Global trade policy during this period was marked by selective easing of tariffs among strategic partners alongside continuing structural uncertainty created by earlier broad U.S. tariff measures. The United States extended tariff exclusions for key Chinese industrial and medical products, signaling a tactical pause in tensions with Beijing. Washington simultaneously advanced targeted liberalization with allies: the U.S. confirmed reduced tariff rates on South Korean autos and industrial components, and it reached a three-year zero-tariff agreement with the United Kingdom covering pharmaceuticals and medical technologies.

Meanwhile, India accelerated its pursuit of new free-trade agreements with the U.S., EU, and Canada as part of its strategy to mitigate global volatility. Commentary published during the week underscored how the U.S.’s sweeping “reciprocal tariff” framework continues to reshape global trade flows, reinforcing an environment where countries balance protectionist pressures with selective bilateral cooperation to secure critical supply chains.

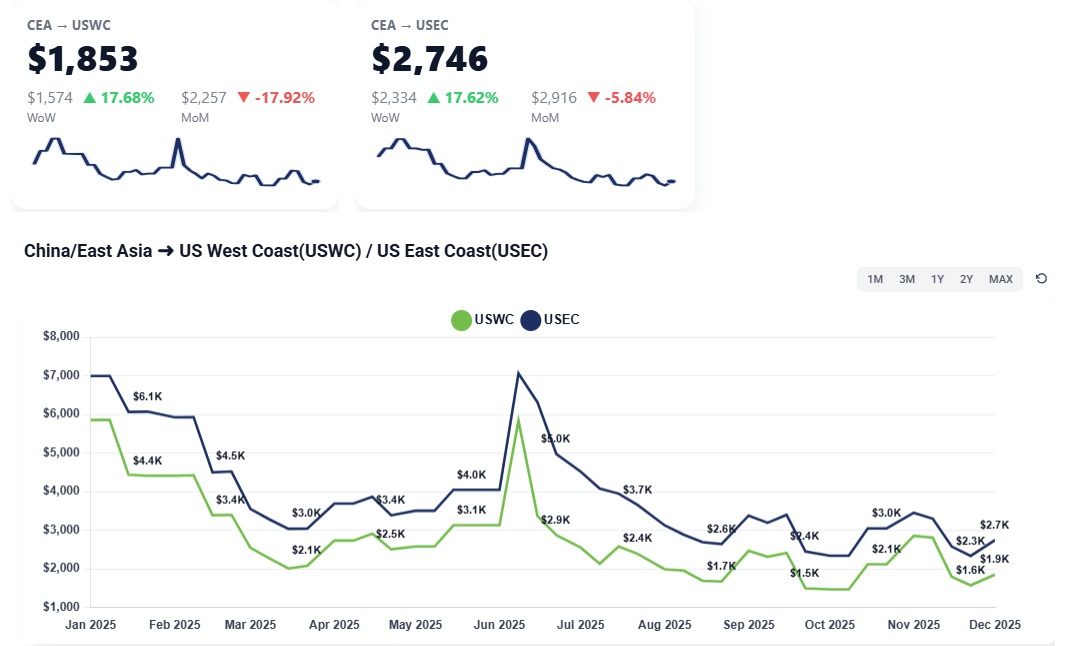

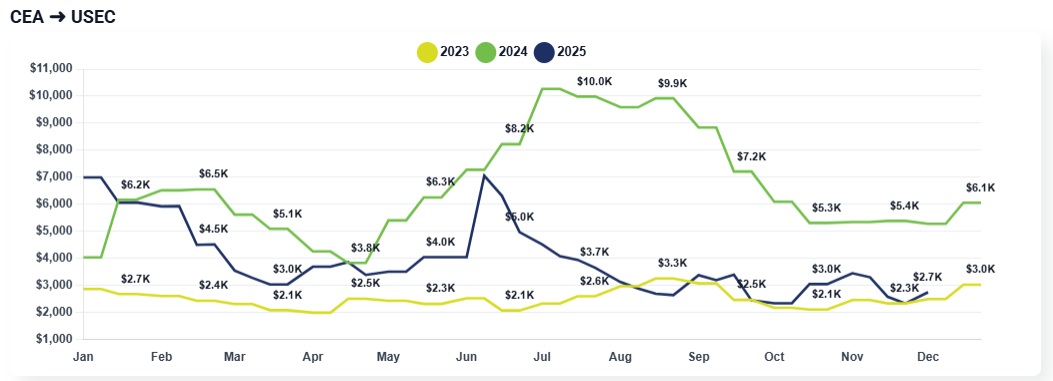

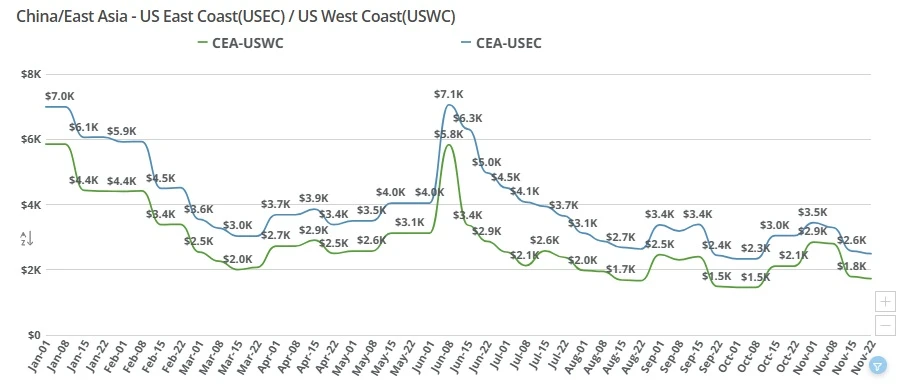

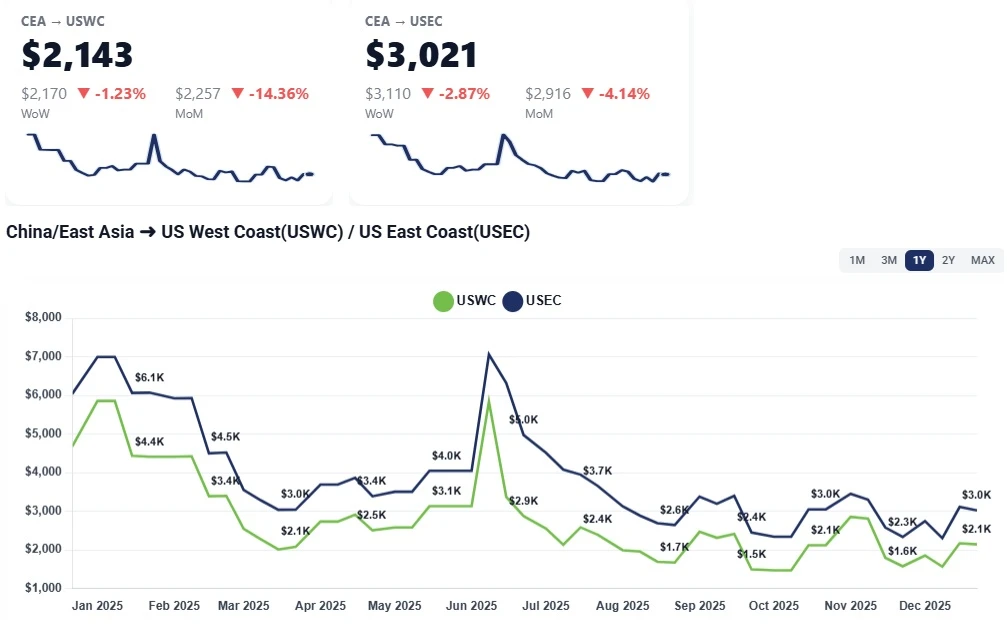

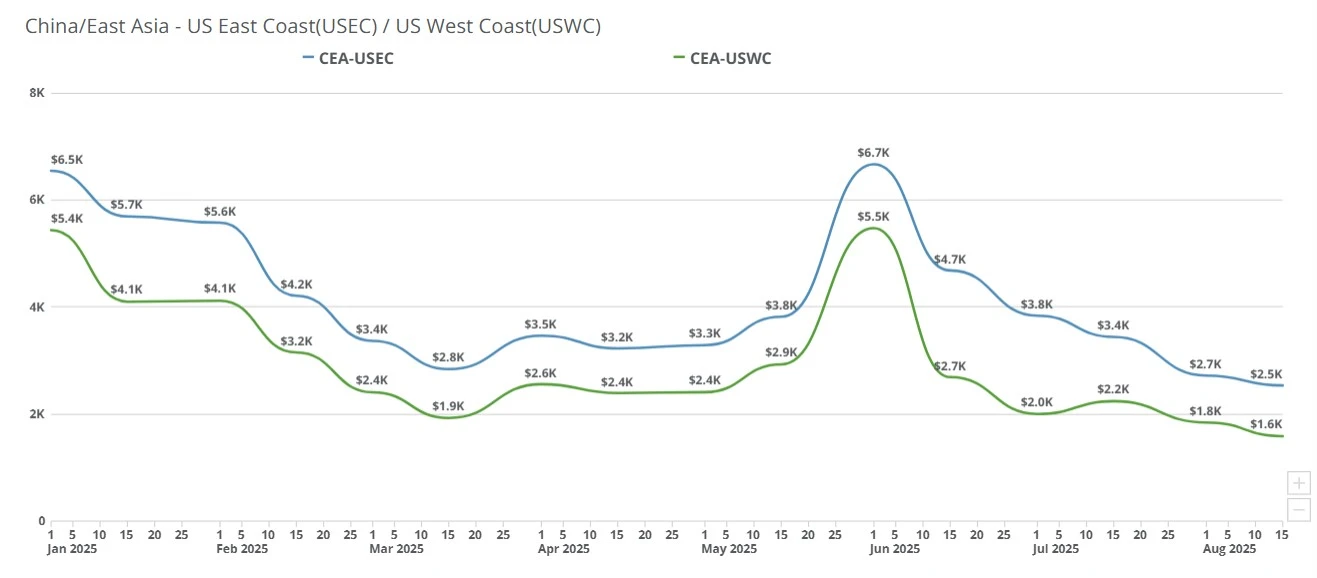

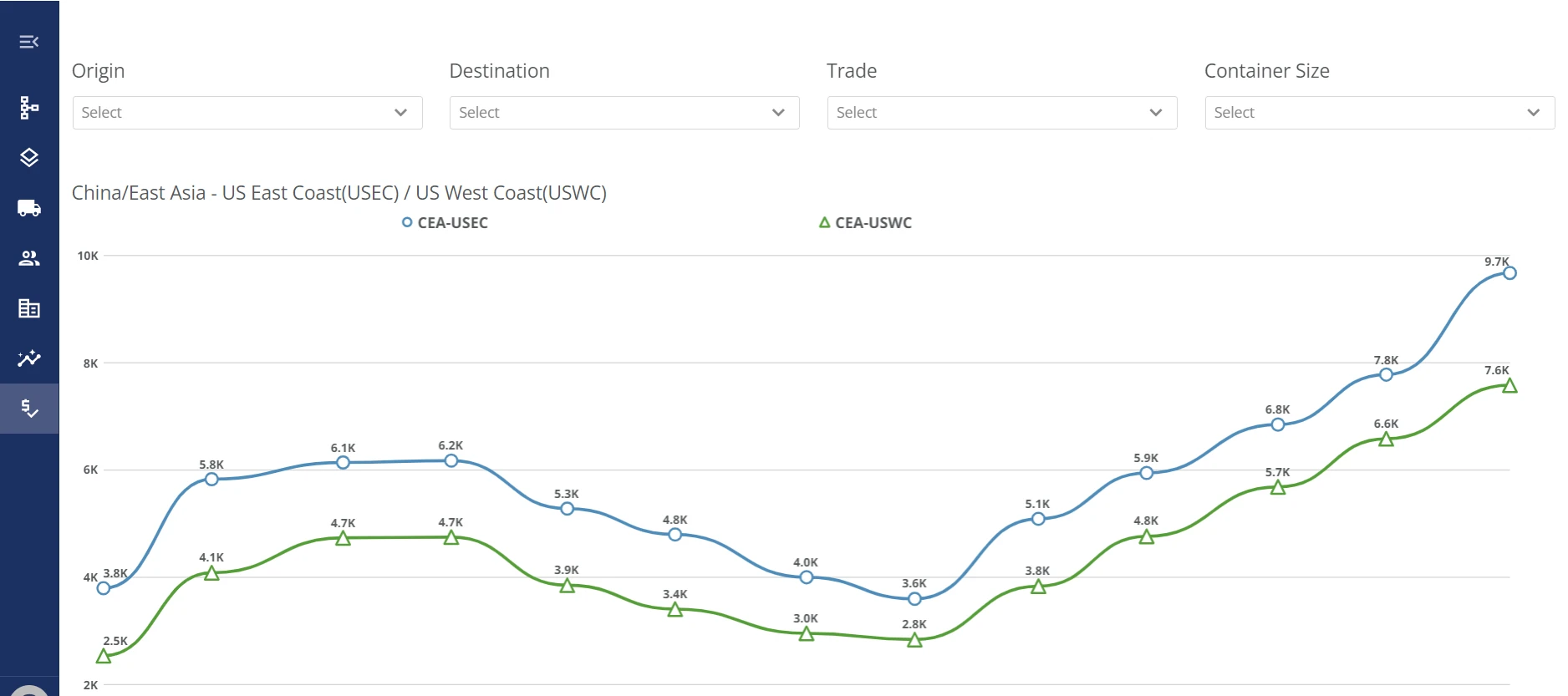

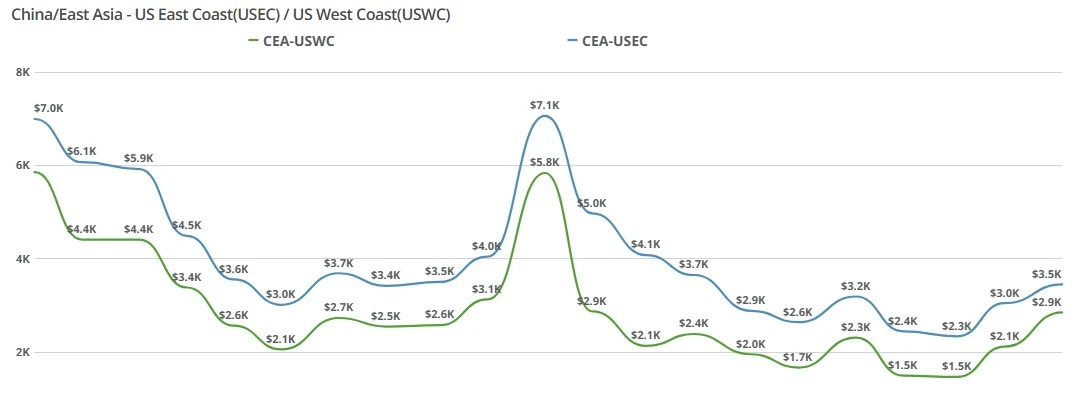

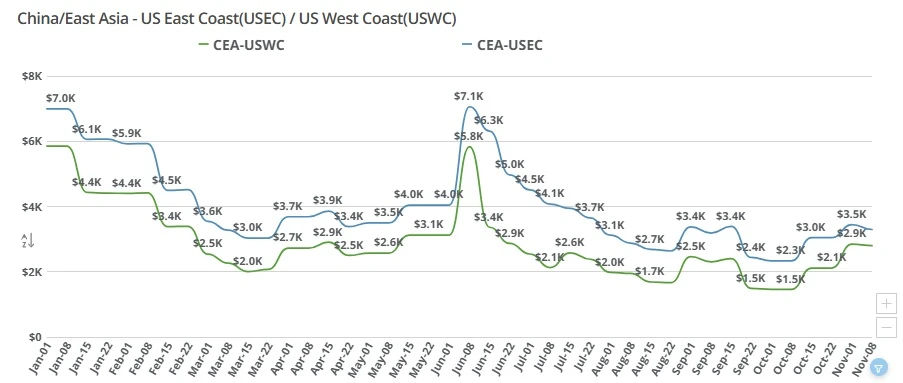

CEA to USWC: Carriers filed an early-December GRI of roughly USD 400/FEU versus late-November levels, but at least one line reversed the increase within hours, and others are expected to follow. As the dust settles, effective spot levels are reverting back to roughly where November closed, in the USD 1,400–1,500/FEU range, leaving the lane essentially flat week-on-week, despite a very brief spike. The originally planned second-week December GRI of an additional USD 200–300/FEU is now unlikely to materialize, given how quickly the first increase broke down..

CEA to USEC: The USEC leg is tracking the same pattern: headline GRIs published for early December, but market resistance and thin demand are capping any sustainable increase. With the traditional premium over USWC still in place but under pressure, week-on-week rates are best described as flat to marginally higher, rather than reflecting the full GRI amounts posted on tariff sheets. Overall, spot conditions remain soft, with actual paid rates gravitating back toward late-November levels, rather than the stepped-up structure carriers hoped to lock in for December and roll into January.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Failed Early-December GRI Test: Carriers brought forward a GRI they had originally expected to apply in the second half of December, instead loading the increase into week 1 and a planned week 2 top-up. At least one major carrier pulled its USD 400/FEU increase back down the same day, signalling that the market would not absorb the hike, and other lines are expected to align.

Strategic Push Toward Higher January Levels: Lines are trying to “ladder” rates up into January ahead of Chinese New Year, targeting USD 1,600–1,800/FEU as a sustainable band, with potential brief spikes above USD 2,000/FEU. Because they cannot credibly double rates in a single period, carriers are experimenting with earlier, smaller steps now to avoid having to leap from roughly USD 1,300–1,400 straight to USD 2,000+ in January.

Demand Too Soft to Support Aggressive Hikes: Feedback from origin indicates very low December volumes, with some shippers cutting bookings by 40–50% versus prior plans. Several factories are shutting or slowing production around Christmas and New Year, reinforcing the perception of December as a “short” and soft month for exports.

Carrier Profit Pressures and Contract Exposure: At current spot levels (~USD 1,400–1,500), carriers struggle to make acceptable margins, especially as they face locked-in contract commitments around USD 1,600/FEU that become uneconomic if spot dips too far below. This is motivating lines to defend a floor in the mid-USD 1,500s and resist any slide back toward USD 1,200/FEU, even as demand remains weak.

Market Still in “Test and See” Mode: Carriers are effectively throwing out different GRI numbers to see what sticks, adjusting quickly when the market pushes back. The rapid rollback of this week’s increase reinforces that buying sentiment, not filed tariffs, is setting the true market level for both USWC and USEC at the moment.

For the rest of December, CEA to USWC and CEA to USEC are expected to hover around late-November levels, with some day-to-day noise as individual carriers tweak offers. The second planned December GRI now appears unlikely to stick, given the lack of cargo and immediate pushback to this week’s increase.

From early January onwards, expect carriers to come back with another strong GRI push, aiming to reset rate levels ahead of the CNY rush. A working forecast band for CEA to USWC and CEA to USEC is USD 1,600–1,800/FEU, with possible short-lived peaks above USD 2,000/FEU if bookings accelerate. However, any peak above USD 2,000 is likely to be measured in days, not weeks, before settling back toward the upper-teens as competition resumes.

In the near term, downside risk (sharp rate collapse) looks limited by carrier loss-making thresholds, but upside risk (fast spikes) is real around any sudden demand pulses or blank-sailing programs.

China to US: Rates on direct-flight lanes continue to rise daily, driven by tightening capacity and stronger end-of-year demand. Airlines are actively pushing rates upward as they enter the final weeks of 2025.

China to Canada: Direct flights into Canada remain heavily constrained, with most capacity absorbed by e-commerce shipments, forcing rates higher and leaving limited space for general cargo.

End-of-Year Surge: Typical Q4 peak season pressure is amplified as shippers rush to move cargo before year-end cutoffs.

Airlines Pushing Up Yield: Carriers are incrementally increasing rates daily on China to U.S. lanes to capitalize on high-demand weeks.

E-Commerce Dominance to Canada: Canadian lanes are packed with e-commerce volume, squeezing space for traditional freight and pushing rates up further.

Capacity Imbalance: Additional charter activity is limited, increasing reliance on passenger-flight belly space, which is already near full.

Forwarders Competing for Space: With demand outpacing capacity, space protection is becoming more competitive, especially for time-sensitive shipments.

The upward rate trend is expected to continue through Week 52, with little relief before the New Year. U.S. lanes will likely experience continued daily rate adjustments as airlines maximize yield during peak season. Canadian lanes are set to remain particularly tight due to persistent e-commerce demand.

A more noticeable softening in rates is expected starting early January, once peak season winds down and capacity frees up.

Thomson Reuters: 2026 Global Trade Report: Tariff turbulence is elevating strategic role

https://www.thomsonreuters.com/en-us/posts/corporates/2026-global-trade-report/

Supply Chain Drive: UPS, FedEx up fuel surcharge rates for domestic, ground deliveries

https://www.supplychaindive.com/news/ups-fedex-fuel-surcharge-table-increases-ground/806623/

Global Trade Magazine: What’s Ahead: Key Ocean, Air, and Trade Trends as We Approach the New Year

https://www.globaltrademag.com/whats-ahead-key-ocean-air-and-trade-trends-as-we-approach-the-new-year/

The Wall Street Journal: America’s Tariffs Jolted the Global Economy. Its AI Spending Is Helping Save It.

https://www.wsj.com/economy/trade/americas-tariffs-jolted-the-global-economy-its-ai-spending-is-helping-save-it-9be60ee0

Container News: MSCS’s Fleet Growth Could Create Market Imbalance

https://container-news.com/mscs-fleet-growth-could-create-market-imbalance/

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

Transpacific ocean freight rates fell sharply in January after carriers failed to sustain GRIs amid weak China-US shipping demand.

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

Today, we're proud to announce Freight Right's proprietary freight rate index, the TrueFreight Index (TFCX). Learn how we built the index. Subscribe to get weekly rate and market updates.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.

China–US ocean freight rates fall as carriers discount to fill space. CEA-USWC down $400-$500; CEA-USEC near $2,800. See what’s driving the drop and what’s next.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.