Global trade policy developments were dominated by tariff shifts and protective measures reflecting broader geopolitical and economic pressures. India implemented multi-year tariffs on imported steel to defend its domestic industry, while China imposed high tariffs on beef imports to support local producers. The European Union enacted its Carbon Border Adjustment Mechanism, ushering in a new era of climate-linked tariffs that could reshape trade flows for high-carbon goods. Meanwhile, the United States continued to adjust its own tariff regime, delaying some increases but presiding over ongoing elevated tariff levels that contributed to a contraction in manufacturing activity.

These policy moves occurred against a backdrop of diplomatic efforts and economic analysis: India’s economy was noted for resilience despite tariff headwinds, and both India and the EU engaged in talks with major partners to address tariff disputes. The period underscores the continued centrality of tariff policy as a tool of economic and geopolitical strategy entering 2026, with countries balancing protectionist impulses, trade negotiations, and evolving trade frameworks.

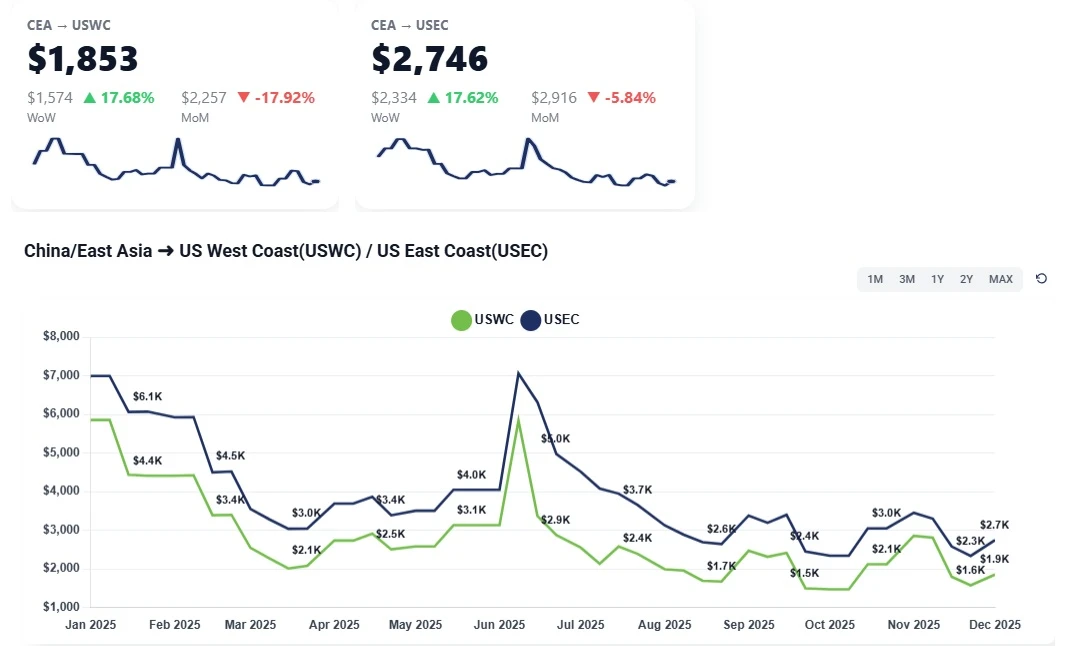

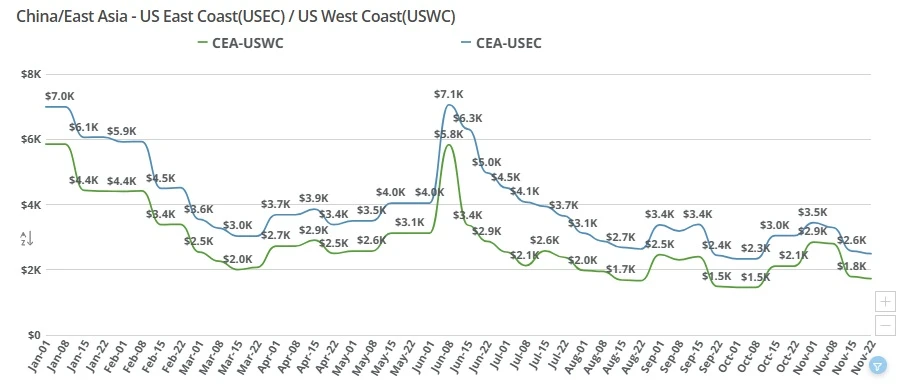

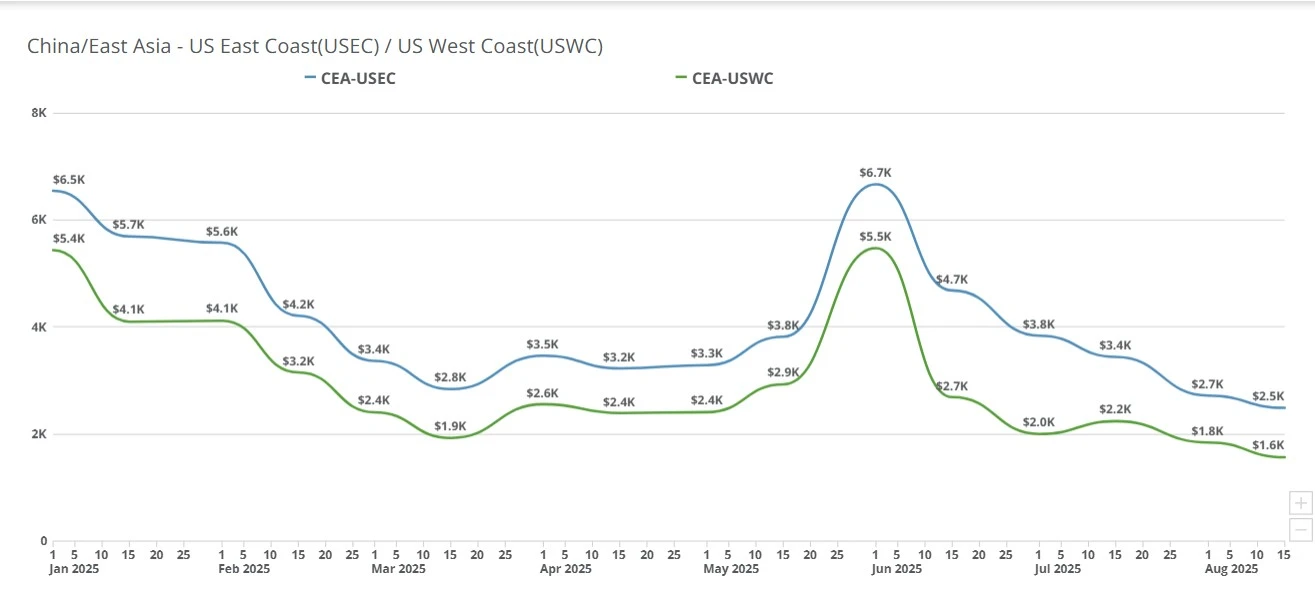

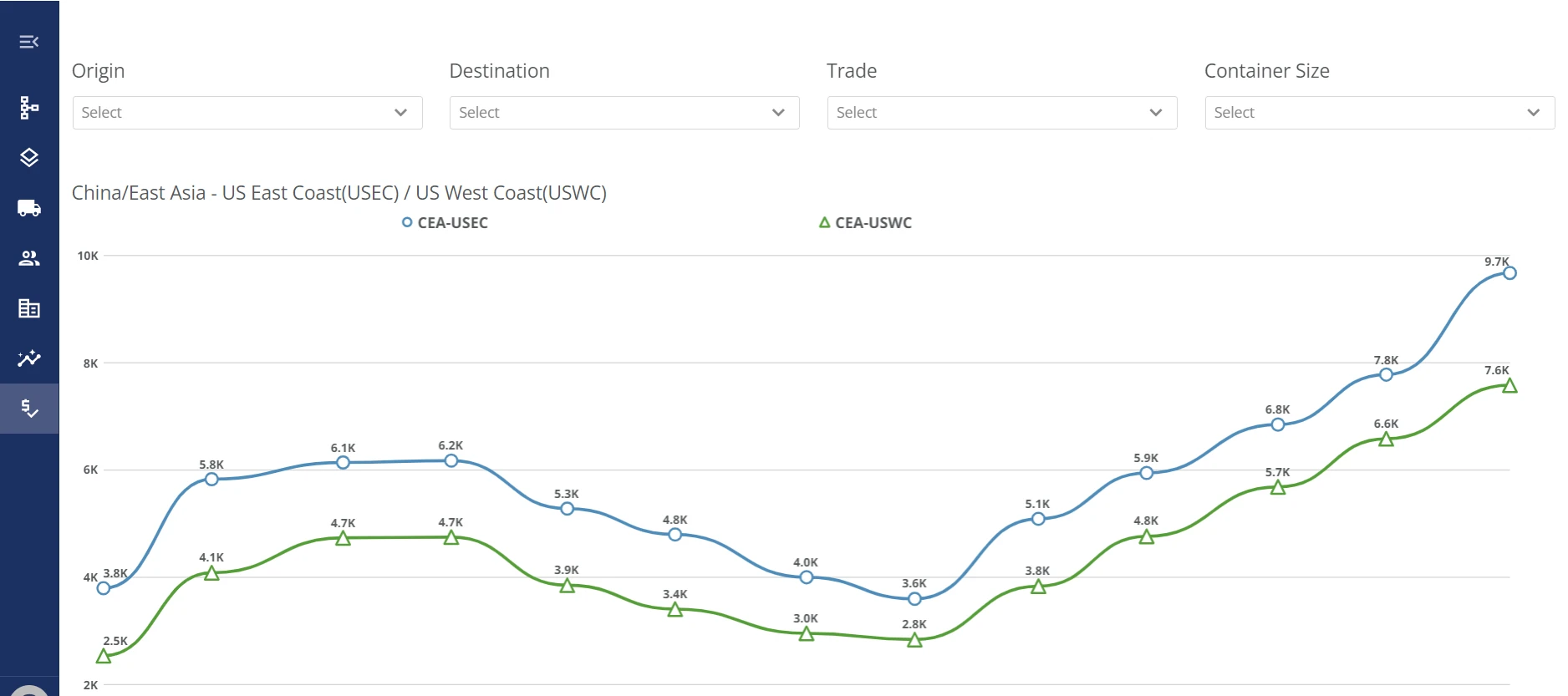

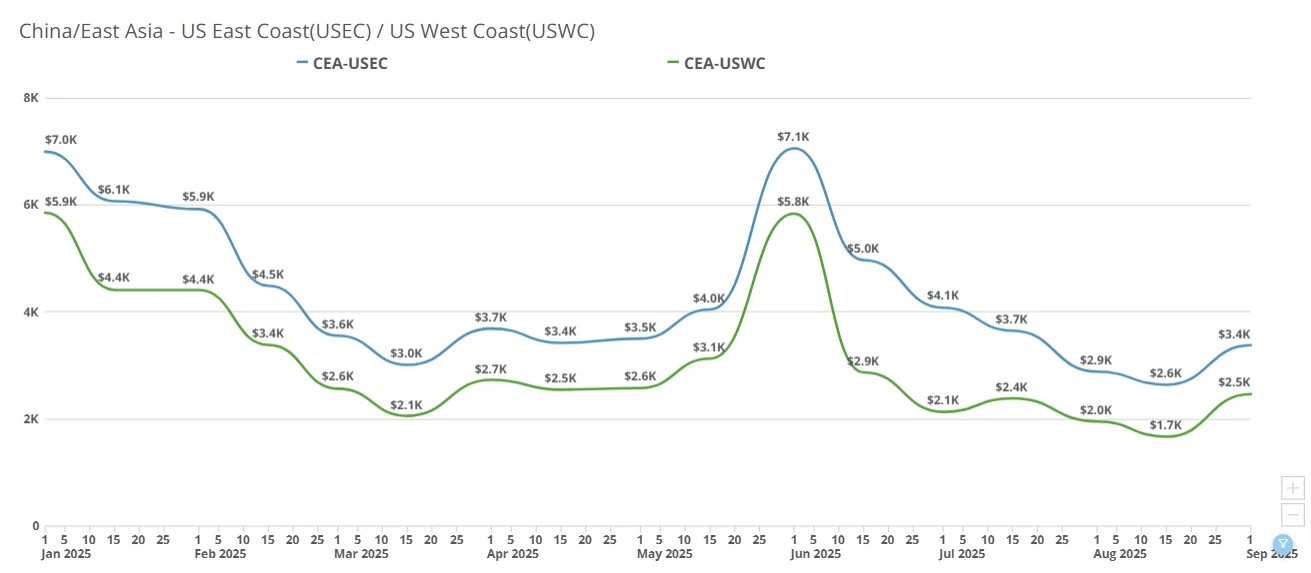

CEA to USWC (China to US West Coast): Rates saw sharp volatility week over week. Carriers successfully pushed through a short-lived GRI at the end of December, with offers briefly jumping above $3,000 per FEU for early January sailings. However, that increase unraveled almost immediately. Within days, rates were rolled back by roughly $1,000, settling back into the $1,800–$2,200 per FEU range, with most market activity clustering around $2,000–$2,100. Promotional rates in the high-$1,800s reappeared quickly as carriers struggled to secure volume.

CEA to USEC (China to US East Coast): East Coast pricing followed a similar pattern, though with slightly more insulation. Early January GRIs lifted rates well above prior December levels, but resistance was swift. As capacity outpaced demand, carriers began pulling rates back, signaling further reductions through mid-January. While USEC remains priced at a premium to the West Coast, the overall trajectory mirrors USWC: brief GRI-driven spikes followed by rapid erosion.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

GRIs met immediate market resistance: Carriers attempted to hold January rates above $3,000 per FEU, but volumes simply did not materialize. As noted in the discussion, “there would be zero volume at $3,000,” forcing rapid pullbacks within days.

Weak fundamentals during a supposed mini peak: Even with Chinese New Year approaching, this traditionally supportive window failed to generate enough demand. The inability to sustain higher rates during a seasonal inflection point highlights just how soft the market remains.

Excess capacity continues to dominate: Carriers cannot afford to leave space unused. Once it became clear that elevated rates were suppressing bookings, pricing discipline collapsed in favor of filling ships.

China-US volumes under pressure: Ongoing geopolitical uncertainty and tariff-related concerns are dampening China export demand. Several shippers have trimmed volumes, reducing carriers’ leverage even further.

Limited relief from supply chain diversification: While some volume has shifted to Southeast Asia (Vietnam, Thailand, Indonesia), those lanes are priced similarly to China and lack the scale to materially tighten overall capacity.

Near-term, carriers are likely to accept suboptimal pricing rather than sail with empty space. With January GRIs already fading, rates are expected to hover near current levels or drift lower into mid-January. The inability to hold elevated pricing even briefly suggests that any further GRI attempts ahead of Chinese New Year will face steep resistance.

Unless there is an unexpected demand shock, the market appears set up for continued volatility with a downward bias, pushing meaningful rate recovery further into late Q1 at the earliest. Structural overcapacity and muted China export volumes remain the defining constraints as 2026 begins.

Air freight rates from China to the U.S., Canada, and Australia declined week-over-week, as the market continues to work through a post-holiday demand lull. Pricing pressure has been most visible in the spot market, where airlines are offering lower rates to secure volume amid soft bookings from large e-commerce players and delayed project cargo activity.

The rate of softness is being reinforced by a notable increase in available capacity at the start of the new year. Additional scheduled lift and the entrance of new charter operators have expanded supply across key lanes, creating a more competitive environment and giving shippers increased leverage in near-term pricing discussions.

Post-holiday demand recovery lagging: Major e-commerce and project shippers have not yet returned to normal shipping patterns following the holidays, keeping overall demand below seasonal norms for early January.

Sharp increase in airline capacity: Airlines have added lift coming out of year-end, with new charter capacity entering the market. This influx has outpaced demand, pressuring rates downward.

Aggressive competition for volume: With excess space available, carriers are actively competing for shipments, resulting in lower spot offers across multiple lanes.

Spot market flexibility favoring shippers: Airlines are prioritizing load factors over rate integrity in the short term, making it an advantageous window for shippers with flexible planning to recheck pricing.

The current softness is expected to be temporary. Market sentiment suggests rates could begin gradually firming from this weekend or early next week, as factories resume full production and shipping activity ramps up ahead of the pre–Chinese New Year rush (February 15–23). While capacity is likely to remain ample, improving demand should start to absorb excess space, shifting the balance modestly back toward carriers. For now, the spot market remains fluid, but upward pressure is expected to build as we move deeper into the January–February shipping window.

The Wall Street Journal: A Shrimper, a Carmaker, a Lawyer: How the World Tackled Trump’s Trade War

https://www.wsj.com/economy/trade/trump-trade-war-tariffs-impact-2025-bf93731a

Bloomberg: Why US Tariffs Failed to Dent Global Trade

https://www.bloomberg.com/opinion/articles/2026-01-05/why-us-tariffs-failed-to-dent-global-trade

The Guardian: Five charts that explain the global economic outlook for 2026

https://www.theguardian.com/business/2025/dec/30/five-charts-that-explain-the-global-economic-outlook-for-2026

The Wall Street Journal: U.S. Copper Prices Set First Record Since Summer Tariff Surge

https://www.wsj.com/finance/commodities-futures/u-s-copper-prices-set-first-record-since-summer-tariff-surge-7ccf2e82

Reuters: Trump warns of higher tariffs on India over Russian oil purchases

https://www.reuters.com/business/energy/trump-warns-higher-tariffs-india-over-russian-oil-purchases-2026-01-05/

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

Transpacific ocean freight rates dropped sharply this week as weak import demand and the Thanksgiving holiday slowdown pushed China–US West and East Coast spot prices to new lows. Get the latest market drivers and outlook.

Ocean freight rates fall as carriers abandon GRIs due to weak demand and tariff uncertainty. USWC rates hit $1,700–$1,800 as the expected pre-Chinese New Year volume surge fails to arrive.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

Today, we're proud to announce Freight Right's proprietary freight rate index, the TrueFreight Index (TFCX). Learn how we built the index. Subscribe to get weekly rate and market updates.

Ocean freight rates from China to the US spiked this week, with carriers testing higher levels before Golden Week. Importers weigh shipping now or waiting.

Ocean freight rates from China to the US hit new lows as Chinese New Year approaches. With USWC rates falling to $1,600 and carriers selling space at cost, discover what's driving the market downturn and the outlook for February 2026

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

U.S-China trade deal specifics; transpacific freight rates hold steady as carriers plan a $1,000 GRI for Nov. 1, easing fears after tariff threats and muted seasonal demand.