During the week of September 30 to October 6, 2025, global trade policy saw a flurry of protectionist moves, especially from the U.S. and the European Union. The U.S. expanded its tariff regime by imposing a 10 % duty on wood imports and delaying cabinet/furniture tariffs, and then announced a significant 25 % tariff on medium and heavy trucks beginning November 1. Meanwhile, the EU made bold moves in the steel sector, slashing import quotas and proposing a 50 % tariff on steel that exceeds those quotas. Amid these developments, India extended export support measures and Brazil sought relief from U.S. tariffs through high-level diplomacy. Observers in Europe, such as Thomas Piketty, urged a rethinking of free-trade doctrine in light of growing global trade volatility. In sum, this week reinforced a trend toward more aggressive tariff activism and growing friction in the international trading system.

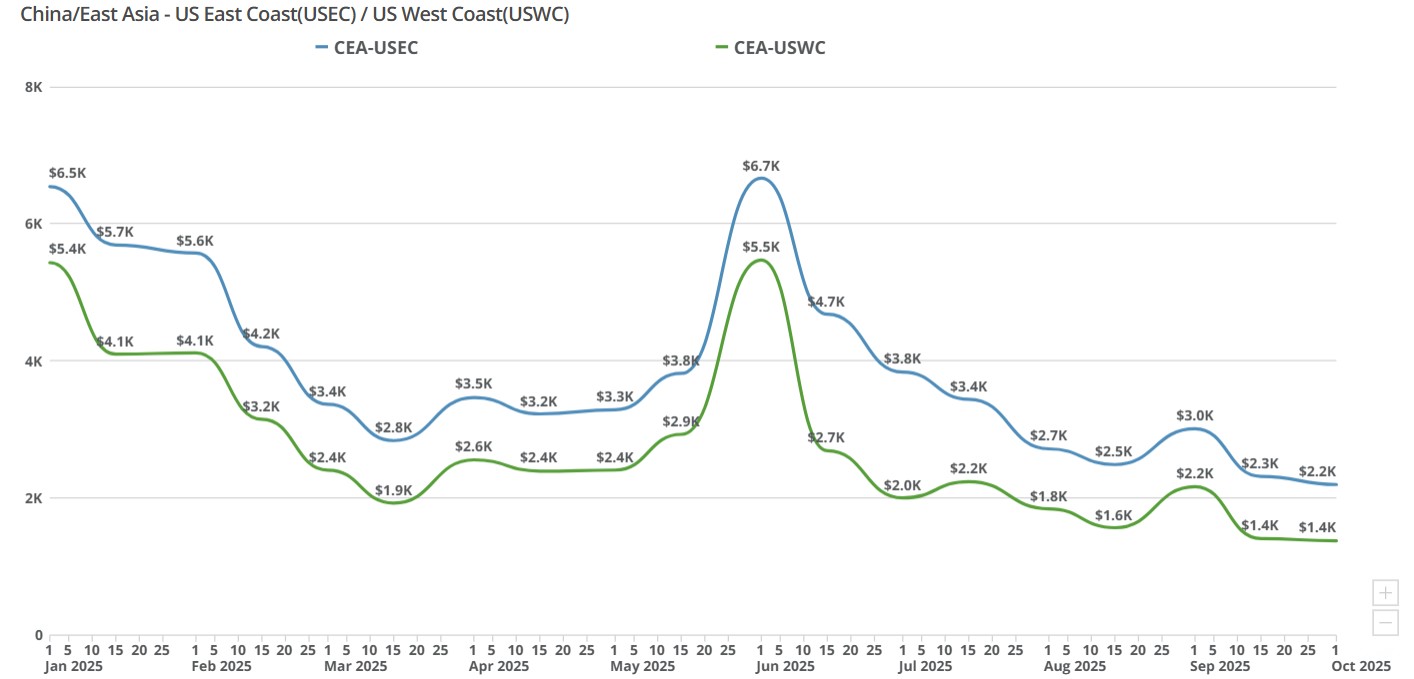

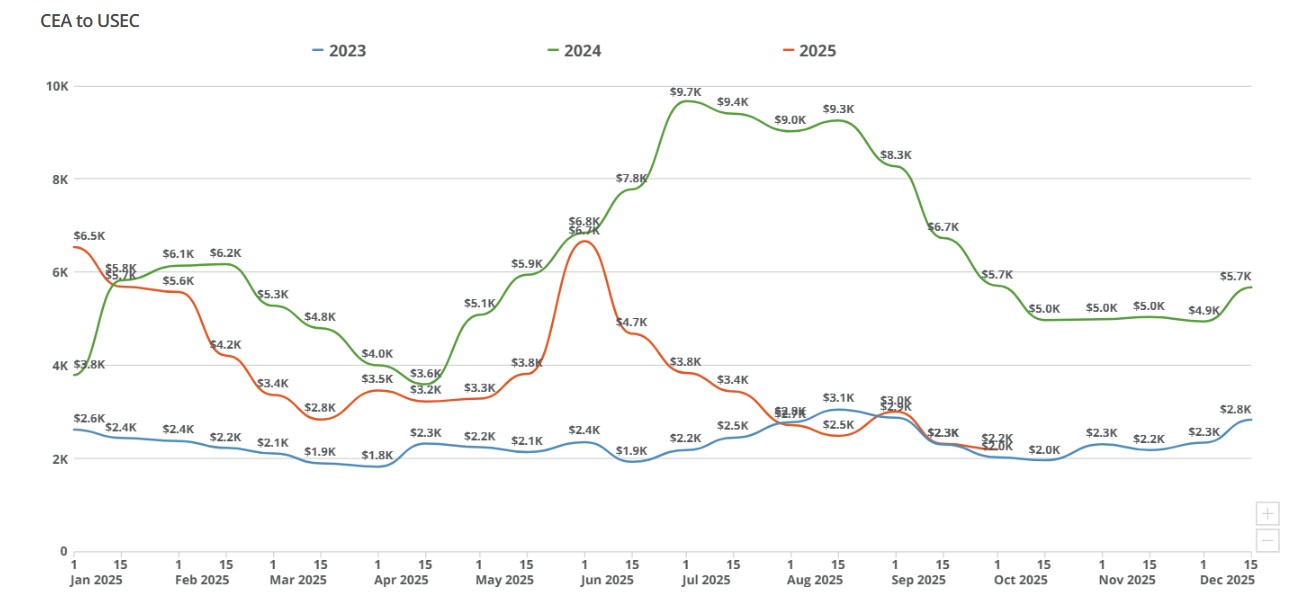

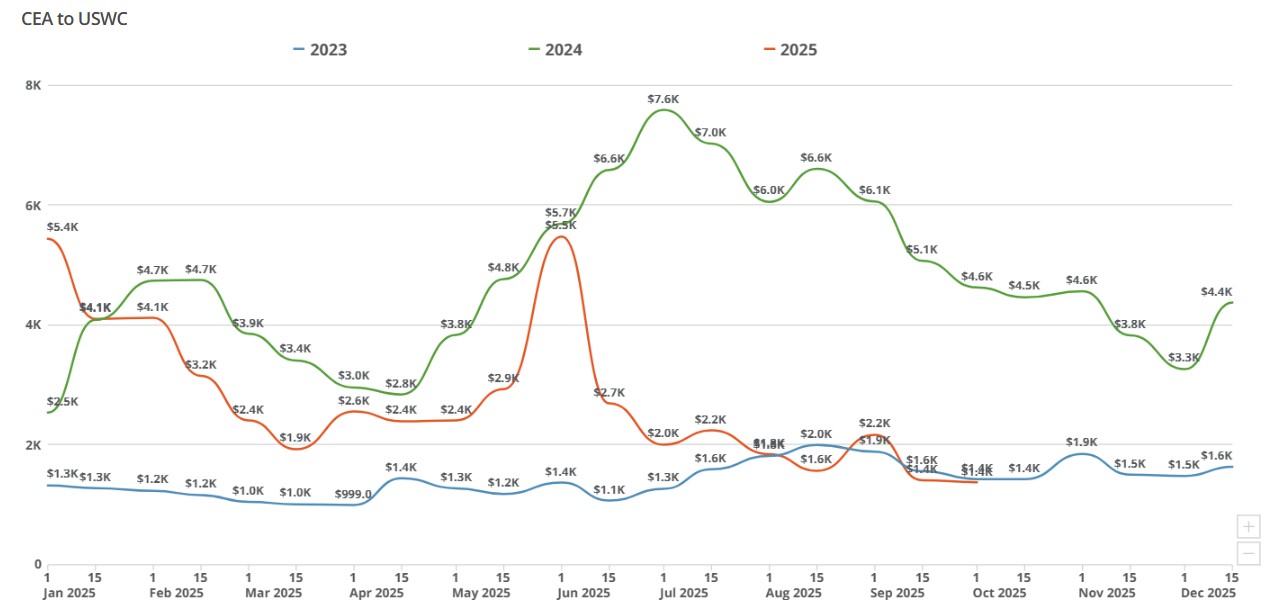

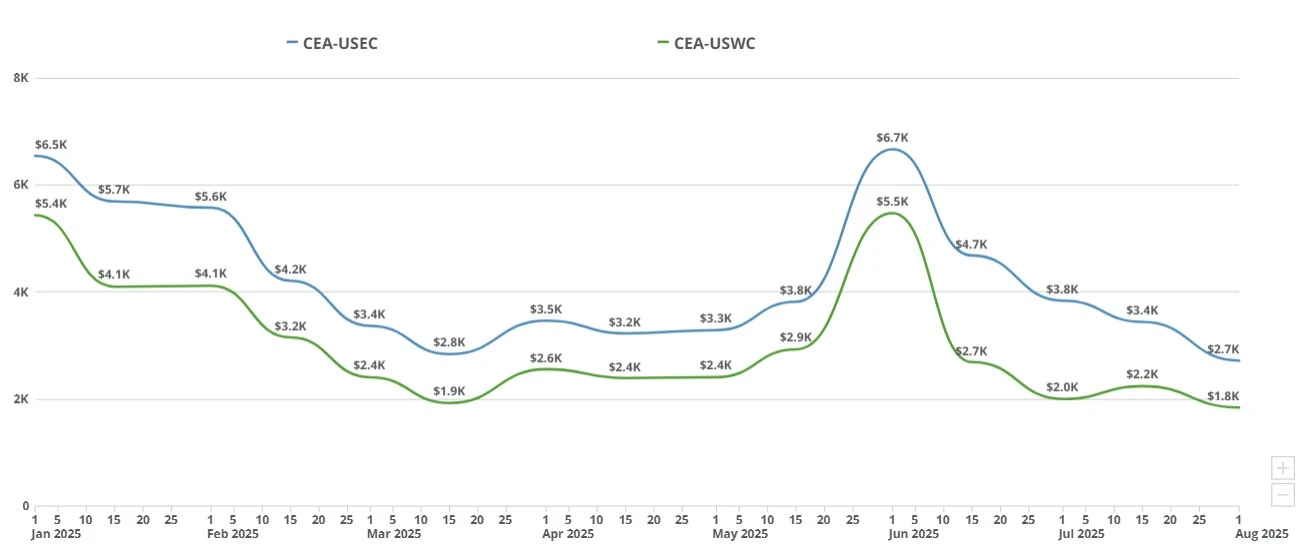

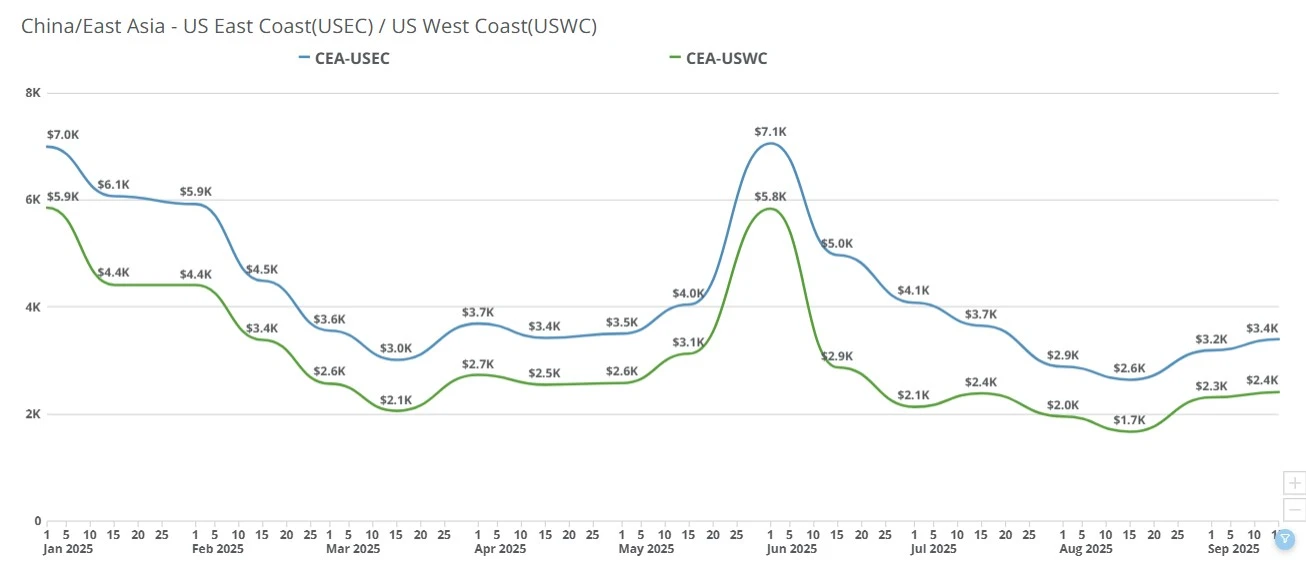

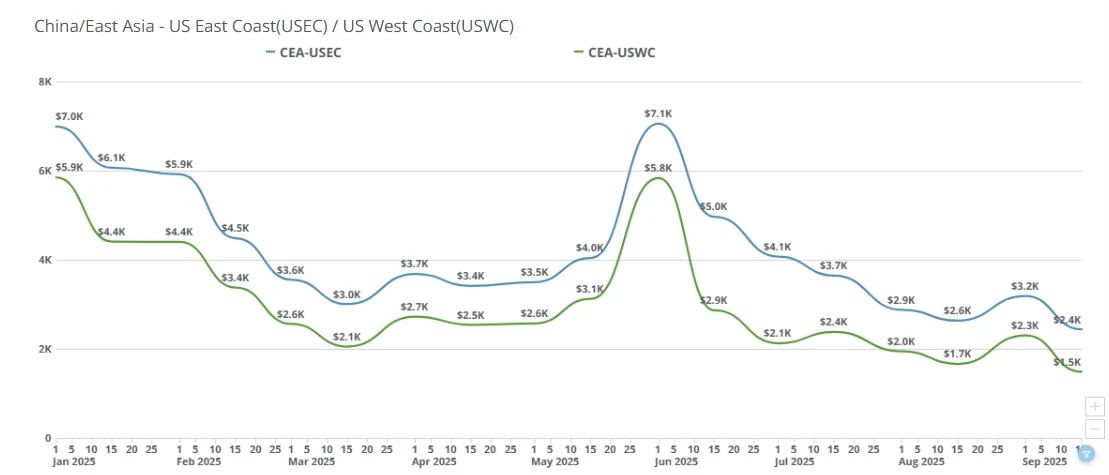

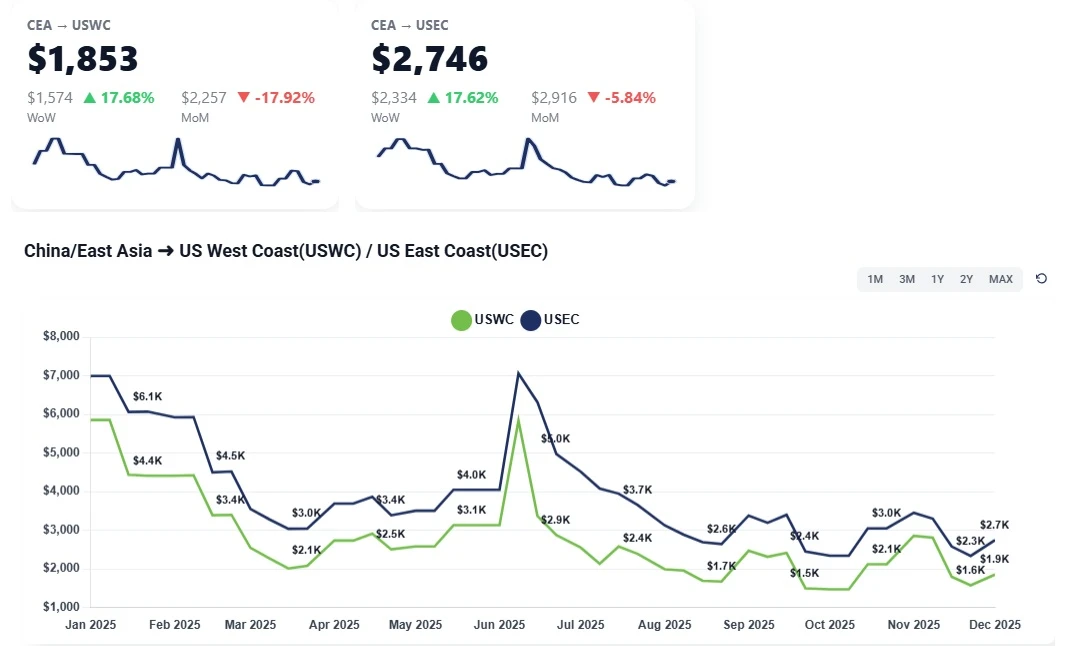

CEA to USWC (China to U.S. West Coast): Flat week-over-week. No meaningful price movement reported amid China’s Golden Week shutdown.

CEA to USEC (China to U.S. East Coast): Flat week-over-week. Same story as the West Coast: muted booking activity and unchanged spot levels.

Week of October 6, 2025:

CEA/USEC 20FT $2381.09

CEA/USEC 40FT $2865.84

CEA/USEC 40HC $2865.84

CEA/USWC 20FT $1592.88

CEA/USWC 40HC $1959.48

CEA/USWC 40FT $1954.52

Golden Week pause: China’s holiday kept factories closed and bookings light, leaving spot markets essentially unchanged on both coasts.

Muted retail catalysts: Even with Amazon’s October event, we didn’t see the usual shipper urgency or pull-forward signals that typically nudge rates—another sign of a very quiet week.

Short post-holiday runway: With China only returning late in the week and many factories not fully back until next Monday, there wasn’t enough time for rate action or GRIs to stick.

Low probability of near-term upside: Market participants characterize it as “quite impossible” for rates to move up in the immediate term given soft demand.

For the remainder of October, we're expecting a sideways market through the second half of October as production ramps gradually post-holiday and demand remains tepid; carriers lack justification for near-term GRIs on CEAto USWC/USEC.

Bias remains down/flat rather than up without a clear demand catalyst, any bounce looks unlikely. Monitor whether factory restarts next week translate into incremental bookings; if not, softening could re-emerge into late October.

We’re advising importers on three things to watch. The first is the post-Golden Week booking pace from core origins; second, any surprise retail promotions that actually trigger pull-forwards; and third is carrier capacity actions - only meaningful blankings would alter the near-term trajectory.

Splash247: Carriers blank sailings at pandemic pace to prop up rates: https://splash247.com/carriers-blank-sailings-at-pandemic-pace-to-prop-up-rates/

The Loadstar: Forwarders eye growing ecommerce – but players want lift, not logistics: https://theloadstar.com/forwarders-eye-growing-ecommerce-but-players-want-lift-not-logistics/

WSJ: Sharpie Found a Way to Make Pens More Cheaply—By Manufacturing Them in the U.S.: https://www.wsj.com/business/sharpie-us-production-cost-cutting-d9ba2abd (archive link: https://archive.ph/h7QvU)

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.

This blog explores digital air freight and how e-bookings provide a more efficient and faster way for logistics professionals to make connections.

Aug 4–11, 2025: EU pauses counter-tariffs; U.S. reciprocal tariffs start; +25% on India due Aug 27; China tariff truce extended 90 days; WTO signals risk.

In a 7–4 ruling on August 29, 2025, the US Court of Appeals found President Trump exceeded his authority under IEEPA by imposing broad reciprocal tariffs. The decision is stayed until Oct 14, giving the administration time to appeal to the Supreme Court.

Freight Right CEO Robert Khachatryan joins the E-commerce Coffee Break podcast to share insights on shipping large, heavy, and high-value goods internationally, avoiding hidden costs, and expanding into 45+ markets without a local presence.

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

The U.S. will impose 10% tariffs on lumber and 25% on furniture starting October 14, 2025, a move set to impact housing costs, supply chains, and trade relations.