Events in global trade fell into 3 buckets this week. The first is best described as escalation. China extended its export-controls on rare earths, technologies and production inputs, signalling a further entrenchment of supply-chain leverage. The US responded by considering export restrictions on software-embedded goods bound for China and by continuing its tariff expansion (e.g., on timber/lumber). These moves reflect a growing shift from tariffs alone to “technology-trade” and export-control levers.

The second major theme was growth and international trade. Institutions such as the WTO and IMF highlighted that while trade volumes were holding up in the near term, growth prospects were softening and the risk of protectionist fragmentation was elevated. The IMF’s advice to Asian economies to strengthen regional trade ties underscores how nations are adjusting to a more volatile trade regime.

The third group of events was around strategic alliances. Evident in Germany’s trade pivot to China, and the breakdown in US-Canada trade talks, the period saw countries responding to US tariff pressure by diversifying away from the US-centric order. For exporters (like you, in big/bulky DTC goods), this signals that sourcing, routing and market selection need to be more dynamic, and that trade-policy risk is not just about tariffs but changing trade-flows and partner dependencies.

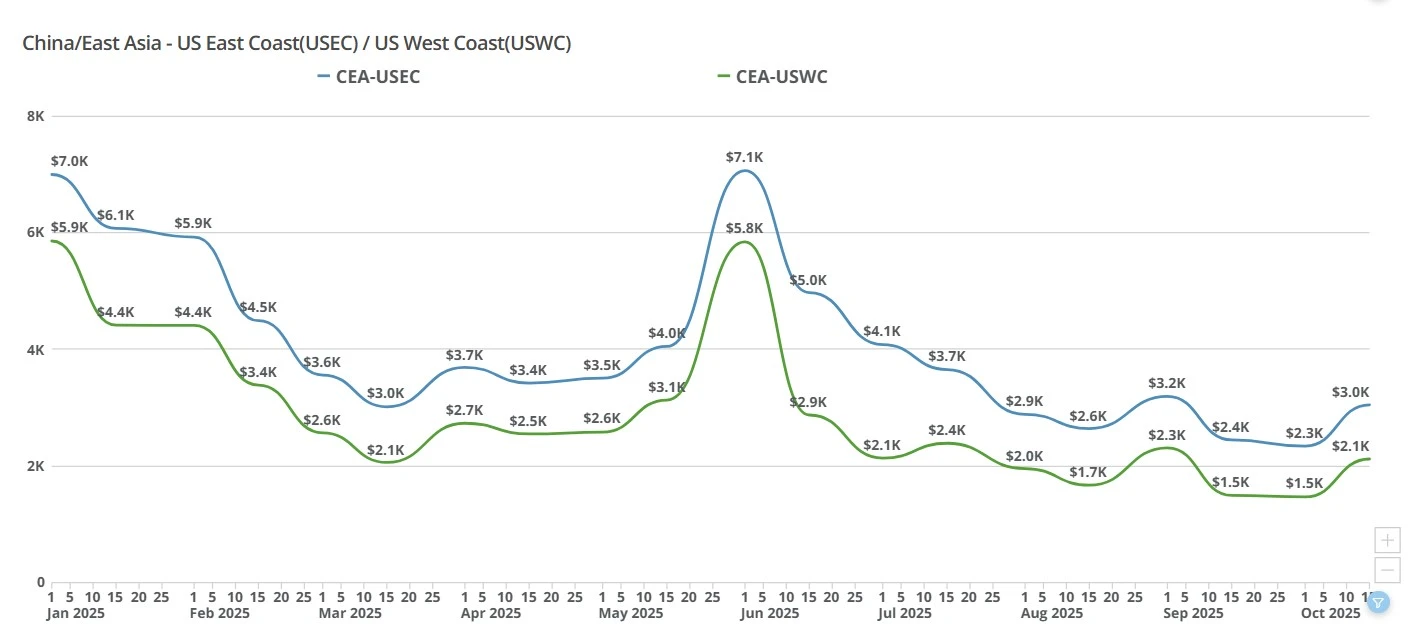

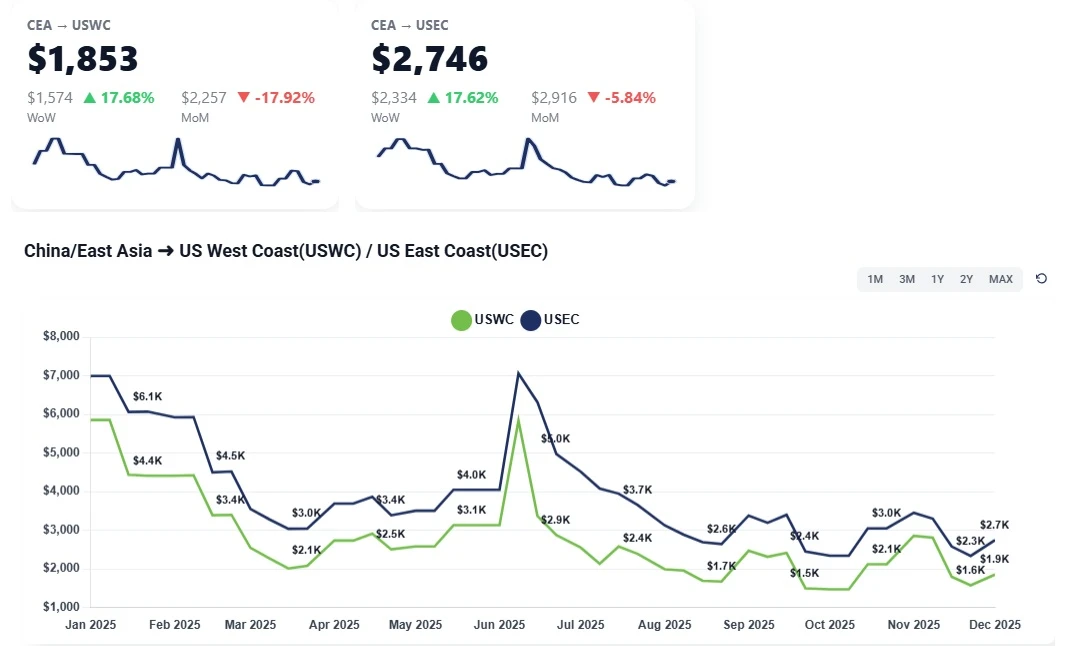

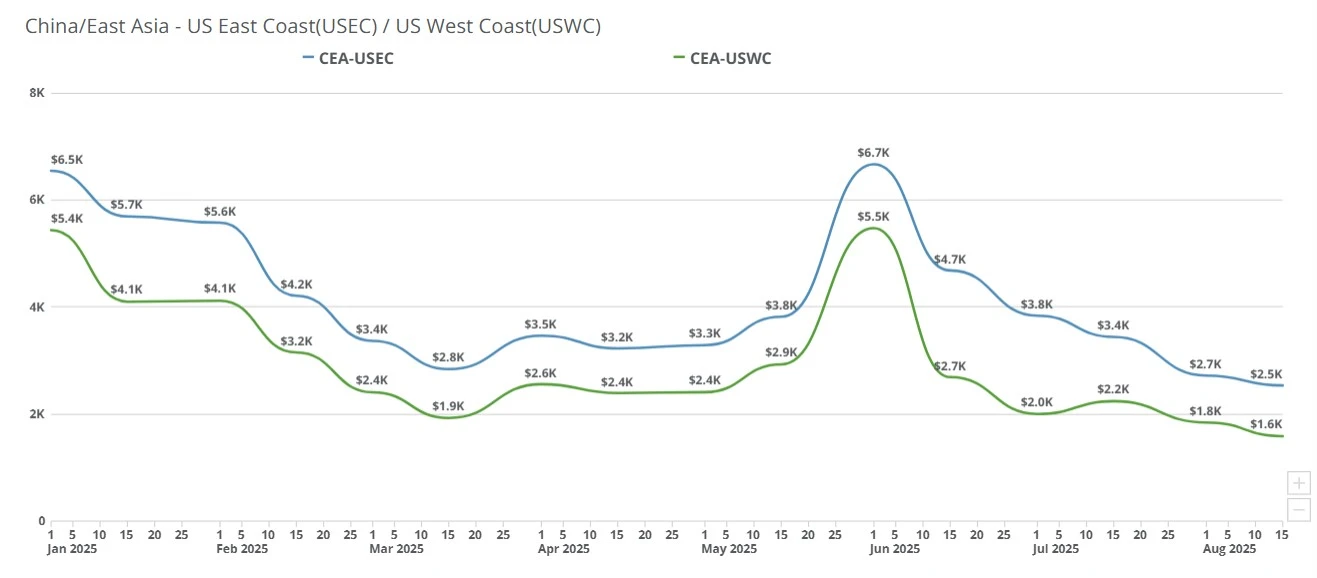

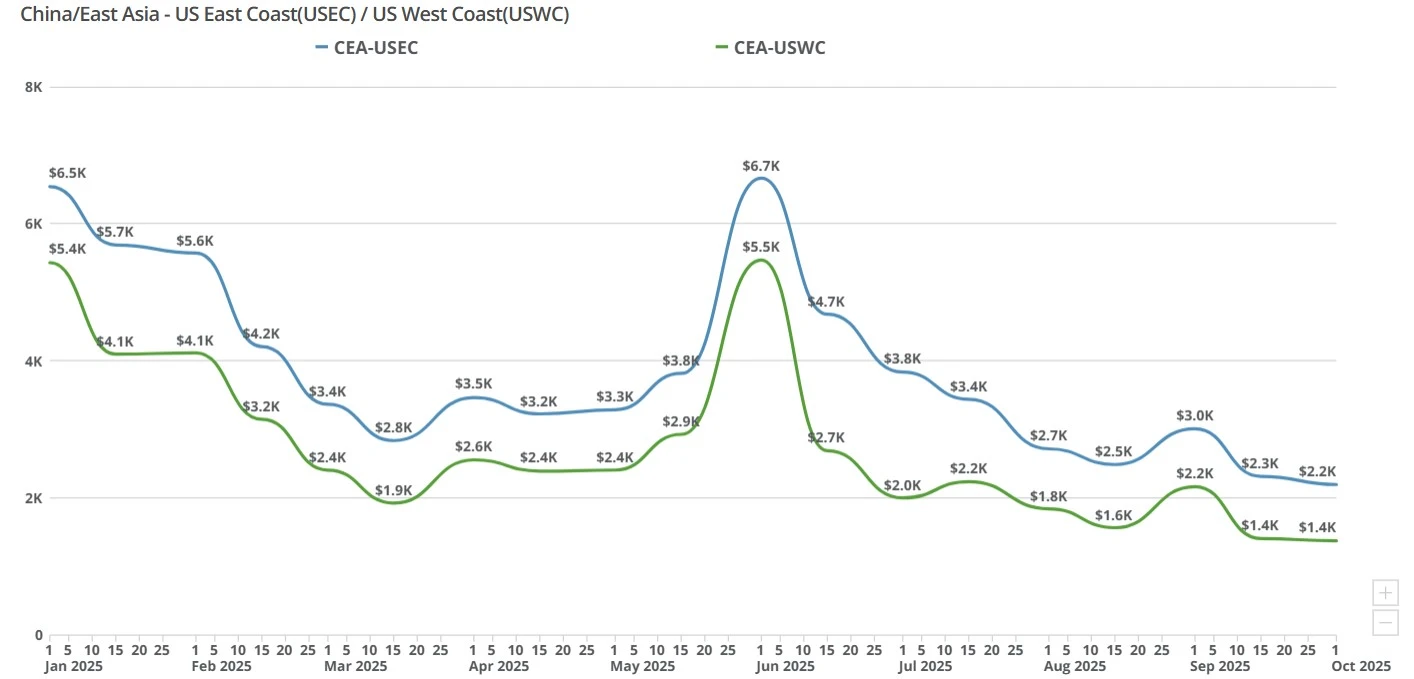

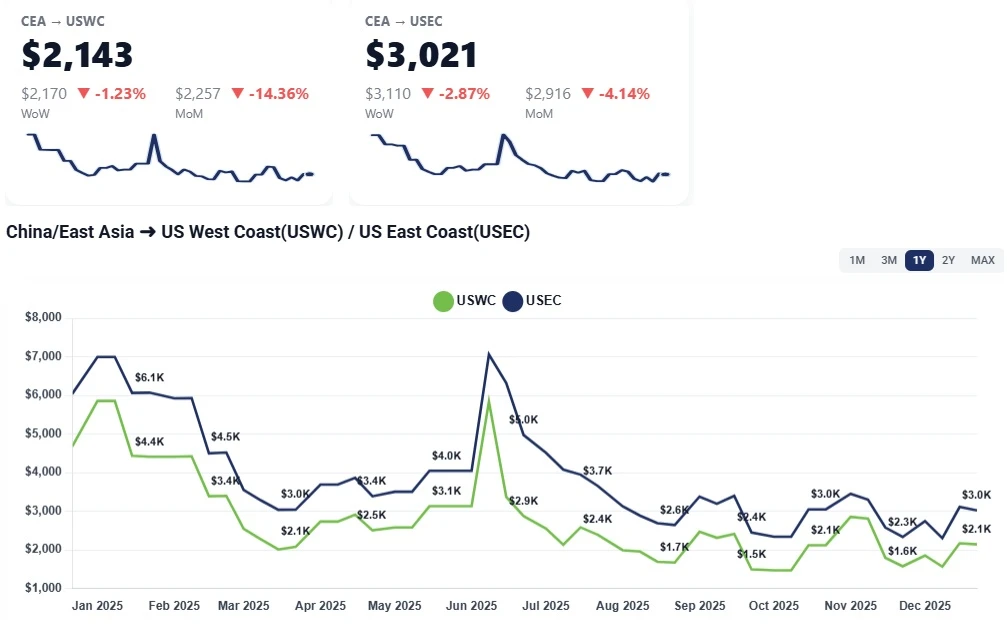

CEA to USWC (China to US West Coast): Spot climbed roughly $700–$900 w/w to about $2,000–$2,100/FEU on mid-month GRIs and acute space tightening.

CEA to USEC (China to US East Coast): Spot rose about $700–$800 w/w to roughly $3,000–$3,100/FEU, but is unlikely to hold given transit times that miss the November 1st tariff risk window.

Pre-emptive GRIs and firm carrier posture: Most carriers are "holding the line" on October hikes and floating a fresh November 1st +$800–$900/FEU increase, keeping the spot market tight despite muted booking activity.

Supply cuts via blank sailings: Our partners and team have estimated that carriers have pulled ~40–50% of rotations in some strings, creating rollovers and constraining space. The result is a classic case of artificially restricting supply.

Importer pause ahead of tariff decisions: Many shippers are waiting a week to see outcomes from high-level US–China talks; missing a favorable outcome could mean cargo landing in early November facing significantly higher duties, so some are sidelined despite higher freight costs.

Air cargo spike confirms deadline pressure: With ocean becoming costlier/tighter, CEA to US air has surged from “high-$4s/kg” to roughly $7.30/kg, reflecting a short-term rush to beat end-of-month timing.

From summer troughs to autumn firmness: Compared with late July, when FBX showed USWC ~$2.3k and USEC ~$4.1k, the current step-ups mark a swing back to carrier control, aided by reduced capacity and GRI discipline.

Over the next 2-4 weeks, we’re expecting a stop-go oscillation: carriers press another hike around November 1st, some urgent importers pay up, then bookings dip as others wait, setting up a brief fade in late November if volumes stall.

Carriers appear to be staging multiple smaller hikes (Oct, Nov, then another in January) rather than one big January jump, both to avoid regulatory scrutiny and to capture demand around pre-Lunar New Year pull-forward.

Currently, for USWC, we're seeing $1.9–2.0k now with a risk toward $2.7–3.1k if November 1st tariff sticks. For USEC, we're currently seeing around $2.85–3.0k now with a risk toward $3.8–4.1k with the same risks involved with November 1st tariffs.

Any tariff outcome shift (extension vs. escalation) or capacity add-backs could quickly reroute this path; conversely, continued blank sailings would cement higher floors through year-end.

The China-US air freight market has entered a period of acute volatility. Rates have surged above $7.50/kg, with space nearly full through early next week on most South China-US lanes. This sharp rise is driven by expectations of November tariff hikes, disruptions in ocean freight, and an influx of high-density cargo, particularly to JFK and ORD. Competition for uplift is fierce, and the scramble is expected to peak around October 29 as shippers rush to clear cargo before new duties take effect.

Tariff-driven preloading: Anticipation of additional US tariffs in November has triggered a wave of front-loaded exports. Major manufacturers, including Apple and Tesla, are pushing urgent shipments out of China to avoid the next duty cycle, consuming vast amounts of uplift capacity.

Ocean freight disruptions shifting cargo to air: A series of blank sailings in October and new port surcharges on Chinese vessels have worsened sea reliability. With lead times expanding and confidence eroding, some high-density commodities (like aluminum coils and industrial cabinets) are being diverted to air, tightening space and pushing rates higher.

Restocking pressure after the Novelis plant fire: The September 16 fire at Novelis’ New York facility, one of the largest aluminum recyclers in the US, has accelerated replacement imports. These shipments, often heavy and voluminous, are flowing into ORD and JFK, absorbing capacity and further distorting regional rate balances.

Regional capacity disparities:

JFK & ORD: Capacity nearly full through early next week. South China to JFK/ORD: $6.50–$7.50/kg; PVG to JFK/ORD: ~$6.50/kg.

LAX: Some capacity relief due to added flights, yet South China to LAX remains elevated at ~$7.00/kg, while PVG to LAX trails by $0.50–$1.00/kg.

We’re expecting that the current rate of importer activity will likely culminate just before November, as shippers race to finalize movements ahead of potential tariff changes. After that, a brief cooling could occur if tariffs are delayed or softened.

If the full set of November tariffs materializes, expect rates to remain elevated or climb further, with carriers potentially repricing above $8/kg for priority space. A partial or postponed rollout, by contrast, could trigger rate normalization toward mid-$6s/kg by mid-November.

Additionally, even if demand pauses, ocean instability, restocking demand, and pre–Lunar New Year exports suggest a high floor for air freight rates well into December. Capacity relief is unlikely until post Chinese New Year.

This week’s Big Number is $35 billion, the estimated cost to global companies of US tariffs to date.

Sourcing Journal: Red Sea Return Could Flood Europe’s Ports With Cargo: https://sourcingjournal.com/topics/logistics/red-sea-suez-canal-return-europe-port-congestion-sea-intelligence-cargo-ocean-carriers-freight-rates-israel-hamas-1234786278/

Container News: The weaponization of flag-hopping as a new trend in shipping industry: https://container-news.com/the-weaponization-of-flag-hopping-as-a-new-trend-in-shipping-industry/

Container News: Japan bets on shipbuilding revival amid China’s market dominance: https://container-news.com/japan-bets-on-shipbuilding-revival-amid-chinas-market-dominance/

Freight Right leads in LAX customs brokerage, managing over 100K tons of air cargo annually. Discover our role in LAX’s cargo efficiency and compliance.

Transpacific ocean and air rates jump as carriers pull capacity, Apple charters tighten space, and shippers rush to beat U.S. tariff deadlines

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.

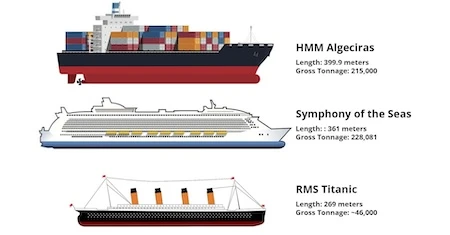

Comparing dimensions, cargo capacity, and gross tonnage of HMM Algeciras, the Titanic, and the Symphony of the Seas.

The U.S. will impose 10% tariffs on lumber and 25% on furniture starting October 14, 2025, a move set to impact housing costs, supply chains, and trade relations.

This blog explores digital air freight and how e-bookings provide a more efficient and faster way for logistics professionals to make connections.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.