The first week of February marked a pivotal moment for "Transactional Diplomacy," specifically with the de-escalation of trade hostilities between the United States and India. The US successfully used tariff leverage to pivot India away from Russian energy markets, trading a 7% reduction in reciprocal duties for expanded access to India's vast agricultural sector. Meanwhile, the European Union signaled a hardening stance against Chinese industrial overcapacity by initiating mandatory registration for specific tech-adjacent imports and drafting the "Industrial Accelerator Act." These events suggest that while the US is focusing on using tariffs to achieve geopolitical alignment, the EU is increasingly prioritizing "strategic autonomy" through local-content mandates and defensive market registration.

The ocean freight market has effectively cooled as China enters its final working week before the Lunar New Year holiday shutdown. Rates have stabilized at the lower levels established in previous weeks, with no significant movement recorded week-to-week as the shipping window for pre-holiday departures has officially closed.

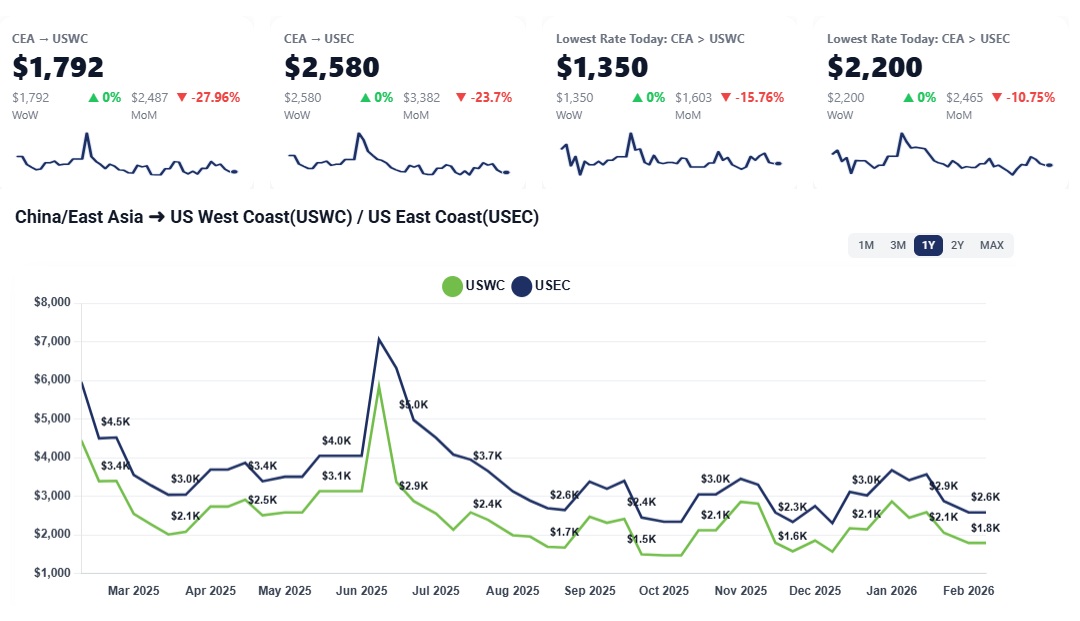

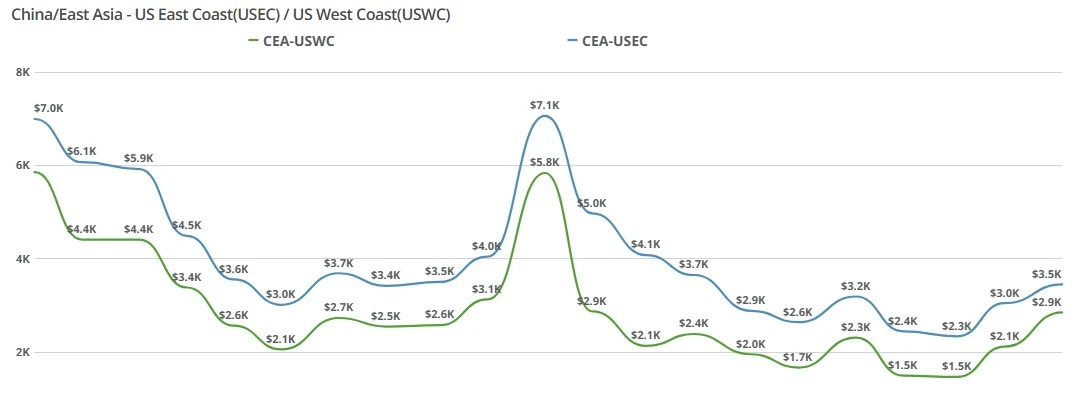

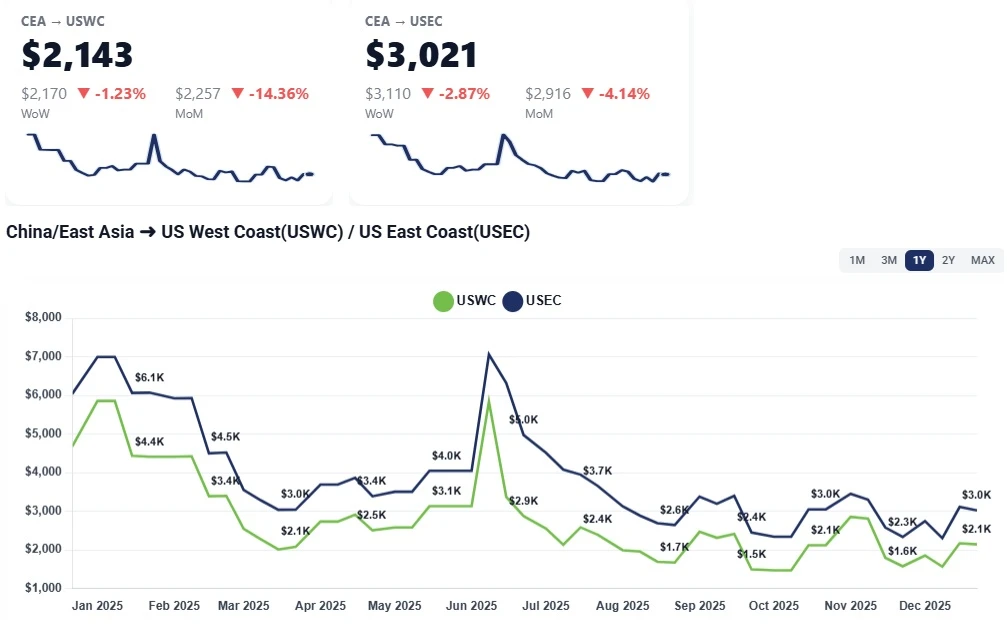

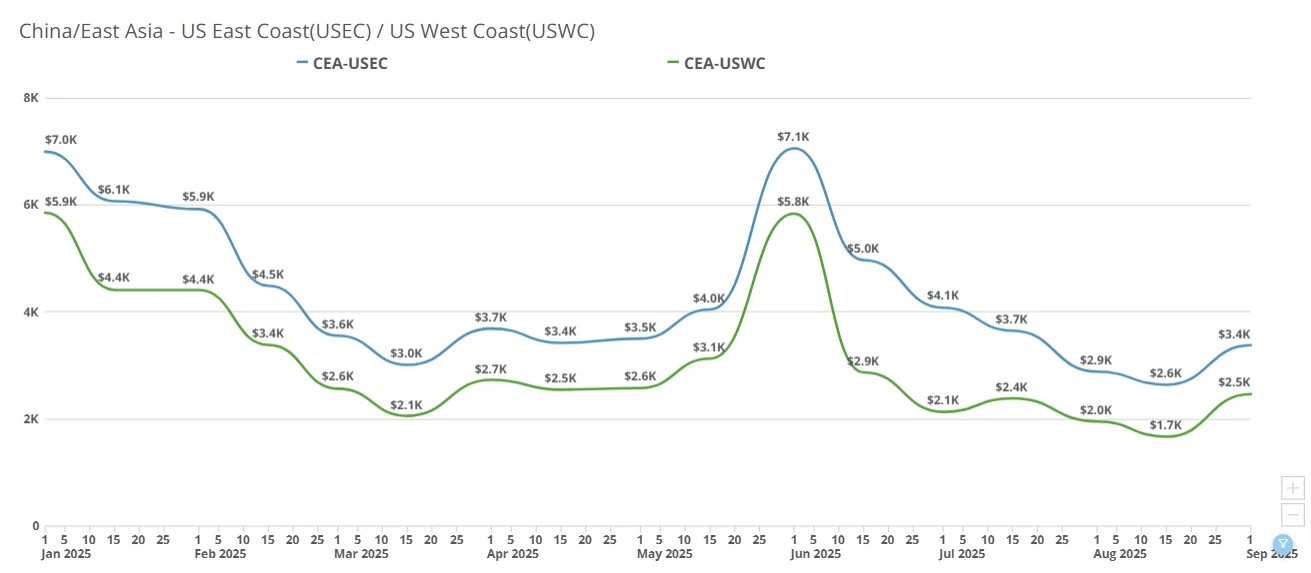

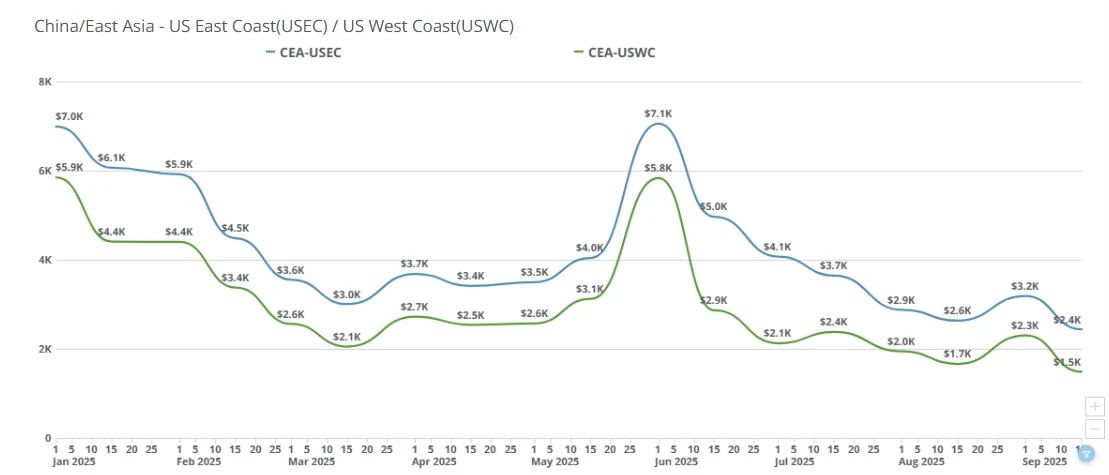

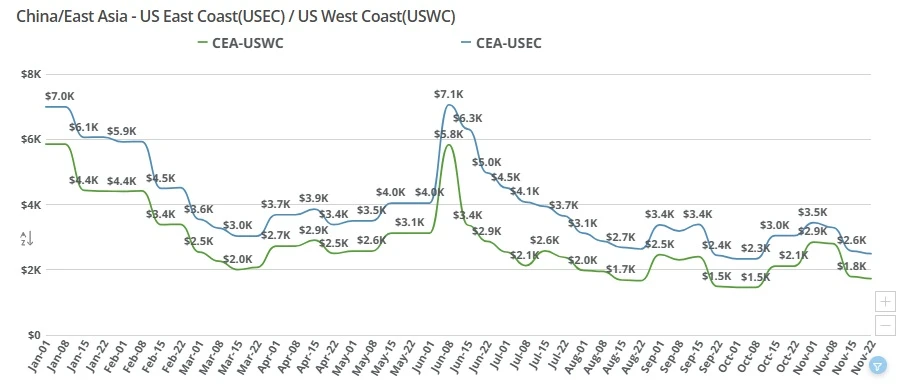

CEA to USWC: Rates remain steady and are currently holding between $1,400 and $1,600 per container. Most bookings are now quoted in the $1,450 to $1,600 range, showing total stability from the prior week.

CEA to USEC: Rates to the East Coast also show no week-over-week change, maintaining a range of $2,400 to $2,500.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Closure of the Pre-LNY Window: The window for shipping cargo to ensure departure before the Chinese New Year has passed. Any new shipments booked this week will not make it out before the holiday, leading to a natural cooldown in demand.

Origin Congestion & Trucking Spikes: While ocean rates are flat, there is significant congestion at Chinese origins. Trucking rates within China have spiked "super high" as drivers prepare for the holiday and capacity tightens for the final pre-shutdown moves.

Exhausted Booking Activity: After a period of "catching up" last week, market activity has died down. Shippers have completed their primary holiday planning, leaving very little cargo left to move in the immediate term.

Air Freight Price Adjustments: Air freight rates have shifted slightly lower as airlines look to fill any remaining space on outgoing flights. Rates are currently landing in the high $3.00 to mid-$4.00 range per kilo, with some outliers still hitting $5.00.

The market is entering a period of total dormancy. Market participants in China and Southeast Asia are shifting focus toward the holiday, with almost no interest in new business or shipping schedules for the upcoming week.

Next week is described as the "main event," during which manufacturing and logistics activity in China will effectively drop to zero. Shippers should expect an even quieter update next week, with rates likely to remain frozen at current levels until factories reopen and a post-holiday volume assessment begins.

Financial Times: There are good reasons to be cheerful about global trade

https://www.ft.com/content/55d88e6c-ae5a-4ac8-a2b6-becb3501ce9e

BBC: US to exempt some Bangladeshi clothes from tariffs

https://www.bbc.com/news/articles/c626r78g122o

Global Trade Magazine: India and US Finalize Framework for Interim Trade Agreement in 2026

https://www.globaltrademag.com/india-and-us-finalize-framework-for-interim-trade-agreement-in-2026/

Bloomberg: Trump Follows in Rebuild of Global Trading Order He’s Dismantling

https://www.bloomberg.com/news/newsletters/2026-02-09/trump-and-the-global-trading-system

CNBC: Trump’s trade war creating economic ‘mirage’ with GDP forecasts, freight market disconnected: Shipping expert

https://www.cnbc.com/2026/02/05/trump-trade-war-frontloading-creating-a-mirage-in-trade-maritime-expert.html

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Ocean freight rates from China to USWC have hit a breakeven low of $1,450 per container. As the Chinese New Year halts Asian manufacturing, explore why rates are falling, the impact of late-week bookings, and the outlook for March contract negotiation.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

What kinds of weather have the biggest impact on trucking? How should shippers plan?

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

Explore the journey from ‘Buy Now’ to your home in our China-US Ocean Freight Shipping Guide. Discover the trade, environmental impact, and future of shipping.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.