Global trade policy developments reflected a continued tension between protectionist measures and trade-liberalizing initiatives. China escalated trade frictions with the European Union by imposing provisional anti-subsidy tariffs on EU dairy products, a move widely viewed as retaliatory amid broader disputes over industrial subsidies. At the same time, several countries pursued deeper trade integration: Indonesia signed a free trade agreement with the Eurasian Economic Union, while India and New Zealand concluded a comprehensive FTA aimed at reducing tariffs and significantly expanding bilateral trade.

In the US, trade policy remained active on multiple fronts, with plans announced for future tariffs on Chinese semiconductor imports and ongoing legal challenges to existing tariff authorities underscoring domestic debate over executive power in trade matters. The European Union also extended its sanctions regime against Russia, maintaining trade and economic restrictions tied to geopolitical considerations. Overall, the period was characterized by a complex mix of escalating trade disputes, strategic use of tariffs, and renewed momentum for bilateral and regional trade agreements.

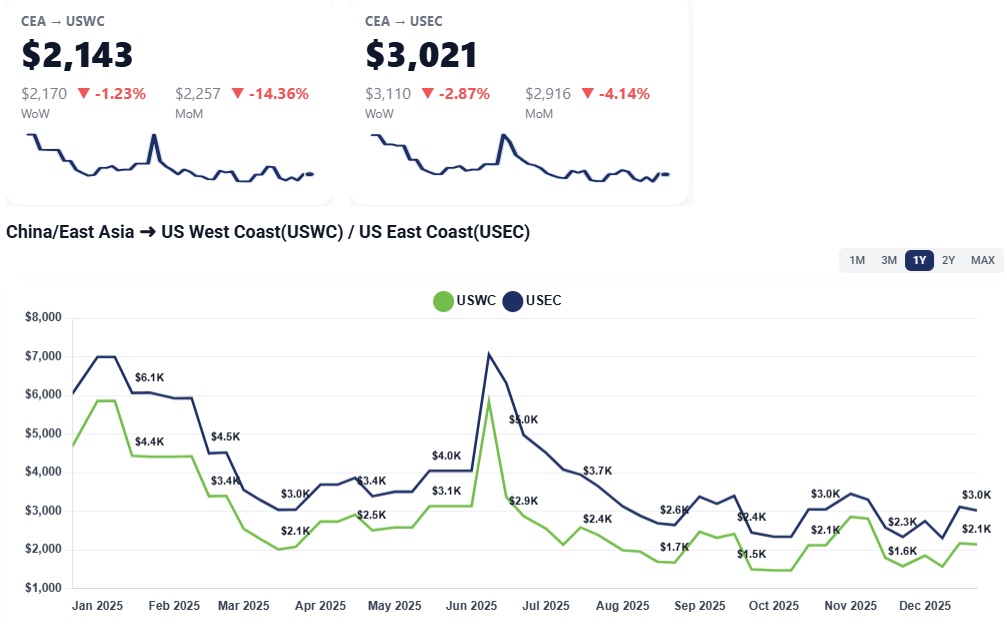

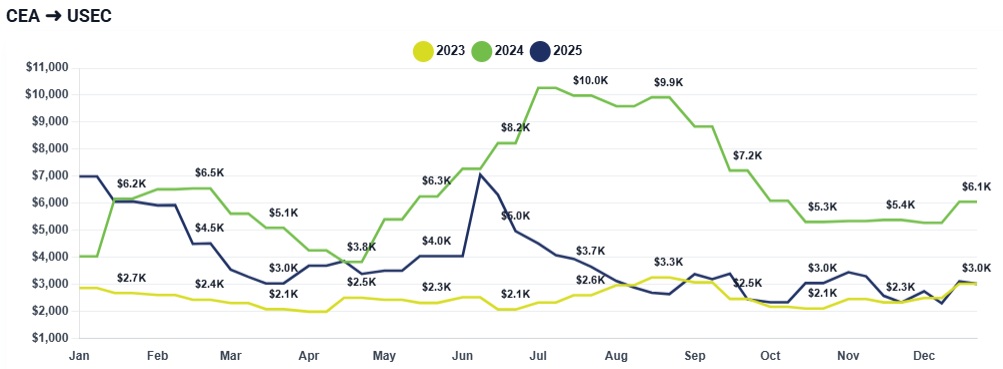

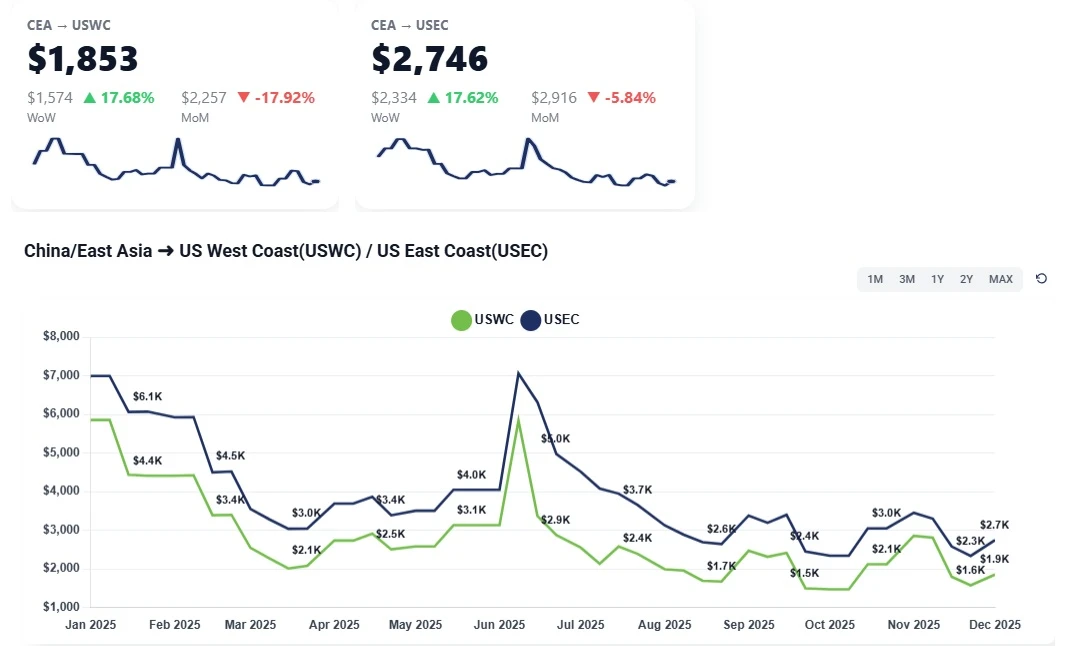

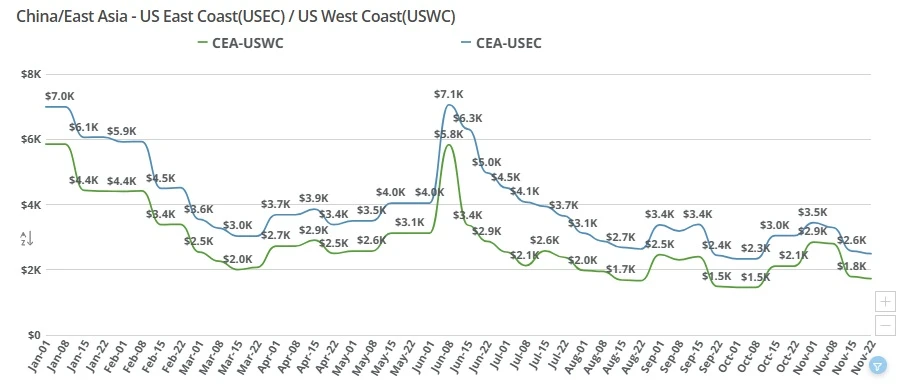

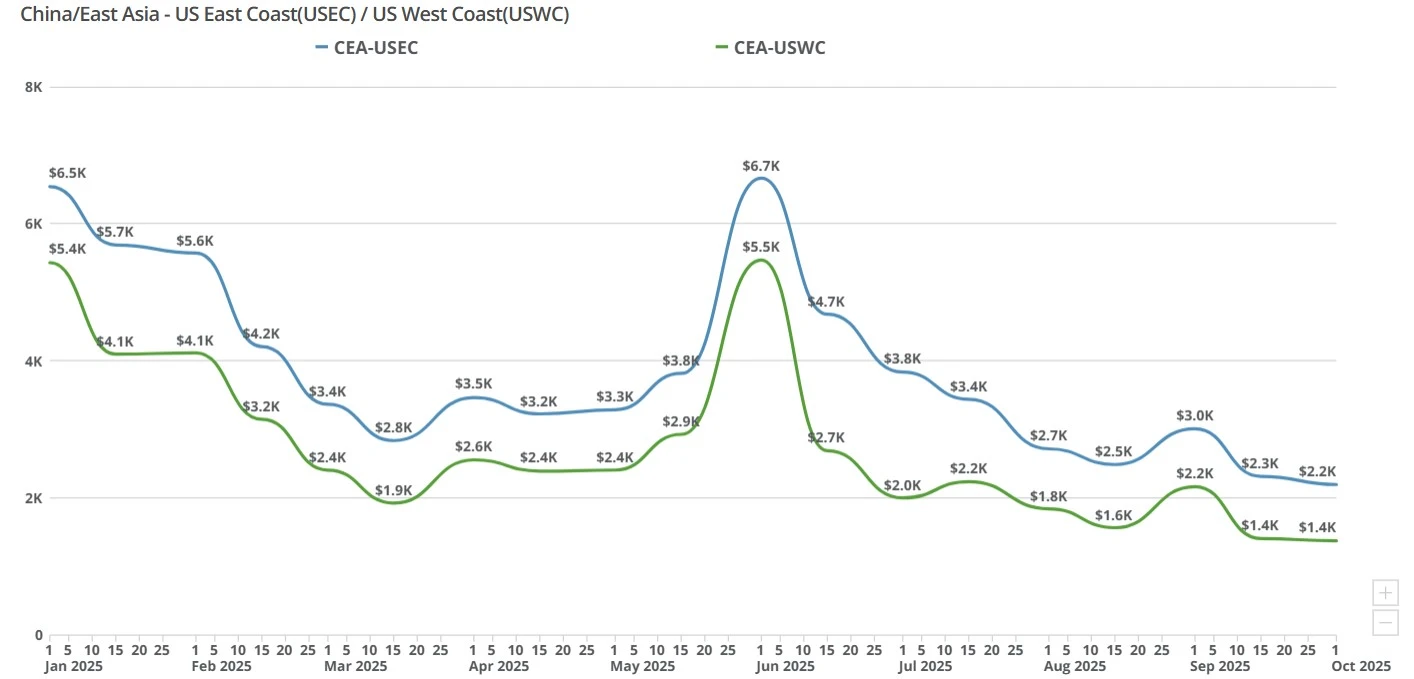

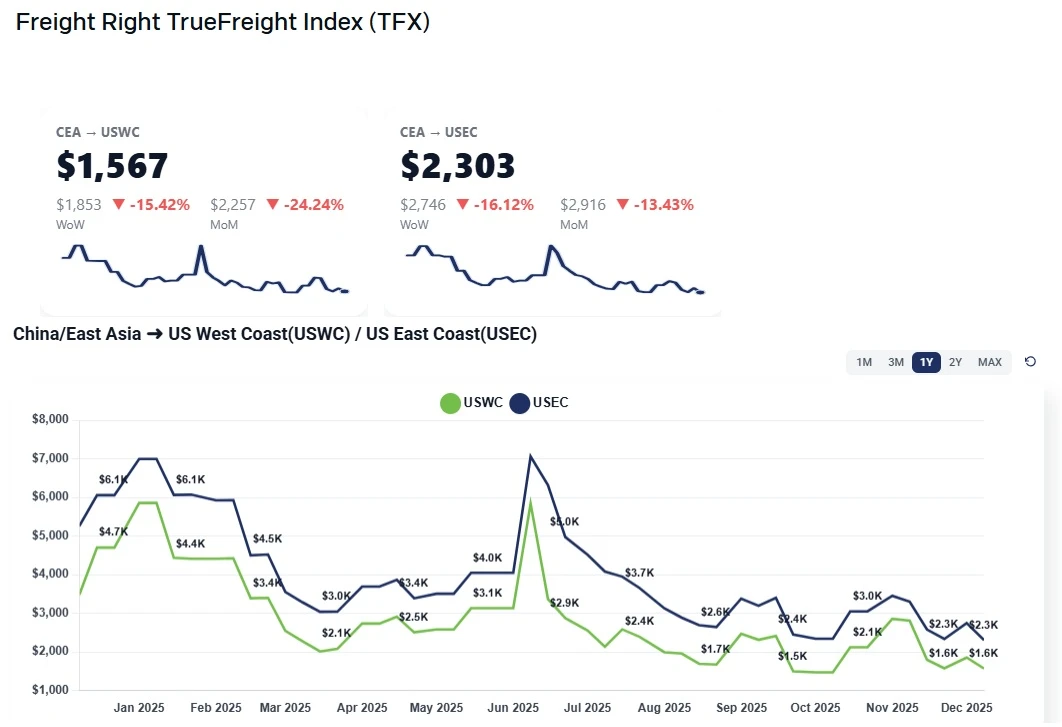

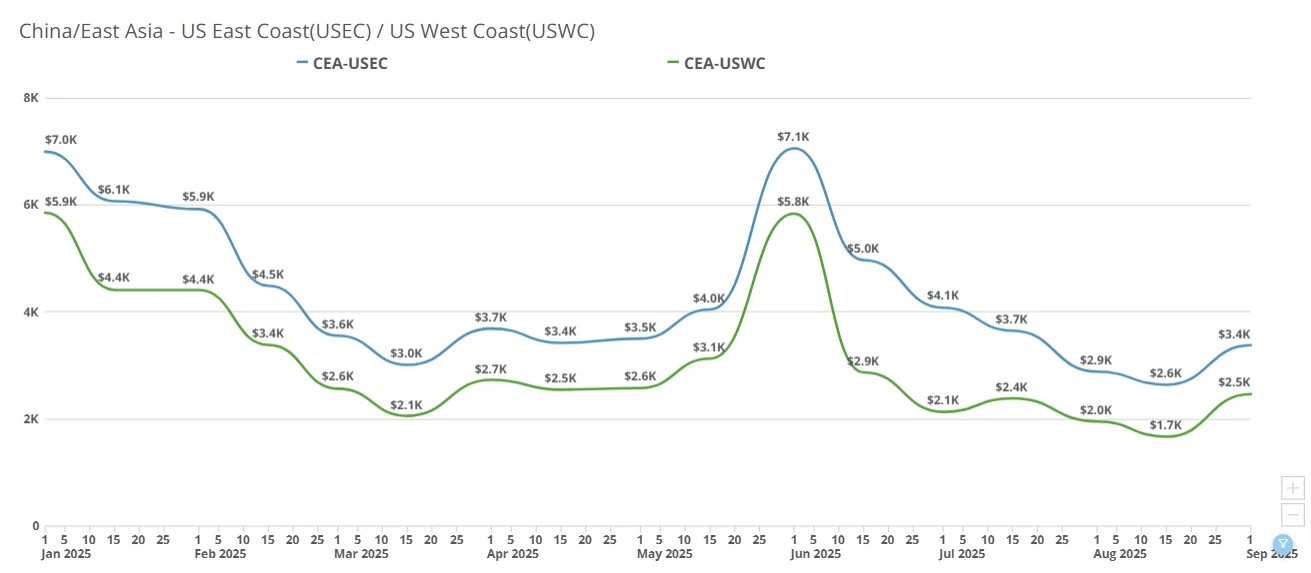

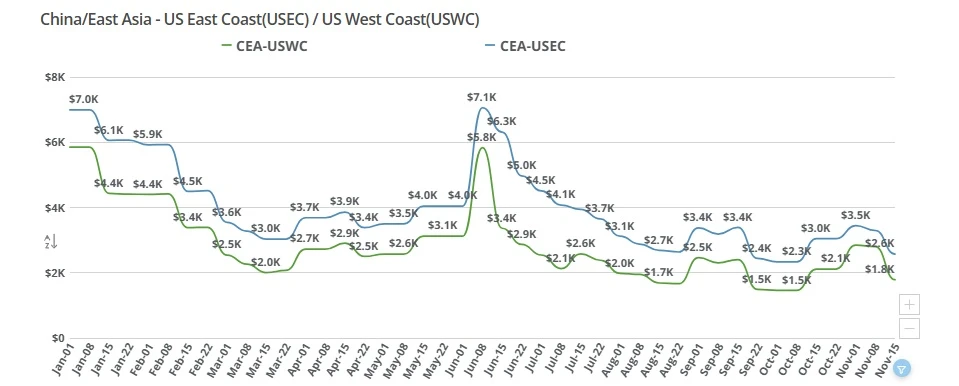

CEA to USWC (China to US West Coast): Rates were effectively flat week-over-week, holding in the $1,800–$2,000 per FEU range. With holiday shutdowns across shipper and carrier offices, there was little incentive for carriers to adjust pricing further, even as volumes dropped to near-zero levels late in the week

CEA to USEC (China to US East Coast): Similarly, East Coast rates remained steady, hovering around $2,700–$2,800 per FEU, unchanged from last week. Carriers appear content to maintain current levels through year-end rather than discount into a market with minimal demand.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Holiday-driven demand freeze: With Christmas week underway, shippers largely paused bookings. As noted in the discussion, “there’s no shipments, there’s no volume,” limiting any real market movement.

Carrier discipline despite low volumes: Even with empty pipelines, carriers avoided rate cuts. Lowering prices by several hundred dollars would not stimulate demand during the holidays, so holding firm was the rational play.

Late-December price stabilization: Small adjustments earlier in December are now done. Rates are expected to stay stable through the final sailings of the year rather than see last-minute volatility.

January GRI expectations already shaping sentiment: Market participants are focused less on this quiet week and more on January 1–2 GRIs, widely expected to be announced around $1,000, even if partially rolled back shortly after.

The calm seen this week is unlikely to last. January shipments are expected to be meaningfully more expensive, with carriers targeting higher spot levels early in the month before Chinese New Year approaches. While some post-GRI mitigation is likely, the broader strategy appears to be holding rates firm into contract season in March-April, supported by seasonality and carrier pricing discipline. Space is not expected to be a constraint, but price pressure will be front and center as 2026 begins

Reuters: US plans to impose tariffs on Chinese chips in mid-2027, USTR says

https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/

The New York Times: Businesses in Canada Navigate Trump’s Tariffs During the Busy Holiday Season

https://www.nytimes.com/2025/12/23/world/canada/canada-trump-tariffs-christmas.html

Reuters: Indonesia eyes US tariff deal signing in January, says all issues settled

https://www.reuters.com/world/asia-pacific/indonesia-chief-tariff-negotiator-says-all-substantial-issues-settled-with-us-2025-12-23/

Global Trade Magazine: US Threatens European Tech Firms in Trade Dispute Over EU Regulations

https://www.globaltrademag.com/us-threatens-european-tech-firms-in-trade-dispute-over-eu-regulations/

ABC News: India accelerates free trade agreements to counter US tariffs and expand exports

https://abcnews.go.com/Business/wireStory/india-accelerates-free-trade-agreements-counter-us-tariffs-128510341

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

The White House has announced new tariffs on branded pharmaceuticals and launched national security probes into medical equipment and robotics. Learn what’s changing, how hospitals and manufacturers could be affected, and where to track historical HS/HTS.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

China-US ocean freight rates continue to decline, with the East Coast premium narrowing as carriers compete for limited volume. Get the key market drivers and outlook in this week’s update.