In this week, the global trade landscape saw both escalation and de-escalation dynamics. On one hand, tensions rose sharply: U.S. moves against Colombia, Canada (via the advertisement row) and China (rare-earth provision threat) signalled an aggressive use of tariffs as geopolitical weapons.

On the other hand, there were signs of diplomatic softening: the U.S. and China reaching a framework agreement, and the U.S.’ outreach to Southeast Asian trade partners, suggest a parallel drive toward managed trade-liberalisation under new conditions.

Importantly for you as a U.S. exporter of bulky goods, these mixed signals mean that while tariff risk remains elevated, there may also be opening windows for favourable deals or supply-chain shifts, especially in Southeast Asia or in sectors like rare earths and critical minerals.

On the U.S.-China front, a meeting between Trump and Xi produced a tactical de-escalation: suspension of shipping-port fees and a rollback of certain tariffs, which helped ease pressure on China’s manufacturing sector (though signs of contraction persist). Legal analysis flagged the unprecedented nature of the U.S. administration’s emergency-tariff powers, and many businesses are assessing contract risk in this unsettled environment.

The main points of the deal include:

The U.S. will reduce its average tariff on Chinese goods from ~57 % to ~47%.

Specifically, the U.S. will cut the “fentanyl-related” tariff component from 20 % to 10%.

China will pause for one year its new export‐controls on rare earth minerals (the controls announced in early October) and review/refine their implementation.

The U.S. will suspend for one year its new rule (announced earlier) regarding export restrictions on entities 50 %-owned by black-listed firms (i.e., delaying that technology export tightening).

Both sides will suspend “tit-for-tat” port/ship fees (via U.S. Section 301 action against China’s ship-/maritime industry and China’s countermeasures) for 12 months.

China made commitments relating to large‐scale U.S. agricultural purchases (for example: soybeans) in the near term.

China committed to cooperate more intensively with the U.S. on controlling fentanyl precursor flows.

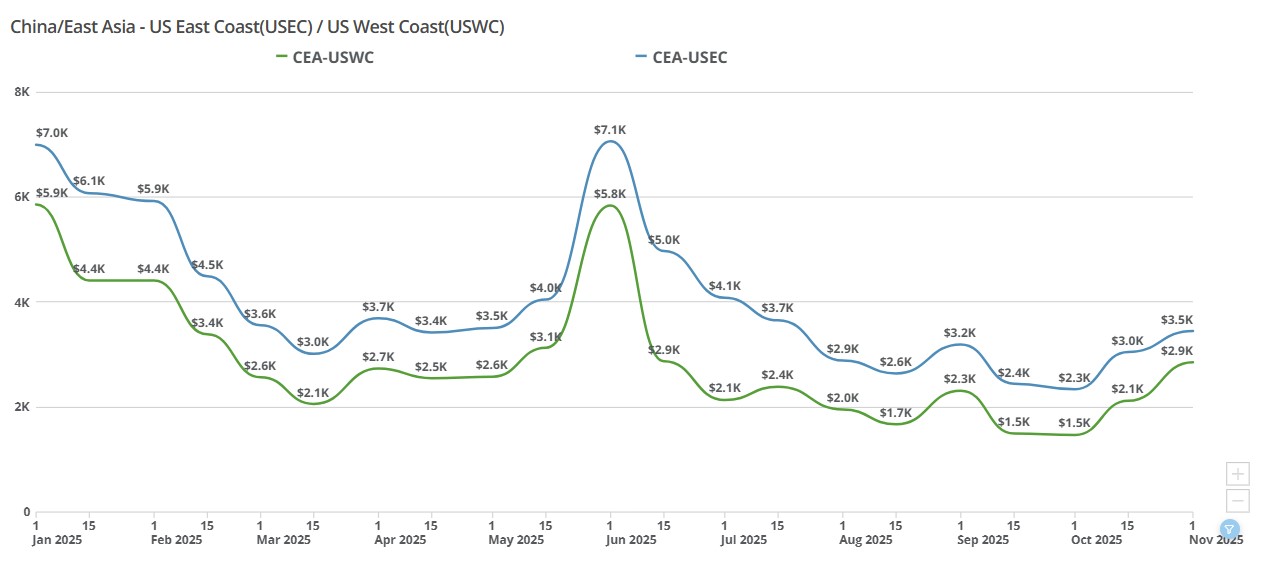

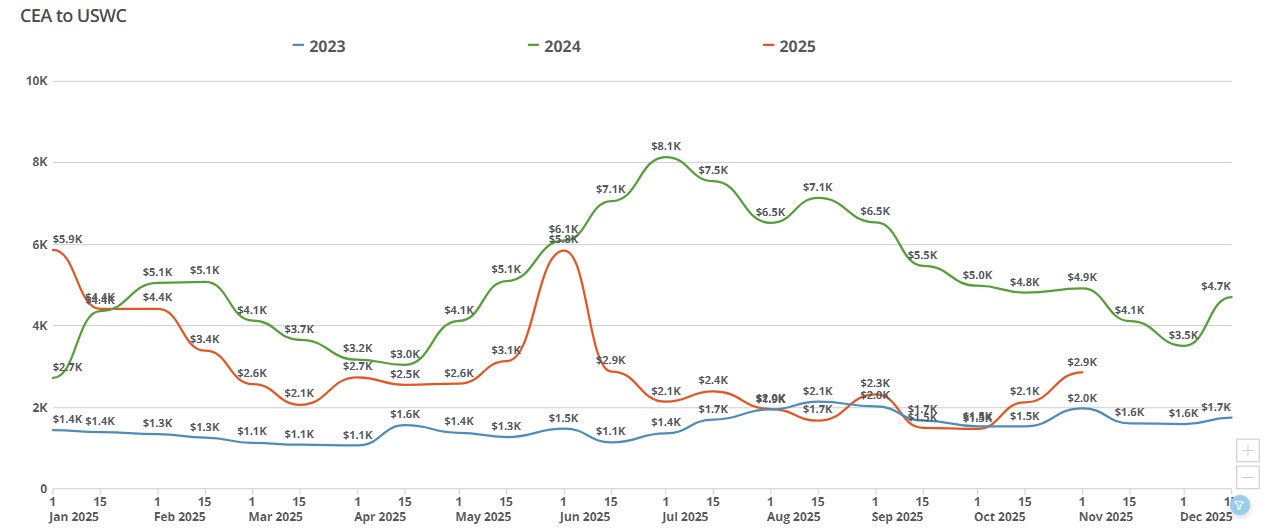

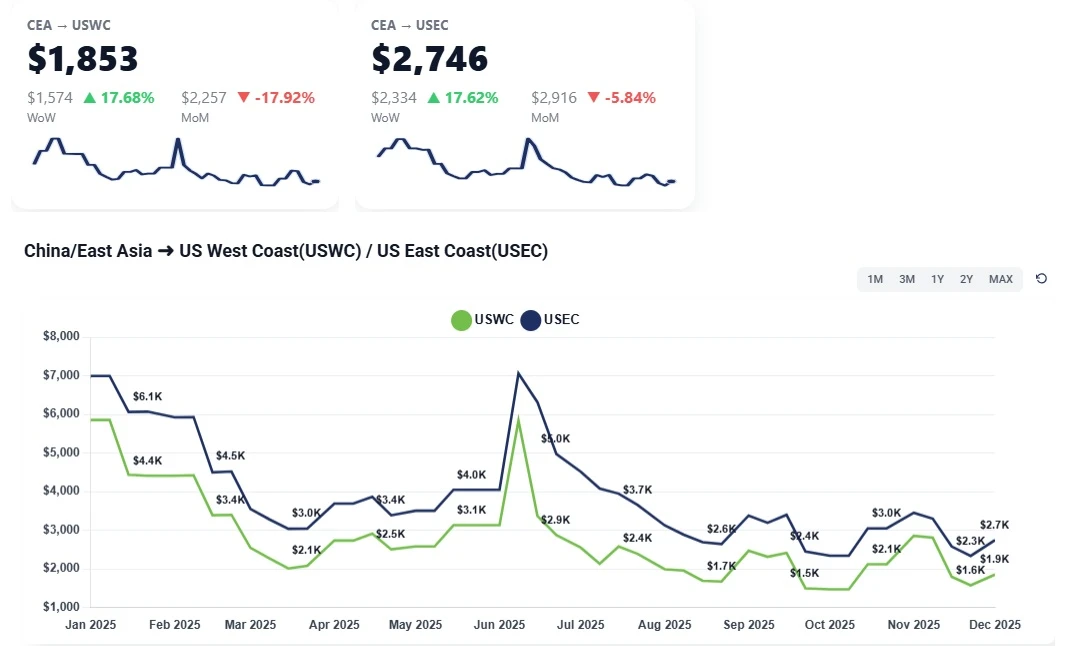

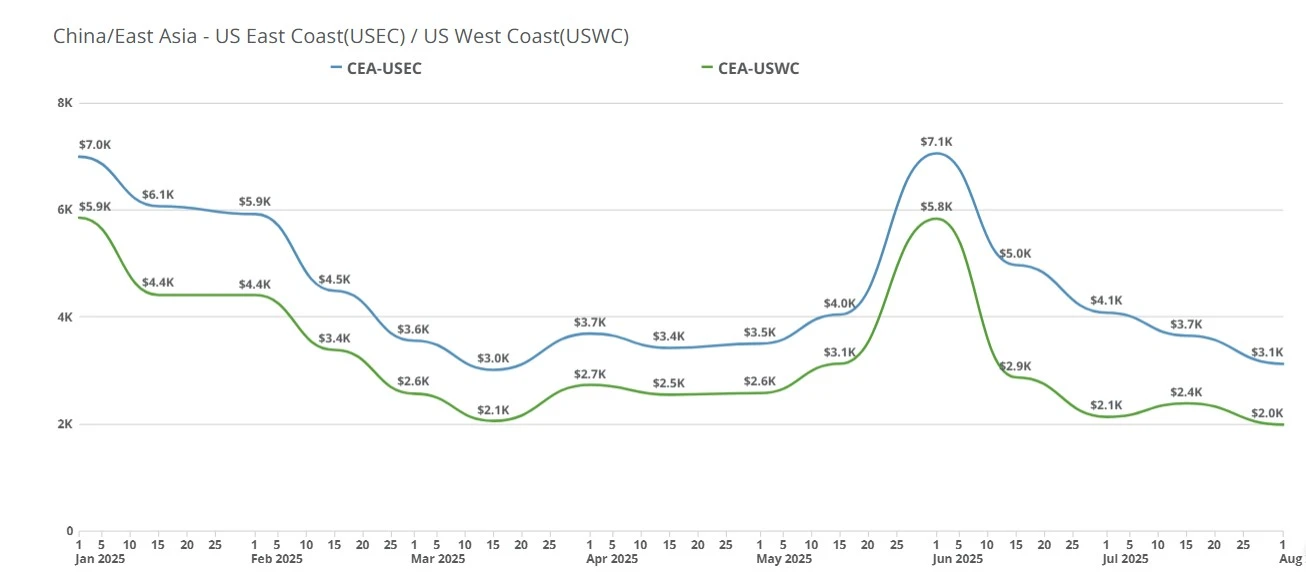

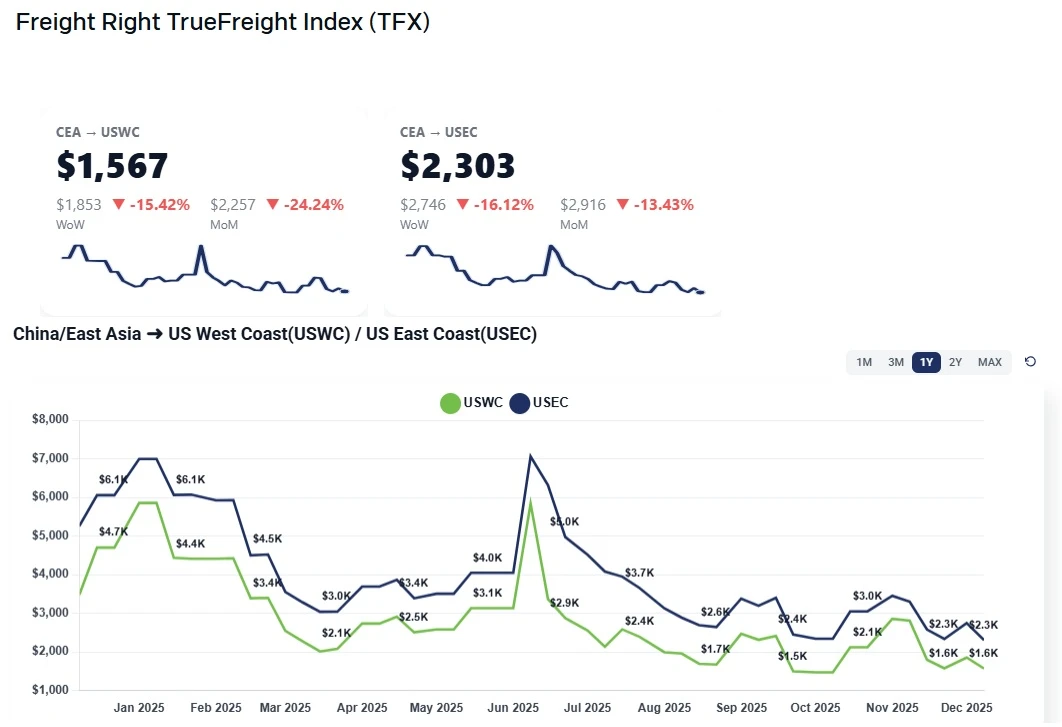

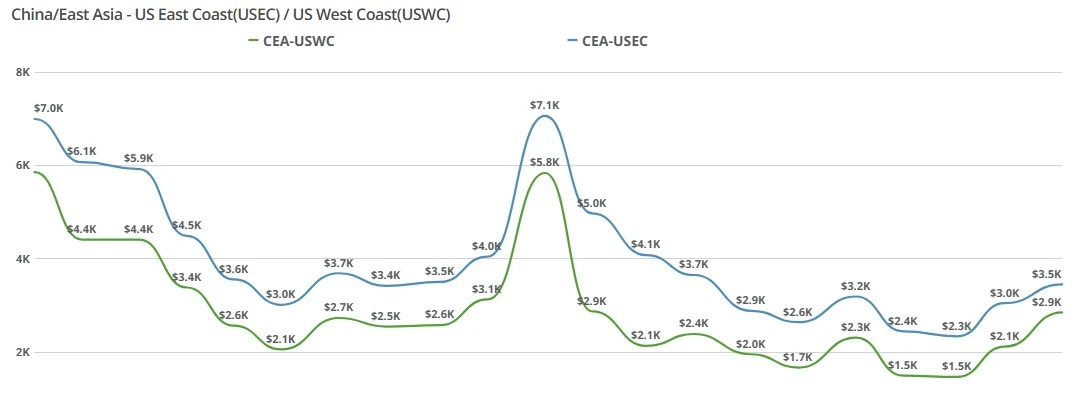

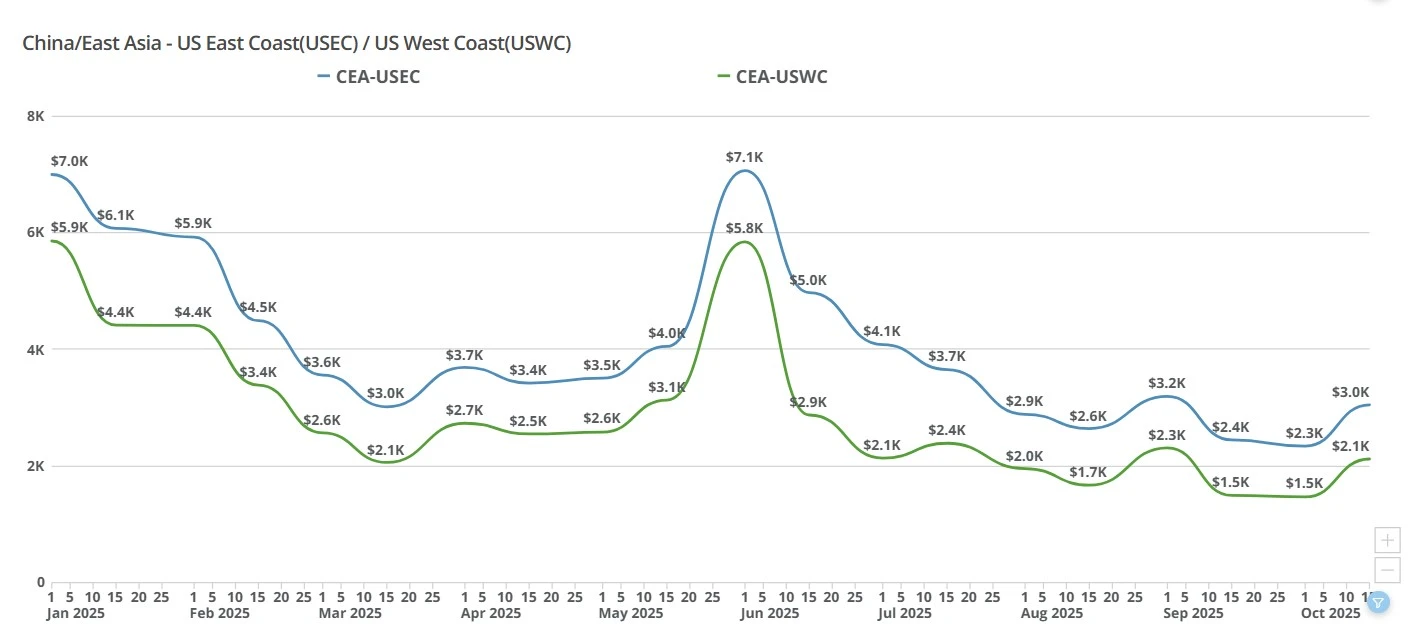

CEA to USWC (China to U.S. West Coast): Spot levels held roughly flat to slightly softer week-over-week, hovering around $2,000/FEU (some carriers briefly $50–$100 below last week via promos). A General Rate Increase (GRI) set for November 1 is widely flagged to lift USWC to ~$3,000/FEU.

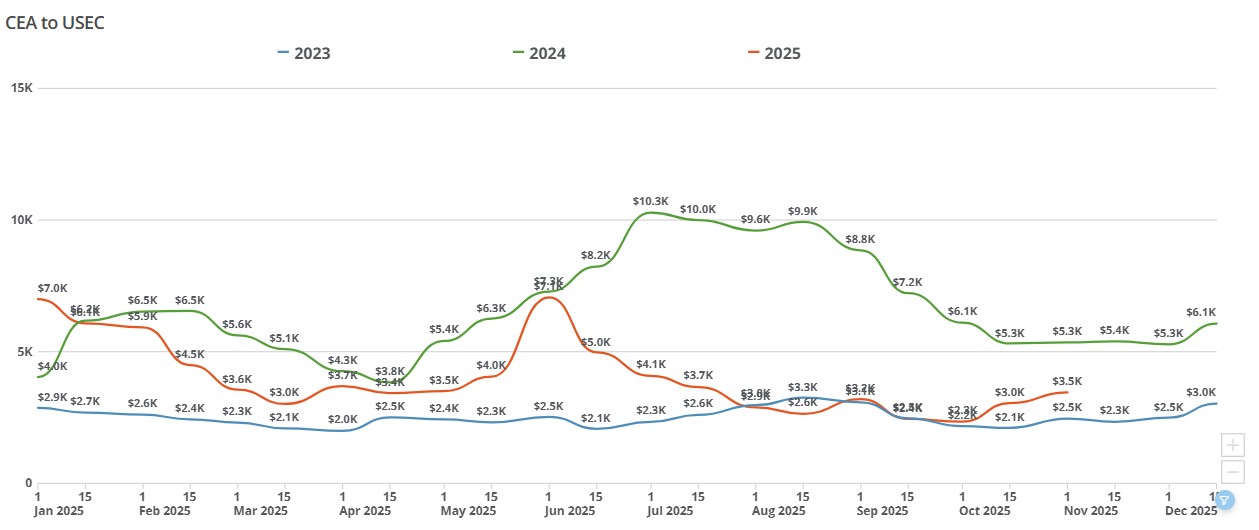

CEA to USEC (China to U.S. East Coast): Current spot indications are $2,900–$3,000/FEU, broadly unchanged on the week. The same Nov 1 GRI is expected to bring USEC to ~$4,000/FEU.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Tariff overhang eased: Market participants now expect the threatened 100% tariff will not go into effect; U.S.-China talks appear to be tracking toward a deal. That clarity removed last week’s panic inquiries and kept bookings on a normal cadence.

GRI timing, not demand, is the lever: Multiple agents confirm a Nov 1 GRI, with guidance of a $900–$1,000/FEU uplift; carriers’ tactical promos created a minor $50–$100 w/w dip ahead of the hike.

Peak-season already landed: Holiday inventory for most importers arrived by late September, leaving only top-up orders now. Seasonal demand is one of the lowest periods of the year, limiting any rate upside before the GRI.

Competitive carrier behavior: The small w/w softening isn’t a structural drop; it’s select carriers jockeying for volume ahead of the GRI, not a broad market reduction.

Structural backdrop remains soft: Since summer, spot rates normalized to the low-$2Ks (USWC) and sub-$4K (USEC) as post-spring front-loading faded and capacity adjustments stabilized pricing.

Early November step-up: Barring a last-minute change, expect USWC ~ $3,000/FEU and USEC ~ $4,000/FEU prints from Nov 1, primarily GRI-driven rather than demand-led. Book sensitive cargo accordingly and watch for short-window pre-GRI roll risks.

Through November and December, after the expected GRI, we're expecting rates to soften or plateau into late November/December as seasonal volumes remain light and most holiday stock is already stateside. Opportunistic back-to-back promos are possible if liftings underperform.

That said, as with ever, policy decisions can influence markets at a moment's notice. Even with a potential U.S.-China accord, a 20–30% tariff baseline is the working assumption. That implies stability over shock, with rate action more a function of carrier GRIs/blankings than sudden demand surges.

Following the announcement that Chinese and U.S. trade delegates reached a preliminary framework agreement in Kuala Lumpur, optimism is building that the planned 100% tariffs will not take effect on November 1st. While this has reduced panic booking from B2B shippers, overall capacity remains tight, particularly on lanes to JFK and ORD due to sustained e-commerce demand and ongoing restocking by key industrial buyers.

China → JFK / ORD: $7.00 – $7.50 per kg

China → LAX: ~$6.50 per kg

Although rates have stabilized from last week’s highs, they remain elevated compared to historical norms. Any sustained pricing above $7.00/kg could begin to deter rate-sensitive e-commerce and B2B volumes in the coming weeks.

Trade Policy Relief: Market sentiment improved after signs of a trade truce between the U.S. and China, easing fears of 100% tariffs and slowing last-minute bookings from traditional shippers.

E-Commerce Surge: Black Friday preparations by major online platforms continue to absorb significant capacity, especially into JFK and ORD.

Restocking Cycles: Ongoing industrial restocking—most notably by Novelis—has tightened air space on metal and manufacturing-related commodities.

High-Value Electronics: Apple and other consumer tech brands are securing dedicated lift for peak holiday demand, maintaining pressure on available bellyhold and freighter capacity.

Selective Pullback: Elevated costs have begun pricing out lower-margin goods, with some shippers delaying or shifting to ocean despite persistent reliability concerns.

The next week will hinge on confirmation of the tariff suspension. If finalized, the market could see a short-term easing in rates as speculative bookings unwind and traditional B2B demand stabilizes. However, with e-commerce and high-value tech shipments dominating capacity into mid-November, space to major U.S. gateways, especially JFK and ORD, will likely remain constrained.

Should rates hold above the $7.00/kg threshold, airlines may need to recalibrate pricing to sustain volume once the holiday surge fades. Conversely, if tariff optimism solidifies and post–Black Friday demand cools, a gradual softening toward mid-$6 levels by mid-November appears plausible.

gCaptain: What Did Trump, Xi Agree to on Tariffs, Export Controls and Fentanyl?: https://gcaptain.com/what-did-trump-xi-agree-to-on-tariffs-export-controls-and-fentanyl/

Reuters: Trump shaves China tariffs in deal with Xi on fentanyl, rare earths: https://www.reuters.com/world/china/looming-trump-xi-meeting-revives-hope-us-china-trade-truce-2025-10-29/

The Guardian: US Senate passes bill with Republican support to block Trump tariffs on Brazil: https://www.theguardian.com/us-news/2025/oct/28/us-senate-trump-tariffs-brazil

Reuters: Trump's Colombia tariffs would flip US policy on drugs, trade: https://www.reuters.com/world/us/trumps-colombia-tariffs-would-flip-us-policy-drugs-trade-2025-10-21/

The Times of India: China warned against unilateral “law of the jungle” trade behaviour ahead of the Xi-Trump meeting, indicating Beijing’s unease with the direction of U.S. trade policy. https://timesofindia.indiatimes.com/business/international-business/tariff-row-china-warns-against-law-of-jungle-ahead-of-trumpxi-meet-wants-free-trade-system/articleshow/124861629.cms

China-US air freight rates spike above $7.50/kg amid tariff fears and tight capacity to JFK, ORD, and LAX.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

The Trump administration re-issued reciprocal tariffs to global trading partners August 1st, transpacific rates nearing 2024 lows, carriers at or approaching the lowest rates we're likely to see for the forseeable future & more.

Explore how the 2025 U.S.-U.K. Economic Prosperity Deal reshapes tariffs, boosts exports, and opens new opportunities for automotive, aerospace, and metals trade.

Trump’s latest trade deal with China and South Korea cuts tariffs, boosts U.S. exports, and deepens security and economic cooperation.

The Trade Deal signed between the two governments has become subject to much discussion as critics say that it's vague and doesn't address the actual problems.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

Transpacific ocean and air rates jump as carriers pull capacity, Apple charters tighten space, and shippers rush to beat U.S. tariff deadlines