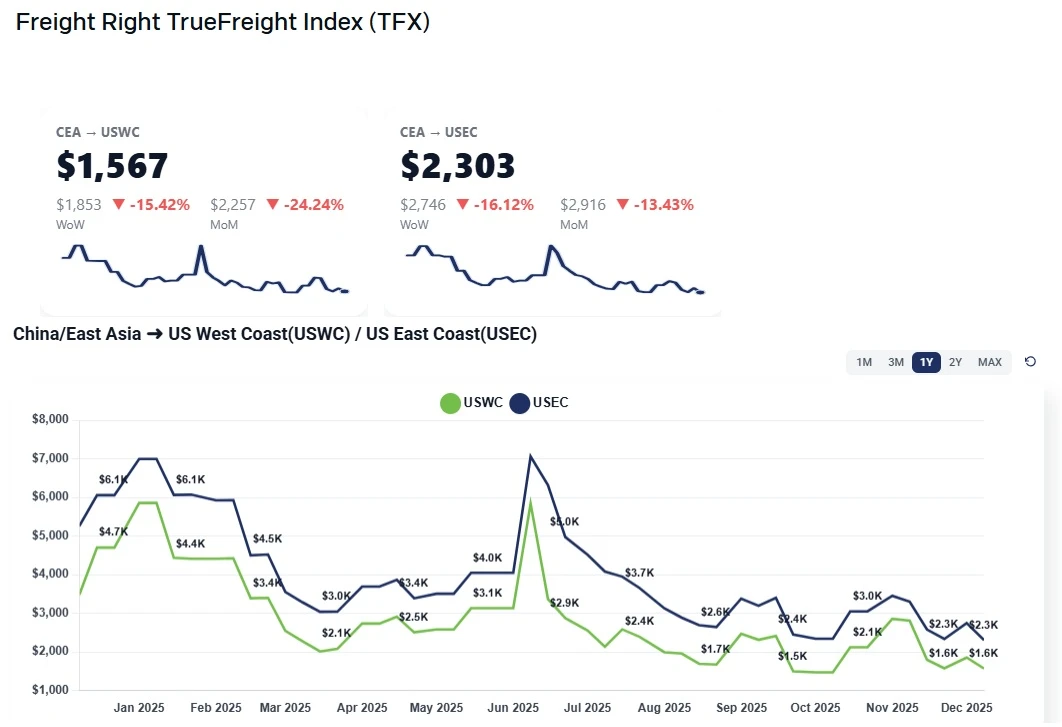

CEA to USWC (China to US West Coast): China–US West Coast spot rates fell sharply week-over-week, sliding back into the $1,850–$1,950 per FEU range. Early-January GRIs have effectively washed out as demand failed to materialize, leaving carriers with little pricing power. While most carriers are signaling another aggressive GRI attempt for the second half of January, targeting rates north of $3,000/FEU, early market behavior suggests limited staying power at those levels.

CEA to USEC (China to US East Coast): Rates to the East Coast followed a similar trajectory, easing week-over-week as volumes remained muted. Although carriers are aiming for $4,000+ per FEU later this month, competitive pressure and weak fundamentals are already undermining these efforts. As with the West Coast, any mid-month increases are expected to face rapid erosion.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Lack of volume support: Post-holiday demand has failed to rebound, with January volumes tracking similarly to December lows. As noted in the discussion, “there’s no shipment, there’s no volumes,” making sustained rate increases difficult.

GRIs without fundamentals: Carriers pushed significant GRIs at the start of January, but most of those increases have already disappeared. The market is now seeing a familiar pattern: GRIs announced, partial stickiness, followed by rapid rollback.

Carrier divergence on pricing strategy: While most carriers are holding firm on announced mid-month increases, at least one smaller carrier is offering sub-$2,000 rates deep into the second half of January, signaling low confidence in demand and pressuring the broader market downward.

Artificial capacity management: Blank sailings and vessels taken out of rotation are tightening space temporarily, but this is a supply-side maneuver—not demand-driven congestion. Once capacity normalizes, rates are likely to soften again.

Pre–Chinese New Year timing mismatch: Unlike stronger years, January demand is not strong enough to support elevated pre–Lunar New Year pricing, forcing carriers into repeated GRI attempts rather than a single, sustained increase.

Expect continued volatility through the second half of January. While carriers will attempt to push rates higher ahead of Chinese New Year using GRIs and blank sailings, underlying demand remains too weak to sustain those levels. Market indicators point toward rates drifting back toward the low-$2,000 range by late January, particularly on the West Coast, with East Coast lanes following closely behind. Into February, pricing is likely to stabilize briefly around Lunar New Year before resuming downward pressure as capacity returns and volumes reset.

BBC: How tariff disruption will continue reshaping the global economy in 2026

https://www.bbc.com/news/articles/czejp3gep63o

Bloomberg: China to Cut Export Tax Rebates to Ease Global Trade Tensions

https://www.bloomberg.com/news/articles/2026-01-09/china-to-cut-export-tax-rebates-to-ease-global-trade-tensions

Global Trade Magazine: US Container Imports Expected to Stay Below 2025 Levels Through Spring

https://www.globaltrademag.com/u-s-container-imports-expected-to-stay-below-2025-levels-through-spring/

The Wall Street Journal: TSMC Plans U.S. Expansion in Proposed Taiwan Tariff-Relief Deal

https://www.wsj.com/tech/tsmc-plans-u-s-expansion-in-proposed-taiwan-tariff-relief-deal-280d8a08

Reuters: Trump's Iran tariff threat risks reopening China rift

https://www.reuters.com/world/china/trumps-iran-tariff-threat-risks-reopening-china-rift-2026-01-13/

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.