While the US successfully used tariff-reduction incentives to secure a massive $250 billion investment package from Taiwan, it simultaneously triggered a diplomatic crisis by threatening a 10%–25% tariff on European allies over the status of Greenland. This aggressive posture stood in stark contrast to the European Union's focus on "competitive multilateralism," evidenced by its landmark signing of the Mercosur (mer-kow-sur) trade deal to diversify supply chains away from China and the U.S. As markets react to the implementation of new 25% semiconductor duties and record-high gold prices, the global trade system appears to be bifurcating into a high-tariff US zone and an expanding network of non-U.S. bilateral partnerships.

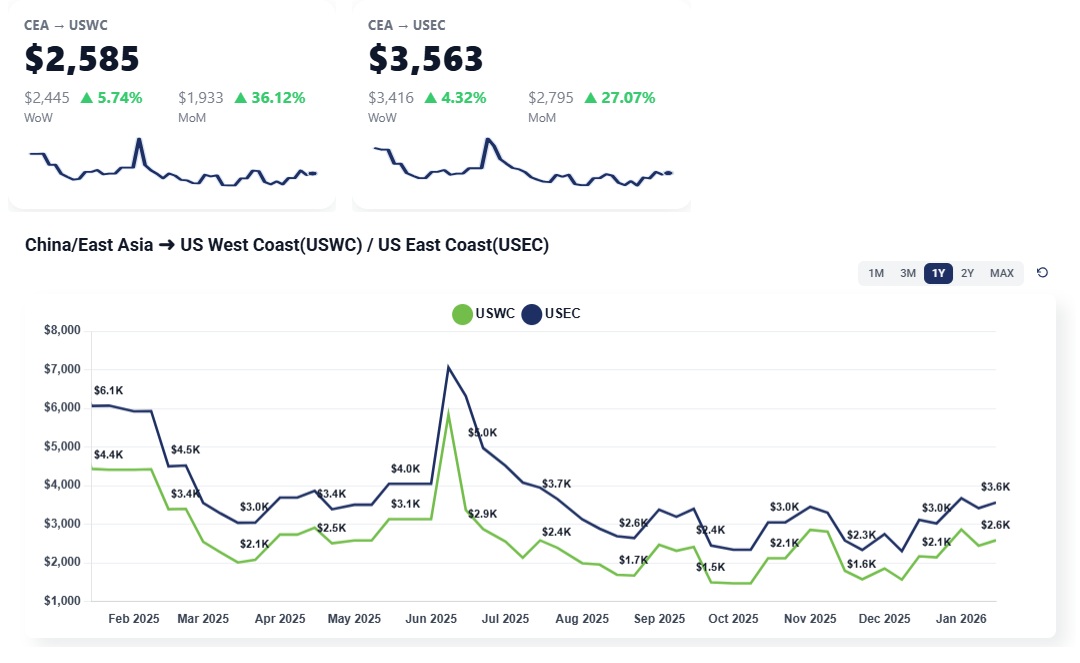

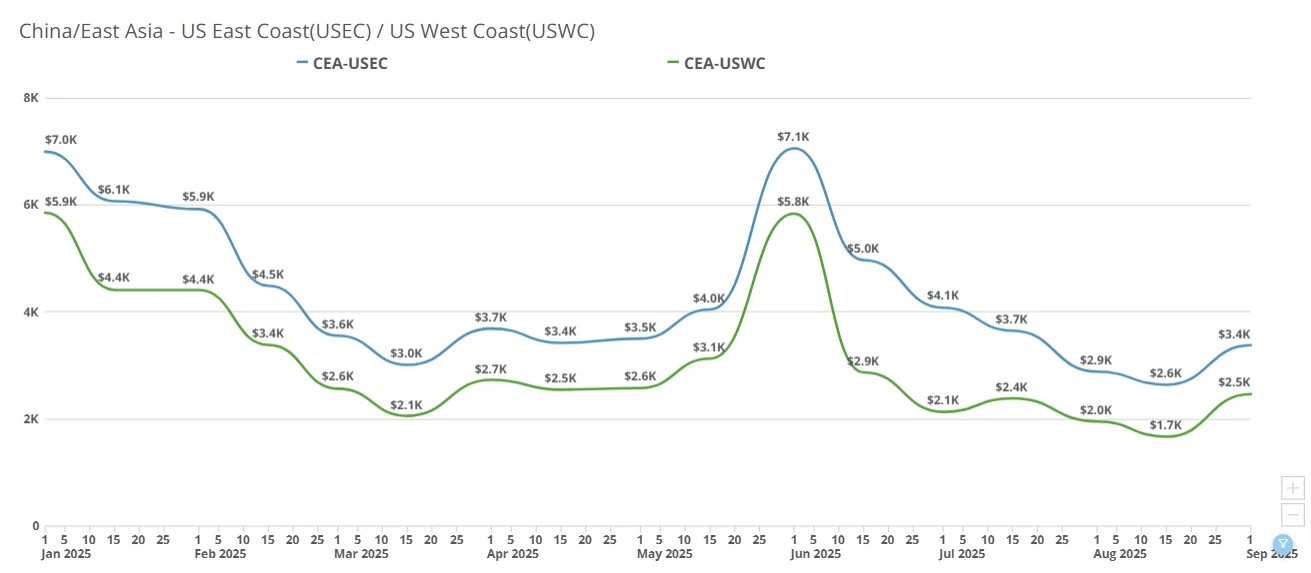

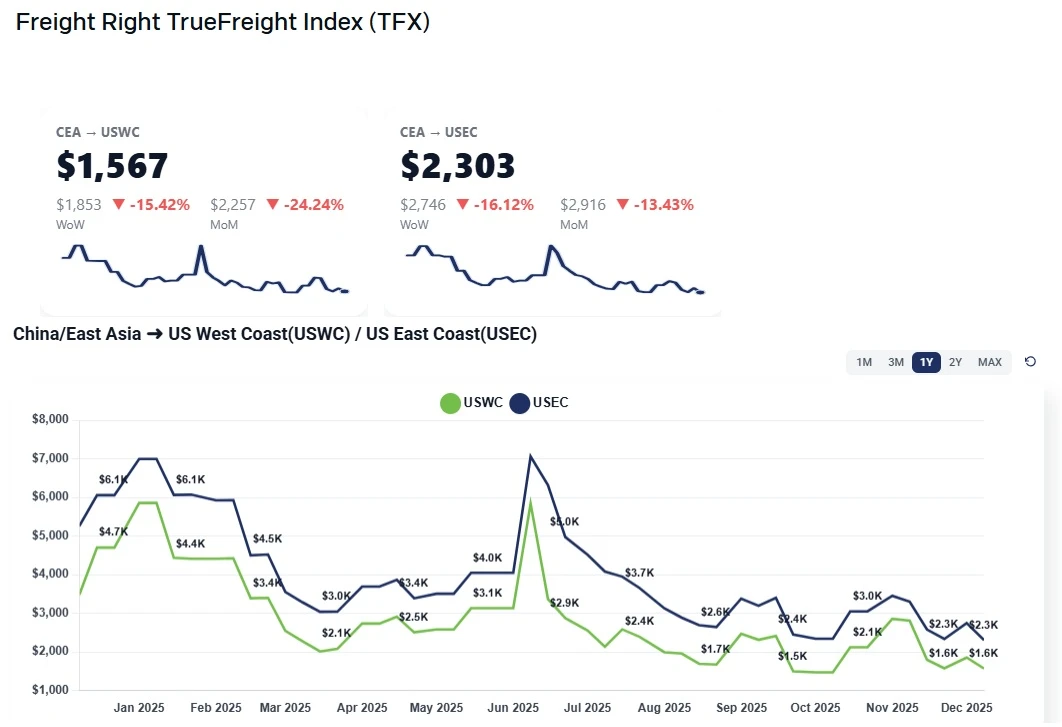

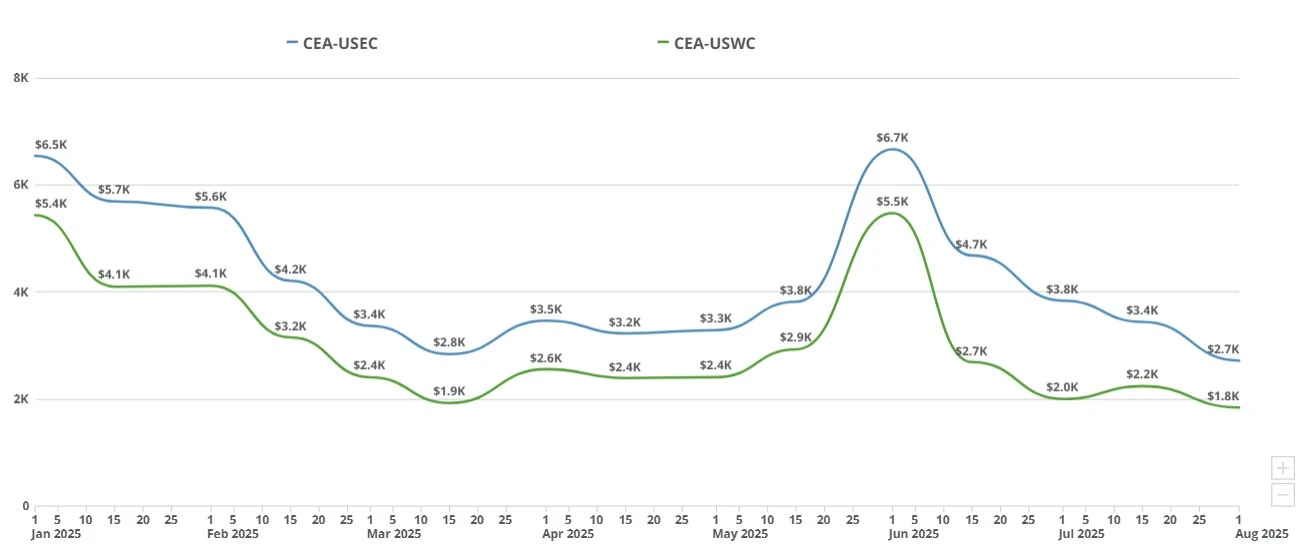

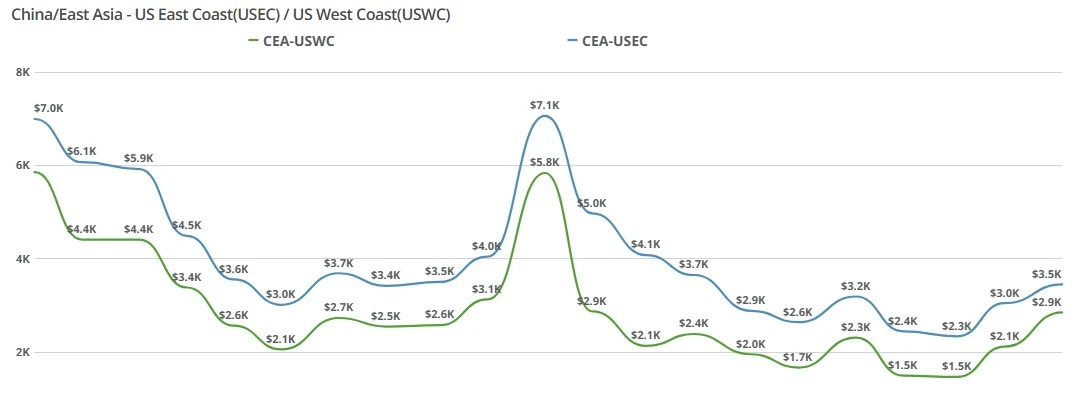

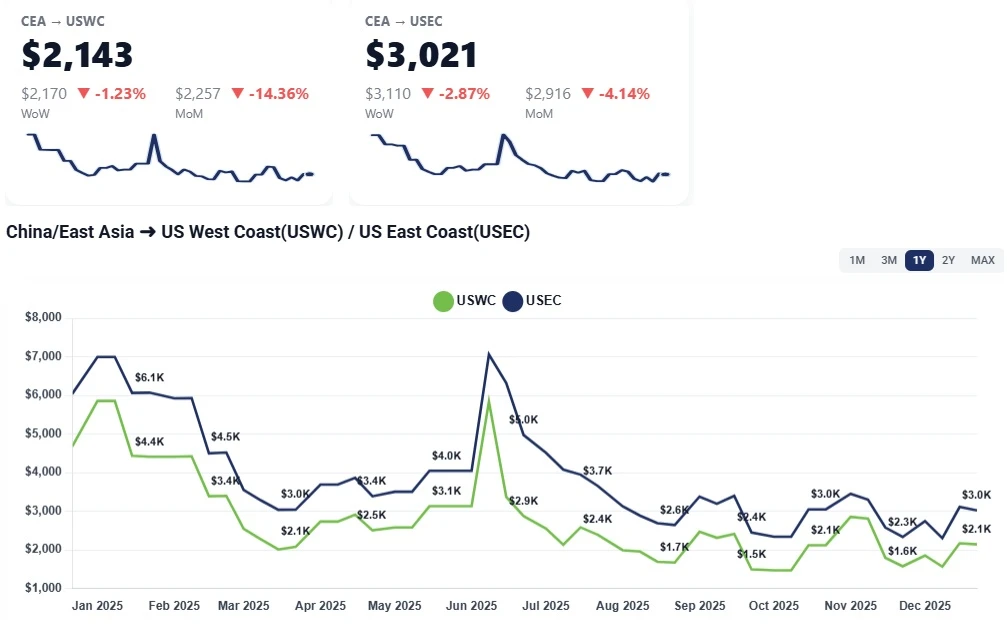

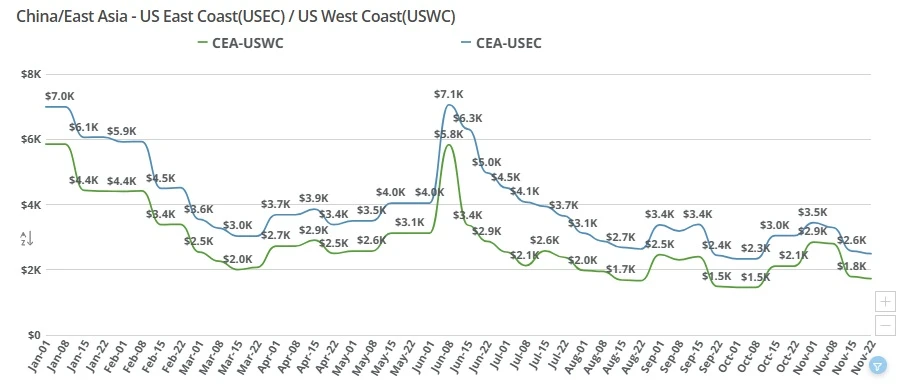

The attempt by carriers to aggressively raise rates in early January has largely failed, as spot prices have retreated due to underwhelming volumes. After a short-lived test of higher pricing at the start of the month, rates are now stabilizing at levels closer to the "fair market" baseline rather than the peak-season highs carriers had hoped for.

CEA to USWC: Rates have dropped significantly from previous weeks, now sitting between $1,700 and $1,800 per container. This is a sharp decline from earlier January attempts to push prices toward $3,000.

CEA to USEC: East Coast pricing has also cooled, with rates currently ranging from $2,300 to $2,500 per container. Some premium services are still quoted around $2,800, but the overall trend is downward.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Abandoned General Rate Increases (GRIs): Carriers initially announced a $1,000 GRI for the second half of January, but they have failed to enforce it because there is no volume to support the hike.

Lack of Pre-CNY Volume Surge: Traditionally, the weeks leading up to Chinese New Year see a 50–70% spike in volume; however, that surge has not materialized this year. Importers simply are not buying at the expected levels.

Carrier capitulation: Recognizing that higher prices would "scare away" the limited cargo available, carriers have extended current rates through the end of January and, in some cases, through the end of February.

Geopolitical "Pause": Threats of new tariffs on businesses trading with Iran have created a sense of "crazy" uncertainty for importers. Many are choosing to pause shipments for a few weeks to see how policy settles rather than risking 50% tariff hikes mid-transit.

Factory Floor Stagnation: Unlike previous years where factories pushed buyers to clear out inventory before the holiday shutdown, factory floors are currently not "flooded," and manufacturers are ready to close without a final shipping rush.

The market is entering an "uncomfortably cool" period that is likely to last through February. With rate validity now extending into late February for many carriers, the industry has essentially written off the typical Lunar New Year peak.

If volumes do not pick up by March, further rate reductions are anticipated, potentially cutting into the $1,500–$1,600 range. Air freight remains the only sector with sustained higher pricing, currently holding at $4.00–$5.00 per kilo, though it has avoided the "sky high" spikes seen in previous years due to the same overarching weakness in US demand.

The air freight market is currently characterized by sustained high rates as the industry enters the peak shipping window ahead of the Chinese New Year. While prices have climbed significantly since the start of the month, they have not yet reached the "sky-high" levels seen in previous peak seasons, largely due to overarching weakness in broader U.S. demand.

CEA to USWC: Following an increase in mid-January, rates for the West Coast are currently hovering between $4.00 and $5.00 per kilogram. Market data for Week 03 shows some high-density routes (e.g., PVG-LAX) priced as low as $2.07/kg, while more urgent or lower-density shipments are reaching the $4.15–$4.60/kg range.

CEA to USEC: Rates to the East Coast remain slightly more elevated than the West Coast, with prices for major hubs like JFK and BOS consistently landing in the $4.15 to $4.89 per kilogram range. This reflects a steady week-over-week hold following the initial January volume surge.

Enterprise Volume Prioritization: Large entities, specifically Tesla and major e-commerce platforms, are consuming a massive portion of available plane space. These "big fish" are moving significant inventory early to ensure they don't have to fight for space as the holiday approaches.

Compressed Manufacturing Window: Many Chinese factories are expected to close early this year, prompting a rush to get finished goods out this week and next. Smaller shippers are now following the lead of larger corporations to clear warehouse floors before the month-long holiday shutdown.

Artificial Capacity "Ceiling": While rates are high, they have been capped by a general slowdown in U.S. consumer demand. While agents expected rates to potentially double to $7.00 or $8.00 per kilo, this hasn't materialized because the volume simply isn't there to support such a spike.

The "Big Fish" vs. "Small Fish" Dynamic: Manufacturers are currently prioritizing orders from large clients like Tesla over smaller and medium-sized businesses to ensure high-value shipments are cleared first.

The air freight market is expected to remain tight with elevated pricing through the second week of February. As factories shutter for the Lunar New Year, a brief skeleton-crew period will follow where bookings will essentially stall.

Looking past the holiday, there is significant uncertainty. If U.S. demand does not show a meaningful recovery by March, the "uncomfortably cool" market conditions seen in the ocean sector may bleed into air freight, potentially leading to rate reductions as carriers compete for limited volume. For now, shippers should expect rates to hold in the $4.00–$5.00/kg range until the post-holiday reset.

Reuters: Global trade finance gap at $2.5 trillion as global trade tensions rise, ADB says

https://www.reuters.com/sustainability/boards-policy-regulation/global-trade-finance-gap-25-trillion-global-trade-tensions-rise-adb-says-2026-01-15/

Bloomberg: Global Trade to Barrel Through Uncertainty, DP World Survey Shows

https://www.bloomberg.com/news/newsletters/2026-01-20/global-trade-resilience-in-2026

Global Trade Magazine: Container Freight Rates Slide as January Momentum Fades

https://www.globaltrademag.com/container-freight-rates-slide-as-january-momentum-fades/

CNBC: Trump’s Greenland tariff threats could be upended by Supreme Court decision

https://www.cnbc.com/2026/01/20/trump-greenland-tariffs-nato-supreme-court-decision.html

BBC: Europe to suspend approval of US tariffs deal

https://www.bbc.com/news/articles/c4gwp2me3gzo

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Aug 4–11, 2025: EU pauses counter-tariffs; U.S. reciprocal tariffs start; +25% on India due Aug 27; China tariff truce extended 90 days; WTO signals risk.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.