The week was dominated by U.S. actions that broaden tariff levers under national-security and reciprocal-tariff authorities. Washington formalized tariff adjustments connected to its new EU framework, then advanced two consequential Section 232 investigations, one sweeping in scope across PPE and medical devices, and another targeting robotics and industrial machinery, with public comments due by mid-October.

Late-week statements also previewed a 100% tariff on branded pharmaceuticals set to begin Oct 1, adding pressure on drug-pricing negotiations. In parallel, the EU moved its next Russia sanctions package forward, including a 2027 deadline to end Russian LNG imports, signaling continued energy-trade decoupling. Finally, as AGOA’s sunset approached, the Administration backed a one-year extension, keeping a key U.S.-Africa trade preference alive if Congress can attach it to a funding bill.

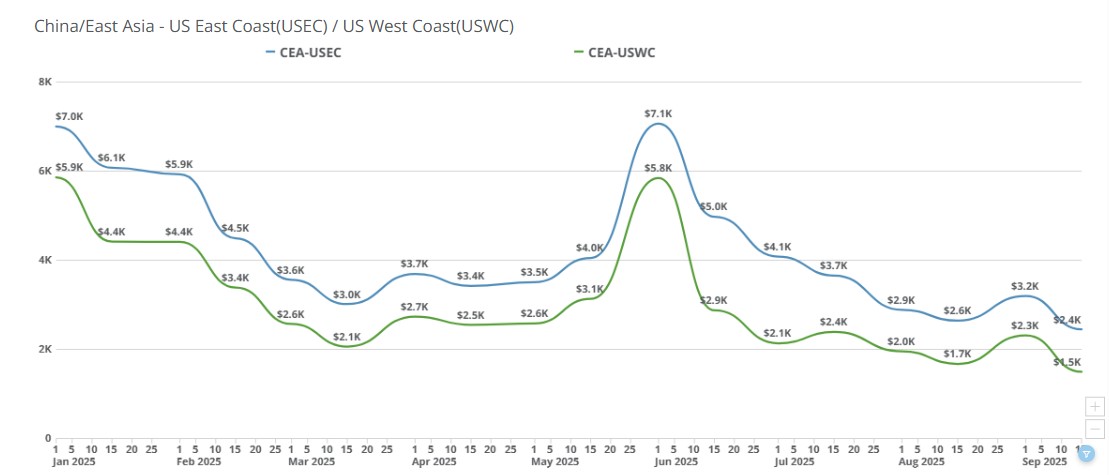

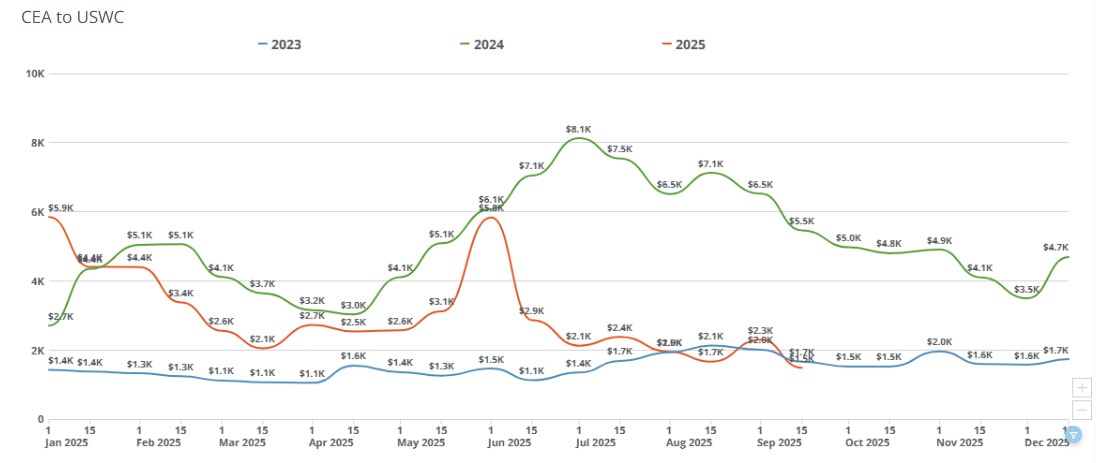

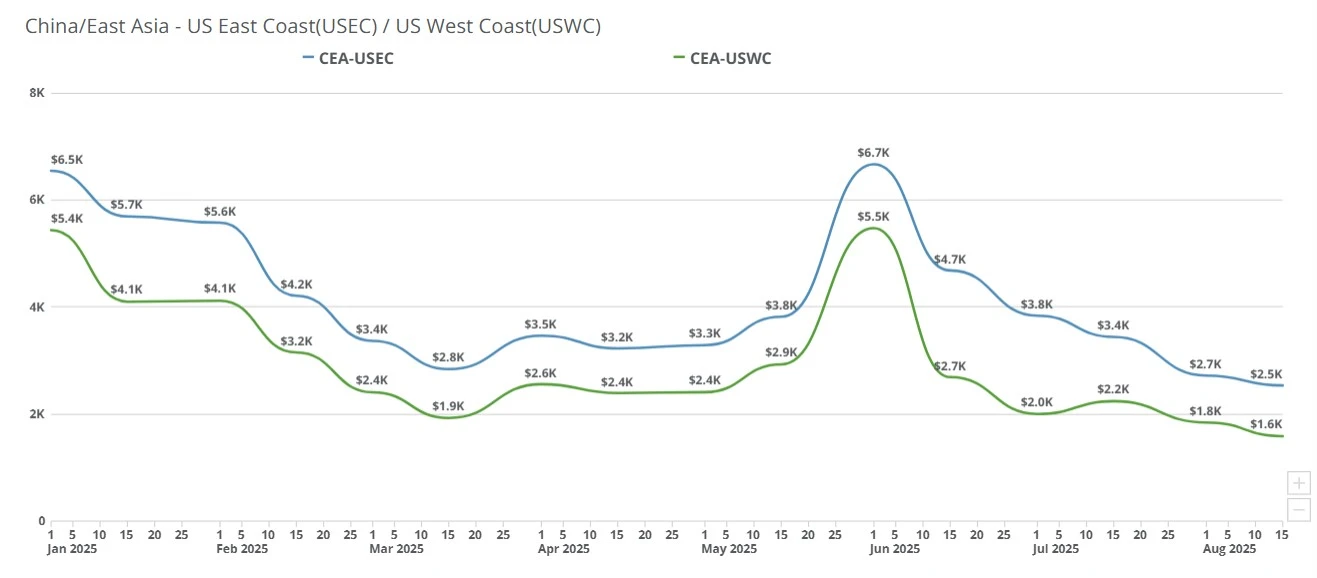

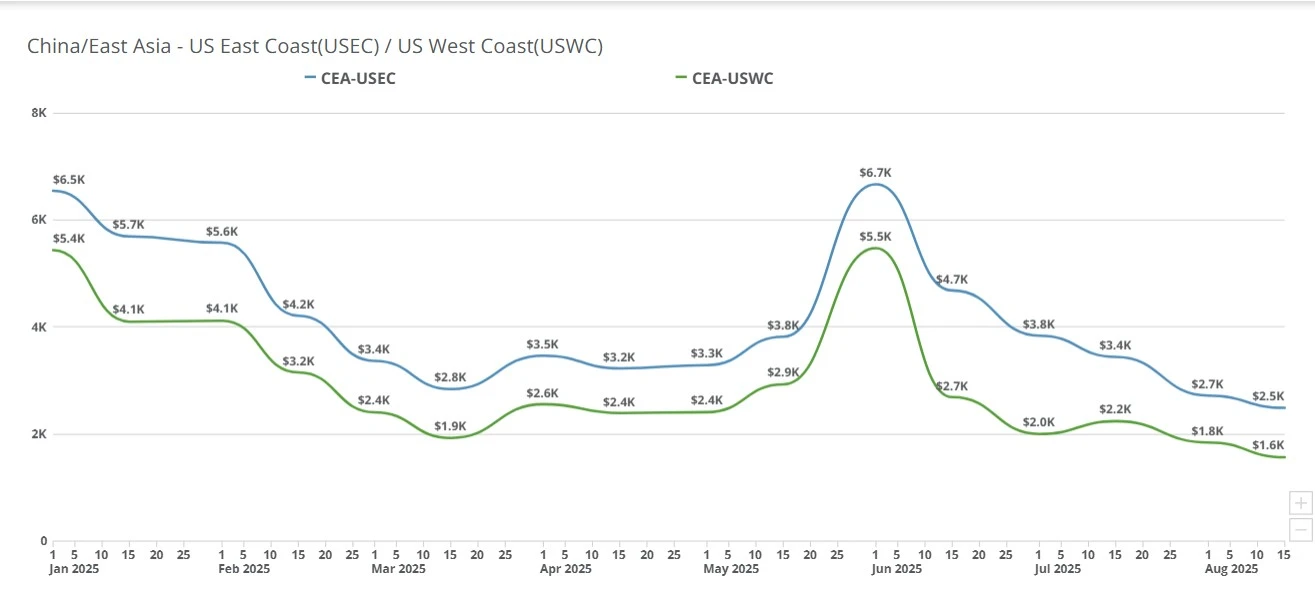

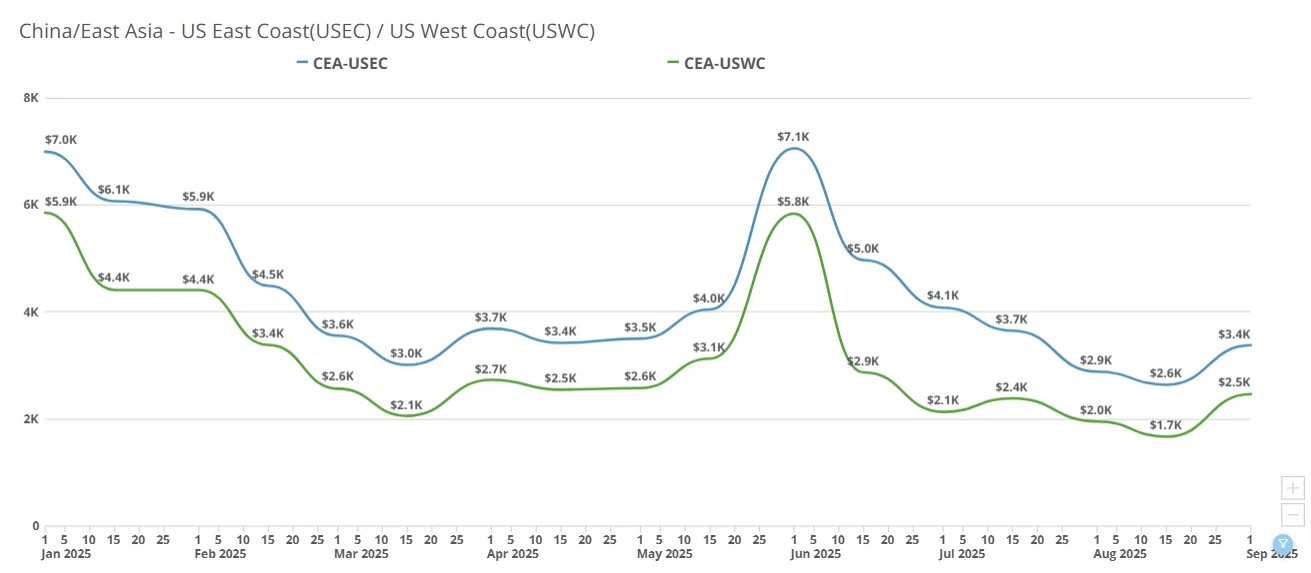

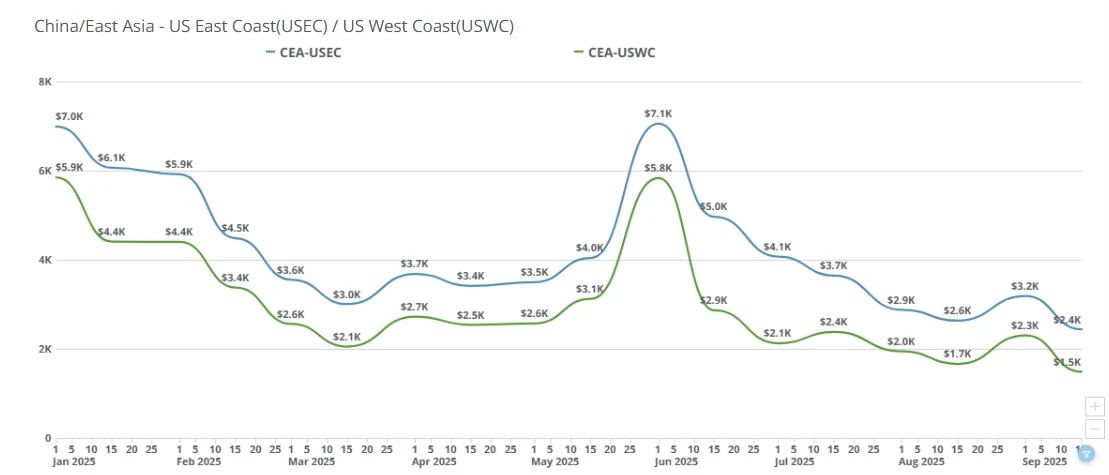

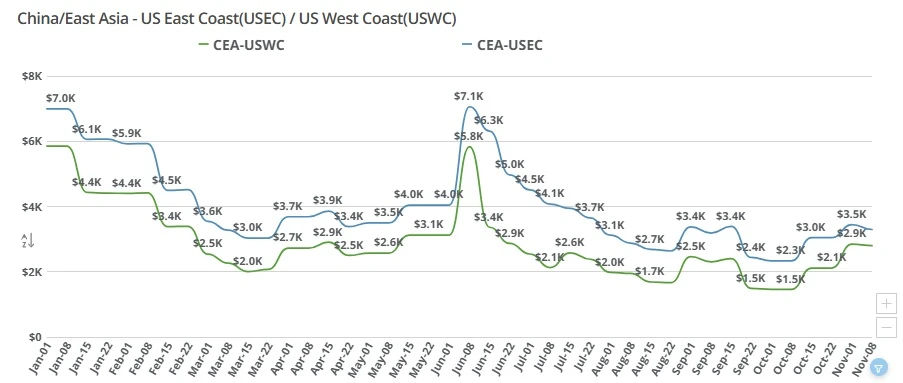

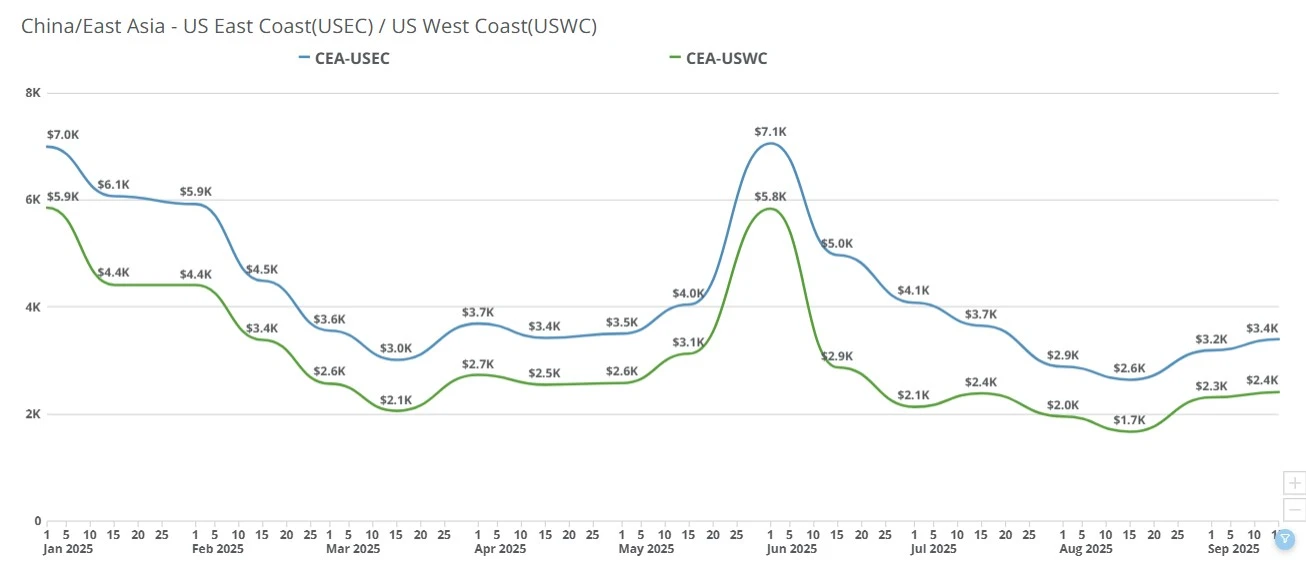

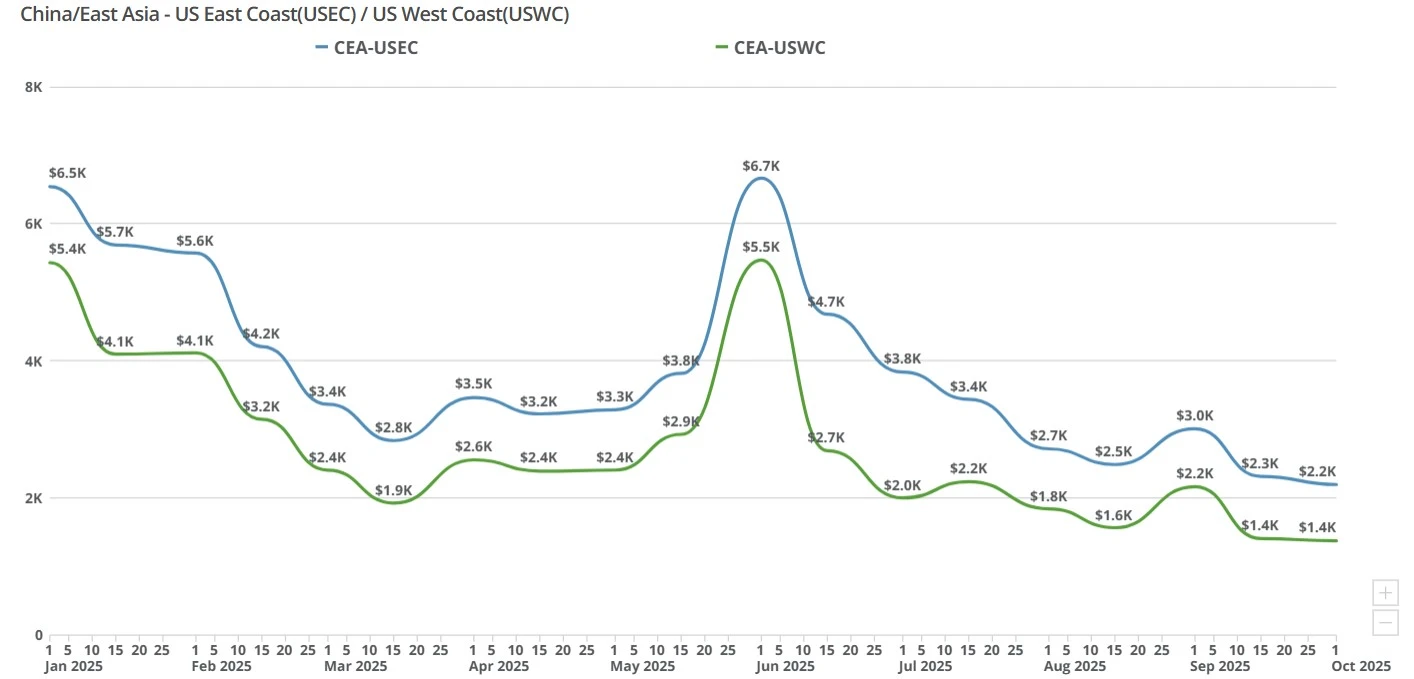

CEA to USWC (China to U.S. West Coast): Spot rates slipped again week-over-week and are now hovering a little over $1,300/FEU, lower than late-August pre-GRI levels.

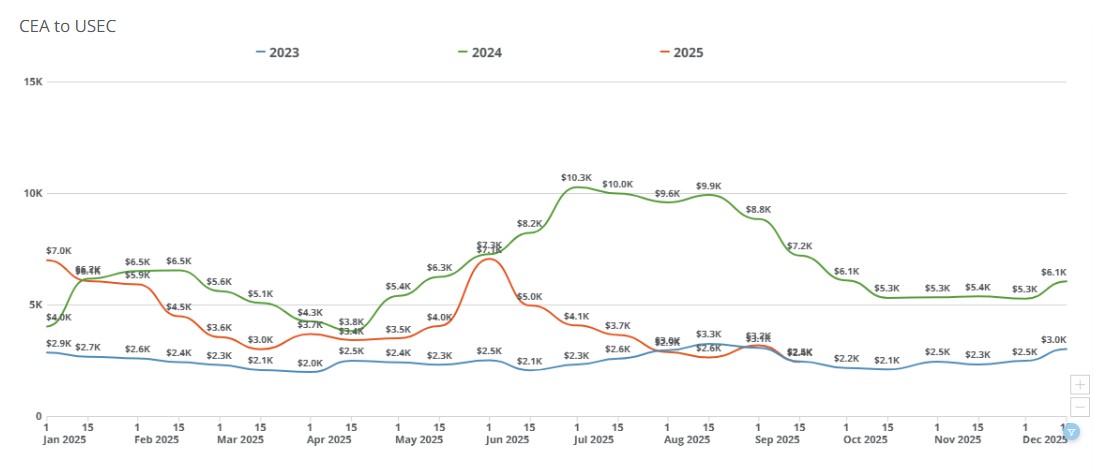

CEA to USEC (China to U.S. East Coast): Rates moved down in tandem with the West Coast. No lane-specific anomalies or countertrends were observed this week.

Golden Week freeze: China’s holiday effectively started for logistics today/tomorrow, slowing replies and bookings and dampening transpac demand/price discovery.

Pre-holiday undercutting: Chinese forwarders sent “at-cost” rate blasts before closing, which helped push the market down and limited selling opportunities this week.

Weak seasonal pull: U.S. holiday inventory is largely in place; shipments loaded in mid/late October won’t make retail windows, muting near-term demand.

Margin knife-fight: Forwarders are defending base volumes and chasing new logos at razor-thin or even negative margins to keep freight moving.

Tariff drag: Additional U.S. tariffs (e.g., on furniture) are discouraging some imports at the margin, reinforcing the demand downdraft.

Carrier floor mechanics: If prices push much below current levels, carriers are expected to pull capacity (blank sailings, slower rotations) to prevent a sub-$1,000 collapse.

Looking forward across the next few weeks, we’re expecting rock-bottom/stable pricing through October-December absent shocks. This implies USWC in the low-$1,300s/FEU +/-$200 and USEC trending lower alongside, supported by carrier capacity discipline. Market participants do not expect rates below $1,000/FEU; a practical floor sits around $1,100–$1,300 given likely capacity withdrawals at deeper losses.

A modest, short-lived lift is most plausible late December–mid-February on pre-Lunar New Year rush, after which softness could resume until late Q2 seasonality.

CNN: Trump places a 10% tariff on lumber and a 25% tariff on furniture and cabinets: https://www.cnn.com/2025/09/29/business/tariffs-lumber-furniture-trump

Supply Chain Dive: US to begin furniture, wood import tariffs on Oct. 14: https://www.supplychaindive.com/news/trump-tariffs-furniture-wood-products-oct-14/761469/

WSJ: Jaguar Land Rover Gets Government Loan Guarantee to Support Supply Chain; Restarts Production: https://www.wsj.com/business/jaguar-land-rover-gets-2-billion-u-k-government-loan-guarantee-after-cyberattack-217ae50a?gaa_at=eafs&gaa_n=ASWzDAjItoLEUHflNiZ-D5B5zISvq5y8x1A3LlD21X-XLwQLeqVYKm7DXNLTX-Gt4nw%3D&gaa_ts=68dc3e17&gaa_sig=2DinQqMOs1XwUk223T3IeDpLzzEKXIRf1pZB4X_hbfqXrrFWlY80epfATQTQGFNbl30k4og5cgHfAemUOew-zA%3D%3D

China-US freight rates dip to $1,520/FEU as carriers cut prices and blank sailings set up a $1,000 September GRI amid weak demand and tariff risks.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

China–US ocean freight rates rose WoW: USWC near $2.1K/FEU and USEC near $2.9–$3.0K as carriers end fixed extensions and hold firm into January.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

China–US freight rates spiked up to $900 to start September but,in a rare move, promptly rolled back to pre-GRI amounts this week to entice bookings.

Last week's transpacific GRI slowly comes down as carriers test market resilience ahead of Golden Week.

China-U.S. freight rates stayed flat this week as Golden Week factory closures paused bookings and kept ocean freight markets calm.

FEU & TEU rates change slightly week-over-week, importers that can afford to keep importing are continuning to do so while those that are hamstrung by tariffs are sidelined and the August 1st tariff deadline is one week away.