Global trade policy developments reflected a mix of caution and continued pressure from tariffs. The United States signaled a temporary easing of tensions with China by delaying new semiconductor tariffs, even as broader analyses emphasized how elevated U.S. tariff levels throughout 2025 have reshaped global trade flows. Spillover effects were evident in Europe, where diverted Chinese exports raised concerns about competition and inflation dynamics, particularly in the United Kingdom. At the same time, India paused proposed anti-dumping duties on Chinese solar modules, highlighting legal and policy constraints around trade remedies, while expectations of new US tariffs taking effect in early 2026 pointed to ongoing cost pressures for importers and consumers.

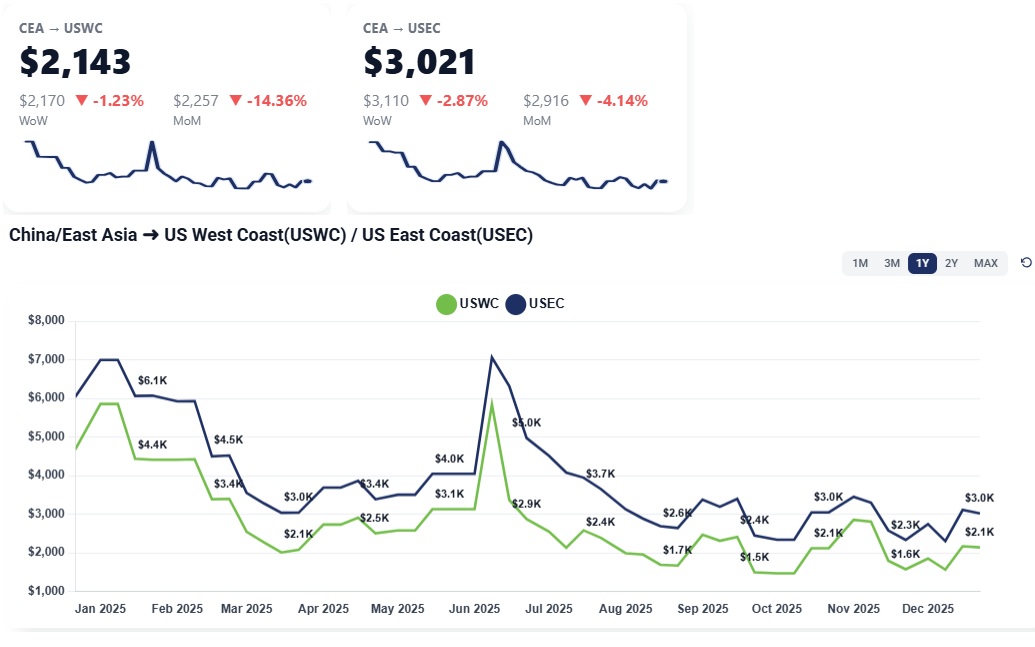

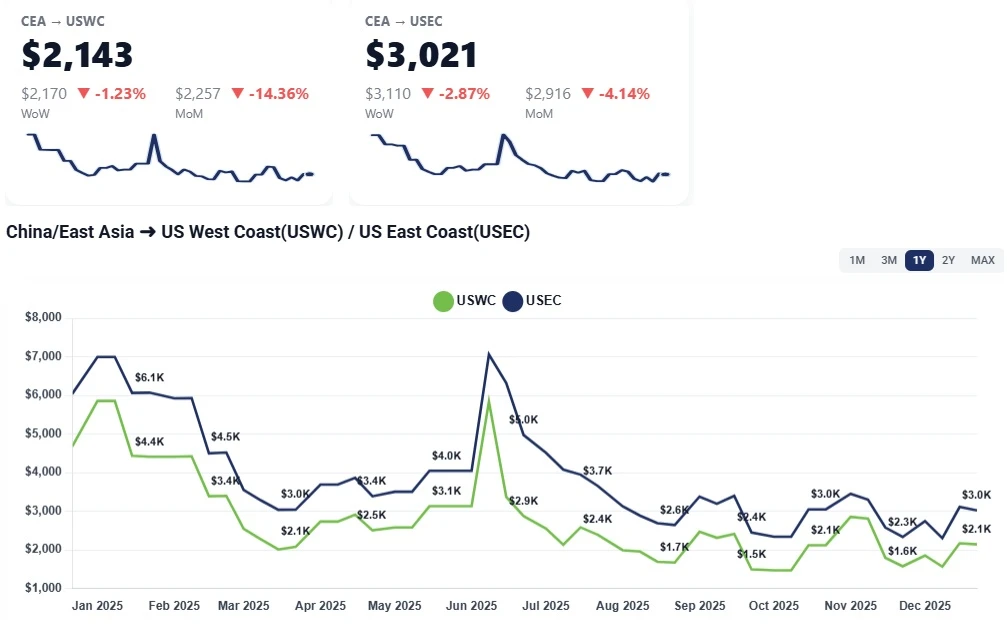

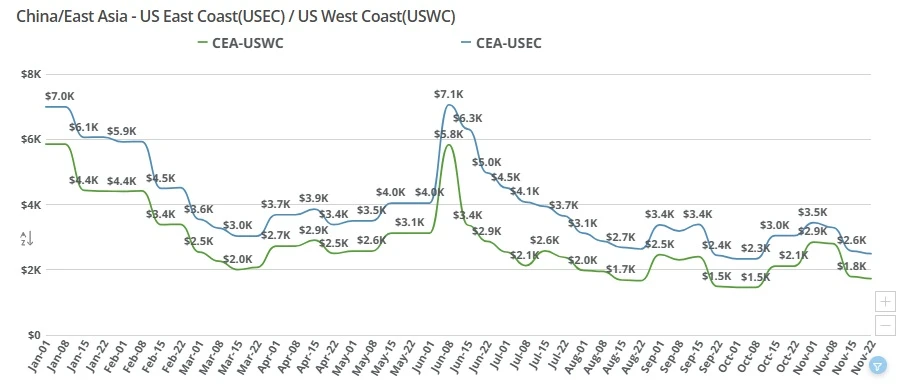

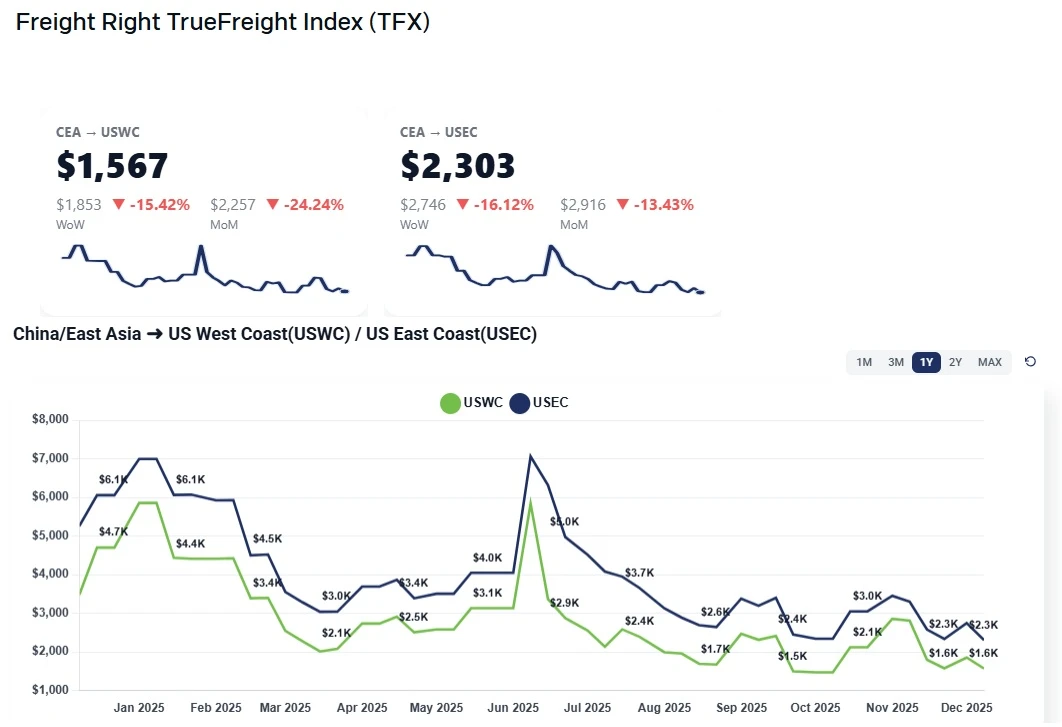

CEA to USWC (China to US West Coast): Week over week, rates were largely flat at elevated levels, holding in the $2,800–$3,000/FEU range. There was little transactional movement due to the holiday slowdown, but importantly, rates did not soften, signaling carriers’ success in defending recent increases despite weak volumes.

CEA to USEC (China to US East Coast): Rates to the East Coast also remained stable WoW, hovering around $3,500–$3,700/FEU depending on service and routing. As with the West Coast, minimal bookings activity meant few data points, but carriers maintained pricing discipline rather than chasing volume.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Global holiday lull suppressing activity: This week was even quieter than last, with Christmas and year-end holidays effectively freezing global freight movement. China closures toward the end of the week further reduced activity, creating a “dead week” for bookings.

Rates holding despite weak demand: Normally, this level of inactivity would pressure carriers to discount. Instead, ocean carriers are holding firm, prioritizing rate integrity over short-term volume.

Chinese New Year pricing strategy already in play: Carriers are positioning January as a pre–Chinese New Year peak window, aiming to keep rates elevated through all of January rather than allowing an early dip.

Contract season looming: With annual contract negotiations approaching in March–April, carriers are highly motivated to keep spot rates elevated now. A higher Q1 average strengthens their negotiating leverage with BCOs later in the year.

Muted underlying cargo demand: Unlike traditional pre-CNY surges, shippers are not signaling strong January volumes. Consumer spending uncertainty and inventory caution continue to cap demand expectations.

That said, these levels are not structurally sustainable. Once Chinese New Year passes and the calendar flips toward late February, downward pressure should re-emerge. A post-Chinese New Year correction is likely, but the floor may settle higher than last year, potentially in the $1,900–$2,100/FEU range, reflecting carriers’ efforts to permanently raise the baseline ahead of 2026 contracting.

Reuters: Commodities buffeted by Trump whirlwind seek relief in 2026

https://www.reuters.com/markets/commodities/commodities-buffeted-by-trump-whirlwind-seek-relief-2026-2025-12-30/

Bloomberg: The ‘Year of the Tariff’ Gives Way to 2026 Worries of the Consequences

https://www.bloomberg.com/news/newsletters/2025-12-24/2026-risks-for-global-trade

Reuters: India's domination of global rice trade stokes looming water crisis

https://www.reuters.com/sustainability/climate-energy/indias-domination-global-rice-trade-stokes-looming-water-crisis-2025-12-30/

Global Trade Magazine: World Container Index Climbs for Fourth Consecutive Week

https://www.globaltrademag.com/world-container-index-climbs-for-fourth-consecutive-week/

The New York Times: Trump Promised Radical Change in His Second Term. Here’s What He’s Done So Far.

https://www.nytimes.com/2025/12/27/us/politics/trump-second-term-promises-actions.html

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

A look into the volatile freight contract season, exploring broken promises, rate surges, and solutions for sustainable agreements through strategic contracting and innovative market practices.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Ocean rates hold steady at $1,400-$1,600 for USWC as China’s pre-holiday shipping window closes. Explore the impact of high trucking costs and the upcoming total market shutdown.

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.