Last week, global trade policy developments were shaped by a combination of rising protectionist measures and continued efforts at trade liberalization. A central theme during the period was Mexico’s decision to sharply raise tariffs, up to around 50 percent, on imports from non-free-trade-agreement partners, including China, India, South Korea and the European Union. These measures, set to take effect in early 2026, triggered immediate diplomatic responses, particularly from India, which entered talks with Mexico to explore preferential trade arrangements in order to protect its exporters.

At the same time, India intensified its use of multilateral and bilateral trade channels, formally requesting WTO consultations with the European Union over EU safeguard measures on ferroalloy imports and reassessing the scope of a potential trade agreement with Canada. These moves reflected broader efforts by India to counter growing trade barriers while securing alternative market access.

In contrast to the escalation of tariffs elsewhere, trade liberalization advanced in Europe and Asia, as the United Kingdom and South Korea finalized an upgraded free trade agreement that preserves near-total tariff-free access for goods and expands cooperation in services and digital trade. However, transatlantic trade relations showed signs of strain, with reports that the United States paused a major technology-focused trade initiative with the UK amid disagreements over regulatory and non-tariff barriers. Overall, the period highlighted a fragmented global trade environment, marked by simultaneous tariff escalation, dispute settlement actions, and selective progress on free trade agreements.

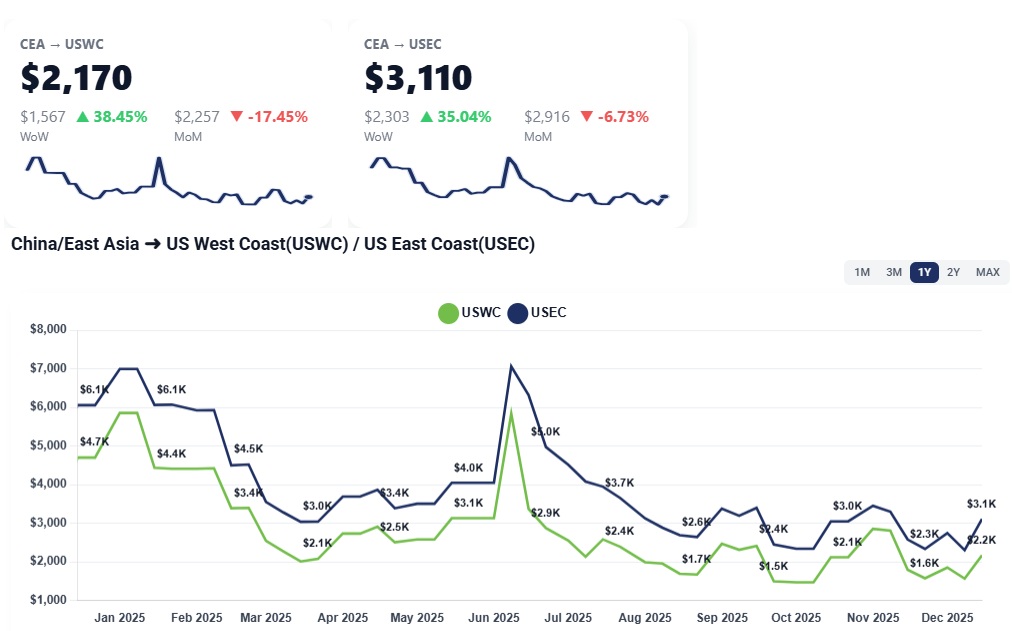

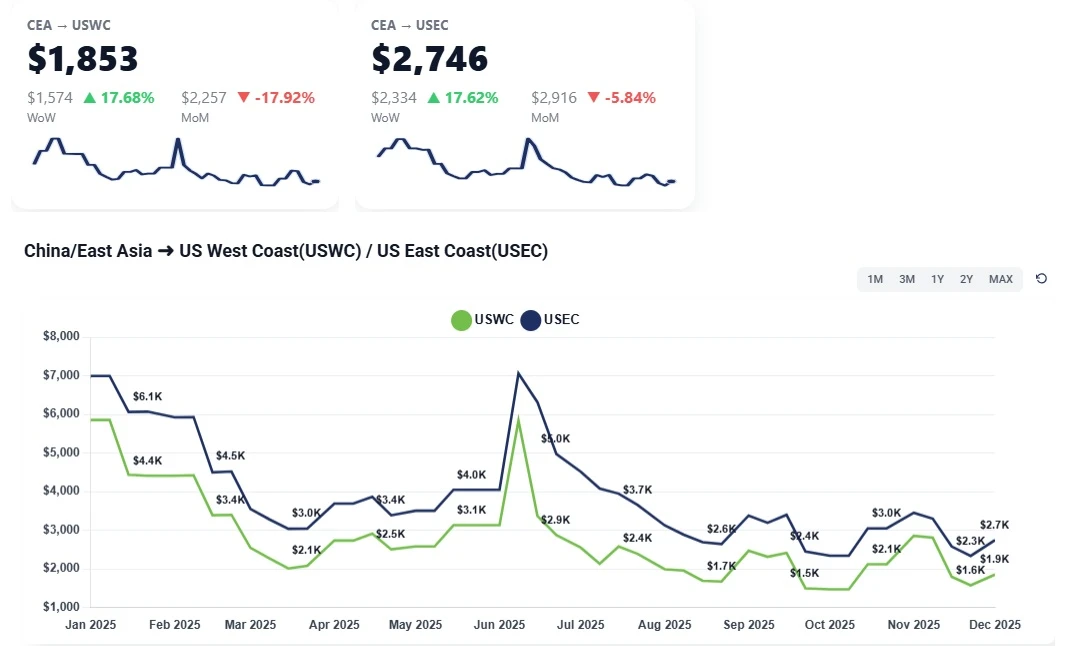

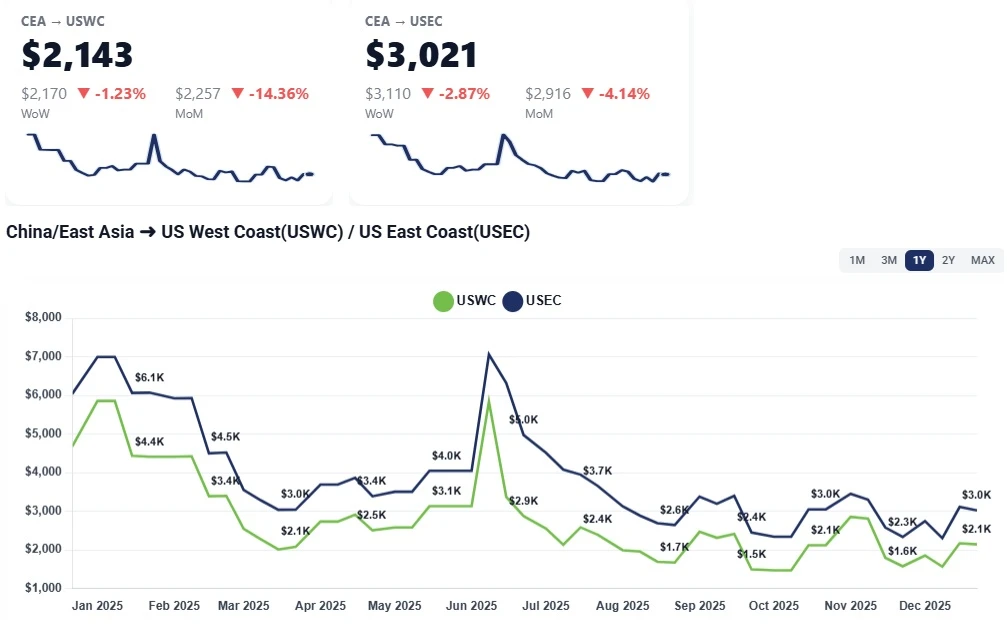

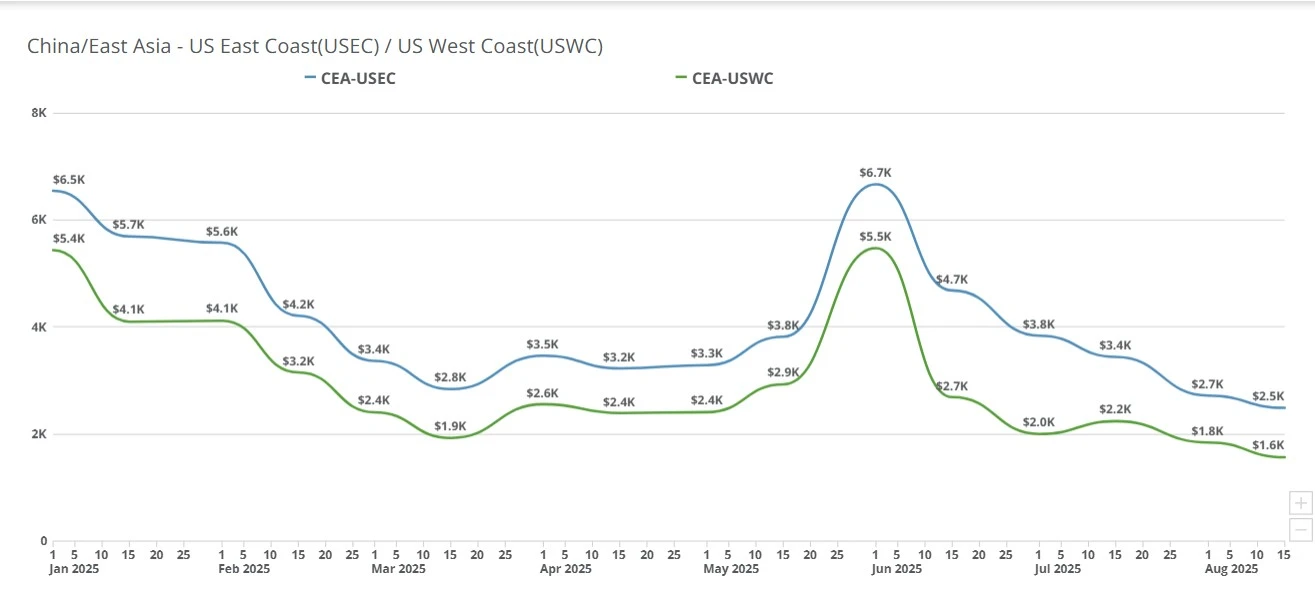

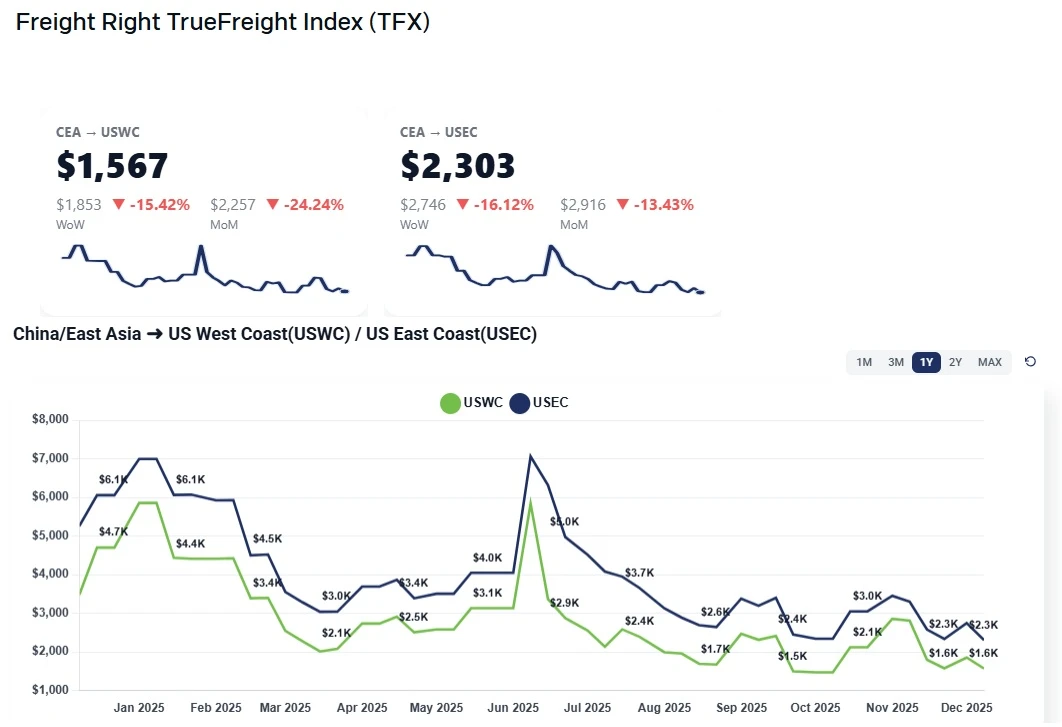

CEA to USWC: Rates stepped up WoW as carriers pushed mid-December increases and held firmer “second-half” pricing. We’re seeing ~$2,100/FEU levels quoted for the back half of December, up from ~$1,600/FEU fixed-rate extensions that carriers have now stopped renewing.

CEA to USEC: Similar upward pressure WoW, with ~$2,900–$3,000/FEU indications for the second half of the month versus prior fixed-rate levels of ~$2,400–$2,500/FEU that are no longer being extended.

Read more about the state of the ocean freight spot market with Freight Right’s TrueFreight Index.

Carriers implemented mid-December increases around $600–$800 higher toward the East Coast as part of their late-year pricing push.

Holiday-driven volume lull is reducing urgency overall, so carriers are using pricing to capture “must-ship” freight while selectively opening cheaper sailings to keep vessels filled.

Fixed-rate “extensions” are ending, a key signal that carriers expect to hold the market higher into January (rather than reverting to earlier contract-like floors).

Pre-Lunar New Year positioning: Carriers are explicitly looking to keep rates elevated through January into the CNY window, maximizing revenue ahead of the typical shutdown period.

Two-tier market behavior: headline GRIs/indices rise, but execution depends on sailing selection with some pockets of lower pricing still available for flexible shippers.

Expect a firm market for “must-ship” cargo, even as overall volumes slow for the holidays, carriers are likely to keep the higher second-half December levels as the headline.

By January, base case rates will stay high and may lift again around Jan 1, with that increase “sticking” through the month as carriers manage pricing into CNY.

Post-Chinese New Year, expect downward pressure to return after the holiday peak dynamics fade, with rates starting to slide back toward late February.

Reuters: India's exports defy tariffs, strengthen hand in US trade talks

https://www.reuters.com/world/china/indias-exports-defy-tariffs-strengthen-hand-us-trade-talks-2025-12-16/

Bloomberg: US Trade Court Won’t Pause Customs Process Amid Tariff Fight

https://www.bloomberg.com/news/articles/2025-12-15/us-trade-court-won-t-pause-customs-process-amid-tariff-fight

Global Trade Magazine: Global Trade Hits Record $35 Trillion as Shipping Patterns Shift Toward Regional Alliances

https://www.globaltrademag.com/global-trade-hits-record-35-trillion-as-shipping-patterns-shift-toward-regional-alliances/

The Wall Street Journal: Global Trade Flows Show Surprising Strength Despite Strain Of Higher U.S. Tariffs

https://www.wsj.com/economy/trade/global-trade-flows-show-surprising-strength-despite-strain-of-higher-u-s-tariffs-6bbbd59b

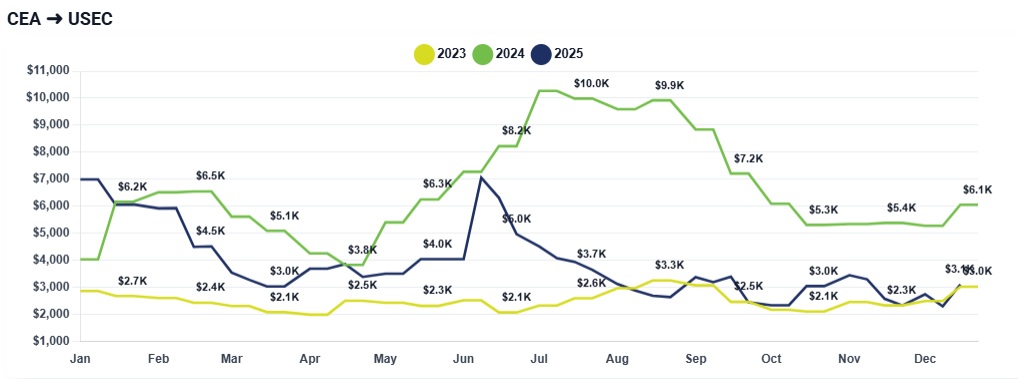

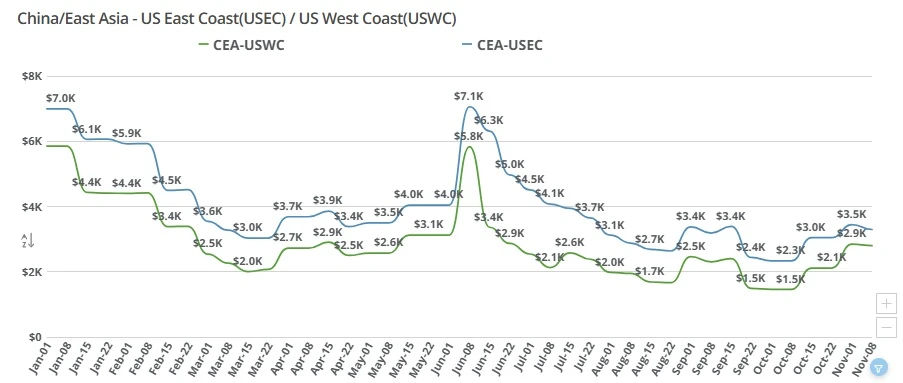

Transpacific ocean freight rates from China to the US West and East Coasts remained elevated week over week as carriers held firm through the holiday slowdown, positioning pricing ahead of Chinese New Year and upcoming contract season negotiations.

China-US spot rates dipped again, with USWC near $1,300/FEU. Golden Week slowdowns and tariff drag curb demand as carriers weigh blank sailings.

China–US ocean freight rates fell week-over-week as weak January demand erased early GRIs. See what’s driving transpacific pricing and where rates may head next.

China–US ocean spot rates eased WoW as early-September GRIs faded. USWC nears trough, USEC softens, and fierce forwarder pricing persists ahead of Golden Week.

Transpacific ocean freight rates continue to decline as post-peak demand cools. China–US West Coast rates near $1,700, East Coast around $2,600 per FEU.

Weekly ocean freight update on China–US West and East Coast lanes as an early December GRI fades, leaving spot rates near November levels amid weak demand.

China–US ocean freight rates to the West and East Coasts held steady this week amid a holiday slowdown. Learn what’s driving the flat market and why January GRIs could push prices higher.

China–US freight rates drop again: $1,400 to West Coast, $2,300 to East Coast, as carriers cut prices before September hikes.

Small December GRIs lift China–USWC and China–USEC rates slightly, but overcapacity, soft demand, and tariff uncertainty continue to cap meaningful recovery. Outlook steady through Chinese New Year with brief January strength.

FEU & TEU rates change slightly week-over-week, importers that can afford to keep importing are continuning to do so while those that are hamstrung by tariffs are sidelined and the August 1st tariff deadline is one week away.